Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

======================================================================================================================================================================================

I enjoy reading a website called “The Daily Bell,” because it is entertaining — laugh-out-loud entertaining.

It is written by a man named Anthony Wile, “Chief Investment Advisor of High Alert Investment Management Ltd.” So far as I can tell, he seems to: Believe everyone should buy gold, love Ron Paul, love Peter Schiff, hate Keynes, hate “fiat” money and be ignorant of Monetary Sovereignty. And oh yes: Buy gold.

Recently, his site published an article titled, Another Chinese Economic Problem: Sky-High Debt Ratios:

China’s boom is to a large extent self-funded. The US can fund its enormous deficit because the dollar is the world’s reserve currency. Countries around the world hold dollars.

Wrong. Being the world’s reserve currency merely means that as a trade convenience, banks around the world hold dollars in reserve.

It has nothing to do with the federal government’s ability to “fund” its deficit, whatever that means.

The deficit is no burden, because our Monetarily Sovereign government has the unlimited ability to create dollars and to determine both the exchange value of the dollar and national inflation rates. That is what being “sovereign” entails.

Those Monetarily Sovereign nations (Canada, UK, Japan, Australia, China et al) whose currencies are not the world’s reserve, have the same powers.

China’s huge size and population and initial backwardness has allowed Chinese banking officials to treat China as a kind of miniature global system. The yuan may not be the world’s reserve currency but it’s China’s, and that’s been enough.

Wrong. Monetary Sovereignty, not size, are the keys to China’s ability to create its sovereign currency at will.

Then we come to the shockers:

The debt level] is up 20 percentage points of GDP since late 2013. The ratio has risen by 100 percentage points of GDP over the last five years. It has pushed debt to $26 trillion, more than the entire commercial banking systems of the US and Japan combined.

That should have been the clue. China is supporting a debt that is greater than “the entire commercial banking systems of the US and Japan combined.”

It sounds huge, but China seems to have had no problem supporting it. So, could the entire “debt-is-too-high” scenario simply be wrong?

The FT’s Jamil Anderlini points out here that the figure is very high for an emerging economy. Mature economies can handle a higher debt ratio for all kinds of reasons, not least because they have large assets to offset their liabilities.

Readers of this blog know that for a Monetarily Sovereign nation, the debt/GDP ratio is meaningless. Why? GDP does not pay for debt.

In the U.S., debt is the total of T-security deposits at the Federal Reserve Bank. To “pay off” this debt, the Fed transfers dollars from T-security accounts to holders’ checking account. No problem at all and no new dollars needed.

The federal government does not sell assets to pay its debts. Yellowstone Park and the Lincoln Memorial are safe.

Meanwhile, according to CNBC, China’s debt soars to 250% of GDP I sure hope China doesn’t have to sell the Yellow River.

This does not mean that China is about to crash. It has a state-controlled banking system. Therefore any bust scenario will play out in a different way, probably through much lower growth and two decades of Japanese-style extend and pretend …

We can inflate some of it away, or we can deflate into defaults and creditor haircuts. Pick your poison.

Forget the “bust scenario” whatever that imprecise term may mean. And forget about creditor haircuts, which are the famous province of the euro (monetarily NON-sovereign) nations.

Instead, think about “inflate some of it away.” This often misunderstood concept supposedly means: Inflation benefits debtors, because cheaper money can be used to pay debts.

Debts however, are not paid with purchasing value, but with face value. If China owes one trillion renminbi, it will have to pay one trillion renminbi, regardless of the purchasing power of those renminbi. Inflation has no effect on that.

But what if China owes one trillion dollars. It will have to exchange renminbi for dollars, and if the renminbi has lost value, China might have to spend more renminbi to buy the necessary dollars.

So what? China is Monetarily Sovereign. It can create unlimited renminbi to exchange for dollars, to pay its dollar debts.

Could this cause more inflation? Possibly. But remember, China has the same or even more, inflation-stopping tools at it disposal, as we do. China not only is sovereign over its sovereign currency, but as the author said, China has “a state-controlled banking system.”

The US in particular urged first the Japanese central bank and then the Chinese central bank to print additional currency that was used in one way or another to purchase US debt.

The currency was then redistributed in the US and recycled as consumer spending. The spending went back to first Japan and then China, thus fueling two “Asian miracles.”

Wrong, yet again. US debt cannot be purchased with foreign currency. To buy a T-bill, one must use dollars.

Further, dollars used to purchase T-securities are not “redistributed in the US.” That’s the “federal-taxes-pay-for-federal-spending” myth. Dollars in T-security accounts have but one place to go: To China’s checking accounts.

The only way American consumers can get their hands on those dollars is if China spends them here: i.e. China imports American goods and services. How has that been going?

In fact, it is U.S. dollar creation, not China’s borrowing, that funds American imports from China, the so-called “Asian miracles.”

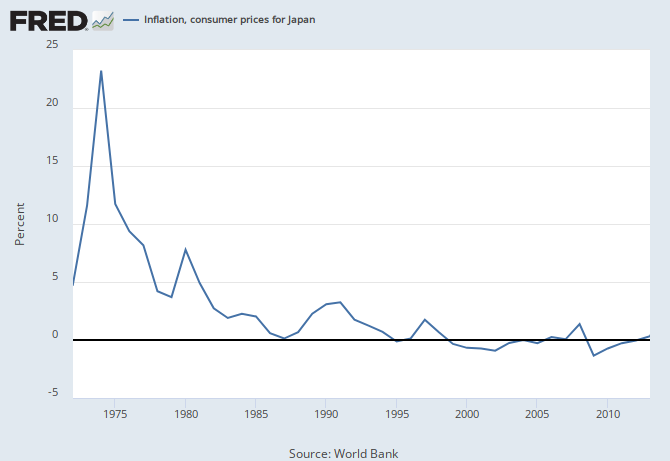

This article provides us with further insights into the precipice on which China is now perched. We’ve usually commented on the eventual immanence of yuan price inflation; in fact, price inflation is already significant in Japan.

Only in the past year has Japan successfully and intentionally created inflation to fight its crippling deflation. Look at the trends:

The author would like you to believe that a large debt/gdp ratio (which has been the norm in Japan for many years) suddenly has caused the inflation Japan worked so hard to achieve.

The end result will no doubt be chaotic and ruinous. We will see then if those who have organized this deliberate, rolling insolvency shall have the wherewithal and credibility to create a kind of global Bretton Woods system that will reconfigure what is yet available.

And there it is: A gold standard will save us. Never mind that every time a nation has fallen into financial difficulties, it has dumped gold in an attempt to avoid a depression.

“The Daily Bell” is committed to selling gold to Anthony Wile’s clients.

And isn’t it ironic that for many years, debt hawks have decried the U.S. federal debt held by China. How often we have been told our debt to China is unsustainable and will break us.

Now suddenly, China’s debt to us has become unsustainable and will break China.

So we owe them too much and they owe us too much. Think about it. Does that make any sense, whatsoever?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

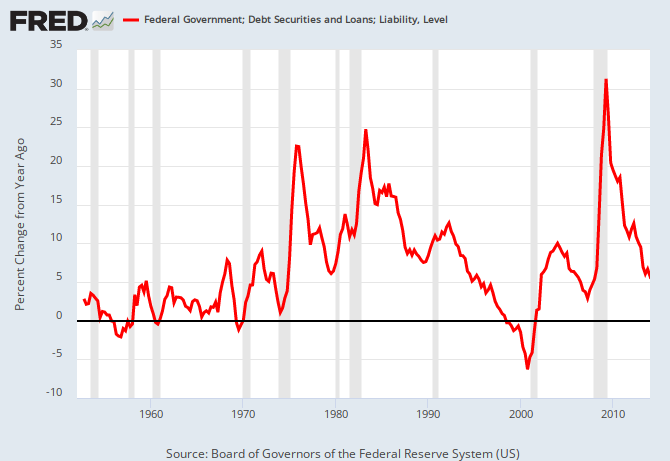

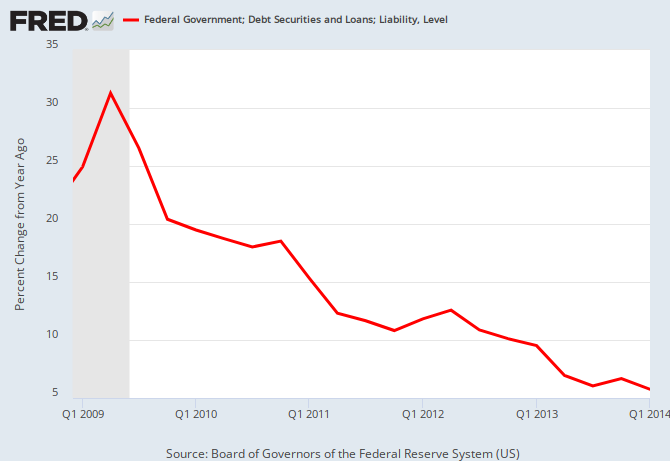

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

[1] Good article about the self-contradictory nonsense at the “Daily Bell.”

Rodger writes: “The Daily Bell is committed to selling gold to Anthony Wile’s clients.”

Yes, and its writers will use any trick to pull in new suckers. But I suppose that’s okay, since the suckers figure they are “smarter” than average people. That is, they get the entertainment and ego gratification they pay for.

Average people do the same thing when they vote for politicians who say they must impose more austerity (i.e. they must widen the gap between the rich and the rest) because of the non-existent “national debt crisis.” That is, average people get the entertainment and ego gratification (and poverty) they pay for.

As for debt that really matters, like student loan debt, most politicians are all in favor of expanding it forever.

[2] A very small quibble…

Rodger writes: “In the USA, (the so-called national) debt is the total of T-security deposits at the Federal Reserve Bank. To ‘pay off’ this debt, the Fed transfers dollars from T-security accounts to holders’ checking account. No problem at all, and no new dollars needed.”

Actually the Fed creates new dollars when it pays interest on T-securities.

For FY 2014 the US Treasury projects that the Fed will create $355 billion in interest – which is the lowest amount since FY 2005. In 1998 the Fed created $363 billion. I don’t know how much of that (if any) was clawed back as taxes.

http://www.treasurydirect.gov/govt/reports/ir/ir_expense.htm

Interest payments figures from GAO, CBO, and OMB are different, but they lie are crass liars about everything, so I ignore them.

[3] The “Daily Bell” makes much mention of Japan. As I have repeated ad nauseum, austerity is a global plague, and Japan is no exception. Household spending has plunged, wages have dropped for 23 months in a row, the number of workers who can only find part-time jobs has ballooned to 38 percent, and most economists now expect Japan’s 2nd quarter GDP to shrink to minus 4 percent or worse.

On 1 April 2014 the Japanese government moved to further widen the gap between the rich and the rest. This was done by increasing the national sales tax from 3% (established in 1989) to 8%. National sales taxes are highly regressive (they mainly hurt the lower classes), and utterly unnecessary in Japan’s case. The jump to 8% has effectively put Japan into a depression.

It’s all part of the plan. Depressions widen the gap between the rich and the rest.

Abenomics is pure austerity-nomics. According to Reuters, “part-time, temporary and other non-regular workers who typically make less than half the average pay in Japan has jumped 70 percent from 1997 to 19.7 million today — 38 percent of the labor force.”

And now Shinzo Abe is pushing hard to privatize Social Security (which in Japan is called the Government Pension Investment Fund, even though it is not a fund). That is, Mr. Abe wants to give Social Security to the stock market. George W. Bush wanted to do the same thing with Social Security, but abandoned the idea after Lehman Brothers collapsed and the financial economy tanked. Now Abe will put the long-term security of Japan’s elderly at risk in order to boost profits for his plutocrat friends.

Abe also wants to eliminate overtime pay. He wants to make it easier for corporate bosses to fire workers. He wants to do away with all laws that benefit workers.

In many ways, Japanese austerity mania is much like UK austerity mania.

Both places are island nations (although Japan is 36% larger), and both places have utterly depraved governments.

LikeLike

I forgot to mention that Japan’s government wants to have a budget surplus by FY 2020 (which begins on 1 April 2019, and runs to 31 March 2010).

Therefore, in addition to the 8% national sales tax, the Japanese government plans to increase the tax to 10% by October 2015.

Japanese consumption (i.e. household spending) has already slowed by 8% since the 1 April 2014 hike in the national sales tax. (The Wall Street Journal calls this disaster a “recovery.”)

Even a 10% national sales tax will not achieve a budget surplus, so the tax will have to be raised yet again.

Austerity mania is global, because belief in the Big Lie is global.

LikeLike

Technically, the TSY pays interest on T-securities not the Fed. Interest payments on excess reserves or the Fed’s IOR policy since QE began is what you are talking about.

This is actually my biggest problem with non-T-bond model of Govt spending, instead of the interest going to regular people, trust funds, pension funds, foreign Govts, it all goes to the banks.

For example, if there no zero outstanding T-securities and instead there was just $20T in reserves, then the Fed would literally be creating and giving directly to the banks, that $355B you referenced for FY2014.

Now thats a policy the banks should be bribing Congress to get behind!

LikeLike

“Technically, the TSY pays interest on T-securities, not the Fed.”

You may be correct. Let’s think this through…

We know that the Fed receives no funding appropriated by Congress.

The Fed says so here…

http://www.federalreserve.gov/faqs/about_14986.htm

So when a T-security matures, the interest is created in a Fed account. Does the Fed create this money all by itself, or does the Fed create it on orders from the Treasury? I don’t know. Perhaps both. That is, the Fed sells T-securities with the US Treasury proviso that the Fed will automatically create the interest money upon maturity.

Incidentally, the Fed itself buys many T-securities, and when they mature, the Fed remits the interest to the Treasury. This is meaningless, since the US Treasury does not need or use interest revenues, tax revenues, or any other revenues — but it helps to sustain the Big Lie.

Anyway, my main point is that no individual will ever have to pay a cent on the so-called “national debt.” And no interest payments are created by Congressional appropriation.

Instead, interest money is created by the Fed-Treasury nexus.

As for the rest of your comment, it flew over my head. I’m not able to follow it.

LikeLike

Regarding these people who hawk gold products and sell gold coins and tell you that the dollar is worthless and the dollar buys 97% less than it did a century ago and the dollar is debased and all this “money printing” (whatever that is) is going to cause hyper-inflation – isn’t it comical that their main business goal is to collect massive amounts of – what? – dollars?? They’re willing to exchange every bit of inventory they have for dollars, dollars, and more dollars. Ask these multi-millionaire gold-hawking business owners what their biggest holding is, and they’ll all admit that it is, by far, dollars – the very dollar they’re telling everyone else is worthless.

LikeLike

Good observation. That calls for a humorous image…

LikeLike

I’m saving that image. Perfect.

LikeLike

“The dollar buys less than it did a century ago”. This statement is factually correct, but it is not meaningful because wages have risen also. If the dollar could buy 10 x as much but the average wage was 1/20 of what it was, would that be something to celebrate? No. What is meaningful is how much labor needs to be performed to buy something today as compared to a century ago. The answer is much less labor.

LikeLike

“China is Monetarily Sovereign. It can create unlimited renminbi to exchange for dollars, to pay its dollar debts.”

I have to confess I’m lost on this. Who will be willing to exchange renminbi for dollars?

LikeLike

People who trade with China. That’s why there is a: Currency converter

LikeLike

So maybe a better reframing of the statement would be that China, being monetarily sovereign, could create unlimited renminbis to finance local investments that will make products it could sell abroad in exchange for dollars, right?

LikeLike