Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Two questions:

1. What happens to the federal deficit in the years preceding recessions?

2. What happens to the federal deficit during recoveries?

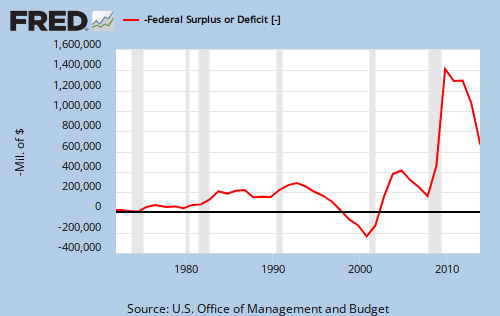

————————–FYFSD is the federal deficit————————–

Inspect at the above graph, and consider your answers to those two questions as you read these excerpts from a Washington Times article:

Federal deficit below $1 trillion for first time in Obama’s tenure

By Stephen DinanPowered by tax increases and deep budget cuts that held spending in check, the federal deficit dropped to $680 billion in fiscal year 2013. Taxes grew to $2.774 trillion, marking an all-time high.

All those who think tax increases stimulate the economy, please raise your hands.

All those who think reduced federal spending stimulates the economy, please raise your hands.

The deficit is less than half the record $1.413 trillion figure Mr. Obama and President George W. Bush shared in fiscal year 2009.

That is still higher than economists say is healthy, but it’s far more manageable than at the height of the recession.

All those who can explain how deficits “at the height of the recession” were not manageable, please raise your hands.

All those, in classes taught by the above-mentioned economists, please tell me their names and contact info.

White House budget director Sylvia Mathews Burwell said the figures mean Mr. Obama has made good on his pledge to cut the deficit in half.

She said the credit belongs to Mr. Obama for fighting to raise taxes in the January “fiscal cliff” deal, and for drawing down troops in Afghanistan.

All those who wish to give Mr. Obama a nice, big pat on the back, for starving our economy of money, please raise your hands.

The 2013 deficit figure would have been worse if the government hadn’t borrowed nearly $40 billion from the Social Security trust funds.

The deficit also benefited from a $83.5 billion credit from federally backed housing programs Fannie Mae and Freddie Mac.

First translation: In government-speak, “worse” actually means “better,” as in, “If the government had not borrowed from the Social Security trust funds, $40 billion more dollars would have entered the U.S. economy. Somehow, this would have made the economy “worse.”

Second translation: “Deficit benefited” actually means “economy injured,” as in Fannie and Freddie pulled $83.5 billion out of the private sector, which injured the economy.

Now for a bit of irony: Fed Chairman Bernanke falsely claims the Fed stimulates the economy by purchasing $85 billion worth of T-securities each month. The world believes him, and panics when he threatens to stop.

(The claim is that this causes $85 billion new dollars to enter the economy every month.) If the claim were true (It isn’t), adding all those dollars would be quite stimulative.

But (here’s the irony), while bragging about how stimulative the Fed is, with its phony $85 billion supposedly entering the economy every month, the government also brags about more than a trillion dollars leaving the economy, via increased taxes and reduced federal spending.

The populace is thrilled about the Fed adding dollars to the economy, and equally thrilled about Obama taking dollars from the economy.

And no one, including those economists mentioned above, sees anything contradictory about this.

That’s why we’re so thrilled with reduced deficits. We hate deficits but we are O.K. with unemployment, poverty, recessions and depressions.

It’s what we’ve been taught.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

most people don’t know that federal taxation takes money out of the economy, so most assume that all the money, once collected, goes into some giant vault somewhere, perhaps at fort knox, to be respent.

most people have never heard an accurate description of how money is “printed” and then “unprinted” or what happens in day-to-day monetary transactions, so you can’t blame them for their lack of understanding.

i say this not just as an observer, but from personal experience, as someone who was totally clueless a few years back and, by a stroke of luck, discovered this blog.

when i first read it, i just couldn’t believe it–it just couldn’t be true. nobody i had ever heard was saying anything like this. and i was listening at the time to peter schiff, ron paul, max keiser and that fool down in florida, karl denninger.

but, somehow, i had the feeling i should continue reading on to see where it would go.

and then, one day, i was listening to denninger and he said something that threw me for a loop. he, for some odd reason, had the need to talk briefly about “neo-chartalism,” as he referred to it. y’know, what he said?

he said something like, “yeah, y’know, i’ve taken a look at this and i’ve read all their literature and you know what? THEY’RE RIGHT!! but i still said the deficit too large!!”

and that was the last time i ever listen to that fool. rodger is totally right when he says that “they” DO understand the monetary system and know exactly what they’re doing, which is to increase the gap.

y’know, this guy denninger has been on TV “debating” mike norman. he told mike he was totally wrong!! he was just lying thru his teeth!!

he totally agrees with mike and the MMT-crowd on how the monetary system actually works. it’s just that he disagrees that it should be used to help anybody other than the rich.

this is actually part of my issue with the use of the acronym “MMT.” warren mosler says that the label just stuck, so it’s pointless to change it, but i think using “MMT” is counterproductive and confusing to the public.

first, a distinction needs to be made between the actual functioning of the monetary system and then solutions to “economic” problems.

i think that “MMT” should be thrown out and some other expression should be used for accurate descriptions of the monetary system. i’ve seen “(neo-)chartalism” and “functional finance,” for example. b/c when you use the word “theory,” then people will say, “aha, but see, you’re not talking about the real world!”

as for solutions to economic problems, some of that could be subsumed under “post-keynesianism.” i say that advisedly, b/c i believe warren has said on a few occasions that he has had disagreements with PK’ers.

LikeLike

Yuu,

I used to read authors like Denninger, Schiff, and Kudlow, and like yourself, I was clueless. The media has gotten the American people so terrified of the debt, deficits and inflation. The government just cut Food Stamps by $20 per month! I tell people that total spending equals total income…when you cut Food Stamps by $20 per month, you are cutting income by the same amount. I’m still waiting for their counter to that.

This country is hopeless. When the debt was $1T, the famous line was that we’re passing the debt to our children and grandchildren. Well it is $17 trillion now, and nothing has changed, except fear.

LikeLike

It’s kind of weird but I both agree with you and disagree at the same time. I do agree that the majority of Americans do not understand the money system and how money gets created or destroyed. It is not an easy subject and takes some thinking to figure it out.

Let me ask a simple question, how many people pack a few hundred dollar bills into an envelope to pay their taxes? Nobody?

So no, Americans are not stupid. They know they write a check, which is essentially a contract allowing their bank to debit their account for said amount and transfer the funds (electronically) to the IRS. Or they pay their dues to the IRS electronically (90% of the people). If the government was collecting pieces of paper I would have the courage to make the argument about the government burning the paper, given that all transactions are electronic, why is this even a topic? Can the government destroy digits?

I am very selective of the blogs I visit and what I believe or don’t believe. I visit blogs that I feel are doing the work out of honesty. At the same time, I visit blogs that pose the opposite opinion – to see the other point of view. Whether you have a bias or not, and I’m sure most of us do, the key is making sense of the argument and making a logical case against or for it. Having said that, I would not put someone like Denninger or Mish next to Schiff and Keiser.

Roger,

As per your own chart, the deficit grew by 700% in about 4 years, 200 billion to about 1.4 trillion. A rate higher than that would require doubling the rate to 1,400% and so on. In your estimation, how much longer can the US government continue to increase the rate of the deficit without eating up the entire economy?

LikeLike

Notyellen,

It’s a topic because people confuse federal (Monetarily Sovereign) financing with personal (monetarily non-sovereign) financing — federal deficits with personal deficits, federal debt with personal debt.

The words “deficit” and “debt” are inappropriate to federal financing. “Deficit” should be “dollar creation.” “Debt” should be “deposits.”

It’s a topic because people are not logical. People always knew cigarettes kill (For over 100 years, they were called “coffin nails.) Yet people took up smoking. People know politicians lie, yet people believe them.

People know a car title is not a car, and a house title is not a house. But they insist a dollar title (dollar bill) is a dollar.

People would rather believe a slogan (“There’s no such thing as a free lunch.”) than try to understand the reality that money is free to a Monetarily Sovereign government. So it’s a topic.

You ask, “Can the government destroy digits?”

Answer:Depends what you mean by “destroy.” If there were $1 in the whole economy, and you sent that $1 to the government for taxes, there then would be $0 in the economy.

Please define “eating up the entire economy.”

LikeLike

Point taken about the payment of taxes and government expenditures. Although I see why people confuse Federal debt with personal debt, I don’t think that’s the issue with government spending by a stretch. While many also believe they are living in a capitalist/free market system, the 2 ideas do not conflate.

By eating up the entire economy I mean government spending taking 100% or close to 100% of GDP. In my estimation, it shouldn’t take long to do by ever increasing the deficit year in and out.

What are the implications of an entire economy running on pure government spending?

LikeLike

Notyellen,

You’re describing the mathematically impossible. Think about it. If the government spends, say $1 trillion, were do those dollars go?

Answer: Into the hands of people, who will spend it. Government spending always will be a small fraction of total spending, because every dollar the government spends goes into the economy for multiple spending.

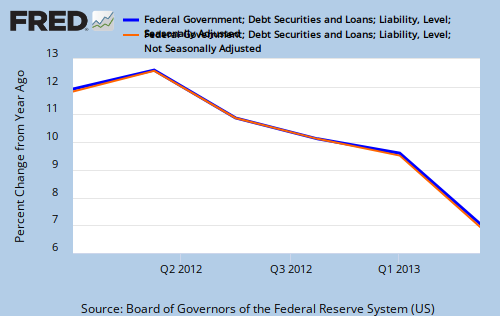

http://research.stlouisfed.org/fredgraph.png?g=nZ3

LikeLike

Thanks a lot for taking the time to help me understand this extremely complex matter.

You made a good point and I think most people would actually agree with you. Perhaps I’ve been over-thinking this, but in my mind there are other things to consider. For example, the deficit would double in 5 years just by increasing 15% a year.

If I understand your post correctly, the deficit should be increasing year after year, a constant or decreasing deficit will negatively impact the economy.

This means that if the deficit increases by 15% this year, it should increase by at least 16% the next, 17% the following, 18%, and so on. In this scenario it is not mathematically impossible to spend 100% of GDP, there would definitely be a time when the government will spend 100% of GDP the following year, without a doubt.

I am 100% sure it won’t get to that point (as there are other parameters to consider), but it is definitely possible. As an example and unless I’m mistaken, government spending can be 20 trillion next year. Having said that I go back to my question – what are the implications of that occurring. Would you still feel that would be a net positive for the economy and if so, why?

LikeLike

The formula for GDP is:

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

For the federal government to spend 100% of GDP, the private sector would have to spend $0.

Since federal spending sends dollars into the private sector, how would the private sector be able to spend $0?

Assume federal spending was truly enormous, say $1000 trillion. What would happen to that $1000 trillion?

LikeLike

It occurs to me that perhaps you are confusing “deficit” with “debt.” While mathematically, it is impossible for federal deficit to exceed GDP, it is quite possible to federal debt to do so.

In fact, Japan’s debt is more than double its GDP, a fact that has no effect on Japan’s economy.

Debt is nothing more than the total of deposits in T-security accounts at the Federal Reserve Bank, and even if those deposits were 10 times GDP, their existence would have minimal effect. on GDP.

LikeLike

You are correct, I was referring to the national debt. I agree with you, per the definition of GDP, a deficit cannot exceed GDP in any given year.

Nonetheless, what appears to be a minor increase of 15% would cause the national debt (or deposits if you prefer) to double in 5 years. I am not sure if this is an issue.

But here is where I think we may run into issues. If the increase is exponential (meaning the increase has to be incremental), it will be no time before the debt/deposits rise every year, and than every 6 months, and than every 3 months and so on. For instance, a 1.4 trillion deficit this year would be 1.61 trillion the next year (15% increase). That would turn to 1.87 trillion the following at 16%, which would turn to 2.2 trillion the next at 17%. The deficit would be about 20 times bigger at over 27 trillion in 15 years. By the 25th year the national debt/savings would be growing at about 50% per year (1.1 quadrillion to 1.5 quadrillion). By the 60th year it would be doubling every year (5 sextillion to about 9 sextillion). We would be hitting over one and a half octillion by year 81.

Does this not have any impact on the economy?

LikeLike

Rodger

I would think that you ‘eat up’ the economy by slowing the deficit, that is, decreasing money injections. If you increase the spending ( proficit ?spending) you feed, not eat up, the economy.

monetary “theory” is bad form too. And money ‘creation’ is against thermodynamics– nothing ‘created or destroyed.’

Since money is primarily electrons, perhaps current-c would be better if you can figure it into a title such as Modern Current C. (The C would represent speed of light transaction from Einstein’s famous equation(MC 2) and would actually be a completely truthful application. Money x Current in all directions area wise.

LikeLike

NotYellen- Besides for Rodger’s excellent answer to why US Govt DEFICIT spending could never be 100% of the economy, when thinking about the right size of the Govt’s contribution to the money supply (the deficit) we need context. Here’s a comment I made on just this subject that I hope is illuminating:

Why hasn’t the $6 trillion in new money created and spent by the Govt in the last 5 years been enough to get us back to full employment. Thats because $1 trillion deficits every year may sound like alot of new money, the amount of new money = debt the private sector creates each year has been much larger over the last 2 decades+.

Check out the nominal growth in total debt = money in the country since 1980:

http://research.stlouisfed.org/…

If you look at the time period between 1998 and 2008, the total number of credit market instruments (the broadest measure of the money supply) rose by about $26 Trillion, or $2.6 Trillion per year. And remember that the average Govt deficit = contribution to the growth in money only averaged $157 Billion per year (a total of $1.57 Trillion for the period). Thats breaks down as far as contribution to the supply of new money 6% Govt created money and 94% private sector created money.

http://www.taxpolicycenter.org/…

Since 2008, we had only about $ 4 Trillion worth of NET NET new money created in 6 years, which is around $800 billion in new money each year. Thats a drop of almost $2 trillion in new money every year on average. So while the Govt has created $6 Trillion ($1.2 Trillion per year) in new money since 2008, the private sector has net destroyed $2 trillion in debt = money ($500 Billion per year on average).

This gives you some sense of the scale of these matters. Again, $6 trillion may sound like a lot, but in order to have kept the money creation pace the same as the 1998 to 2008 time period, the Govt’s deficit = contribution would’ve had to have been around $17.6 Trillion (a doubling in the number of T-bonds outstanding).

$17.6 T – $2 T (the private sector destroyed) = $15.6 Trillion in new money / by 6 years = $2.6 Trillion average in total new money created each year since 2008.

And thats why the $1 trillion deficits have only been sufficient to barely keep us afloat.

P.S. There is plenty of room for adjustment in all these numbers as its all been done on a constant dollar basis coming from the Fed, plus there are obviously many other financial factors in play, like that the $26 trillion in new debt between 1998 and 2008 wasn’t all put to productive use and consumer goods and services, it was a lot of paper wealth in derivatives, inflated asset prices that was essentially wiped out. But as a general framework for understanding the scale and macro data, it works and is worth remembering.

LikeLike

Auburn,

Excellent points and well taken here. I actually feel that we’ve destroyed more than 2 trillion if you consider how many folks have lost their homes and have had to declare bankruptcy.

I think Roger hits the nail on the head when he says the Fed cannot do much – the Fed cannot do squat and the reason is pretty simple. The Fed can flush the markets with more debt/credit, how can more debt fix an economy that’s already up to the tilt in debt? It can’t and it won’t.

The congress, however, the congress can do things the Fed cannot. For instance, it can decide to send people checks, pay their rent, pay for their homes, etc… I think we are all in agreement there.

I really appreciate having access to so many different economic experts (including you and Roger), at the end of the day everyone wants to make the US economy, for the good of it’s people, better. From my readings, I think the matter boils down to 2 major theories. 1) is for government intervening in the markets and 2) a capitalist free market economy.

As I had mentioned on my previous post, the 2 theories do not conflate. From where I am sitting, it seems theory 1 is in the lead. The question to ask is – is this the road we should be on?

LikeLike

Notyellen,

Debt increases have little effect on the economy, as they do not increase the money supply. Federal “debt” is not really debt, but just bank (FRB) deposits, which are unnecessary and should be eliminated.

Unlike the case with personal finance, the federal government can have deficits without debt, and can have debt without deficits.

Deficit increases do affect the economy, as they are stimulative. There is indeed some point at which deficit increases could cause an inflation that cannot be controlled by interest rate increases — or at least not the increases we would be willing to accept.

However, despite the stimulus increases of the recession, we are nowhere near that level. In fact, we have hovered closer to deflation than inflation.

I have no doubt that one conjure up a rate of deficit growth that would be harmful to the economy, but the real problem, currently and for the past few years, is inadequate deficit growth.

My suggestion is that we solve the real problems of our economy. When a man is starving, I don’t worry that if we make enough food available, he may eat so much as to grow obese.

LikeLike

I often hear about how broke the USA is, and at the same time how we’re the wealthiest country in the world. That to me is a real problem of economics education.

There is a need to clearly define what wealth is and is not so this dilemma can be explained. We’re scientifically/technically extremely well off but that’s not the same as financially well off. We could be financially well off if our economic policy was as realistic as our technical understanding of the physical universe. What I like about MS/MMT is it provides a way to make economics move forward into the 21st century, putting economics and science more or less on the same page. Right now science is going through the roof and economics 101 is in the basement or I should say de-basement! Yet no one I know of outside of MS asks why this disparity exists. How can you be wealthy and broke at the same time? What is wealth anyway?

LikeLike

tetra,

Your question is a good one (or maybe a bad one, because it has so many different answers.)

Some people have written to me to say that money is not wealth, and one can have money without being wealthy. This is a philosophical point, that cannot really be debated. After all, having a good family, good health, good education and safety from crime all are a kind of non-money wealth.

Attempts have been made to measure non-money wealth, but they fail at the point of measurement. (i.e. what is “good” health and how valuable is it vs. safety from crime, etc.)

The other question is: Who is “we”? The U.S. never can be broke, although millions of Americans and thousands of cities, counties and states are insolvent.

Economics actually is one of the humanities, and the humanities are not like the physical sciences. In the humanities, definitions are not clear cut.

LikeLike