Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

======================================================================================================================================================================================

Once, I’d been puzzled by the AFL-CIO, and lately this puzzle had become more — puzzling. Here are excerpts from an article in the AFL-CIO blog:

Good News for All Americans in Social Security, Medicare Reports

Said AFL-CIO President Richard Trumka: “Social Security and Medicare will be there for us and our families if elected leaders listen to the American people and reject calls to cut benefits. Instead of undermining these crucial programs, we must build on their success and adopt measures to strengthen and expand them.

O.K., good enough. But . . .

Richard Fiesta, executive director of the Alliance for Retired Americans, said the most important lesson from the Social Security report “is that Social Security has a large and growing surplus.

Uh oh. A large and growing “surplus”? Social Security is a federal agency. The federal government is Monetarily Sovereign.

A Monetarily Sovereign government doesn’t need a surplus. In fact, because a federal surplus = a deficit for the economy, a federal surplus always is harmful to the economy.

It gets worse:

The Medicare report, Fiesta said, “reminds us once again that the Affordable Care Act is controlling health care costs.” He said: It is great news that the life of the Medicare Trust Fund has been extended by another four years to 2030.

Yikes! does he actually believe there is a “Medicare Trust Fund” — a fund that pays for Medicare? Is he not aware that all federal “trust funds” — ALL — are accounting fictions that don’t pay for anything?

The U.S. money supply consists only of balances in the private sector. Since the federal government has no money, it pays its bills by sending instructions (not dollars) to creditors’ banks, instructing the banks to increase the balances in the creditors’ checking accounts. These instructions are in the form of checks or wire transfers.

Only at the time the banks obey the instructions, and increase the checking account balances, are dollars created.

Imagine an economy having a total of $1 trillion. On Monday, the federal government mails you a $100 check. On Tuesday, the check has not yet arrived at your bank. The economy still has $1 trillion.

Mail is a bit slow this week, so on Wednesday, the check still has not yet arrived. The economy still has $1 trillion.

By Thursday, the check arrives at your bank, but the bank is closing, so a clerk puts the check in a pile for tomorrow’s processing. The economy still has $1trillion.

On Friday, the clerk opens the mail, sees the check (the instructions) and pushes a computer key, which raises your checking account balance by $100. At that instant, and not before, the total money supply in the economy rises to $1 trillion, one hundred dollars. And this is how the federal government creates dollars.

The fictional “Trust Fund” is not part of this process. No matter what the balance in that trust fund may be, your bank’s clerk will push the button that adds $100 to the nation’s money supply.

That is why there need be no Army “trust fund” to pay for Army expenses, no Congress “trust fund,” no Supreme Court “trust fund,” no CIA, FBI or NSI “trust funds.” For a Monetarily Sovereign nation, a “trust fund” is a non-functional fiction, serving only to deceive.

Clearly the deception is working:

The Social Security Trustees reported once again that the Disability Trust Fund can pay full benefits until 2016, with enough revenue after that time to cover about 80% of promised benefits.

Trumka said: Congress should act soon to ensure disabled workers and their families will continue to receive the benefits they have earned. This can be done by allocating a larger share of current payroll tax contributions to the Disability program.

No, Mr. Trumka, federal taxes do not pay for federal spending. If federal taxes rose to $999 trillion, or fell to $0, neither event would affect by even one penny, the federal government’s ability to pay its bills.

That clerk at the bank doesn’t care about tax collections. He just follows instructions. And the federal government has the unlimited ability to send instructions.

Oh yes, there is a limit, and that limit is inflation. At some level of money creation (deficit spending), it’s possible for there to be an inflation the Federal Reserve can’t control. At that time, but not before, deficit spending would have to end.

Fortunately, such an inflation is quite rare. In fact, in the almost 240 year history of America, through wars, recessions, depressions, stagflations and even “normal” inflations, we never have had an uncontrollable inflation.

So the puzzle is: Why don’t Trumka and Fiesta seem to understand this? Is it ignorance, or is there a motive?

I suspect that in Truma’s case there is a motive: Increased Social Security and Medicare benefits may benefit the union’s members, but they don’t benefit the union’s leaders. So why waste much time, effort and political capital? A few perfunctory statements should be enough to show workers that the union stands behind them.

Far better to press for increased membership and higher salaries. That’s where the union leaders make their money.

As for the Alliance for Retired Americans, it’s mission statement claims:

“A primary objective of the Alliance is to enroll and mobilize retired union members and other senior and community activists into a nationwide grassroots movement advocating a progressive political and social agenda.”

So, they are going after “retired union members” — those people who no longer pay union dues — and ask them for $10 or more membership.

And what are the membership benefits? Apparently, they are the AARP for union people, with the same kinds of insurance business and discounts.

Given its business model, what would be the benefit to its leaders of higher Social Security benefits or reduced FICA?

None.

So, I guess the puzzle isn’t much of a puzzle. The AFL-CIO leaders and the Alliance for Retired Americans leaders and AARP’s leaders, have no real motivation to tell Americans the truth about the federal government’s ability to spend.

In fact, because the Alliance and AARP sell health insurance, they sure as heck are not going to tell anyone how Medicare for every man, woman and child in America, and a more generous Social Security with no FICA, easily are affordable for our government — just as AARP won’t tell.

O.K., puzzle solved. Those three organizations benefit from the ignorance of their members, and no one is going to kill that goose while it’s laying those golden eggs. The members will have to figure things out for themselves.

Lots of luck with that.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

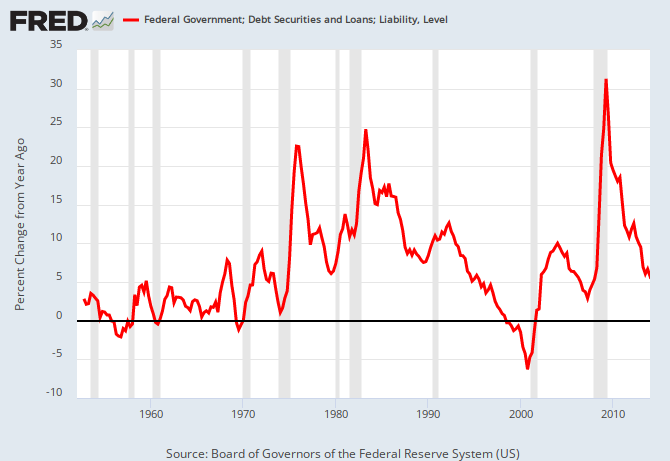

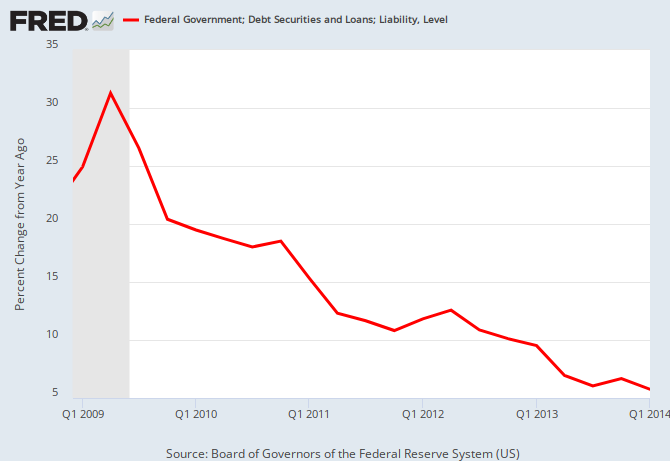

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Satirical image 1…

Satirical image 2…

LikeLike

One of the nice things about economics is that idiots can say whatever they want, and get away with it.

For example, last week there were a bunch of news stories saying the US economic “recovery” is weaker than was expected.

This week there are a bunch of news stories which claim that the US economy is booming.

The “proof” is that Obama’s pal Penny Pritzker says so.

(Pritzker, the Chicago billionaire, provided most of the money for Obama’s early political career. Last year Obama rewarded Pritzker by making her head of the US Dept. of Commerce, and giving her a $10 billion budget. Pritzker was confirmed by a US Senate vote of 97 – to – 1.)

These clowns make up whatever they want.

See satirical image…

LikeLike

Listening to the “news” you never hear of the real economy booming or the financial economy booming, just the “economy.” The word REAL would/might send too many shock waves through a suspicious public asking what the hell’s the difference. Then the crap hits the fan when the cat starts sneaking out of the bag and the subject quickly gets changed to avoid everyone getting educated. The closest we get to this difference is when you hear about ” Wall Street and Main Street,” the former is financial (recovering), the latter is real (struggling) and like East is East and West is West, never the twain shall meet.

LikeLike

However, the story failed to gather the appropriate public attention. What a job killer making it harder to do business and grow your company. Unfazed by weak August jobs report, he attacked Republicans for the havoc that their proposals will unleash on older workers and those nearing their retirement.

LikeLike

As well, some older folks who fall into the rich category due to scrimping and saving during their young lives will end up sharing with the poor who lack the motivation to move upward financially. Except no one can guarantee they will never have a day of illness or need some treatment as they get older. When Nancy Pelosi became the Speaker of the House she said that this would be the most ethical Congress ever.

LikeLike

Nice: Three myths in one sentence:

Myth 1. The rich make their money by scrimping and saving.

Fact: This is rare. Most of the rich belong to the “lucky gene” club. They received their money from mommy and daddy, and/or received great jobs from friends of mommy and daddy, and or were sent to the best schools, and/or received a giant break that could have gone either way.

Bill Gates was just one of many programmers, when IBM chose his software and Gates became the world’s luckiest man. Mark Zuckerberg didn’t get rich by “scrimping and saving.”

Those kinds of “Horatio Alger” story are vanishingly rare.

Myth 2. The rich share with the poor by paying federal taxes.

Fact: Federal taxes do not fund federal spending. If all federal taxes fell to $0, the federal government could continue to spend as always. The rich spend a lower % of their income on charity than do the middle and poor.

Myth 3. The poor are lazy and would rather live in poverty than work.

Fact: The poor, on average, work harder than do the rich — unless you consider vacations on the yacht, foreign travel, dining in the best restaurants and attending the opera to be hard work, while manual labor is easy.

LikeLike

8% tax on unearned income for families who make more than $250,000 annually. Otherwise we may get runaway inflation and $5,000 gold after 2020. The federal government will now set the standards for raising children and will enforce them by home visits.

LikeLike