Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

Here is why the Fed continues with Quantitative Easing (QE) — and it’s not what Chairman Bernanke tells you.

Background: What is the single biggest problem facing the American economy? No, it’s not the federal deficit or the debt, not inflation, deflation, recession or depression, not reduced employment or unemployment, not health care or Social Security.

No, the single biggest problem facing the American economy is the growing gap between the few very rich and the rest of us.

THE GINI RATIO — A MEASURE OF INCOME INEQUALITY — CONTINUES TO WORSEN

(“0” means everyone receives the same; 1.00 means one person gets it all. The rising line means rising inequality.)

When a large percentage of a nation’s citizens suffer from poor housing, inadequate access to medical care, less affordable and less nutritious food and less affordable, quality education, poor prospects and opportunities for success — and when that large percentage is growing — the nation and its leaders have failed.

President Kennedy was wrong when he said, “Ask not what your country can do for you – ask what you can do for your country.” For what, after all, is the fundamental purpose of a nation, if not to care for its citizens?

The Situation: The Fed, under Chairman Bernanke, claims QE (Quantitative Easing) stimulates the economy. His theory goes like this:

Under QE, the Fed buys $85 billion dollars worth (currently) of T-bonds from the private sector every month. Bernanke would have you believe that each month this pumps $85 billion into the American economy.

Utter nonsense.

When the private sector purchases T-bonds, dollars are transferred from private sector checking accounts at various banks, to T-bond accounts at the Federal Reserve Bank. (Think of transferring dollars from your bank checking account to your bank savings account.)

Then, when the Fed buys those T-bonds from the private sector, dollars are transferred back from T-bond accounts to private checking accounts. No new dollars are added to the economy.

What does happen however, is that the Fed’s bond purchases increase the demand for T-bonds, which increases the price of T-bonds, which in turn, decreases the interest rate paid by T-bonds. In short, QE simply is a gigantic long-term-interest-rate-reduction device. Nothing more.

Because the Fed controls short-term interest rates (via the Fed Funds rate), QE closes the circle, by lowering longer-term interest rates. So the question becomes, “Why does the Fed want low interest rates?”

The usual claim is that low rates make borrowing more attractive, which supposedly is economically stimulative. But, while low rates make borrowing more attractive, those same low rates make lending less attractive.

As a result, there is no historical relationship between low rates and GDP growth. See: “Low interest rates do not help the economy.”

If QE merely keeps interest rates low, and low rates don’t stimulate the economy, why QE?

The Fed is a creature of the rich, and the rich want low interest rates. Low rates reduce federal bond interest payments, so when rates are low, the government pumps less money into the economy. And, low rates make borrowing less costly for businesses, thereby adding to business profits.

Thus, QE causes two complementary effects: Less money coming into the economy plus higher profits for business: The perfect combination for taking money from the poor and giving it to the rich.

Here is how that works:

Spiegel

Near Zero: ECB Interest Rate Cuts Hit Savings Hard

By SPIEGEL staff

As the European Central Bank pushes interest rates to a new low, Germans are growing increasingly concerned about their savings. The money in their accounts is losing value and life insurance policies are yielding lower returns.

Only a few years ago, Germans were convinced that they could offset the cuts lawmakers had made to government-mandated pensions by saving more money on their own. Because Germans tend to be risk-averse, they invest most of their money in savings deposits, life insurance and fixed-income products.

But savings can only grow in real terms if the interest rate is higher than the rate of inflation.

“In Germany today, people can no longer provide for their retirement by saving,” says Walter Krämer, a statistics professor in the western city of Dortmund.

The percentage of young people in the population is shrinking, and yet they must generate greater economic output to reduce the debts they are inheriting from the current generation.

Because this is unsustainable, a redistribution from creditors to borrowers, or from savers to the state, is now occurring. The government makes money when interest rates on government bonds are lower than inflation. Its debt burden is decreased, while savers are left to foot the bill, with their assets losing value in real terms.

The consequence is a massive redistribution. McKinsey, the consulting firm, has calculated that the governments of the United States, Great Britain and the euro zone already saved $1.6 trillion between 2007 and 2012 as a result of low interest rates. This is offset by a loss to private households of $630 billion. Older citizens are losing more than younger people, because the latter tend to have more debt and fewer savings.

As much as savers are being fleeced, there are also those who profit from low interest rates. People who own real estate have benefited from increases in value in recent years, while stock owners have seen Germany’s DAX share index climb from one record high to the next. But this primarily benefits those who are not worried about having enough retirement income.

In this way, the low-interest-rate policy doesn’t just lead to a transfer of assets from citizens to the state, but also from the poor to the rich</strong>. Affluent households are in a better position to shift their focus to stocks, real estate and other investments than those with average incomes.

Bottom line: The Bernanke purpose of QE is to reduce interest rates while convincing the public this is beneficial. It is beneficial, but only to those who invest in stocks and real estate. Low rates are detrimental to the vast majority of Americans who try to save via bank accounts, insurance accounts and other “safe,” interest-paying investments — i.e. the middle class and the poor.

QE, deficit reduction, debt reduction and interest rate reduction all have been sold to the American public as economically stimulative and beneficial to the poor and middle classes. But, in fact, they widen the gap between the rich and the rest.

That is why Bernanke and the rich bankers love QE. It is the gap that makes the rich rich. If there were no gap, no one would be rich, and the wider the gap, the richer the rich are.

Bernanke, the politicians, the media and the mainstream economists have been paid by the rich to widen the gap. That is the purpose of QE.

So far, it’s working.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

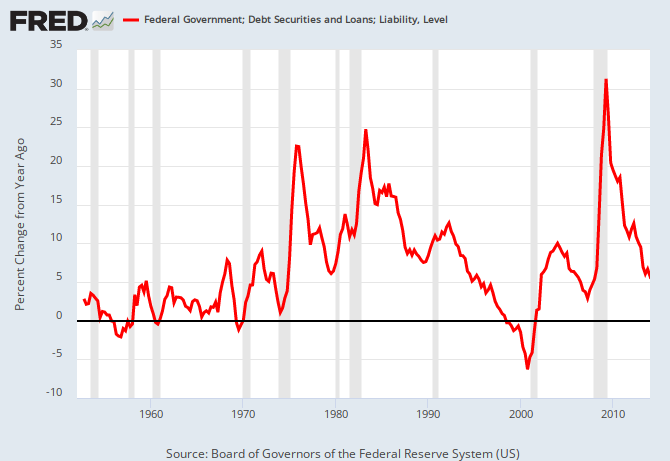

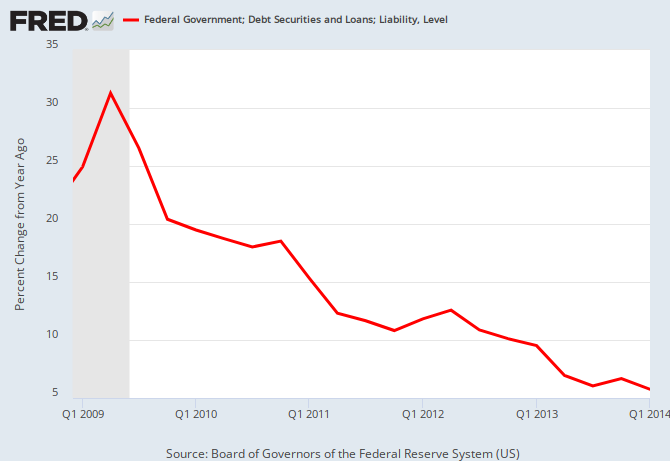

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Do you think it would be a good rule for the federal funds rate to match the national unemployment rate?

LikeLike

Tyler,

Unemployment seldom goes below 6% and often rises much higher. A Fed Funds rate well above 6% might be deflationary.

If I were President, I would tell the Fed Chairman, “You have one job: Keep inflation under control. Don’t worry about GDP. Congress and I will grow GDP.”

LikeLike

@Rodger: Assume we implement your solutions, and eliminate the gap and there are no longer any rich people, what effect would this have on technological innovation? To make money and create wealth, in part, is a big motivator for entrepreneurs. If there is no incentive regarding making any more money, why bother? Being comfortable with one’s current state in life can be dampening to fostering entrepreneurship – the less relative reward to effort seen in one’s endeavors such as entrepreneurship which would undoubtedly require lots of hard work, time, resources and persistence to succeed.

LikeLike

Instead of the Fed buying bonds and tying money up, they should just move money directly into individual accounts without bondage. 310 million people receiving (untaxed) $400/month is $124 billion and yearly $1.488 trillion. A family of four gets an extra $1600/month!

This would gradually push the private sector toward 100% capacity and record profits. IF the private sector can keep up with demand there’s no reason to advance prices. ( Nor would business want to act in collusion and shoot themselves in the foot?)

Yea yea, I know– oil prices. A stimulated economy means greater demand for transportation and fuel. But would the NYSE in a knee jerk response necessarily bid up a barrel of crude knowing they too would be shooting themselves in the foot by helping to cause inflation, cutting off monthly treasury payments short term and dividend growth long term? And would banks necessarily be threatened if the average person feels secure in being able to repay a loan?

LikeLike

See #3 in the Nine Steps to Prosperity.

LikeLike

Start fixing by properly reforming the monetary system. Who is in control of the power of money creation is the beginning; since the answer to the question of does so is primary when it comes to fixing the entire economic system. QE facilitates the raping and destruction of economies at each level. It facilitates the continued transference of wealth from all other segments of the economy to the financial elites. The 0.01% who truly believe those less fortunate are disposable and not necessary other than to be of service to their every whim. Widening, as you put it, the “gap” is one of their primary objectives to be sure. Ensuring servitude by creating a sense of desperation is at the very top of their list of them. The money system must be made to serve public purpose not the opposite as is the current order.

LikeLike

I’m starting to get this. Businesses work for pieces of paper, even if those are worthless. Man was I confused. I thought businesses produced those goods and services for something of value in return. And you would think they would produce those goods and services, ONLY, if they trusted the government to safeguard their efforts.

Anyway, lower rates are for the banks as well as for the government. Low rates: 1) prolongs home bankruptcies that would occur with higher rates, providing stability for the banks until they can recapitalize. 2) allows banks to slowly recapitalize by borrowing at cheap rates from the Fed and lending to the treasury for a profit, all while eating up savers. 3) allows the government to continue to borrow at cheap rates.

Let’s stop thinking that the Fed has complete control of the rates – it doesn’t. Do you really think Volcker increased the rates in the 80s to be cute? No, he did so because he had no choice. And if low rates are good for the wealthy, so were the high rates of the 80s. The Fed merely follows what the market, much larger than the Fed, dictates.

And yes, the poor and middle class – who have NO access to credit and who don’t have investments to hedge against – are the ones that lose. And let’s not forget that all the poor and most of the middle class have is their labor. A product that loses it’s value day by day due to money printing. With people having to borrow more and more just to stay afloat, Is it any wonder that the gini ration is where it is?

In the same way Volcker had to increase rates, Greenspan was forced to lower them, and Bernanke was forced to maintain them at zero. There will come a time when the Fed will have to tighten, likely under Yellen. A time will come when investors will demand a higher premium – and it will be painful for those highly levered and for the government (so wait for higher taxes).

Why $1,600, let’s make it $20,000 a month instead – do you really think this will make us better off? I am willing to wage a bet with any of you that the best that could happen is that prices go up by the same amount – washing out any “benefit”. At worst, business stop producing, fire employees and produce for themselves – resulting in a total collapse of the nation. Those who propose such nonsense do not understand what money is.

LikeLike

‘A product that loses it’s value day by day due to money printing.’

Monetary base against M2 (y-o-y). The base which the Federal Reserve has direct control over, has had virtually ZERO correlation with M2:

LikeLike

Steve,

There should be no doubt that the Fed is printing. How else would stocks have more than doubled from 2008? I guarantee it hasn’t been economic growth, that’s for sure.

From 2008 until 2010, M2 increased by approximately 15% in the face of falling economic demand and falling demand for money. See this: http://globaleconomicanalysis.blogspot.com/2010/08/will-quantitative-easing-spur-inflation.html

I suggest that the increase was the result of the Fed’s manipulation. However, the Fed can only create more liquidity, it does not dictate where it goes or if it goes anywhere at all. The banks were insolvent, so they took the money and either lent it to the treasury for guaranteed returns or parked right back at the Fed. The money went no-where. Also keep in mind that although the Fed was trying to increase the money supply at all costs, various loans (in the trillions) were defaulted on. Essentially muting alot of the Fed’s work. Direct printing by the Treasury is not the same as what the Fed is doing. Money issued by the treasury is debt free, and as such, does not have to be repaid and will never, ever, ever be defaulted on. That money will remain in circulation chasing goods and services until the Treasury decides.

So don’t think for a heartbeat that because the Fed has been issuing debt (while other debt is defaulted on or repaid) is the same as the Treasury printing. It’s NOT.

LikeLike

On last sentence, meant to say – just because the Fed has been issuing debt currency without creating high inflation – do not think this is the same as the Treasury issuing debt free money. It is NOT.

LikeLike

1) Its’ my understanding that inflation is not a universal scientific principle that happens automatically whether we like it or not like gravity. My understanding is that there is no need for inflation as long as demand doesn’t exceed capacity to supply.

2) Business will never stop producing. If it does ( total collapse of the nation ) where do you get food, light, heat or a haircut?

3) Prices go up by the same amount – washing out any “benefit” when people win pay increases from the private sector. When the private sector doesn’t have to cough up, there’s no reason for them to play catch up. So don’t take from them in the form of higher wages; take from the process of institutionalized money creation w/o attachment to debt, i.e., (ms/mmt).

4) I’ll take your bet, but how do we set up the experiment?

LikeLike

Great article! I quicklinked to it on Opednews: http://www.opednews.com/Quicklink/The-real-reason-for-the-QE-in-Best_Web_OpEds-Debt_Depression-131125-783.html

LikeLike