Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

Readers of this blog have read about two fundamental beliefs expressed here:

1. A monetarily non-sovereign government requires net infusions of money from outside its borders, in order to survive and grow long term.

2. The single greatest problem facing the world’s economies is the growing Gap between the rich and the rest. (“Rich” meaning money, wealth and power)

Here are two articles referring to those beliefs:

1. Monetarily non-sovereign governments cannot control the supply of their sovereign currency, because they have no sovereign currency.

The U.S. government and the governments of Canada, China, Australia, Japan et al are Monetarily Sovereign. Being sovereign, they have the unlimited ability to create their own sovereign currencies.

The U.S. never can run short of money with which to pay its bills.

Even if all federal taxes fell to $0 or rose to $999 trillion, neither event would affect the U.S. government’s ability to spend.

By contrast, the governments of Illinois, Cook County, Chicago and the euro nations are monetarily non-sovereign. They have no sovereign currencies. They cannot create money to pay their bills. They can and do run short of money.

Eurozone GDP fails to grow in Q2

The eurozone economy stalled last quarter after 12 months of weak growth, underscoring concerns that the region is mired in a deep rut of high joblessness and weak consumer prices that could worsen amid tension in Ukraine and the Middle East.

Gross domestic product in the 18-member currency bloc was flat in the second quarter compared with the first, (with) 0.2 per cent growth in annualised terms, down from the first quarter’s 0.8 per cent pace. European equity markets fell and safe-haven government bond markets rallied early Thursday as national figures trickled out in advance of the region-wide figures.

The weak recovery leaves the eurozone lagging other advanced economies such as the US and the UK, which have experienced firmer, albeit uneven, expansions. Those economies have recouped the output lost in the aftermath of the global financial crisis in 2008 and 2009.

The eurozone has yet to do so and remains 2.4 per cent below its pre-crisis peak, leaving it vulnerable to outside shocks from Ukraine, Russia and elsewhere that could tip it back into recession.

Because the euro nations voluntarily surrendered their former sovereign currencies, they now cannot create money. Their economic growth demands that they all have more exports than imports — a practical impossibility. They have no way to add money to their economies and to lift themselves out of recession.

The report will likely put added pressure on the European Central Bank (ECB) to do more to spur growth and boost inflation, which at 0.4 per cent is far below the bank’s target of just under 2 per cent. In June, the ECB cut its key interest rates and introduced a new program of cheap loans to banks that are intended to be passed on to businesses.

The ECB’s approach to money shortages is to lend money. But loans must be repaid, and monetarily non-sovereign governments have no ability to make repayment. The loans merely drive the nations deeper into debt. (Visualize the result of lending money to a person who never will have income.)

France’s finance minister Michel Sapin wrote: “The truth is that, as a direct consequence of sluggish growth and insufficient inflation, France will not meet its public deficit target this year despite a complete control of spending,”

The key words are, “deficit target” and “control of spending.” A deficit target (i.e. a reduced deficit target) requires increased taxes and/or reduced government spending — both of which are recessionary.

Gross Domestic Product = Government Spending + Non-government spending + Net Exports

But taxes reduce non-government spending, so by formula, reduced deficits always must reduce GDP (barring increases in Net Exports). So the fixation on deficit reductions absolutely, positively must be recessionary.

The US returned to strong growth in the second quarter after a disappointing, weather-induced contraction during first three months of the year, while China has resorted to a variety of stimulus measures to shore up flagging growth, registering a pick-up in its year-to-year expansion to 7.5 per cent in the second quarter from 7.4 per cent in the first.

The U.S. and China, being Monetarily Sovereign have the unlimited ability to stimulate their economies (though even in the U.S. there is a fixation on deficits — an unnecessary fixation — that has slowed the recovery.)

2. The Gap between the rich and the rest

Jobs coming back post-recession, but with much lower pay, study says,

Chicago Tribune, 8/12/14

The U.S. has regained the 8.7 million jobs lost in the recession, but the average wage has dropped 23 percent, according to a U.S. Conference of Mayors study released today.

The report, “U.S. Metro Economies: Income and Wage Gaps Across the U.S.,” also found a widening income gap between the rich and poor, with the highest earning 20 percent of households gaining the most.

“While the economy is picking up steam, income inequality and wage gaps are an alarming trend,” said Kevin Johnson, conference president and mayor of Sacramento, Calif. The organization expects the trend to continue.

The average annual wage of jobs lost in 2008-09 was $61,637 nationally, while the average wage of jobs added through the second quarter of this year was $47,171.

The Gap between the rich and the rest is exacerbated by:

*Taxes impacting the lower income groups: FICA, sales taxes, gas taxes real estate taxes, Social Security taxes and higher taxes on salaries vs. dividends and capital gains.

*Insufficient and/or reduced benefits for Social Security, unemployment, SNAP, school lunches, aids to education, aids to housing

*Excessive unemployment

*Reduced wages for new or existing jobs.

The first three of the above factors are caused by austerity laws specifically designed to widen the Gap by cutting the federal deficit.

Congress and the President, having been bribed by the rich (via campaign contributions and promises of lucrative employment later) repeatedly pass the laws that widen the Gap.

Their pretext is that in some unknown way, the federal government will find the federal deficit so burdensome it could run out of money to pay its bills — a financial impossibility.

The fourth factor is a result of recessions (caused by austerity), which force desperate people to accept low-paying jobs, together with inadequate support for education and training, which would allow more people to create businesses or take sophisticated jobs.

The bottom line:

The rich care only about widening the Gap, for it is the Gap than makes them rich. (If there were no gap, no one would be rich, and the wider the Gap, the richer they are.

The rich bribe the politicians to pass laws that will widen the Gap. They bribe the media (via ownership) to publish articles praising deficit reduction, the result of which is a widening of the Gap.

And they bribe university economists (via contributions to university foundations) to provide “scientific” support for federal austerity.

Together, these are known as “The Big Lie.”

And, as you can see, the bribes and The Big Lie are working.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

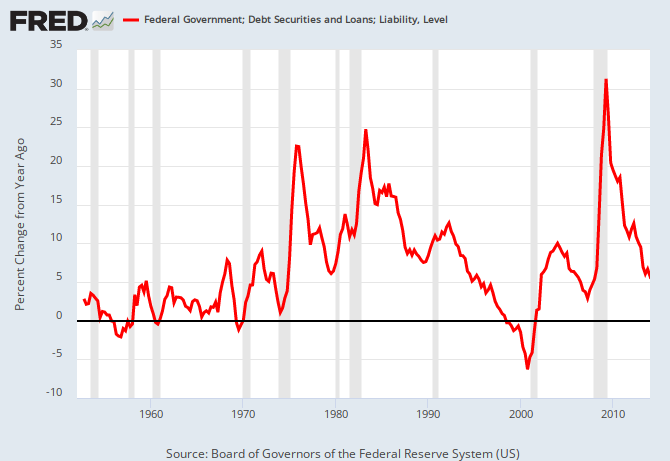

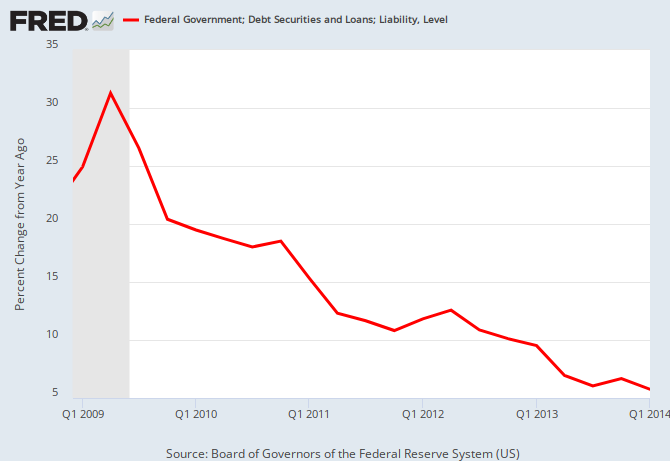

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

What a surprise!

See, it’s really not the lack of money that’s causing the everlasting recession in the euro nations. No, it’s the bad laws about authorizations — or something. Sure it is.

As I said in 2005:

LikeLike

The Business Spectator (above) says: “The US returned to strong growth in the second quarter after a disappointing, weather-induced contraction during first three months of the year.”

LIES.

Only the financial economy has strong growth. That is, only Wall Street and the markets have growth.

Meanwhile Main street is dying. The regular economy (what I call the “real” economy) remains in a depression.

Indeed, Time Magazine says that the big banks are now enjoying their second most profitable year ever. Their most profitable year was in 2013. Their third most profitable period was at the end of the real estate and mortgage boom (i.e. the fraud epidemic) during the last quarter of 2006.

https://time.com/3103834/banks-profit/

This distinction between Wall Street and Main Street brings me back (once again) to finance capitalism.

In any given country there are two economies that are separate, but which overlap and intertwine.

[1] The “real” economy, which operates by industrial capitalism. It consists of the production and sale of goods and services that are useful to the general community. This is “Main Street.”

[2] The financial economy, which operates by finance capitalism. This is “Wall Street.” It consists of making money from money. And example is the student loan scam, where lenders create money out of thin air, and use it to enslave people for life. The financial economy includes debt games, derivative games, gambling in markets and in commodity futures, high-speed stock trading, and so on. The practice of making money from money enriches the few at the expense of the many. It contributes nothing positive to the community. It is destructive and parasitic. It has halted the social evolution of man. Yet, it now rules a huge and ever-growing percentage of planet earth.

In the USA the financial economy sets new records each day, while the real economy plunges to new lows each day. Each day, most of the people in the financial economy get richer, while most people in the real economy get poorer. The USA allegedly has a “strong GDP.” In reality, Wall Street thrives while Main Street dies.

When corporate media outlets claim that America’s economy is in “recovery,” they pretend that Wall Street is the same as Main Street. They pretend that the financial economy is the same as the real economy.

It’s all lies.

And when they claim that America’s GDP is up, they are including the endless trillions of “paper wealth” in the financial economy. (Or quadrillions when derivatives are figured in.) Since Wall Street and Main Street are supposedly identical, the USA can have a strong GDP, while the real economy is in a depression.

Occasionally the masses question the lie that Wall Street is the same as Main Street. The masses question whether GDP is as strong as the corporate media claims it is. Therefore governments and media outlets now calculate GDP by including things like estimated rates of prostitution, and estimated sales of illegal drugs. On Main Street, average people have been reduced to prostitution and selling drugs — but on Wall Street, the criminals live like kings. Therefore America’s GDP is supposedly “up.”

Again, it is all lies.

The liars sustain the illusion that austerity is good for the real economy, when in fact austerity is good for the financial economy at the expense of the real economy. Austerity helps Wall Street suck the life out of Main Street.

Corporate media lies about the economy are designed to make average people feel ashamed if they can’t make ends meet. People on Main Street blame themselves, rather than blaming their slave-masters on Wall Street. They also blame some scapegoat outside themselves, such as migrants, or Muslims, or Blacks, or whatever.

The truth is that people in the financial economy (i.e. Wall Street) are parasites that produce nothing, and contribute nothing. Yet they call themselves “makers,” and their hosts “takers.”

Their hosts (average people) are the only people that produce anything. They are the “makers,” while their Wall Street parasites are the true “takers.”

The more “developed” a given nation, the more it is ruled by its own version of Wall Street. That is, the more its financial capitalism eclipses its industrial capitalism.

For example, China’s economy was until recently based on industrial capitalism — i.e. the production of goods for export. Today China still has its sweat-shops, but (in terms of total money amounts) China’s financial economy has eclipsed China’s industrial economy. China is becoming financialized. China’s Wall Street has eclipsed China’s Main Street. This has been accelerated by rampant fiscal austerity, including mass privatization and deregulation.

The result is extreme inequality. China’s masses are suffering, yet China now has the second highest number of billionaires, after the USA. These billionaires specialize in making money from money, while they leave the planet earth to rot.

The phenomenon is now global.

LikeLike

While I agree with the sentiment, it’s wrong to tar the entire financial industry with such a broad, negative brush. Millions of people work in that industry, a very tiny fraction of whom are among the rich.

The vast majority are regular folks, just like the people who work in factories or on farms.

If we ignore what we consider to be useless industries, perhaps we should begin with the tobacco, gaming, alcohol and entertainment industries.

Tons of money being made there by people who don’t produce anything.

My concern is not how people make money, or for instance, the fact that a poker dealer is included in GDP, but rather the Gap.

The Gap is the real problem, and that should be our focus..

LikeLike

First the monetary system must be reformed and at the same time campaign finance reforms must be implemented. Then we can focus on the “gap”. Do you actually believe without those primary reforms that inequality, and I am not speaking of racial inequality though it is of great importance, the issue of the gap can be addressed?

LikeLike

Depends on what you mean by “reform.” Exactly, what “reforms” are you talking about?

LikeLike

RODGER SAYS: “While I agree with the sentiment, it’s wrong to tar the entire financial industry with such a broad, negative brush. Millions of people work in that industry, a very tiny fraction of whom are among the rich. The vast majority are regular folks, just like the people who work in factories or on farms.”

I was referring to the main instigators of the frauds and the scams. My central point is that corporate media outlets always pretend that there is no difference between Wall Street and Main Street, and that what’s good for rich people and the markets is good for America. The media outlets spout this lie in order to further widen the gap.

RODGER SAYS: “If we ignore what we consider to be useless industries, perhaps we should begin with the tobacco, gaming, alcohol and entertainment industries. Tons of money being made there by people who don’t produce anything.”

I disagree. Regular gambling casinos produce entertainment for regular people who like to gamble. Tobacco and alcohol producers supply tobacco and alcohol for regular people who want them. The entertainment industries produce entertainment (e.g. movies) that millions enjoy. However today’s Wall Street, by contrast, produces little of benefit to the vast majority of average people. It is a cesspool of parasitical “takers.”

RODGER SAYS: “My concern is not how people make money, or for instance, the fact that a poker dealer is included in GDP, but rather the Gap. The Gap is the real problem, and that should be our focus.”

In order to offset inequality (i.e. the Gap) and the Big Lie, we must understand how social processes work. One of the social processes involved is lie that Wall Street is the same as Main Street. This lie allows pundits, professors, and politicians to falsely claim that austerity is boosting the GDP for Main Street as well as Wall Street, which is an odious lie.

The bottom line is that money is an abstraction, and making money from money is not the same as making money via the purchase and sale of goods and services. Indeed, I think that one of “Mitchell’s Laws” should be: “Wall Street is not Main Street.”

The media outlets falsely claim that we are in a “recovery,” in order to justify austerity, which in turn justifies the Big Lie.

Why is this so hard to understand?

LikeLike

Not sure I agree that Warren Buffett is more “cesspool” than Bill Gates, or that Las Vegas provides “amusement” but Wall Street doesn’t, but it’s an interesting argument.

LikeLike

== Off topic ==

ON TAXES AND “TWATS”

Rodger and I say that the purpose of federal taxes is political. Specifically, federal taxes help widen the gap between the rich and the rest.

My own reasoning for this is that rich people use the government to enslave us. The government’s power derives from the government’s Monetary Sovereignty, and its ability to tax. This monetary power, not guns, is the crux of the federal government’s authority. You yourself might personally be able to avoid government troops, goons, killer drones, and murderous SWAT teams, but you cannot escape taxes, nor can you escape the need for money, unless you live alone on an island with absolutely nothing obtained from human society. In other words, you cannot totally escape the federal government’s power. Even if you are very rich, you still need the federal government’s power. You need the government to protect your wealth, and to crush the filthy peasants.

People at the NEP blog claim that federal taxes play a technical role, not a political role. They repeat the empty mantra that “taxes drive money,” implying that if there were no federal taxes, then people would no longer use money to buy and sell goods and services. Without federal taxes, this nonsense goes, the USA’s monetary system would collapse.

In the second paragraph of the latest post at the NEP blog we read this…

“A collective government (sovereign) establishes a treasury which issues—at the direction of the collective government—fiat dollars. The collective government establishes a need for the citizens to earn those fiat dollars by imposing taxes which can only be paid with the fiat dollars themselves.”

http://neweconomicperspectives.org/2014/08/world-without-banks.html#more-8485

Got it? It is federal taxes that establish your need to obtain (“earn”) dollars. Without federal taxes, you would have no need to obtain money. Right?

Nonsense of course. How do they justify this ridiculous claim? They simply resume chanting their mantra that “taxes drive money.”

Another of their mindless chants is “There is no proof” (that pundits, professors, and politicians are paid to sustain the Big Lie).

Many of their blog posts start with a chant that is empty, meaningless, and absurd. Entire meaningless theses are built on meaningless absurdities. If you point this out, they call you an “obnoxious twat.” Or they simply delete your comment, no matter how polite and respectful it is.

And they wonder why MMT does not have a larger audience.

See image…

LikeLike

Although this seems to be a fundamental tenet of MMT, I never have seen any evidence to support the claim. Warren Mosler even likes to use the term “tax credits” in place of “money.”

Apparently, to MMT, this claim is logical, and needs no supporting evidence. It reminds me of how “The deficit is unsustainable” also is logical, and needs no supporting evidence.

I suggest that money is accepted because people trust the full faith and credit of the issuer, and not because of taxes.

I’ve had this argument with Warren and with Randy Wray many times, but to no avail. At one point I said, “Even if taxes did drive money, there are plenty of state and local taxes, so federal taxes are unnecessary.”

And they agreed!

But apparently they have forgotten they agreed.

At any rate, store coupons are a form of money that are not “driven” by taxes, and are valued, just as dollars are valued. People even pay for coupon books (“Entertainment” is one), only because they trust the Entertainment organization — and not taxes.

In every science there are certain, unprovable assumptions (Gödel’s incompleteness theorems), and I guess that’s one for MMT.

LikeLike

Excellent comments, Rodger, and thanks for understanding.

You write, “I suggest that money is accepted because people trust the full faith and credit of the issuer, and not because of taxes.”

Yes. Precisely.

I criticize the NEP people because federal taxes are regressive, unnecessary, and confiscatory, and they help to sustain the Big Lie. Furthermore tax rates, like federal “spending” rates, can be used to widen or narrow the Gap.

However the people over there seem to love federal taxes. And they seem to have no understanding of the gap. Hence their insulting claim that there is “no proof” that pundits, professors, and politicians are paid to maintain the Big Lie.

But beyond all this, my number one complaint is rather petty. Quite simply the people over there can’t write worth a damn. Two paragraphs into any blog post over there, and my eyes are thoroughly glazed over.

And they wonder why MMT doesn’t have a larger audience.

LikeLike

Actually, Warren Mosler (not an academic) wrote a short book (“Innocent Frauds”) that in its first couple of chapters, does a good job explaining in layman’s terms, the fundamentals of MMT.

He may have been the first to compare federal money creation to a sport scoreboard, in which the scoreboard never can run short of numbers.

I think he became sidetracked somewhat, by the academics, when he agreed that money actually is tax credits. That’s Randy’s belief.

LikeLike

You’re right about Mosler. I wasn’t thinking of him when I derided the “NEP types.”

I have Warren’s book, and it is indeed succinct. (I have your book too.) In fact, Mosler’s comments on his own web site are almost TOO succinct. As in sparse.

I don’t like the title of Warren’s book, since the frauds (i.e. the Big Lie) are not “innocent,” but perhaps he had to tread lightly, knowing that his book would anger many people.

UNRELATED:

Here’s something that irks me. I have two accounts at Bank of America. I can sit right here in my bathrobe and “move” money from one account to the other, simply by changing the numbers. I can do this at 3:00 am when nobody is in the bank. I can do it as often as I wish, for any amount I wish. I can do anything except add to the total numbers (the aggregate) in both accounts.

So, right in front of me is proof that money is not physical, but instead consists of abstract numbers. Money is simply the “score,” so to speak.

Anybody can witness this. Yet, they still think that money has to be physical or it is not “real money.”

Presumably when I move money from one account to the other at 3:00 am, a little elf in the bank runs around collecting physical bills from one bucket, and dropping them into another bucket.

In fiscal year 2015, which begins on 1 Oct 2014, the federal government is projected to “spend” (i.e. create) around $3.9 trillion, which would weigh about 88.4 million TONS in hundred-dollar bills. (I triple-checked my math.)

Presumably the little elf in the bank carries those millions of tons around too.

This web site has an interesting calculator…

http://www.1000000-euro.de/how-much-does-a-million-dollars-weigh/index.php#weigh-dollar

LikeLike

I think if NEP claims that taxes payable in US dollars (Fed, State, or local, doesn’t matter) drive a need for dollars, they are on solid ground. Obviously, what people really need is food, shelter, medical care, etc. Dollars seem to be the way we get those things in modern America, right? NEP may not be connecting all the dots explicitly, but I don’t think they are on the wrong track either. And NEP also will say that taxes should be used as a demand regulator. The tax credit function is not the entire story.

What I would like to see NEP/MMT emphasize more is the distributional aspect. They do call for the elimination of payroll taxes, but never seem to say why taxes on poor people are more detrimental to the economy than, say, estate taxes on multi-million dollar inheritances. Or more generally, how taxes could be used to create a more equitable society.

LikeLike

This Week In Crazy

LikeLike

So let me get this straight, taxes don’t drive money, but state and local taxes drive money? That’s some logic right there.

And taxes drive money is a fact not an opinion. Within the last 20 years we’ve had the largest example of this in history, called the Euro.

How did Europe get all their domestic economies to change from their long-held domestic currencies to the Euro? The Govts decided that they would only spend and tax in Euros.

If the USA wanted to switch its currency to the “mamba”, it would do the same.

LikeLike

Monetary Sovereignty claims federal taxes are not necessary. MMT claims they are necessary to drive money.

When MMT claims that taxes drive money, they mean that without taxes, people would not demand dollars — that people want dollars, because they can pay their taxes with dollars. In short, dollars have value only because they are needed to pay taxes.

Monetary Sovereignty claims dollars have value because they are backed by the full faith and credit of the U.S. government. Every form of money is a debt, and all debts are based on the full faith and credit of the debtor.

See: Full faith and credit explained

Both MMT and MS agree that federal taxes do not fund (Monetarily Sovereign) federal spending, but state and local taxes DO fund (monetarily NON-sovereign) state and local spending.

You are correct that deciding to tax in “mambas” would force people to use mambas, but that doesn’t address the question of whether taxes are necessary, i.e. whether people would use mambas without taxes.

There are forms of money that are not driven by taxes. Coupons, for instance, are a form of money not driven by taxes. Stores accept coupons because they trust the full faith and credit of the issuer.

And, by the way, dollars are not necessary to pay federal taxes. Let’s say you owe federal taxes, but you have hidden all your dollars in an island, somewhere. The federal government would put a lien on all your possessions. In short, you could pay your taxes with your car.

But your response is the perfect example of why MMT’s wrong theory does nothing but confuse. You yourself confused the need to use dollars to pay taxes with the need to levy taxes.

Two, completely different things.

LikeLike

“When MMT claims that taxes drive money, they mean that without taxes, people would not demand dollars — that people want dollars, because they can pay their taxes with dollars. In short, dollars have value only because they are needed to pay taxes.”

This is a gross misreading of what MMT says.

The point MMT is making is that whatever a Govt accepts in taxation, will become “money”. That is quite different than saying the Dollar only has value because of Federal taxes, 200 plus years after the start of the currency.

You conveniently ignored the case of the Euro which demonstrates how this effect works.

“whether people would use mambas without taxes.”

Would German people have switched out their Deutschmarks for Euro’s if the German Govt wouldn’t accept Euros for tax and service payments? Thats an interesting thought experiment. Some probably would for FX speculation, and to trade and buy things that other countries sell in Euros.

“There are forms of money that are not driven by taxes.”

MMT never makes the claim that the only form of money is the one the Govt taxes in, thats a huge strawman argument. Anyone can create money as ‘money” is just an IOU, a social debit – credit relationship.

” The federal government would put a lien on all your possessions. In short, you could pay your taxes with your car.”

Wrong, the Govt will sell your car for dollars that extinguish some portion of your tax liability aka tax credits.

LikeLike

The argument between MS and MMT began when I claimed that federal taxes are not necessary. Randy said that federal taxes are necessary to “drive” money (whatever you think that means).

That is the fundamental question? “Are federal taxes necessary?”

So do you believe federal taxes are necessary?

LikeLike

“That is the fundamental question? “Are federal taxes necessary?””

Taxes are necessary, I would say that it doesn’t matter fundamentally whether they are state and local taxes or federal taxes wrt driving the currency at this point.

On the other hand, state and local Govt’s could never establish the national currency as they aren’t sovereign over the dollar, so at the beginning, only the sovereign (federal Govt) could start the cycle in the USA. But now that we’ve been at it for 200 plus years, the inertia is powerful enough to maintain the widespread use of the US dollar even if there were no federal taxes.

However, I would disagree that we could have no federal taxes because of the inflationary problem. $4T in Govt money creation per year is probably too much as I don’t share your belief that interest rates are more powerful than money creation.

LikeLike

In one sentence you say that taxes are necessary to drive currency, and then in the next sentence you say that the inertia is enough to maintain the currency without federal taxes.

Hmmmm . . .

Anyway, the states, being monetarily non-sovereign, need to levy taxes, so perhaps the question is moot — except I can’t get MMT to say the words: “Federal taxes could be eliminated.”

As for inflation (It always comes down to inflation, doesn’t it?), no one knows how large a deficit has to be to cause inflation, simply because inflation is so complex and deficits are but one factor.

I never said (and don’t even understand the meaning of) “interest rates are more powerful than money creation.”. What interest rate and how much money creation are you talking about?

Remember, if federal taxes were eliminated, much less money creation would be needed. Stop impoverishing people with FICA and taxes on salaries, and the populace would have far more savings to spend.

Anyway, bottom line:

1. For a Monetarily Sovereign government, taxes are unnecessary (but for certain purposes, like sin taxes, etc.)

2. For a Monetarily non-sovereign government, taxes or some other form of income, are necessary.

3. And the acceptance of all money depends on the full faith and credit of the issuer, not on taxes (otherwise Zimbabwe dollars would have great acceptance).

LikeLike

Umm rodger, “federal taxes” and “taxes” are not the same thing. There is a big difference between the two phrases.

“except I can’t get MMT to say the words: “Federal taxes could be eliminated.””

Even though I already agreed with you about this with this line:

“I would say that it doesn’t matter fundamentally whether they are state and local taxes or federal taxes wrt driving the currency at this point.”

I should have been clearer, so I will. At THIS point in time, federal taxes could be eliminated. Happy?

“As for inflation (It always comes down to inflation, doesn’t it?), no one knows how large a deficit has to be to cause inflation, simply because inflation is so complex and deficits are but one factor.”

I completely agree with this.

“I never said (and don’t even understand the meaning of) “interest rates are more powerful than money creation.”. What interest rate and how much money creation are you talking about?”

I never said you said that. But that is just about what you imply with your ‘the Fed controls inflation through the interest rate” claim.

I am talking about the rates the Fed sets to “combat” inflation.

Let me try and put this another way.

If federal taxes were $0, and spending was the same ~$4T, then it is my belief that we would get higher levels of inflation then we want. Furthermore, I do not believe that the Fed could ever raise interest rates high enough to effectively combat the inflation, as monetary policy is a weaker force than fiscal policy.

“Remember, if federal taxes were eliminated, much less money creation would be needed. Stop impoverishing people with FICA and taxes on salaries, and the populace would have far more savings to spend.”

I completely agree wrt to FICA, there is absolutely no reason for a payroll tax unless absolutely necessary to combat inflation.

“(otherwise Zimbabwe dollars would have great acceptance)”

Zimbabwe dollars have acceptance in Zimbabwe, which only further demonstrates that taxes drive money.

LikeLike

“Zimbabwe dollars have acceptance in Zimbabwe, which only further demonstrates that taxes drive money.”

Zimbabwe must be the only place in the world to have eight currencies as legal tender – none of them its own.

The reason: Nobody trusts the full faith and credit of the Zimbabwean government. All money is “driven” by the full faith and credit of the issuer, not by taxes.

LikeLike

While that article does definitely show that my comment….

“Zimbabwe dollars have acceptance in Zimbabwe,”

is factually wrong since they are not in circulation anymore. That article doesn’t show that taxes don’t drive money. The Govt uses more than one currency, in order for your belief to be true, the Govt would have to accept taxes and spend in only one currency and yet for the public to not use that currency.

Again, taxes drive money is not an opinion that you can disprove. Its an historical observation that is factual.

Again, the largest example of this in history is the Euro.

LikeLike

” . . . the Govt would have to accept taxes and spend in only one currency and yet for the public to not use that currency.

There was a time when Zimbabwe collected taxes in Zimbabwe dollars.

As inflation worsened, Zimbabwe continued to collect taxes in Zimbabwe dollars, but the world no longer trusted the full faith and credit of the Zimbabwe government. So, the world no longer would accept Zimbabwe dollars — despite taxation.

Taxation could not save the Zimbabwe dollar.

I suspect Zimbabwe would love to return to its dollar, but instituting taxation would not accomplish that, so long as the world does not trust the full faith and credit of the Zimbabwe government.

There was a transition period in which Zimbabwe was still taxing in Zimbabwe dollars, but people refused to use Zimbabwe dollars, so Zimbabwe was forced to use other currencies.

It is the full faith and credit of the money issuer that drives the money. Always has been; always will be. Taxation is just one the 8 or 9 guarantees provided by full faith and credit.

MMT forgets all the other guarantees as well as the credit of the guarantor..

As for the euro, no doubt that taxing, as well as the other guarantees established the euro, and most importantly, the world trusts the full faith and credit of the EU. (If the world didn’t trust the credit of the EU, no amount of taxing could save the euro.

However, if for some reason, the world no longer trusted the full faith and credit of the EU, it would meet the same fate as the Zimbabwe dollar.

All money is debt, the value of which depends on the credit of the debtor.

But I won’t argue further. So long as you agree that federal taxes could be eliminated, and that interest rates can fight inflation, there’s nothing more to discuss.

As for monetary policy being a “weaker force” (whatever that may mean) than fiscal policy, that too is a matter for much debate.

Fiscal policy is far too slow in implementation, far too political, far too controversial, far too uncertain in strength and far too economically disruptive than ever to be a good method of controlling inflation.

Can you imagine Congress trying to get inflation down from 4% to 3% using fiscal policy?

LikeLike

Rodger, you keep talking about the full faith and credit, but I don’t understand full faith and credit to do what? Full faith and credit would have to be more than good intentions and warm fuzzy feelings, wouldn’t it? Like at least a guarantee that taxing organizations, whoever they might be as long as they are backed by a credible threat of compulsion, will accept (require, even) dollars in payment. And doesn’t that make dollars a tax credit? What else is there to full faith and credit? Sure, there may be legal tender laws, but those laws are not really enforced, perhaps because they are not now really being challenged. Is that just because there is no realistic alternative to dollars? Will Bitcoin change that, and would the Gov then react? I haven’t found a story, other than tax credit, that really sounds compelling.

LikeLike

See: https://mythfighter.com/2010/02/23/understanding-federal-debt/

LikeLike

Thank you. I believe you’re saying that in addition to accepting dollars as tax payments, the Government commits to not pulling the rug out from under its currency, and will in fact take steps to prevent others from doing it either.

LikeLike

Full faith and credit? In a word “trust” which is etymologically related to the architectural/engineering homonym “trussed.” When you drive over a bridge or fly in an airplane you trust it to work due to its structurally “proven” capacity.

Taxes (takes) reduce purchasing power. Remove all federal taxes and you give everyone a very big break– the economy gets a boost as well as lowering overhead pressure on corporations caused by zero taxes, and the stimulus of increased purchasing power/sales/profits and share price increase.

This isn’t an inflationary scenario; there’s no need to advance prices due to mass production’s capacity to keep up with general demand. In fact, no one knows what the breaking point is. No one knows at what point today’s production capacity will begin to fall behind increasingly higher purchasing power. No one knows if such a scenario could easily absorb the overseas effect on inflation. We may only be scratching the surface of our capacity provided business is honest and competitive, rather than spouting spurious excuses about “internal problems” or convenient “reasoning” directed at those sabre rattling Middle East tyrants.

The only way to stop “believing” this or that is to replace “belief” with practice. I.E., just DO it and see what happens instead of “believing” what others are saying, or what history under very different circumstances has shown to happen, such as the oft false comparisons or Zimbabwe or Germany’s Weimar disaster.

The technology is 2014; the economic psychology is preindustrial 19th century, Malthusian/Darwinian–i.e.,not enough to go around, survival of fittest.

LikeLike