Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

======================================================================================================================================================================================

I just read a 2011 article in Forbes Magazine, titled, “What is the purpose of a gold standard?” (O.K., so I’m a bit late.)

Although the author, Nathan Lewis, has an axe to grind (he wrote the book: “Gold: the Once and Future Money”), he makes some interesting points:

If you ask the typical academic Keynesian economist this question, he would probably say that there was no purpose at all.

If you ask the typical gold standard advocate this question, he would probably respond with some vague platitudes like “gold is honest money,” or perhaps would argue that a gold standard prevents government debt issuance, or some such thing. They have, I would say, only an imprecise grasp of the purpose of a gold standard system.

I agree, with all he said.

The purpose of a gold standard system is to produce a currency of stable value.

Agreed. That is the stated purpose. Of course, a gold standard does not fulfill that purpose. And it begs the questions: What is a stable value and what is its purpose?

Now we can say what a gold standard does not do: It does not prevent panics, crashes, depressions and so forth, caused by various factors unrelated to currency value. It does not prevent government debt issuance – although it does prevent printing-press finance of government expenditures.

A gold standard doesn’t prevent, panics, crashes and depressions, but it produces a currency of stable value???

I’m not sure how that is possible, and not sure why anyone would want a currency of “stable value” during a depression, panic or crash, even if it were possible.

A gold standard system does not put some sort of artificial limit on the supply of money. You can have as much currency as your economy needs, within the constraint that the currency must be stable in value. In other words, you cannot over-issue money to the point that it loses value.

What does stable in value really mean? Does “stable value” mean no inflation? Or does “stable value” mean stable exchange rate? Two very different goals, neither of which can be accomplished with gold.

The Fed already controls inflation to it’s annual goal of 2.5% -3%, without gold.

Is there another, even better method of creating a currency of stable value? No, there is not.

Yes there is. Interest rates. Raising rates “strengthens” the dollar. It increases the demand for dollars, which increases their value.

That is why, when people desire a stable currency, they have used gold again and again over hundreds of years.

And they have gone off gold standards, “again and again.” The author doesn’t explain why. (It’s because limiting your nation’s money supply, by the accident of gold discovery and inventories, causes national insolvency — that is the “instability” the author preaches about.)

Is there some deficiency in the gold standard, such that we would be motivated to find another, better system? In other words, did gold’s value ever change so much that it caused some sort of significant economic problem? Did it fail in its role as a benchmark of stable value?

It is quite difficult to find evidence of any example, in the last three hundred years, of a major gold-instability event. It pretty much worked as advertised.

Yes, those gold-instability events are so-o-o-o-o hard to find — except right under our noses:

And we have had many, many recessions, as well as the Great Depression, while we were on gold standards. (See graph)

“Worked as advertised”?

(Today’s) currency manipulation leads only to economic stagnation and decline. A capitalist economy simply works better with a stable currency than with an unstable one.

Again, he gives no definition of “a stable currency.” Is he talking about inflation or is he talking about foreign exchange. A currency can be stable in one and not stable in the other.

And what does he mean by “works better”? Is there some measure of this criterion?

The article demonstrates the usual gold-bug, vague generalities.

We are now on the path of currency decline, which will eventually end in hyperinflation if it is not arrested at some point.

Ah, the old hyperinflation myth, which always includes the words, “eventually” and “at some point.”

Of course “eventually” and “some point” may be centuries away. After all, we already have gone more than two centuries, through wars, depressions, recessions and yes, inflations, without hyperinflation — sometimes on a gold standard, sometimes not.

The U.S. federal government is being funded in large part with printed money, a red flag if there ever was one.

Dollars are not printed. The U.S. government is Monetarily Sovereign. The dollar (not the printed dollar bill) is its sovereign currency.

The U.S government not only can create as many or as few dollars as it wishes, but it can change the dollar/gold exchange ratio any time it wishes.

So, how is this freedom to change the dollar/gold ratio at will, any more or less “stable” than the ability to create dollars at will?

It isn’t.

We don’t have to put up with the endless chaos, punctuated by disasters and crises, characteristic of the floating currency arrangement.

When people are ready to return to a system of stable currencies, they will look for a way to do so, and discover once again that a gold standard system remains the best path to this goal.

Let’s get this straight. A Monetarily Sovereign nation is sovereign over its currency. It can do whatever it wishes with that currency.

It can run larger or smaller deficits. It can spend more or less. It can peg to another currency or to a precious metal, like gold or silver. It can “unpeg” at any time. It can set and revise its currency’s exchange rate with any other currency, a basket of currencies or with any element in nature.

A gold standard does not force a Monetarily Sovereign nation to do anything it can’t do when not on a gold standard. When a nation on a gold standard runs short of gold, it merely changes the money/gold ratio, as Nixon did on August 15, 1971.

So how can a gold standard be a path to a system of stable currencies?

It’s a path to one thing, and one thing only: Big profits for the brokers who hawk gold to the suckers who guess future prices.

Place your bets, folks. The wheel is spinning.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

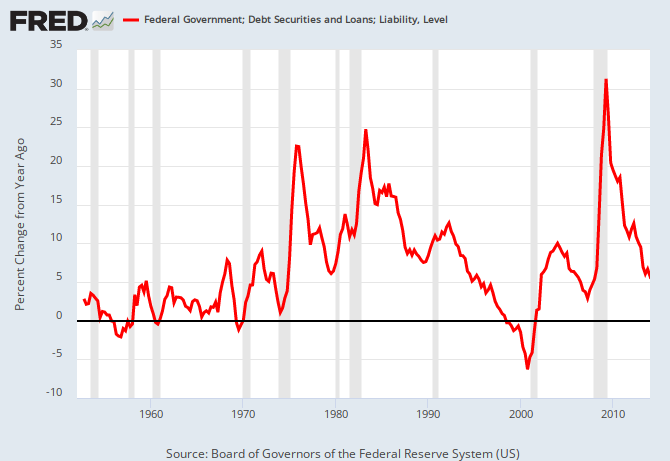

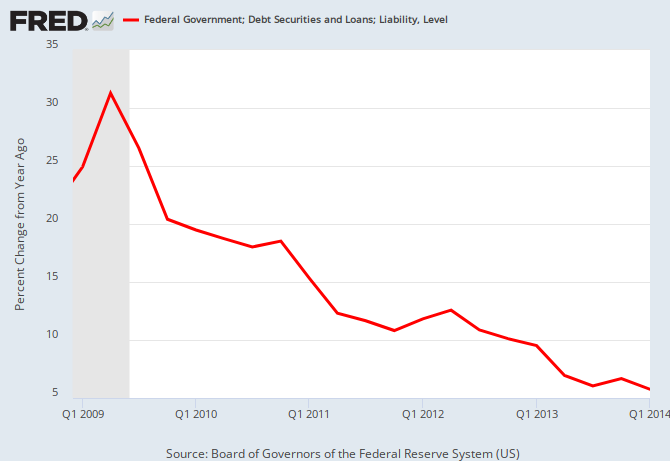

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

“The US can change the dollar ratio…”

Bullshit… it’s like having unprotected sex and saying that you can control pregnancy. The 2 do not go together, gold prices are closely aligned with money issuance.

LikeLike

Me,

Wrong yet again. Always dependable:

Where do you get your economics information? I swear, if you told me it was sunny outside, I’d know to wear a raincoat.

LikeLike

“Gold prices are closely aligned with money issuance.”

Actually “gold prices” are set by gold markets, which have little to do with actual gold. When you speculate in a “gold market,” you can buy or sell physical gold in the form of coins or bullion, but this kind of speculation is quite rare.

The majority of all “gold” speculation has little or no connection with gold. Instead, it involves “exchange-traded products:” — i.e. the buying and selling or “shares” in a “gold exchange” or in derivatives based on these “shares.” These “shares” and their derivatives are not gold, yet they are falsely called “gold.” They are worthless outside the “gold exchange” (or commodity exchanges, in the case of derivatives).

The buying and selling of these “shares” is what sets their price in the exchange. Some of these exchanges have their “shares” traded in the regular stock markets, even though there is nothing physical to back up the “shares.” This in turn has given rise to derivatives (e.g. gold forwards, futures and options) that are often as fraudulent as mortgage-backed securities.

This is why many people have established “gold exchanges” despite never having any gold. The gold game is even sillier than trading in tulip bulbs or cabbage patch dolls, since the latter involve physical items, rather than “shares” in an “exchange” that exists only in computers.

One of the biggest gold exchanges is SPDR Gold Shares. Another is iShares Gold Trust. These outfits claim to own gold bullion, yet they cannot prove this.

“Gold futures” are not gold, but they can be traded in commodities exchanges. In the U.S., gold futures are primarily traded on the New York Commodities Exchange (COMEX) and Euronext.liffe. If you buy these futures and you try to exchange them for physical gold, the exchange will do everything possible to dissuade you, since the exchange owns little or no gold. But if you push hard enough and long enough, the exchange may (I say MAY) eventually look around and buy a gold bar somewhere, and arrange for you to take physical possession. The serial number stamped on your bar will not match the serial number in your contract, and the weight will not match the weight specified in your contract. It’s such a hassle that most “gold traders” don’t bother with getting their hands on actual gold.

Besides, in the world of gold speculation, it is considered a sin to ask for physical gold, since if everyone did this, it would jeopardize the entire game.

In mid-2012 Peter Gauweiler (a German politician) started leaning on Germany’s federal bank (Bundesbank, not to be confused with the ECB) to prove that Germany’s gold reserves held abroad still existed. There were supposedly 1,536 metric tons of German gold (1,693 US tons) in the Fed’s vaults on Liberty Street in NYC.

Finally in October 2012 the Bundesbank asked the New York Fed for an official audit of German gold in the Fed’s vaults. The Fed refused, and would not even let German authorities view Germany’s gold bullion in the vaults.

When the Germans were finally “permitted” an audit, they were admitted into the vault’s anté chamber where 5 or 6 gold bars were shown to them as “representative for Germany´s holdings.”

The German auditors apparently returned a second time. The NY Fed granted them permission to “look into” one room (supposedly there were nine rooms), but the Fed did not allow the Germans to enter the room or touch any gold.

In January 2013 the Bundesbank called for 674 tons of German gold to be shipped from New York and Paris to Frankfurt by 2020. That would mean 84 tons shipped per year. But by the end of the first year, only 37 tons had been shipped, and only 5 tons of that came from New York.

Why?

Had the gold vanished? Had it been leased or sold without any announcement? Had it been “rehypothecated”? (That is, fraudulently pledged as collateral for many different parties in “fractional reserve” style?)

No one knows except the most “inside” of the insiders. But if gold had the innate value that gold bugs imagine it does, then this would be an international scandal.

The bottom line is that gold is not money, and never has been. Gold is a commodity like energy products, but has less utilitarian value than energy products.

The shenanigans connected with fraudulent gold exchanges are what caused Germany and then the USA to finally dump the ridiculous “gold standard” in 1971. Before that, we had the Bretton Woods system, in which Western central bankers pinned the dollar to gold at a fixed rate, while still allowing gold to trade privately as a commodity. This repeatedly led to a gap between the market price of gold as a commodity, and the “official price” as set by the US Treasury. As the market value of gold separated further and further from its official US Treasury rate, the dollar system became unstable. This always happens with gold standards, and it is why gold standards always lead to instability (contrary to claims by gold bugs).

President Nixon finally ended this nonsense.

LikeLike

Thanks for more historical details.

LikeLike

The Fixed Exchange Rate is effectively (i think) a Federal Govt Subsidy for holders and traders of gold, because the fixed price that the Treasury agrees to is almost 100% of the time LESS than the price in commodity markets.

Lysander Spooner — ironically featured on Mises dot org — explained why creating any kind of a gold-backed currency —- or even gold coins of a fixed weight and fineness, with a unit value stamped on the coin — was a LIE the moment it was issued, because the additional demand for gold for commerce causes the price to rise.

I’d have to check history, but I think Spooner’s commentary in the early 1800s preceded Gresham’s Law.

Gresham explained the “good money” — that is gold coins — leaves circulation or is “driven out” of circulation — Spooner explains that as hoarding by speculators, big and small, who know that the value of the gold will continue to rise higher than the “face value” — by “bad money” such as paper (which has some commodity value as bird cage liner) or electronic credits (which have no commodity value at all) and therefore “bad money” is ideal for circulation and commerce, for business, but not so smart to store up in your walls or in a mattress or a metal safe.

LikeLike

The Federal Govt CANNOT control the overall supply of money. That was tried. It failed, repeatedly. Why?

Because while the Govt controls the quantity of its own spending of Dollars into the economy which are interest-free to recipients and which are not “locked” to tax revenue in any way but idiotic ideology, the Govt cannot manipulate the amount of CREDIT that banks issue.

Banks don’t issue loans out of some pool of saved Dollars they *have*. Banks issue loans out of signed debt agreements. Loan customers — in conjunction with banks determining their solvency, collateral, and risk levels of potential borrowers — are the SOURCE of credit that banks issue. As long as customers want loans, and as long as banks perceive a good risk ratio in a growing economy, there are NO LIMITS to how many Dollars banks can create.

Granted, these are not “sovereign” Dollars which can become the “net savings” of Americans, some more than others. These are credit-dollars which are extinguished over time by loan repayments. Bank loans cannot be “net wealth” because loan proceeds are matched to debt obligations.

But loans DO increase the volume of Dollars in circulation at any time.

When banks ramp up lending — during a Credit Bubble and thereby inflating the Credit Bubble — or more slowly during normal growth — the volume of money-in-circulation expands. (Federal taxes can reduce that volume, cuz Federal taxes extinguish part of the money supply just like loan payments.)

When banks cut lending, esp during severe Recessions when they attempt to confiscate more Dollars in loan payments than issuing new credit, the volume of money-in-circulation contracts, sometimes severely. (Federal spending can increase the money supply to counteract bank-led contractions.)

The point being, a “balanced budget” does NOT control the volume of money.

The Govt would have to *IMPOSE* tough Gold Standard rules on banks, like a financial dictatorship. For a strict 100% Gold Standard, banks would be forbidden to issue Account Credits in the form of consumer of business loans. The Feds would have to arrest “criminal bankers” for simply doing business and serving customers.

You know what that means. Same as during Prohibition and current narco Prohibition. We’d see the rise of “black market” lending, aka Loan Sharks. Or American business & consumers would have to rely on foreign lenders — or major Narco-Traffickers with lots of cash — perhaps shady unregulated account services — in order to simply do business.

Yet Libertarians are AGAINST any govt regulation of banking. So somehow — despite a Gold Standard, which means a “Fixed Exchange Rate” —- banks would still be permitted to operate freely and issue as much credit as they desired to issue, as much credit as customers wanted to sign for.

That would give vastly MORE power to banks, but that still would not stabilize the money supply in-circulation at all.

LikeLike

My guess is that globalization has had far more to do with our low inflation rates than any interest rate adjustments since 1990

LikeLike

Why do you guess that?

LikeLike

Inflation and wage growth are linked, so low wage = low inflation.

Low wage growth is tied to globalization (among other factors that severed the historical link between productivity growth and real wage increases).

And thus globalization has had a large impact on inflation rates in the USA. This belief is every bit as logical and valid as your belief that the Fed controls inflation through interest rate adjustments.

LikeLike

“Inflation and wage growth are linked, so low wage = low inflation.”

I could explain why this is incorrect, but I will instead ask the writer to precisely define “inflation.”

If the writer cannot define “inflation,” then the statement is invalid.

If the writer can give a clear definition, then we can see if the definition has actually applied to the real world.

My own definition, which I will dissect if challenged, is that inflation is the product of the supply of and demand for money, goods, and services. Note the word demand. When most people discuss inflation, they focus on supply, while ignoring demand.

Incidentally, I don’t recall Rodger saying that “the Fed controls inflation through interest rate adjustments.” Instead, Rodger says that interest rate adjustments are only one way to control inflation. Taxation and the sale of T-securities are another way, but as Rodger has said, these techniques are slow and unfair (i.e. regressive) compared to interest rate adjustments. Moreover these techniques only address the supply of and demand for money. Another way to control inflation is to stimulate demand for goods and services by (for example) launching a campaign to repair and upgrade the USA’s physical and IT infrastructures.

Anyway, for the USA, all discussions about inflation are academic, and secondary or tertiary in importance.

What we need is an end to austerity, and thus an end to the current depression.

For that, we must overthrow the Big Lie.

LikeLike

“I could explain why this is incorrect, but I will instead ask the writer to precisely define “inflation.”

Actually you can’t because as RMM showed with his graph, wage growth and inflation are linked. But he was right, “low wage growth = low inflation” is a bridge too far. That sweeping conclusion is not accurate all the time.

“If the writer cannot define “inflation,” then the statement is invalid.”

Pick any one of the metrics, they all show the same relative movements more or less. CPI, CPI core, PCE, billion price projects, TIPS, 10 yr break-evens, whatever

“Incidentally, I don’t recall Rodger saying that “the Fed controls inflation through interest rate adjustments.” ”

Then you don’t pay attention:

RMM: “The Fed already controls inflation to it’s annual goal of 2.5% -3%,” The Fed only uses one real tool (interest rate changes) so that would be the way it purportedly “controls inflation”. Now in a perfect world, the Fed could impact inflation significantly through its macroprudential regulatory powers, but they dont like to do that since the BOG are mostly corrupt bankers and banker cronies.

“Anyway, for the USA, all discussions about inflation are academic, and secondary or tertiary in importance.

What we need is an end to austerity, and thus an end to the current depression.

For that, we must overthrow the Big Lie.”

I couldn’t agree more with you on this stuff.

LikeLike

It’s becoming clearer to me in more ways that “inflation rate” is a garbage metric, for the most part. I don’t mean that measured inflation doesn’t matter at all, one measure being “CPI”. I mean it’s political and a lot of bull-oney. Here’s what I mean.

We *want* stock prices to inflate. Ideally, this means a company is being productive, making stuff, or providing services, for consumers, or for govt, hiring employees.

In reality, we cheer when stock prices inflate even if it’s just due to credit-driven inflation.

Sellers and producers of milk want milk prices to rise. Sellers and producers of cars want car prices to rise. Commodity futures sellers want high futures prices, while commodity futures buyers want low futures prices. Unless the said traders are betting on shorting the market.

What’s really important in Main Street life is that wages rise in tandem with consumer prices. The anti-inflation argument, coming mostly from the financial sector, is they will do anything they can to prevent wages from rising, unless it’s their own incomes.

LikeLike

Auburn,

I agree that China et al have reduced our inflation, but I was curious about the quantitative “far more” part of your comment.

I see you have changed it to “every bit as,” which still is quantitative.

Just looking for a measure.

Although there clearly is a relationship between wages and inflation, one can’t say low wage = inflation.

LikeLike

I agree wholeheartedly with you here:

“Just looking for a measure.

Although there clearly is a relationship between wages and inflation, one can’t say low wage = inflation.”

And I turn this exact phrase around towards you wrt your claim about the Fed controlling inflation through interest rate adjustments. The graph looks the same. There is a relationship between interest rates and inflation, but you cannot come to your repeatedly stated conclusion that:

“The Fed already controls inflation to it’s annual goal of 2.5% -3%, without gold.”

Just as wrong as it would be to say that globalization is THE thing that is controlling inflation, it is wrong to say that THE Fed controls inflation.

IMHO, inflation is the most complicated economic issue, and there are no absolute conclusions that can be made about it, given our current level of economic understanding.

LikeLike

Yes, many things cause inflation, including imports/exports, deficits, wages, natural disasters, wars and on and on. But it is the Fed that controls inflation, from whatever level it would have been without those controls.

There is an important distinction between the causes and the control.

For decades, the Fed has been very successful at keeping inflation near its stated goal, and one can’t say it all has been an accident of events.

LikeLike

” But it is the Fed that controls inflation, from whatever level it would have been without those controls.”

I’m just looking for a measure, any measure that confirms this. Although there clearly is a relationship between interest rates and inflation, one can’t say Fed changing interest rates = controlling inflation.

“There is an important distinction between the causes and the control.”

Absolutely, the problem is that you have simply asserted that the Fed controls inflation. You have not demonstrated in any way that interest rate adjustments control inflation.

“For decades, the Fed has been very successful at keeping inflation near its stated goal, and one can’t say it all has been an accident of events.”

Its just as likely that inflation has been what its been because of globalization and wage growth as it is that interest rate changes are responsible.

LikeLike

During Jimmy Carter’s time didn’t we have high inflation and high interest rates? Would this disprove Rogers model?

Interesting article here; “Price fixing had been a fact in the case of railroads since the 1880s, and since the 1930s for trucking and airlines, but no president until Carter. As a result of what Carter did to open these markets, price increases have been restrained ever since.”

“The bottom line is this. The uninformed will tell you during the debate about Bernanke’s successor that the country needs an inflation hawk at the Fed because monetary policy is what keeps inflation low. Tell them that what is being inflated is the role of the Fed and monetary policy and that maintaining intense competition throughout the economy is far more important. And when people repeat the myth about the courageous steps Ronald Reagan took to fight inflation, don’t buy it. Instead tell them about Carter’s record for which you can cite data from the Fed itself and legislative chapter and verse.”

http://www.huffingtonpost.com/paul-a-london/inflation-the-reagan-myth_b_3418868.html

LikeLike

Yes, we had high inflation that Fed Chairman, Paul Volcker, cured with high interest rates.

LikeLike

No because we already had high interest rates at 11% and inflation went to 12%. The only thing that changed was the level of competition.

LikeLike

Penny,

As inflation rose, the Fed kept raising interest rates. In 1980 inflation and interest rates reached a high point, at which time inflation dropped and the Fed followed it down.

Then inflation picked up, and the Fed again raised rates. The Fed always raises rates when it sees inflation running above it’s top-end target of about 3%. The purpose is to increase the Demand for dollars.

LikeLike

Rodger-

Do you think a 15% FFR caused the price of gold to drop by 75%?

LikeLike

Price of OIL, not gold damn-it, stupid gold bugs are in my sub-conscious!

LikeLike

Rodger,

Just curious here – are you familiar with Wayne Jett and his book “The Fruits of Graft”? He is an unabashed gold bug who defines “inflation” as any devaluation of the dollar relative to gold. He decries what he calls the “mercantilists” control of the economy, and pinpoints, basically, the gap as the motivation for their skewing the economy in their favor, but his solution, a return to a gold-pegging standard, just seems bizarre to me. He does present a nice history of federal monetary/fiscal policy, and he paints FDR as a mercantilist pawn who chose to impoverish the country with high taxes and short money supply. His arguments seem reasonable but his solutions sound zany. I wonder if you’ve heard of him and have any assessment of him. Thanks.

LikeLike

I’m not familiar with Wayne Jett.

If he is a gold bug, my assessment of him is described in the above post.

As for Roosevelt wanting a “short money supply,” isn’t he the President who maneuvered us into a world war, the gigantic spending for which ended the Great Depression? Some “short money supply” that was.

LikeLike