Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Two questions:

Exactly, what is federal wasteful spending, and why is it bad?

Imagine there are only two men in America. Our Monetarily Sovereign, federal government pays one man $10 to dig a hole, and pays the other man $10 to fill it in. Is this an example of wasteful spending? If so, why?

.

The word “wasteful” is a pejorative. Anything labeled “wasteful” is bad by definition. So yes, wasteful federal spending would be bad — if it existed. But does wasteful federal spending really exist?

Keep in mind that our federal government is Monetarily Sovereign. This means:

*The federal government, unlike state and local governments, has the unlimited ability to create dollars. It never can be forced to run short of dollars.

*The federal government creates dollars by spending. To pay a bill, the government instructs vendors’ banks to increase the balance in the vendors’ checking accounts. This is how the federal government creates dollars.

*Thus, unlike state and local taxes, federal taxes do not pay for federal spending. Even if federal taxes were $0, the federal government could continue to instruct vendors’ banks to increase the balance in vendors’ checking accounts, i.e. the federal government could pay its bills.

*Therefore, taxpayers do not pay for federal spending.

*And federal spending for one purpose does not replace federal spending for another purpose.

So again, exactly what is federal “wasteful” spending?

The Heritage Foundation, a mouthpiece for the notorious, right-wing, billionaire activist Koch brothers, offers:

1. Programs that should be devolved to state and local governments;

2. Programs that could be better performed by the private sector;

3. Mistargeted programs whose recipients should not be entitled to government benefits;

4. Outdated and unnecessary programs;

5. Duplicative programs; and

6. Inefficiency, mismanagement, and fraud.

Numbers 1 and 2 merely represent the Koch’s attempt to shift spending from the federal government (which can afford anything) to burden the state and local governments and the private sector with unaffordable spending. The purpose: To widen the gap between the rich and the rest by eliminating government spending, the vast majority of which benefits the non-rich.

Widening the gap gives the rich even more power over the rest, and power is what the rich want.

Number 3 reveals its purpose by the use of the word “entitled.” To the rich, no one but the rich is entitled to anything. Social Security, Medicare, Medicaid, food stamps and other aids to the middle and poor all are “mistargeted entitlements.”

But surely, “outdated,” “unnecessary,” “duplicative,” “inefficient” and “mismanaged” programs must be examples of federal wasteful spending, and they would be except for one detail, and that goes back to the first question in this post: Exactly, what is federal wasteful spending?

Or said another way: Is it possible to “waste” something for which there is an unlimited supply?

Your rowboat floats in the middle of Lake Michigan. You have a bucket of fresh water, which you now use for cleaning your boat. Have you “wasted” the fresh water?

Or: Your boat floats in the middle of the Atlantic ocean. Again you use your bucket of fresh water to clean your boat. Have you wasted the fresh water?

In the first case, there is no waste. You’re in the middle of a giant lake, having unlimited fresh water, and you now have a clean boat. In the second case, there is waste, because you’re in the middle of a salt-water ocean, and that lost fresh water is irreplaceable. It was wasted.

And that is how the Monetary Sovereignty of the federal government differs from the monetary non-sovereignty of state and local governments and the private sector.

I submit that the term “wasteful” cannot apply to federal spending. Yes, some federal spending may be more productive than other federal spending, but no federal spending precludes other federal spending. It simply is not correct to say that federal spending for “A” could have been used for “B.”

All federal spending has one huge advantage for the economy: All federal spending adds dollars to the economy, which grows the economy. (GDP = Federal Spending + Non-federal Spending + Net Exports)

What about Heritage/Koch’s final caveat, “fraud”? Is fraud an example of wasteful spending?

It depends. If the fraud steals dollars from someone in the private sector, it is wasteful. But if the fraud steals dollars from the federal government, it may be criminal, but it isn’t wasteful. In fact, it adds dollars to the economy.

Even counterfeit dollars grow the economy. So long as they are not caught, they add to private sector buying power.

Let’s get to motivation. Why does Heritage/Koch, and all the bought-and-paid-for politicians and equally bought-and-paid-for university economists stress about federal waste?

The primary financial motivation of the rich is to widen the gap between themselves and the non-rich. It is the gap that makes them rich. Without the gap, no one would be rich, and the wider the gap, the richer they are. What the rich call “waste,” are benefits to the non-rich.

As Heritage/Koch said,

“It is possible to reduce spending and balance the budget. In the 1980s and 1990s, Washington consistently spent $21,000 per household. Simply returning to that level would balance the budget by 2012 without any tax hikes.

The Kochs et al, want reduced federal spending — reduced Social Security, reduced Medicare, etc., etc., etc. The goal is to deprive the non-rich and to widen the gap.

The best way to rationalize reduced federal spending is to call it “wasteful.” Nobody likes waste. Even the people most affected by cuts in federal programs feel obliged to agree that “waste” must be eliminated. As Heritage/Koch says:

“Lawmakers seeking to rein in spending and budget deficits should begin by eliminating this least justifiable spending while also addressing long-term entitlement costs.”

And there you have it: “Long term entitlement costs.” Get rid of entitlements and the rich will have even more power over the rest.

Should there be any limit to so-called “wasteful” spending by the federal government? Yes, that limit is an inflation that cannot be prevented or cured by interest rate increases.

So, what are the 5 ways to eliminate wasteful federal spending?

1. Target all federal spending toward the goal of narrowing the gap between the rich and the rest.

There are 4 additional ways, but to recite them would be wasteful.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

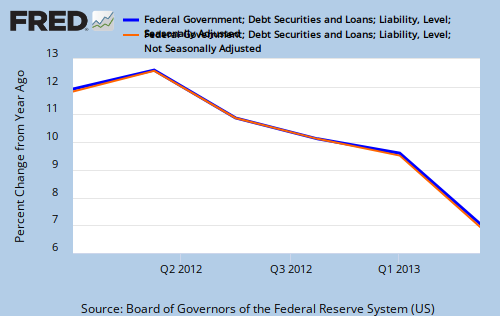

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

*The federal government, unlike state and local governments, has the unlimited ability to create dollars. It never can be forced to run short of dollars.

Question: “Never” is not true because inflation via the compound interest that has to be paid on the ‘new creation’ via T Securities can *never* be satisfied without creating new money with new interest payments. The only cure for this infinite increase is default or ZERO Interest paying T Securities. True or False?

*The federal government creates dollars by spending. To pay a bill, the government instructs vendors’ banks to increase the balance in the vendors’ checking accounts. This is how the federal government creates dollars.

*Thus, unlike state and local taxes, federal taxes do not pay for federal spending. Even if federal taxes were $0, the federal government could continue to instruct vendors’ banks to increase the balance in vendors’ checking accounts, i.e. the federal government could pay its bills.

*Therefore, taxpayers do not pay for federal spending.

Question: “…federal taxes do not pay for federal spending.” is not true.

Since “The federal government creates dollars by spending” it is in fact at the same time creating a taxation being placed on the people, i.e. interest they must pay on the T Securities.

PLEASE,please continue on your path for the betterment of all mankind:

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

And please consider, that maybe,just maybe that SOVEREIGN MONEY CREATION could make all nine steps a reality.

You may find a tremendous amount of agreement here:

http://www.positivemoney.org/

LikeLike

Interest on T-bonds is not compound interest. Its a fixed face value nominal rate.

There is no financial rule or law that says we must pay a positive interest rate on T-bonds. We currently issue 3-month T-bills for practically 0% and we could do so forever. There is practically no difference between issuing 0% T-bonds and reserves, they are both accounting notations or CB balances at the Fed.

We already have sovereign money creation, but I still appreciate positive money’s efforts at promoting the cause of public purpose.

LikeLike

“True or False?”

False. The “infinite increase” is matched by the infinite ability to create money.

” . . . interest they must pay on the T Securities.”

People do not pay interest on T-securities. The government does.

LikeLike

YOUR COMMENT (#7):”However, when the federal government pays interest on T-securities, money is created. The money supply increases — one reason why keeping interest rates low is recessive, not stimulative.”

Please help. Isn’t money issued by the Sovereignty NOT a debt of the people of the sovereignty which they must “by their good faith and credit”, honor that issuance as redeemable in “goods and services that are owned by the social group of that sovereignty”?

Doesn’t that mean that the people “pay” via the sovereign currency issuance?

As for the interest payments benefiting the people (citizens) , what benefit do the ‘citizens’ receive from the $5 trillion in INTEREST the Chinese will receive over the next 30 years from their holding of T- Securities they now posses? BTW they still retain their original amount owed.

What if… China were to “help” the American people to have affordable housing? Fund residential loans for $5 trillion (money they got for nothing) for 2% for 36 years.Give a fantastic jump start to 1 or 2 million jobs .And for this ‘help’ take from US an additional $10 trillion for a total gain of $15 trillion (when you add the $5 in interest from the still owned $5 tr. in T-securities). They don’t have to ship US any toys, computers or anything; just repeat procedure till they have $120 trillion-Cash out by buying the entire stocks of the NYSE; All possible by not one single bullet being fired., using interest to gain “the wealth of the nation”.

LikeLike

Sorry I had to add this. “Just do unto US what the private for profit banks are doing to us; getting money from nothing making loans and more than doubling the amount for their own private interests (Top 10%)”

The 90% work and earn maybe $100 billion on housing construction sales of $1trillion. Yet the PFPB gain gross Interest Income from loans that they make for the “people” to “help” them purchase these homes;more than $3 trillion. AND they do not need any REAL money of their own to do this. (Reserves and/or capital requirement can be Other Peoples Money.)

LikeLike

Good example with the hole-digging. I agree that the federal spending is not wasteful, however, the labor is wasteful. The concept that most people miss is that when you have people that are unemployed, it is not very different than having them perform wasteful labor.

LikeLike

Agreed.

LikeLike

As long as they were receiving the same level of income. If an unemployed person has zero income, then they are overwhelmingly likely to be contributing less to the economy than someone that is paid to fill holes.

LikeLike

Why does the Federal Government borrow when it can

create all the money it needs?

LikeLike

Federal “borrowing” is a relic of the gold standard days, and needless, today.

Further, what commonly is called “borrowing,” is different from federal “borrowing.” The total federal “debt” is nothing more than the total of outstanding T-security accounts at the Federal Reserve Bank.

Since a T-security account essentially is a bank savings account, federal “borrowing” is very much like a bank accepting deposits in savings accounts.

To repay its “borrowing,” the Federal Reserve Bank does what any bank does: It just transfers dollars from savings accounts to checking accounts.

The words “debt” and “borrow,” when referring to the federal government, are red herrings, used by the rich to scare the rest of us into agreeing to spending reductions.

LikeLike

And remember Rich, for the purpose of spending, the US government does not borrow at all. Not from China, not from taxpayers, not from anyone.

The US government creates it spending money out of thin air, simply by crediting bank accounts.

The “borrowing” is a trivial side show that has no effect on (or involvement with) the US government’s ability to spend.

As Rodger notes, the “borrowed” money is simply that which investors have used to buy T-securities. Investors lend that money to the Fed as depositors lend their money to banks. And like bank deposits, the loan is both a liability and an asset. Hence the $16 trillion “national debt,” is also a $16 trillion Fed asset.

But again, this has NOTHING to do with the US government’s ability to spend.

Note that I said “ability.” The government’s WILLINGESS to spend is strictly a political matter.

Rodger says the federal government can never be forced to run short of dollars. However, through politicians, the government can arbitrarily choose to force itself to run short, in order to widen the gap between the rich and the rest.

This arbitrary choice is called austerity.

LikeLike

though i totally agree with a dramatic increase in spending targeted to the 99% (well, perhaps just the bottom 75% would be good enough), i’m beginning to wonder how could federal spending alone narrow The Gap– without a dramatic increase in taxes on the richest, say, 1%-5%?

enriching the bottom doesn’t automatically impoverish the top…

LikeLike

I don’t want to impoverish the rich. I want to improve the lives of the rest.

Hunger, poor housing, inadequate health care, inadequate education, hopelessness — those are the things increased federal spending can address.

LikeLike

yes, of course, neither do i–it was an unfortunate choice of words on my part. it’s just that it seems to me that, if you dramatically increase spending to the bottom, it would eventually make it’s way up to the top.

anyhow, on a totally different subject–i know this is totally off-topic–but since you’ve written so much about it, i thought i’d bring it to your attention–more mind-blowing stats on gun deaths & children in the US:

LikeLike

Me too! I don’t want to bring the rich down. I want to bring the rest up. I favor prosperity over punishment. If I have a nice house, a good job, secure benefits, and a life of meaning and dignity, then I don’t care that some other guy is a billionaire.

When we have security, we see that the small things in life (the “free things”) are the most momentous. However, we cannot see this when we are in poverty.

Put another way, if we drag the ultra-rich down into the dungeon with us, then we merely expand the dungeon. I want everyone to escape from the dungeon.

Let us not seek to take power from the rich.

Rather, let us seek to gain the same power as the rich.

LikeLike

Just to emphasize your last point, the Defense Department spending $600. on the proverbial toilet seat may not be “wasteful”, but most likely would increase the wealth gap.

So, it seems it would be helpful to re-frame the concept of “wasteful” with another term that reflects inappropriate US Government spending, as stated in Rodger’s “…ways to eliminate wasteful federal spending.” I think this should be a single word that captures the concept of “spending to reduce the income and wealth gaps. Ideas?

LikeLike

spenvesting = spending that is an investment into people’s care

LikeLike

Rodger, et al, I’m still confused about the debt issues. When the US Govt. issues T-bills, and the Fed “buys”(?) them, I’m under the impression that it’s the Fed that is creating the money. However, if I understand a previous post of yours, the Fed’s role is simply an accounting/brokering function, and the money is really created with the creation of the T-Bills.

Also, you say the Federal “debt” and “borrowing” are red herrings. But, red herrings though they be, they actually exist. Isn’t it also true that the money to pay the interest on this “debt” is not created along with creation of the debt? Finally, if I understand a previous comment of yours, dollars paid as US income taxes are used to “retire” the deficit, which I, correctly or not, associate with the Federal debt.

So, to the degree that the above is correct, aren’t personal (and corporate) income taxes being used to pay interest to the “debt” holders, thus expanding the income and wealth gap?

LikeLike

Jeff,

When you buy a T-bill, money is transferred from one bank account (your checking account) to another bank account (your T-bill account). The U.S. money supply doesn’t change.

However, when the federal government pays interest on T-securities, money is created. The money supply increases — one reason why keeping interest rates low is recessive, not stimulative.

And as if the above were not confusing enough, there is no necessary relationship between federal deficits and federal debt.

Contrary to popular wisdom, federal debt is not the total of federal deficits.

There could be deficits without debt (i.e. deficit spending without the issuance of T-securities). And there could be debt (T-securities) without deficit spending.

Federal income taxes are not used for anything. Dollars held by the Treasury do not exist. Those sheets of dollars on the Treasury printing presses, are not dollars until they enter the economy.

Because federal tax dollars disappear from the money supply upon receipt by the Treasury, federal income taxes impoverish the economy, which hurts the lower classes more than the rich.

(Visualize everyone losing half their money. Who would be hurt worse; you or Bill Gates? Recessions always hurt the rich less, which grows the gap.)

State and local income taxes remain in the U.S.money supply as state and local bank account deposits.

One way to understanding all this is to visualize T-securities as nothing more or less than bank savings accounts.

Have I now added to the confusion?

LikeLike

Rodger, it would seem to me that these two sentences can’t coexist:

1: “Yes, that limit is an inflation that cannot be prevented or cured by interest rate increases.”

And

2: “one reason why keeping interest rates low is recessive, not stimulative.”

How would increasing the FFR to 10%, help to control inflaiton and too much spending? Ceterus Paribus, this would presently increase Govt spending by ~$1.5T per year, roughly 10% of GDP? I know, Govt spending would be some amount less initially due to the longer term securities structure of at least some of the T-bond global portfolio. If interest rate increases were an effective tool to combat inflation, when the CB of Zimbabwe set interest rates at 900%, we would have expected to see spending and inflation decline significantly since the “value” of a Zimbabwe dollar would have been so high.

LikeLike

Interest rates are THE tool the Fed uses to combat inflation.

The dollar is a commodity, the value of which is determined by supply and demand.

Demand is determined by risk and reward. The reward for owning a dollar is interest. When the Fed raises interest rates, this strengthens the dollar, i.e. makes it more valuable.

As you can see however, the value is determined by four factors: supply, demand, risk and reward. Interest affects only one factor: Reward

In the case of Zimbabwe, supply and risk overwhelmed reward.

LikeLike

Rodger, I understand your response. You’ve written the same thing on many occasions. My point is, which you’ve completely ignored by giving me a generic response, that with our current level of T-bonds outstanding, the disinflationary impact of 10% FFR, would have to more than offset a $1 trillion increase in new money creation through the deficit. I’ve yet to see any evidence that FFR increases would be sufficient to offset the increased money supply. It may be, but certainly the answer is not obvious.

And there is no historical correlation between inflation and interest rates, as you’ve shown on multiple occasions by posting the FFR and CPI YOY changes on the same graph.

LikeLike

Not bad. It triggered, for me, “voxspending” or “voxvesting”, neither of which are very “catchy”. I also like the capitalist (small c) concept of a “Citizen’s Dividend”, to reflect the concept that we are all “stockholders” in the US economy. I’ve heard the Saudi’s economy works that way; at least for the very large Saudi “family”.

LikeLike

Rodger, a belated thank you for your response. The beauty of confusion is that it’s the optimum point of learning. I will mull over your response and, I’m sure, bother you soon with more questions.

One question I have now is, “What is your opinion of HR2990, the National Emergency Employment Defense (NEED) Act of 2011”. I see it as a step toward recognizing monetary sovereignty, and would appreciate your analysis.

http://thomas.loc.gov/cgi-bin/bdquery/z?d112:HR02990:@@@L&summ2=m&

LikeLike

Some good; some not so good.

I like the elimination of T-securities. Though they do have some value, they confuse the public into accepting debt and deficit reduction.

I don’t understand the purpose of eliminating interest from bank deposits.

I don’t understand the benefit of eliminating fractional reserve (more properly, “fractional capital”) lending. Bank insolvency has not been a major problem for Americans, especially with FDIC insurance. The bigger problem in inadequate bank oversight.

I like the “Citizens Dividend,” and in fact, recommend it as part of the “Nine Steps to Prosperity.”

I don’t understand the purpose of the 8% interest limit on bank loans.

I really, really, REALLY don’t understand the 25% limitations on money creation as they do not take into consideration changing economic circumstances.

Bottom line: This bill seems to have as its fundamental goal, a limitation on money creation. But too much money creation is not, nor ever has been, America’s economic problem.

Mostly, the problem has been too little money creation — the reason we remain stuck today in a slow growth mode with increasing GINI ratio.

Frankly, I just don’t get it.

LikeLike

Rodger, I am exasperated by so-called “progressives” who deny the facts of Monetary Sovereignty.

Consider this faux-defense of Social Security…

“Social Security spending has risen by only one percentage point as a share of GDP since 2000. It is projected to rise by roughly the same amount over the next two decades, due to the continued aging of the population. It is then projected to remain pretty much flat for the rest of the century.”

This “progressive” author (economist Dean Baker) agrees with right-wingers that federal spending is bad. Baker just says the problem is not that bad.

(On a side note, millions of people who are in default on their student loans will get NO social security at all.)

Now consider this faux-defense of Medicare…

“Medicare costs are projected to grow more rapidly due to the projected rise in per person health care spending in the private sector. This suggests a need to contain health care costs in the economy as a whole.”

Again, note that the author (Baker) agrees with right-wingers that “federal costs” are bad (even though the federal government suffers from no “cost,” since it has infinite money.)

Now consider these reader comments:

[1] “The real deficit driver is unemployment.”

This reader believes the lie that the federal deficit is bad. He just says the cause is not social programs.

[2] “The real driver of the nation’s debt is fraud.”

This reader believes the lie that the “national debt” is bad. He just says the cause is fraud.

[3] “They call Social Security an entitlement because Bush spent all the money on the wars.”

This reader believes the lie that the federal government is “broke.” He just says the cause is Bush. (Where did Bush get the money to fight his wars? “From China.”)

[4] “SS is an entitlement because people are entitled to receive money which they have paid into during their lifetime.”

This reader believes the lie that the FICA tax pays for SS and Medicare. He has no defense when right-wingers say, “You may have paid into it, but the money is all gone. SS and Medicare were unsustainable.”

Ironically, the people who most tend to resist the facts of Monetary Sovereignty are not right-wingers, but liberals and “progressives.”

Set me up to debate a right-winger, and I will quickly destroy him. However “progressives” are smug. They simply shut down. They are “right.”

Period.

LikeLike

Man do I agree with this comment

LikeLike

Than why not just legalize counterfeiting? Wouldn’t that make it even more convenient for all of us?

Good that you made the point about the man digging and the other covering it up. Question: taking into consideration that the hole won’t be used to bury anything, what do the 2 men gain by digging and covering it up?

Nothing – that’s what. As I have said various times – it’s productivity that makes the currency valuable. Now, think of the one man creating food and the other creating clothes. Day by day, the quality of each man improves. So yes, paying these men to do nothing productive is a waste.

LikeLike

What is legal counterfeit called? Money. Every lender creates it. You can, too. Just lend someone money and get their note in return. Bingo. You have created money.

So, the dollar gets more valuable as production increases? ?

LikeLike

it’s productivity that makes the currency valuable…”

The only way I can imagine this to be true is if ‘productivity’ is mass-productivity; and ‘valuable’ is the drop in unit costs, the easing of inflationary pressure, and the subsequent increase in value of the currency.

LikeLike

Fiat currencias float against each other. That’s not what I was refering to. What I mean is – if we produce more of something, that something becomes cheaper because the supply goes up.

The issue with productivity is – corporations produce up to a point they remain profitable. If inflation remains in check, I.e. no printing, productivity will increase much faster than today.

We were lucky to have had the technological advancements of the 90s, which improved productivity dramatically. Unless we have a repeat, we are in dire straights.

LikeLike

Inflation has been in the 2%-3% range for many years – about where the Fed has controlled it to be. I suspect inflation will continue in that range, only because the Fed has the power to control it.

I also suspect the the “sky-is-falling” inflation worriers will continue to mention such nations as Zimbabwe, Venezuela and Weimar Republic as solid evidence the world is coming to an end, conveniently forgetting all the other nations of the world.

LikeLike

Roger,

You are 100% right, inflation has been around 2 to 3% for years. That is, inflation in terms of prices. And no, I am not worried about high inflation.

What I am referring to when I say that our currency is a fiat, it’s that the inflation is on reverse. Laborers don’t lose their purchasing power because prices go higher, as in Venezuela or Zimambawe, etc. They lose their purchasing power when their incomes are replaced with debt. The 2 manifest in different forms, but at the end of the day, both eat into the people’s real incomes. That’s what has been happening since 1971.

So don’t expect hyperinflation nor even high inflation. Expect stagnant salaries coupled with huge levels of debt. The end result remains the same, loss of purchasing power.

LikeLike

I would ask that to the folks in venezuela. Why would prices be rising at 50 percent? Why is milk hard to find?

I think it’s because those that produce milk and other goods and services cannot make a profit with a government emiting excessive amounts of currency to support a socialist regime. So, producers stop producing. To top it off, the workers dont have insentive to work when their neighbors are getting a “free” check.

The dumb ones always pay Mr Mitchell.

LikeLike

And yes. The more things we produce, the more each of us can purchase. Is that not common sense?

LikeLike

You said, “it’s productivity that makes the currency valuable.”

But, the value of the dollar has gone down every year, while productivity has increased every year.

LikeLike

Roger,

That has been the case in the US, but I bet not in Venezuela. Let’s see.

The US has a credit based system, a bulk of the credit was emitted by banks, essentially taking real income and replacing it with debt. That’s what a fiat system is designed to do.

Although debt acts like currency, driving prices higher, it’s not the same. It’s why the Fed cannot fix this. And if fixing requires real growth in economic output, neither does congress. You need 2 things, 1 investors to create and run new productive capacity, 2 more people to start working.

So yes, productivity went up, but our money supply went up by much more. By the way, that productivity gain should have gone to the laborers, instead, it went to the bankers and the already rich – talk about inequality. But hey, people deserve it for not wanting a gold standard.

I meant a machine to create dollars, not bapoy notes. If unlimited amounts of money made the economy better, just give each citizen a machine so they can print as much as they’d like. Of course, we would resort to eating grass shortly after.

LikeLike

Your argument is absurd.Counterfeit is not legal money.There is no such thing as legal counterfeit. And people can’t print legal money.

I enjoy much of your ideas but this does not make any cents 🙂

LikeLike

Auburn, you said,

“I’ve yet to see any evidence that FFR increases would be sufficient to offset the increased money supply.”

You may have yet to see any evidence one way or another, so here is a bit.

In 2009, the deficit was $1.4 trillion and inflation leaped all the way “up” to 2.5% — and that was with essentially 0% interest rates, while the Fed worried about deflation.

As you know, money supply historically has not been a good predictor of inflation, despite the hand-wringing of the inflation worriers, who keep mentioning Zimbabwe, Venezuela and Weimar Republic as “typical” examples.

LikeLike

Actually Rodger, being an MMT\MSer, I would never use Zimbabwe etc as a means of “falsifying” MTM\MS (as if that were possible). And I certainly am not repeatedly mentioning them as you just wrote, obviously you are comparing me to Bapoy above.

You claim that the Fed can control inflation through interest rates, not me.

My claim is that there is no historical empirical data to support it your claim.

I may be wrong, and I don’t care if I am, I only want answers, and I don’t care whose answers they are.

The graph you posted shows CPI and the deficit, I specifically wrote about CPI and the FFR. In order for the Fed to control inflation with the FFR, they should be inversely related, when the FFR goes up, CPI goes down and vice versa. This framework is not supported by the data.

Furthermore, as I described above, even if the Fed can use the FFR to impact the greater economy and thus inflation, the effectiveness of this tool changes with the relative level of T-bonds. Because increases in the FFR = increases in Govt money creation through the interest channel.

LikeLike

Auburn, who said YOU were mentioning Zimbabwe?

If the Fed can’t control inflation via interest rates, what has controlled inflation?

You said, “I may be wrong, and I don’t care if I am, I only want answers, and I don’t care whose answers they are.”

In that case, ask Bapoy. He’ll give you answers.

You said, ” . . . the disinflationary impact of 10% FFR, would have to more than offset a $1 trillion increase in new money creation through the deficit.”

I assumed you meant that the $1 trillion in new money would cause inflation, and you were questioning whether 10% interest rate would be sufficient to control the inflation.

The graph was to demonstrate that the inflationary effect would be minimal.

You said, ” . . . even if the Fed can use the FFR to impact the greater economy and thus inflation, the effectiveness of this tool changes with the relative level of T-bonds.

Total BS. Show me your data indicating that ” the effectiveness of this tool (Fed Funds Rate) changes with the relative level of T-bonds.”

LikeLike

“Auburn, who said YOU were mentioning Zimbabwe?”

whoops, you wrote “people…WHO” and not ‘YOU”. My apologies, you did not say that “I” keep mentioning Zimbabwe.

“If the Fed can’t control inflation via interest rates, what has controlled inflation?”

Well, savings (income not spent on goods and services), productivity increases (more output with the same # of workers), population growth (more workers = more output given a constant level of productivity), and the trade deficit (foreign held dollars circulating outside the USA cannot impact prices inside the USA) are all inherently deflationary. So we have simply not see the supply of money grow (inflationary bias) faster than the natural deflationary biases. It seems to me that adjusting interest rates can only really impact the first of the four deflationary factors, savings.

http://research.stlouisfed.org/fred2/graph/?utm_source=research&utm_medium=website&utm_campaign=data-tools#

“In that case, ask Bapoy. He’ll give you answers.”

Thats funny, Bapoy is so clueless, his answers can’t help anyone.

“I assumed you meant that the $1 trillion in new money would cause inflation”

I meant to say that $1 trillion in new money would have an inflationary bias, and that the 10% FFR would have to overcome at least this bias to be effective.

“and you were questioning whether 10% interest rate would be sufficient to control the inflation.”

I am questioning that, but even if the FFR went up to 20%, I just am not convinced (and the historical data does not support), the position that the deflationary impact of increased savings that comes with higher interest rates (I presume, but haven’t looked at the data) would now have to overcome, $2 trillion in new money per year through interest payments from the Govt.

“The graph was to demonstrate that the inflationary effect would be minimal.”

Thats a good point, now I see why you replied with it.

“Total BS. Show me your data indicating that ” the effectiveness of this tool (Fed Funds Rate) changes with the relative level of T-bonds.”

My point was simply that for every 1% increase in the FFR, the amount of new money creation through the increase in interest expense by the Feds is dependent on the number of outstanding T-bonds.

For example:

With our current GDP (~$15T)

If T-bonds held by the public outstanding were like today (~$10T), each 1% increase in the FFR would increase interest spending by $100B or .66% of GDP

If T-bonds outstanding were $20T, each 1% increase in the FFR would increase interest spending by $200B per year or .1.33% of GDP

If T-bonds outstanding were only $1T, the increased interest spending would be only $10B or .066% of GDP.

If we had T-bonds outstanding of 300% of GDP ($45T), every 1% increase would bring about $450B in new spending per year or 3% of GDP.

This is what I meant by claiming that the FFR’s effectiveness in combating inflation is related naturally to the current level of T-bonds outstanding since that level of T-bonds impacts increased level of new Govt money creation due to the increased FFR.

LikeLike

Roger,

We talking different things. The US is not Venezuela, it’s not Weimer Republic, it’s not Zimbabwe.

This inflation thingy you are worrying about has already happened. The money supply has grown, and that is what inflation is. A growth of the money supply. The end result is loss of purchasing power.

Whether your purchasing power is taken due to higher prices or high levels of debt – the end result is the same. People’s purchasing power is removed. In the US, this has already occurred. People are tapped out – what you can expect is either deflation (natural course as people’s income has not increased in years) or stagnant economy – until people’s income catch up to the rate of inflation. Like Japan, the US has chosen to defend zombie banks that should have gone under – and like Japan – this shell of an economy will remain until the banks are well capitalized and people’s income (in real terms – NOT in dollar terms) catch up to the level of inflation.

LikeLike

Bapoy,

You said, ” . . . that is what inflation is. A growth of the money supply. The end result is loss of purchasing power.”

In economics, inflation is a general increase in prices, not a “growth in the money supply.” See: http://en.wikipedia.org/wiki/Inflation

For the past 40 years, there has been zero relationship between inflation and the money supply. See: https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/

LikeLike

These days the inflation is more the result of Middle East tension and a hyper sensitive NYSE that goes ape over the slightest sneeze by some Arab Sheik.

We need to stop Middle East meddling and gradually get the hell out of there, then equally gradually switch over to green. It was a mistake going over there to begin with when we’ve always had plenty of crude on this side of the Atlantic. Anybody know why we stuck our noses in that part of the world to begin with, and shipped our money out on top of it? Since when did we need to help those people out, and WHY? What was the attraction?

LikeLike

Than explain why Venezuela has hyperinflation. They sure don’t need the Middle East for oil. As I mentioned on an earlier post, Venezuela has the lowest price of gasoline in the world, 6 cents. I know nobody will explain – because there is no explanation, so please save the name calling.

Inflation has zero to do with oil prices. It has 100% all to do with money printing. In fact, the definition of inflation used to include a growth in the supply in money and was changed to prices to fool the masses.

It’s the only way the ultra rich and the government can extract wealth from the dumb sheeple. No need to enforce a totalitarian regime – all you need to do is issue new currency. The new currency will by default remove purchasing power from the existing currency. If you are not wealthy, there is no way to keep your wealth – it will slowly but surely be removed from you by force.

The wealthy and politicians understand this – and are rich for the same reason. The poor and middle class are as dumb as a donkey. Take all from them and give them a bone and they will be happy. And this is not going to change ever.

LikeLike

“…Than explain why Venezuela has hyperinflation…”

I should have said “These days {U.S.} inflation is more the result of Middle East tension .” I didn’t mean to imply Venezuela’s problem is connected to the Middle East.

Also, the low price of gas (6 cents) in Venezuela is due to heavy state subsidization.

The money supply problem is due to the ‘one horse’ petro economy.”

Venezuela’s income is 90% oil export. But it has swung the other way. So now their government had to print a ton of money in response. At heart, the inflation problem is still domestic oil production not the money supply .

Inflation in the U.S. is mostly due to oil prices responding to a politically unstable Middle East.

LikeLike

Quote RMM, “What is legal counterfeit called? Money. Every lender creates it. You can, too. Just lend someone money and get their note in return. Bingo. You have created money.”

Your statement is false. Every lender does not create “legal counterfeit”, for there is TWO different kinds of lending in our present monetary system:

“Genuine Lending and Fictitious Lending”

As Frederick Soddy stated in “The Role of Money”

“Genuine and Fictitious Loans.-For a loan,if it is a genuine loan does not make a deposit, because what the borrower gets the lender GIVES UP, and there is no increase in the quantity of money,but only an alteration in the identity of the individual owners of it. But if the lender gives up nothing at all what the borrower receives is a new issue of money and the quantity is proportionately increased (is a fictitious loan)….

These vast sums of money are entirely of the banks creation…When the bank pretends to lend their money they do not reduce the amount of the claims of the owners to goods and services on demand by a …(CENT).They do not inform them that they can no longer draw it out as it has been lent to others! ”

Roger should you wish to prove your statement true and Soddy’s false, please just write me a check for a $1,000 loan and I will send you

a certified “note” of repayment;not to worry because there would be no risk as you believe you can lend ‘just like a bank’; they will create two owners of that $1000 you own at the same time so you will still have $1000 in your account. Please before Christmas as I will have no difficulty exchanging my “counterfeit” for goods and services immediately. Justaluckyfool.

PS: Should you decide to write that check ,please make it payable to:

“Nine Steps to Prosperity:”

IT IS A GREAT CAUSE !

LikeLike

Apparently, your Soddy does not understand the difference between a gift and a loan.

When he writes,” . . . what the borrower gets the lender GIVES UP, and there is no increase in the quantity of money,but only an alteration in the identity of the individual owners of it,” he is describing a gift.

When you give a gift, you lose money.

When you lend, you do not lose money. You receive a NOTE, which is a form of money (credit market instrument).

For example, your dollar bill is a federal reserve NOTE.

That is how a bank creates money: By accepting newly created personal NOTES in exchange for Federal Reserve NOTES.

When a bank lends, it credits someone’s account. Does the bank lose money? No, it receives a personal note in exchange.

That bank only would lose money if it gave that money as a gift.

Every form of money is a form of debt. There is no money that is not debt.

Understand the difference between a loan and a gift, and you will know far more than Soddy.

By the way, if I trusted you as much as I trust the U.S. government, I wouldn’t hesitate to exchange Federal Reserve Notes for your notes. But, I don’t.

LikeLike