Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

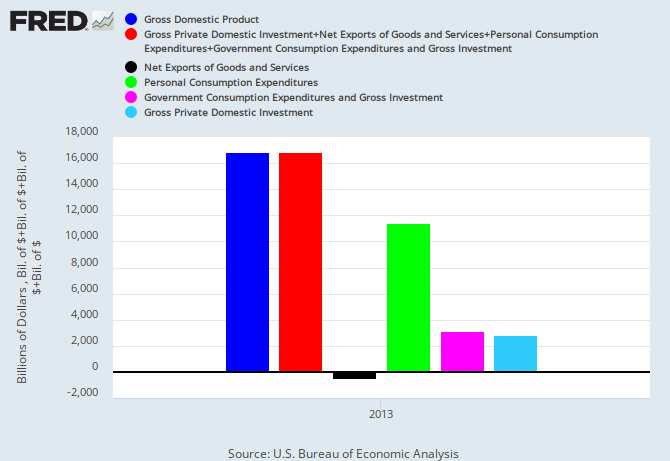

Gross Domestic Product (GDP) is the most commonly used measure of the economy and economic change. There a several ways GDP is calculated, all arriving and the same total. One is the total of:

1. Personal Consumption Expenditures: A measure of goods and services consumed by individuals.

2. Gross Private Domestic Investment: Spending on residential equipment and buildings, spending by businesses on capital, total change in business inventories.

3. Net Exports of Goods and Services: The difference between imports and exports.

4. Government Consumption Expenditures and Gross Investment: Purchases of goods and services by the three levels of government: Federal, state and local

Here is a graph demonstrating this calculation:

The blue bar is the total of the above 4 categories. The red bar is Gross Domestic Product. As you can see, the bars are identical.

Federal austerity involves a reduction in federal spending and/or an increase in federal taxes.

–A reduction in federal spending, by definition, decreases the violet bar.

–An increase in federal taxes decreases the pale blue bar

–An increase in federal taxes and/or a decrease in federal spending, decreases the green bar.

–An increase in federal taxes and/or a decrease in federal spending has a mixed effect on the black bar. If the net effect were inflationary (the dollar loses value), the black bar could rise, but if the net effect were deflationary (the dollar gains value), the black bar could fall. Historically, net federal spending has had little effect on inflation.

Recently, GDP growth has declined, as shown by the red and blue bars, below. (Note: These bars show growth, not totals):

The recent decreases in the violet, pale blue and green bar growth all can be attributed to austerity (as explained, above).

Even with increases in Net Exports growth (black bar), GDP growth has declined, demonstrating the seriousness of our economic situation and the debilitating effects of our austerity.

Mathematically, austerity ALWAYS decreases GDP. There is no mathematical formula that will demonstrate a decrease in federal spending and/or an increase in federal taxes having a positive effect on GDP.

Politicians, having been bribed by the upper .1% income/power group (via campaign contributions and promises of lucrative employment later), use the Big Lie to brainwash Americans into believing that by some unknown magic, austerity benefits the economy.

There is no mathematical mechanism by which reductions in net federal spending can benefit the economy or the lower 99.9% income/power group. To say otherwise is the Big Lie.

The media, which are owned by the .1% parrot the same Big Lie, and mainstream economists, who work for universities receiving contributions from rich donors, will not contradict their employers.

The next time anyone –a friend, a politician, a media writer or an economist — tells you the federal deficit and debt should be reduced, show him this post, and ask him to explain it.

Be prepared for the Big Lie, and a great deal of obfuscation.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise. Federal deficit growth is absolutely, positively necessary for economic growth. Period.

#MONETARY SOVEREIGNTY

Probably the biggest obstruction to understanding money is the feeling that it’s something physical like paper or metal. It’s no more physical than the title of USA president or CEO or the California-Nevada border. These are legal abstractions. They don’t really exist. We made them up. We can change titles or boundary lines legally but not a real boundary line like where ocean meets land requiring eons of physical erosion. So we have no legal power to make money, the federal government does. Nature makes the tree and metal; government assigns the title “Money” toward any amount congress wants.

Thus we suffer from a massive confusion between legal, abstract, unprincipled wealth and real wealth as knowhow in the form of completely principled science & technology. This would be another GAP to go along with the gap between rich and poor; unifying the former would eliminate the latter.

LikeLike

Tetra-

That is very well put and I couldn’t agree more.

I like the dollars as a unit of measurement comparison too. “I can’t measure that bridge because I’ve run out of inches!!!”

LikeLike

TETRAHEDRON720 SAYS: “Probably the biggest obstruction to understanding money is the feeling that it’s something physical like paper or metal.”

Well said.

Because people think that money is physical, they think that money is limited, and that the US government must obtain it by taxing and borrowing. They believe the rich and their lackeys who claim that the federal government has “no magic money tree.” They think that gold is money — indeed the only viable money. They think the $17 trillion “national debt” is a pile of physical notes that weighs 18.7 BILLION TONS in hundred-dollar bills, and that we are leaving this multi-billion-ton physical “debt” to future generations.

Because people cling to this delusion, they submit to poverty and inequality. They are complicit in their slavery and brainwashing. Their delusions and their hate justify each other.

When people cling to a delusion (any delusion), they reject what they see with their own eyes. For example, if I insist that man cannot fly, and you show me an airplane, I will continue to reject the facts. I will ignore the airplane, and I will ask, “Show me precisely where it is written that man can fly!”

Likewise, if I insist that money is physical, I will say, “Show me precisely where it is written that the federal government creates money out of nothing, and destroys tax revenue upon receipt.” You can sit me in front of your computer monitor at home, and access your bank accounts, and use your keyboard to move money from one account to the other. Nothing physical moves. The numbers simply change. And yet I will remain unconvinced. I will cling to my delusion. I will say, “Okay, money is electrons, but it is still physical.” If that doesn’t work, then I will resort to increasingly wild claims.

Yes, we humans love our delusions, especially when we are full of hate and selfishness.

TETRAHEDRON720 SAYS: “Thus we suffer from a massive confusion between legal, abstract, unprincipled wealth and real wealth as knowhow in the form of completely principled science & technology. This would be another GAP to go along with the gap between rich and poor; unifying the former would eliminate the latter.”

Yes, just as there is a wealth gap, there is also a knowledge gap. Not only are the masses increasingly deluded by the Big Lie, they are finding higher education increasingly harder to get. And higher education itself is increasingly garbage.

All gaps are increasing. The wealth gap, the knowledge gap, the mental health gap, the physical health gap, the longevity gap, the social mobility gap, and so on. All measures of inequality are accelerating.

This is why we have food stamps. Genuine revolutions (not fake ones, like the recent coup in Ukraine) have many different causes, but they all share one trigger: people get hungry. You can enslave people, impoverish them, imprison them, sicken them, even kill them, but the masses will not rebel until they become physically hungry, and there is no food (or food is too expensive to buy). Then the masses go mad, and cannot be stopped by police bullets.

LikeLike

Yesterday I went to a birthday party in a part of town I had not visited in ten years. I was dismayed to see that at least half of all businesses had shut down. Not just “mom and pop” stores, but big name franchises too. National chains. Famous businesses, some of them very big. (Or formerly big.)

The birthday was for an infant. I stopped at a large shopping mall to buy a small gift. I remember when that shopping mall was built. Now, half the stores inside the mall were closed down. Convenience stores were closed down. Many had been there for decades. Movie theatres were closed down. A swank and elegant hotel was boarded up, its lawn now a dirt lot. On the sidewalk were numerous homeless people with their bags of belongings. Circling overhead was a police helicopter. Drivers in traffic gave each other their middle fingers. A small dog tried to cross the road, and a guy in a truck swerved to try and kill it. The weather was sunny, but it seemed like a gray day. When I arrived at the birthday party, half the people there were drunk.

It’s the extinction of the middle class.

And the middle class cheers it.

Why?

Austerity is like smoking. I know that cigarettes will kill me in a hideous and excruciating manner, but I smoke anyway, because I enjoy it. Maybe I’ll stop smoking one day. Or maybe I’ll avoid health problems. After all, doctors don’t know everything.

Likewise, I champion the Big Lie, so I can demand more austerity. I know that austerity is killing me, but I enjoy attacking “liberals” and “godless socialists.” I enjoy hating people. I enjoy smugly being “right.” Besides, what’s killing me is not the austerity / cigarettes. What’s killing me are the people I hate. They are the reason my city is dying.

And it’s just as well, since I am a Christian (or a Muslim, or whatever). When I die, I’m going to an elegant resort in the sky that will exclude the people I hate down here.

So, don’t tell me that austerity is a bad thing. Without it, the people I hate would get even fatter on the taxpayer dole. Without it, the roaches would multiply even faster.

LikeLike

Nothing less than a revolution, it seems, will end the insanity of austerity economics.

The only peaceful way to do it is for the plutocrats and their stooges in gov’t to start understanding MS/MMT. Otherwise, an American Spring may just be forthcoming.

LikeLike

Understanding those positions will not accomplish the following:

1. Replacing the capitalist system. Capitalism requires exploitation. Capitalism cannot function democratically. Capitalism will not distribute profits equally. If you cannot grasp this you are and will always be a slave to that system.

2. True reformation of the monetary system. MMT agrees with the current system and functions within the that monetary system. It requires it. It validates it. Unfortunately few understand that simple truth.

3. Merely tweaking those systems will accomplish nothing. Radical changes are needed.

4. Understanding the fact that fiat currency is a wonderful gift rather than a curse is necessary.

Wake up.

LikeLike

Gone in my town in the past few years (so far): Blockbuster, Circuit City, Barnes & Noble, and many small, independent Mom & Pop stores … . Pretty depressing (many vacant strip mall fronts). But there seems to be a lot of new home construction though – Who is buying these homes? But I live in the Washington DC area that seems to weather bad economic periods better than most due to the federal government employment presence.

LikeLike

I think you meant to say “THE GOVT DOESN”T CREATE JOBS!!!!”

LikeLike

The government creates jobs when it pays private industry for goods and services. It also creates jobs when it hires employees.

LikeLike

WRONG Rodger,

Haven’t you been listening to Bachman and Palin? Cruz and Boehner?

LikeLike

I don’t, but conservatives do, which says all one needs to know about conservatives (a segment of our population that includes nearly every politician.)

LikeLike

It’s amazing to me that people don’t even ever to think about where money comes from in the first place – Dollars come from the fed. government, not the private sector. Dollars have to be “spent” by the federal government into the private sector economy. People think that dollars only get acquired by the fed. government via taxes from individuals and the private sector – these economic ignoramuses have it backwards. They think that dollars just magically appear in the economy, then the fed. gov. has to borrow or tax to get this money to fund itself – without even thinking that it is the government that has the “printing press” that originates these dollars in the first place.

John Stossel with his show was on Fox News last Sunday night promulgating all of the typical misconceptions – An incredible disappointment. And to think he probably knows the truth was disheartening even more.

There is no infamous “income redistribution” that occurs at the federal government level – absolutely nothing is taken unfairly from anybody and given to someone else to fund these various programs and services beneficial to our society. With the monetary system that we have, it has to function this way to work. Our fed. government being Monetary Sovereign is fundamentally designed to be of valuable service and an important resource to its people – but people are too ignorant to understand this reality. Along with the Constitution and the Bill of rights, with Monetary Sovereignty and MMT, we are the inheritors of societal conditions that have never been more conducive to the betterment of humankind in history. Why people have to view government as the enemy or hindrance to their lives, as Stossel constantly parrots, is mind boggling – It just doesn’t have to be this way.

LikeLike

Add to that list, Radio Shack, Staples, Sears, and more. Actually, for me, I have no problem with creative destruction replacing no-longer-appropriate business models. This is progress I can accept – doing more with less. But the saddest, most discouraging part of this creative destruction, is that the workers (including most management)…the people who made the commercial outlets successful to start with…are the ones who are out in the cold. The Rentier class, those who live off the productive efforts of the workers, are, for the most part, unaffected.

My proposed solution, which would never see the light of day, is to guarantee RIF-ted workers their existing wages, with COLAs, until each finds another, hopefully more satisfying, employment.

LikeLike

I agree with Jeff Rudisill. I also say that the reason why those stores’ business models are no longer appropriate is that their customers no longer exist. The stores and restaurants that are dying most rapidly are those that catered to the dying middle class.

There was a time when “99-cent” stores were uncommon. Now they are everywhere. So are auto-title-loan places and paycheck-loan places. Pawn shops are also proliferating.

The cause of all this is mass greed, hate, and selfishness, which are the engines of austerity, offshoring, and de-industrialization (i.e. the shift from industrial capitalism to finance capitalism).

LikeLike

Yep, the only way the private sector can grow without a deficit or net exports is to have a private debt boom. And we all know just how unsustainable and short lived those are. And with prviate debt to GDP still at 250%, its going to be quite a while before we see any surges is private debt driving growth.

LikeLike

Ssshhh! You’re not supposed to mention private debt! You’re only supposed to talk about the (fictitious) “national debt.” That is, the federal government’s “debt” (which is not even a “debt” in the usual sense).

You are correct, though. The debt-to-GDP ratio is meaningless when we speak of the “national debt,” but it is crucial when we speak of private debt.

Indeed, one of the purposes of austerty is to increase the private debt-to-GDP ratio, thereby reducing people to being slaves of private lenders. An example is the student loan racket.

LikeLike

Or a very short lived private sector net savings reduction, as described by Mosler this week. I had never really thought in those terms before.

LikeLike

Really? Warren advocates a “very short-lived” recession? How odd.

LikeLike

He referred to it as a ‘jump’ in ‘borrowing to spend’/’reduction in savings.’

‘Jump’ seems to imply the near term. Would not formerly ‘held or saved’ dollars spent offset to some degree proactive deficit reduction? I guess I am confused.

http://moslereconomics.com/2014/03/10/proactive-fiscal-tightening-damages-income-growth/

LikeLike

I have no idea. You might drop him an note and ask him.

LikeLike

Khan academy view on hyperinflation. Does hoarding lead to hyperinflation?

LikeLike

The video makes the usual error of reversing cause with effect. Government “money printing” is not a cause of hyper-inflation, but an effect of hyper-inflation.

As Rodger recently explained, inflation involves rising prices, usually caused by shortages. Hyper-inflation involves a loss of full faith and credit in the money system, which may or may not lead to “money printing.”

The shortages that cause inflation are usually intentional, as in Venezuela where the rich are conducting an economic war on the government. Or in Zimbabwe, which was the target of an economic attack by the USA.

LikeLike

The dangers of hyperinflation are show in Argentina:

http://www.johntreed.com/Reader's-report-on-month-long-vacation-in-Argentina.html

LikeLike

Beaker,

Interesting: http://www.tradingeconomics.com/argentina/inflation-cpi

LikeLike

Thanks RMM, the current 10% annual inflation rate in Argentina is still just little higher than what the U.S. had in the 1970’s (about 7% annually from the link). So what is really going on in Argentina then?

See:

http://inflationdata.com/Inflation/Inflation/DecadeInflation.asp

LikeLike

An incompetent, thoroughly criminal government.

LikeLike

What would be a leading indicator(s), if it even exists, of hyperinflation occurring?

See:

http://www.johntreed.com/hyperinflationredlights.html

LikeLike

Since the U.S. never has had hyper-inflation — not during our many wars (including a civil war), depressions, recessions, inflations, stagflations and civil disobediences — it is difficult to imagine a hyper-inflation here, much less identify a leading indicator.

Perhaps a violent military coup would do it. and even that might not. What the inflation Henny-Pennies don’t understand is that hyper-inflation is truly an extraordinary event.

They casually use the word “hyper-inflation” as though it were an extension of inflation, or could be caused by overspending. Wrong. It would be more like all of America being wiped out by a giant meteor.

Meanwhile, as they fret about the extraordinarily rare, the real, current problems, like poverty, the widening of the gap and economic stagnation are ignored.

It’s like building an ark to house all life, while your basement floods.

LikeLike

So is deflation actually more of an issue than increasing inflation? Is deflation more likely due to a decrease in the money supply and more tapering?

LikeLike

I would rather have a 4% inflation than a 1% deflation, since deflation discourages commerce while inflation encourages commerce.

Yes, insufficient money supply can lead to deflation.

“Tapering,” i.e. a reduction is quantitative easing, is essentially meaningless. It has very slight deflationary and inflationary effects.

LikeLike

http://www.epi.org/publication/nowhere-close-the-long-march-from-here-to-full-employment/

Figure 11 in the above link shows the exteme austerity of the US Govt starting with the 2011 Budget Control Act. It is a good article throughout, but particularly where it shows how the growth in Federal spending collapsed compared to that in the prior three recessions.

LikeLike