Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

======================================================================================================================================================================================

Laurence J. Kotlikoff is a professor of economics at Boston University and the co-author of “The Clash of Generations: Saving Ourselves, Our Kids, and Our Economy.”

Here are excerpts from an article he published on August 1, 2014:

HOUSEHOLDS can’t spend, on a continuing basis, more than they earn. Countries can’t either, at least not over the long run. But countries can certainly leave the bill for their current spending to the young and to future generations.

In just three short sentences, this economics professor demonstrates everything that is wrong with the teaching of economics in America:

1. His first sentence is correct. Households, being monetarily non-sovereign, can’t spend more than they earn, long-term. They can’t create money at will.

2. His second sentence is wrong for two reasons: First, he doesn’t differentiate between Monetarily Sovereign countries (U.S., Canada, UK, Japan, Australia, China et al), which have their own sovereign currency vs. monetarily non-sovereign entities (all euro nations, cities, counties and states, individuals and businesses) which don’t have their own sovereign currency.

A Monetarily Sovereign nation creates its sovereign currency from thin air, by passing laws that make that currency possible. The laws are under the total control of the nation, which has the unlimited ability to change those laws and to create its currency, at any time it wishes. A Monetarily Sovereign nation cannot run short of its own sovereign currency.

Monetarily non-sovereign entities, like you and me and Kotlikoff, don’t have a sovereign currency and so, cannot create money at will. We can run short of money.

3. His third sentence compounds the ignorance by assuming Monetarily Sovereign governments need to borrow or tax in order to pay their bills. They don’t. Why would they? They have the unlimited ability to create their own sovereign currency.

But the ignorance gets worse:

Official borrowing is the old-fashioned way to do this: Sell Treasury bonds, and other securities, and spend the proceeds. But borrowing in broad daylight has a drawback: The more you do it, the more lenders worry about repayment, and the more interest they charge for their loans.

The federal government sells Treasury bonds but it doesn’t “spend the proceeds.”

When you buy a Treasury bond, dollars are transferred from your personal checking account to your personal T-bond account, at the Federal Reserve Bank, where the dollars stay nice and safe. To “pay you back,” the Federal Reserve Bank merely transfers those dollars back from your Treasury Bond account to your checking account. No new dollars needed.

So lenders (you and I who buy those T-bonds) don’t worry about being paid back. And we don’t determine how much interest to charge. The Fed does that. Really, look around you. Have you seen T-bond interest rates going up, despite massive sales of T-bonds?

But incredibly, the ignorance gets even worse:

Social Security . . . takes in money, via payroll taxes, while promising hefty retirement benefits in return. Dig deep into the appendix of the most recent Social Security Trustees Report, and you’ll find that the program’s unfunded obligation is $24.9 trillion “through the infinite horizon” (or a mere $10.6 trillion, as calculated through 2088). That’s nearly twice the $12.6 trillion in public debt held by the United States government.

Ooooh! How scary! Two unrelated numbers (Social Security “debt” and federal “debt”) and one is bigger than the other. Oooooh!

A Monetarily Sovereign government, owing its own sovereign currency, has zero “unfunded obligations.” All its obligations are paid for (“funded”), ad hoc. When the U.S. government pays a bill, it sends instructions (not dollars) to the creditor’s bank, telling the bank to increase the numbers in the creditor’s checking account.

At the moment the bank does as it is instructed, dollars are created. Sending instructions is the way the U.S. government funds all its obligations. The government never can run short of instructions, so all federal debt is funded.

Oh, but the ignorance continues:

The prospect of formal default by the United States is remote. Informal default via the inflationary, easy-money policies of the Federal Reserve since 2007, is more likely. (Social Security is pegged to inflation, so while inflation would help with our official debts to creditors, like China, it is far from a panacea.)

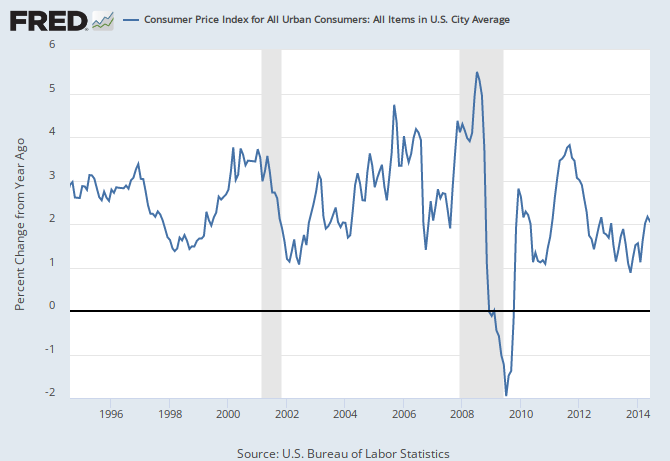

First, those “easy money policies” have resulted in low inflation rates, below the 2.5% – 3% Fed target rate

And second, and more important, inflation does not “help with our official debts to creditors, like China.” Two reasons:

First, we “pay off” China’s “debt” (i.e. T-bonds), simply by transferring China’s money — dollars that are in China’s T-bond account at the Federal Reserve Bank — to China’s checking account, also at the Federal Reserve Bank. It’s just a transfer of existing funds.

Second, U.S. debts are paid with dollars. The value of those dollars (i.e. inflation) is irrelevant. If the U.S. owes someone a thousand dollars, it makes no difference whether those thousand dollars can buy a car or a loaf of bread. The U.S. simply sends instructions to the creditor’s bank, telling the bank to increase the number in the creditor’s checking account by one thousand.

And the beat goes on:

The fiscal gap — the difference between our government’s projected financial obligations and the present value of all projected future tax and other receipts — is, effectively, our nation’s credit card bill. Eliminating it, would require an immediate, permanent 59 percent increase in federal tax revenue.

Or, professor, we simply could continue as we have for the past 240 years, and pay our bills by sending instructions to banks. Better yet, we could cut federal taxes, thereby enriching the private sector and assuring we never again would have a recession. (Federal Deficit = Private Sector Income)

And now for the truly scary part:

Even if we do nothing, we should at least be transparent about our insolvency. A bill introduced last year . . . would require the Congressional Budget Office, the Government Accountability Office and the Office of Management and Budget to conduct such “generational accounting.”

Former government officials from both parties, and more than 1,200 economists, including 17 Nobel laureates, have endorsed the legislation, known as the Inform Act. It would keep our government honest, and sound an alarm.

OMG! Is it possible for all these “experts” to be completely ignorant of Monetary Sovereignty? Are they descendants of the people who insisted the earth is the center of the universe?

Or have they been bribed by the rich, to widen the gap between the rich and the rest? (Cutting federal spending hurts the lower income groups more than the upper income groups, thus widening the gap.)

We know the politicians are bribed via campaign contributions and promises of lucrative employment, later. We know the university professors do what the big contributors tell them to do. And of course, the media are owned by the rich.

The nonsense Kotlikoff spreads is what a person who has zero understanding of economics believes. It’s the belief government finances are the same as personal finances.

I seriously doubt Kotlikoff is that ignorant. I believe he knows that what he is saying is a pack of lies (aka the Big Lie).

So really, Professor Kotlikoff, have you no sense of pride?

Why are you doing this to our children? For the money?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

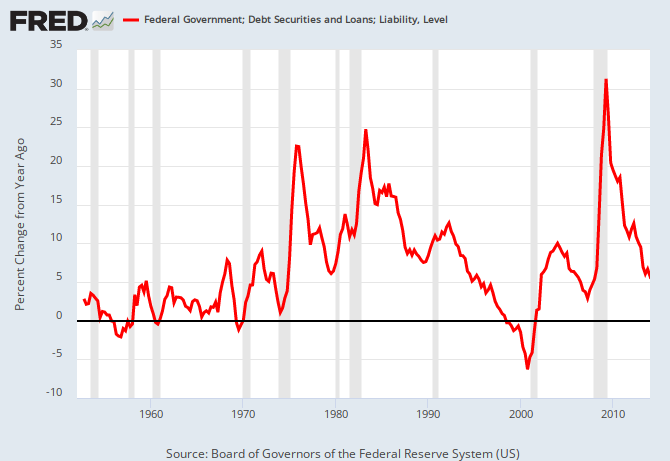

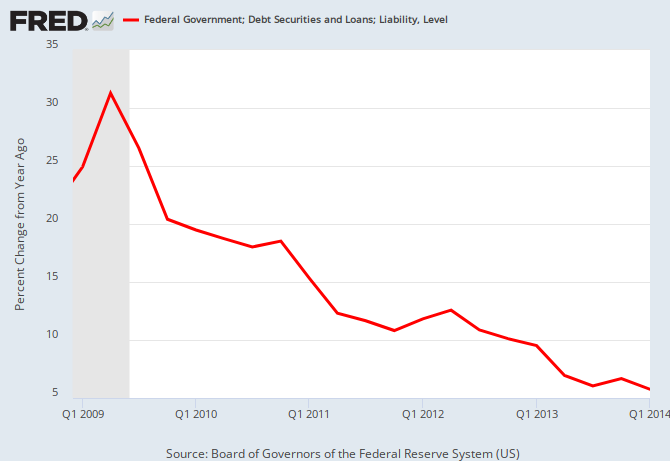

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

my take:

Laurence Kotlikoff Tries To Screw His Country Again … On Behalf Of Whomever’s Paying Him. The NY Times Jumps Onboard As Willing Accomplice

http://mikenormaneconomics.blogspot.com/2014/08/laurence-kotlikoff-tries-to-screw-his.html

LikeLike

Response from Kotlikoff:

His example that the U.S. can “go broke”: Argentina, a nation whose citizens prefer to use the U.S. dollar rather than the peso. This is truly sad.

LikeLike

The Argentina situation supports Roger’s comments. See the link below with the excerpt.

http://theweek.com/article/index/265652/the-main-lesson-of-argentinas-debt-nightmare

“But the biggest problem was the fact that Argentina’s external debt load was denominated in dollars — a currency that Argentina did not control, and so had to trade goods and services to acquire. Argentina’s external debt load prior to its depression was by no means excessive, coming in at less than 40 percent of GDP. The trouble was not the amount of debt, but the nature of that debt.”

LikeLike

Excellent article. Thanks for the reference. Kotlikoff is teaching the same crap nearly all economics professors teach. Why?

Would they be kicked out of the school if they spoke against what the donors want said? Maybe.

LikeLike

You’re welcome, Rodger. Thanks for all your hard work on this blog.

It baffles me why nearly all economists, politicans, media, etc. pretend that there is a limit to the amount of dollars that the US can create. The debate should be how many dollars the US should fund towards infrastructure, healthcare, medical research, education, and other long term investments before certain contraints such as labor force availability and inflation risks mitigate the benefits. These investments benefit the wealthy as well as the poor. Instead, the debate is about whether the US will default on its dollar-denominated debt and when Social Security will go insovent. And those much-needed investments are not made.

LikeLike

All discussions with the economics ignorant devolve to this:

Notice how the argument shifts from the Big Lie that the U.S. can’t pay its bills, to the admission that well yes, the U.S. can pay its bills, but this will cause inflation.

In short, “can’t-pay-its-bills” is a diversion. It’s a fake concern, that even the debt-hawks don’t believe, but still repeat.

Everything boils down to inflation — usually Weimarish hyperinflation — which we never have had in our history.

Then we get to the inconvenient fact that since the beginning of the great recession, in 2008, the federal government has spent massively, and inflation has been low. The debt hawks don’t want to hear that fact — or any fact.

The mantra of the ignorant: “Don’t give me any facts that disagree with my intuition.”

LikeLike

Ian Winograd says: “These investments (would) benefit the wealthy as well as the poor.”

Yes, and that exactly is why we have austerity.

The sensation of wealth and power does not depend on how much money you have, but how much [MORE] money you have than others have.

If everyone has a million dollars, then no one is “rich” in terms of enjoying more power and freedom than others.

But if you have a million dollars, and everyone else has close to zero, then you are rich and powerful. You are “special.”

Therefore people at all economic levels seek to narrow the wealth gap above them, and widen it beneath them. At the top, rich people spend every waking moment stealing, scheming, and scamming in order to widen the gap between themselves and the masses. They take pleasure in your suffering, since your suffering is precisely what makes them rich.

Therefore investments that would benefit the poor as well as the rich are generally to be avoided. Such investments would ease the suffering of the masses, and therefore reduce the gap between them and the rich.

That’s why we have austerity, whose sole function is to increase inequality. Austerity is justified by the Big Lie that the U.S. government is “broke.”

Of course, the rich would have no fun if 98% of humanity were dead. That would be like being marooned alone on a distant asteroid made of gold. Therefore rich people don’t want to kill the masses; just reduce them to a level in which the masses barely survive, and are in extreme misery.

As for the masses, they love to be in misery. They eagerly submit to enslavement. If this were not so, then masses would question the Big Lie.

LikeLike

Hahahahahaha…

This is too good… So not only do you have to be a monetary sovereign, you must also force your citizens to use your currency. Rodger?

LikeLike

I’m not Monetarily Sovereign. Nor are you. But the U.S. government is.

You are not forced to use U.S. dollars (except to pay your taxes). You can use any money your creditors will accept.

Why is that so funny?

LikeLike

Kotlikoff either has severe mental deficiencies, or is a sociopath. I think its the latter.

LikeLike

Either Kotlikoff or Rodger. I pick Rodger…

LikeLike

Kotlikoff is a professional liar who seeks to turn the masses against each other, so that the gap between the rich and the rest can continue to widen. For example, in his books and articles, Kotlikoff falsely claims that Social Security recipients (including the disabled) are “robbing” young people. His solution is to eliminate or privatize all social programs.

Kotlikoff also advocates a national (i.e. federal) sales tax, knowing it would mainly hurt the lower classes, and thereby widen the gap between the rich and the rest.

His writing style is standard for liars in academia. Namely, Kotlikoff peppers his books and articles with screaming tabloid-style headlines and buzzwords, buttressed by esoteric vocabulary (i.e. meaningless bullshit) that intimidates average readers. Since average readers do not actually read this techno-bullshit, they believe the lying headlines, and they assume that “Kotlikoff must know what he’s talking about, since he is an expert.”

The result is that average readers think only in headlines: “Social Security is insolvent! The US government is broke! Federal finances are a Ponzi scheme! We have a national debt crisis! Social programs must be cut!”

And so on. These empty claims are “common sense.”

All these lies have one purpose: to justify an ever-widening gap between the rich and the rest.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

== OFF TOPIC == OFF TOPIC ==

Have you ever wondered why there was a sudden baby boom after World War II, plus the rise of suburbia?

These events happened because Western nations had middle classes for the first time. President Eisenhower commissioned a national highway system in 1956. Everyone had a car. Women were home-makers. Men were paid enough from their jobs to support a family. Marriage rates reached 90%. Everyone assumed that each generation would be better off than the last.

Today politicians claim that the (non-existent) “highway trust fund” has “run out of money.” Meanwhile austerity has destroyed the middle class, such that the impoverished masses see nothing in their future but ever-worsening despair.

As a result, marriage rates and birth rates are plummeting in most “developed” countries.

In France and Spain the number of weddings has fallen to an all-time low, while ages for first-time marrieds is at an all-time high. In Spain the average age of newlyweds is now 37.2 years for men, which is almost 10 years higher than it was in the 1980s. (Spain adopted the euro scam on 1 Jan 2002.)

In Italy there were fewer than 200,000 marriages last year, the lowest number since 1914. Numbers have fallen by 24% in the past decade, and halved since 1965 (when Italy still had a middle class).

Marriage rates have also plummeted in Greece, Denmark, Ireland, Portugal, Hungary, Holland and Britain.

Austerity forces half of people aged 18-30 in Europe to still live at home with their parents. People are kept home by a lack of jobs, by massive debts, and by skyrocketing property costs.

Some pundits claim that marriage rates have fallen because social values changed. Nonsense. Marriage has always included a serious economic component. It is a pooling of resources, but there are no resources when more than 60% of Greek youth (for example) are unemployed.

In Germany, however, marriage rates have >NOT< fallen, since Germany is the chief national beneficiary of the euro scam.

A Google search on this topic produces many articles, none of which mention austerity as the cause of plunging birth rates and marriage rates.

See satirical image…

LikeLike

The gap, the gap, the blah… I think that’s what you mean – the blah… Why? Because you have no clue what the gap means or is.. it’s as good as saying the rich are bad and the poor are good.

Austerity should be renamed to: blah-erity…

LikeLike

Do you have something informative to say, or are you just here to wise-crack?

LikeLike

@RMM: How would currency problems affect stock values? For example, if the euro has problems, is devalued, or abolished, how would these currency issues affect stock values of companies in countries that use the euro?

LikeLike

The euro nations already have problems, because being monetarily non-sovereign, they cannot control their money supplies.

If the euro were “abolished” (i.e. nations returned to Monetary Sovereignty), the health of European economies would improve. Presumably, that would improve the health of European companies.

If the euro were devalued, euro nations’ net exports would increase, and their economies would improve, if they could prevent inflation.

Preventing inflation would be more difficult for them, however, without control of their money supplies and interest rates.

LikeLike

Why do you think Larry called you out Rodger? The notion that economies lack from a lack of money is laughable.

Most nations more than doubled their money supply since 2008 – still not enough money for you Rodger?

Click to access Anderson.pdf

Crack won’t do much for an already overdosed addict. Don’t you think that perhaps that’s where we are now? The central banks have created abundant amounts of crack, luckily, it can’t kill the patient more than it already has. There only bones left and nobody wants crack at the moment.

But there will come a point where someone will grab the crack, inject it on his system, and like a herd, the rest will follow. Good luck controlling the herd with your “tools” at that point.

LikeLike

Actually, it was I who called Larry out for one of the dopiest comments an economic professor ever made: “HOUSEHOLDS can’t spend, on a continuing basis, more than they earn. Countries can’t either, at least not over the long run.”

Yikes!

That he should display such profound ignorance of the differences between Monetary Sovereignty and monetary non-sovereignty, is distressful. I pity his students.

Larry also gave the uninformed example of Argentina, as a supposedly Monetarily Sovereign government that is broke. He didn’t even know that the reason Argentina can’t pay their debts is because their debts are in U.S. dollars, not in pesos.

More yikes!

Larry thinks the federal government lacks the dollars to pay for Social Security and Medicare.

Your analogy about “crack” and “herds” is ridiculous. Money is not crack. Money is the lifeblood of an economy. No economy ever has grown with a decrease in its money supply.

In fact, reduced money supply has caused every depression in history.(See: https://mythfighter.com/2009/09/07/introduction/) I’ve referenced this link, knowing you won’t bother to read it. Learning does not seem to be your forte.

GDP = Federal Spending + Non-federal spending + Net Exports.

LikeLike

“Most nations more than doubled their money supply since 2008 – still not enough money for you Rodger?”

RESPONSE:

The problem is not in the amount of money, but in the distribution of money.

Today, most money is in the financial economy (e.g. Wall Street and the markets). Meanwhile big corporations are sitting on mountains of money, and the rich have more money than they have ever had before.

Meanwhile among the masses, money is so scarce that the real economy is in a bitter depression.

Each day the financial economy (where most of the money is) rises to a new record high.

Each day the real economy (where most of the people are) sinks to a new record low.

The purpose of austerity is to cause more and more money to be sucked out of the real economy, and funneled into the financial economy. Since money in the financial economy is counted as part of GDP, a nation can have a high GDP and still have a severe depression. If I pay $20 billion to acquire a company, then the GDP increases by $20 billion, even though the masses remain broke and unemployed.

What we desperately need is more money in the real economy.

LikeLike

How much money and with what frequency will you distribute this money?

Who receives, who doesnt?

What is your success/ failure criteria?

LikeLike

“He didn’t even know that the reason Argentina can’t pay their debts is because their debts are in U.S. dollars, not in pesos.”

@RMM: Could Argentina, being monetarily sovereign in their own pesos, just print more pesos, then these pesos would be converted to dollars, then pay off the dollar-based debt?

LikeLike

Good point, Rodger actually said the same on a recent post. Argentina should be able to print, buy dollars and pay down its debt as per that comment. I disagree but that’s what the comment said.

LikeLike

I’m not an expert, but as with any forced sale, Argentina would get terrible terms on the exchange. Argentina needs to use the default option as leverage.

Zerohedge addressed this here:

http://www.zerohedge.com/news/2014-07-23/argentina-debt-mediation-goes-surreal-neither-side-turns-meeting-black-market-peso-t

LikeLike

I would like to ask professor Kutitoff what his interpretation of functional finance is, and why he thinks this bullshit show is acceptable.

Please help explain the private sectors new pseudo monetary sovereignty –( though i believe projects have been funded like this for the past 20 years)- which i guess they’ve achieved through esoteric debt instruments traded between entrenched corporate entities, looking for 100% financing with non recourse clauses. Sort of an oxymoron, but not anymore in the arcane world of structured financial instruments. Corporations using special purpose entities designed to be off their balance sheets, verified and sort of collateralized by third party collateral investors such as hedge funds, private equity groups, and trust management firms, vouching for the projects ,so large top rated banks can draw up credit lines against their structured financial instruments, now euphemistically called medium term notes, acting as collateral for the credit lines, fully funding the corporate borrowers projects, plus their obligatory interest payments due back to the bank, as well as all the fees and commissions due the the hedge funds and bank structuring the collateral bonds, their dispersed fees and reimbursements , sort of skin in the game down payments of 30%, are quickly drawn upon. . Basically at closing, maybe an hour after the loan documents are drawn, the hedge funds are reimbursed and advanced exorbitant fees and commissions for their important due diligence and verification of non fraudulent intentions, i suppose? Then they’re out of the mix. . The most amazing and confusing part is the collapse concept at the end of the bonds life, where the financial instrument collapses in on the outstanding principle loan balance and pays it off in full. Made possible because maturity date of the zero coupon instrument will always coincide with the loan term, and the borrower is only responsible for interest payments during the term, which was advanced to them by the bank anyway, so i suppose the loan cost the corp.nothing,. There was no recourse, and the credit obligation was off their balance sheet so as not to effect any other projects seeking funds. Very confusing to me. Cant believe this is legal. Example- 100 million loan for a hotel, needs a 250 collateral bond written up by a hedge fund, bank loans against the 250 financial instrument 175 million, of which the hedge fund initially puts up 75 million but at closing gets back the 75 plus 25in fees, and than is happily sent away to fund another deal, the hotel gets a 100 million line of credit with another 50 in reserve for interest service, while 25 goes back to bankers for their profits, and on their books and they have a loan for 100 mill, which is also accounted as a deposit , and a corresponding liability for 100 million, and they each cancel one another out on the banks balance sheet ,with the 250million collateralized structured financial medium term note, the hedge fund drafted, the equitable collateral the loan was drafted against. Heck i think they than further trade that new debt obligation , using it as collateral for other loans. The whole process seems like 3 card monte. .

Monetary sovereignty is simple, clear, and rational. This new functional finance is purposely confusing, filled with terms that are meant to sound important, but really mean nothing. I believe the confusion stems from economists and finance innovators lacking a basic understanding about their monetary system and the role banks and government play. They base their assumptions on neo classical notions of economic theory. Failing to understand their equilibrium models, absent debt, money, and banks, are based on fantasy, as well as models depicting banks loaning out depositors money,and that there needs to be savings before an investment.So in some crazy way , this money creation out of thin air by the private sector , under the vetted promise of productive exploits, is somehow acceptable , where as an accountable government simply creating the money from nothing to fund public purpose needs, is unacceptable. Maybe because we never know what intentions are., where as in the private sector we know every thing is self serving, and in competition for profits all will benefit. That to me is an illusion. Fraud is committed in the private sector generating instability and steep business cycles , recently much of the chicanery from creating complicated debt instruments, because its so damn confusing, and yet we are alright with it .

Makes no sense to me. I wish i could get a non recourse fat loan with the interest payments set aside, even better would be the 100% financing without equity participation, using third party financial instruments as collateral that dont mature for ten years. funny , how many banks are still around in ten years anyway, they merge, are acquired, and fold. There must be so many fraudulent derivatives and debt instruments on the banks balance sheets . Wouldnt it be great if we could all do this? probably not , but I’d use the money to purchase land for unwanted horses, farm animals falling through the cracks of our intensive factory farms, and displaced alumni from cruel roadside circus’s and zoo’s. But i probably cant get a hedge fund to vouch for that unprofitable well intention ed project. Of course we can easily write up a bond to take care of these displaced latin american victims, and heck , stop the slaughter of so many animals throughout the world. Why doesnt anybody fund benevolent projects with these fanciful loan generations? Thats why we need people to understand monetary sovereignty, and the push back by the elites to obfuscate it. .

LikeLike

Request from Kotlikoff

I looked up Kotlikoff’s Wikipedia article. It included his beliefs about the economy, and I added what I believed to be corrections. He didn’t like that:

I didn’t think that correcting a famous person’s errors in economics theory was “defamatory” and “libelous,” But since he seems especially sensitive about his Wikipedia listing, I agreed not to touch it:

I’m not going to comment about his comparing federal financing to a Ponzi scheme.

Nor will I comment about his “tripling of the price level.”

And I especially won’t comment about his saying the U.S. is “In worse shape than any developed country.”

What could I possibly say that would make his comments any more ridiculous than they already are?

And because he asked politely, I surely will not touch his Wikipedia article.

LikeLike

Not sure if he does not realize that debt disappears overnight in a stress scenario, which actually makes it deflationary, not inflationary.

Plus people are already struggling with prices as they are. For higher inflation you need any of 2 scenarios. Large increase in bank lending and/or the government giving people money directly.

Quat,

There is no lack of money anywhere, the money supply was steady for years and years and increased by multiples in the last few. Most countries aren’t communist the last I checked, how will you” distribute” the money, tell us your plan. My opinion, it won’t work and will probably make matters worst.

LikeLike

You’re right. Average people are too rich. We need more austerity and less money in circulation.

As for my “plan,” it is quite simple, but you do not merit any further thought or effort.

Have a nice whatever.

LikeLike

8/3/14; 12:45AM Note from Kotlikoff:

My response follows.

LikeLike

Larry is correct!

Hurt at- one economist that can think. There is definitely a seignorage tax when money is created. I can see why most can’t see what’s wrong with this, but I’d say you are not thinking hard enough.

My argument is not whether it’s right or wrong or possible or not, it’s that it is a form of tax. And nowhere does the government tell it’s people that it’s taking an additional layer of taxes. Its wrong on many counts.

LikeLike

@Money, Re: “seignorage tax when money is created”

If you want to call money creation a tax, that’s fine, however, have you read Rodger’s 10 steps to prosperity? Rodger promotes eliminating FICA, insituting a reverse income tax, eliminating corporate taxes, and increasing the standard deduction. Are there enough tax reductions in there for you, or are you going to organize a tea party?

LikeLike

You monetarily need to figure out how to change the other side of the equation, the asset side, the stuff side.

If there are 10 Apple’s, doubling the amount of money to buy still the same 10 Apple’s is not going to help.

Its not difficult, but you want to make it so.

LikeLike

Mr/Ms Money,

The fundamental mistake you’re making is assuming that “the same 10 apples” is a constant. The rate of static asset diversification makes all static assets obsolete – or at least grossly devalued – in ever decreasing epochs. As static assets AND options diversify & multiply at increasingly stunning rates … our #1 priority is to use enough nominal units to denominate all the possible transactions that growing populations with growing options want to make.

Please see Current Fiat vs Future Options

http://mikenormaneconomics.blogspot.com/2013/12/conflating-current-fiat-with-future.html

If you can understand Algebra 101, then you can understand why a national currency supply of a growing nations must constantly expand. If you can’t understand either, then it’s OUR currency, but your cognitive problem.

LikeLike

I admire your patience, Rodger.

LikeLike

When he stated “Economies have a finite present value of resources — of, call it corn” I knew right then he was a Malthusian. Yes, some resources are still scarce for one reason or another –pure clean water, medicine, rare gases, and other elements–but we have the tech and the knowhow to make the world work. We just don’t have an acceptance of monetary (MS) knowhow to match all the tech knowhow.

I doubt he’ll take your advice. The largest egos with all the titles/honors are confronted by the greatest cognitive dissonance.

I think the biggest and most dangerous gap is the one that exists between understanding Monetary Sovereignty and rejecting traditional scarcity economics; specifically, the gap between the econ dept. at UMKC and all other econ depts.

I can’t envision standard economic theory simply yielding to MS short of an economic emergency that would hopefully force MS to the surface.

LikeLike

@ tetrahedron720: Some months ago I compared the mass mind to magnetic fields, and I still think the analogy is valid.

The sun and the earth both have magnetic fields. The sun reverses its magnetic field (i.e. reverses polarity) every 11 years. The earth changes polarity at random intervals. Why random? We don’t know. What causes the reversals? We don’t know. They just…happen. All we can do is guess. The strength of the earth’s magnetic field also varies at random, for reasons unknown. If you run an electric current through a tank of liquid sodium (or some other excellent conductor), it too has a magnetic field that randomly changes polarity. Why? We don’t know.

Likewise I think it is possible that acceptance of the facts of MS could become widespread. How? By societal collapse, or world war, or some other disastrous event? Not necessarily. I think it is at least possible that it may just…happen.

LikeLike

I’m shocked. 🙂

LikeLike

I hope to live to see it.

LikeLike

MMT is just cultism, like postmodernism, which makes up a bunch of bullshit to “prove” what it wants to be true.

The USG needs to print $1,600 trillion over the next 75yrs, per its own model. Default/hyperinflation is what’s coming.

LikeLike

Do you mean the federal debt is a ticking time bomb? See: https://mythfighter.com/2018/08/01/the-fake-debt-time-bomb-still-ticking-after-78-years/

LikeLike