Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Many posts in this blog describe the following cause and effect:

The income/wealth gap between the rich and the rest is what makes the rich rich. If there were no gap, by definition, we all would be the same, so no matter how much we would make or have, no one would be rich.

If everyone on the planet had $1 million, none of us would be considered rich. But if one person had just $100, while the rest of us had $1, that one person would be rich. The wider the gap, the richer are the rich.

For those reasons, it is not absolute income or wealth that concerns the rich. It is the gap.

For me to be richer, I need only to increase my income relative to yours, or to decrease your income, relative to mine. Either approach accomplishes the same ends of making me richer.

In their ongoing desire to become ever richer, the rich bribe politicians, media writers and economists. The politicians are bribed via campaign contributions and promises of lucrative employment later. The media, being owned by the rich, bribe their writers )(with jobs) to mislead the public and the economist, who work for universities bribed by rich donors, write articles designed to improve tenure.

The result of all this bribery is to convince the public that federal deficit spending should be reduced. The reason: Federal deficit spending primarily benefits the non-rich, and so, narrows the income/wealth gap.

In summary, the cause is the desire of the rich to widen the gap, who use the “BIG LIE,” the false statement that austerity benefits the economy. Austerity, by reducing federal benefits spending and/or increasing taxes on lower incomes (FICA being a prime example), widens the gap.

Or, that is what I have written on many occasions. One example: Tax “expenditures,” “broadening” the base, and other lies to widen the gap Friday, Jul 26 2013.

Recently, however, I came upon a somewhat different scenario. It was in an article in the October 10, 2013 NewScientist Magazine. Here are a few excerpts (Updated 17:01 10 October 2013 by Debora MacKenzie):

The government of the most powerful country on earth has shut down and is dangerously close to defaulting on its debt. Its people and economy are feeling the consequences, and a new global financial crisis might not be far behind.

For Peter Turchin, a mathematical ecologist at the University of Connecticut in Storrs, the stand-off was predictable. He is one of a small group of people applying the mathematics of complex systems to political instability. They have been anticipating events just like this.

Turchin has found what he believes to be historical cycles, two to three centuries long, of political instability and breakdown affecting states and empires from Rome to Russia.

Workers or employees make up the bulk of any society, with a minority of employers constituting the top few per cent of earners. By mathematically modelling historical data, Turchin finds that as population grows, workers start to outnumber available jobs, driving down wages. The wealthy elite then end up with an even greater share of the economic pie, and inequality soars.

This process also creates new avenues – such as increased access to higher education – that allow a few workers to join the elite, swelling their ranks. Eventually this results in what Turchin calls “elite overproduction” – there being more people in the elite than there are top jobs. ”

The richest continue to become richer, existing advantage feeds back positively to create yet more. Elite overproduction explains why competition becomes so bitter, with no one willing to compromise. This means the squabbling in Congress is a symptom of societal forces at work, rather than the primary problem.

Such political acrimony is paralleled by rising discontent among workers left with less and less, and increasing state bankruptcy as spending by the elite who control the government coffers spirals. Ultimately, the situation gets so bad that order cannot be maintained and the state collapses.

In Turchin’s theory, this phase in the cycle should also be marked by political polarisation and rising government debt – both current crises in Washington.

According to Turchin, the cause of economic disorder does not begin with the rich wanting a larger gap, but rather, begins with increased population, not only among the not-rich, but later among the rich, themselves.

Turchin finds that a simple mathematical model, combining economic output per person, the balance of labour demand and supply, and changes in attitudes towards redistributing wealth – the minimum wage level is one proxy for this – generates a curve that exactly matches the change in real wages since 1930, including complex rises and falls since 1980.

The statistics show we are in another phase of rising instability that began in the 1970s, just when, as his theory predicts, labour supply started outstripping demand.

Such close agreement between model and reality is exceptional in social sciences, says Turchin, and shows that all three factors control the rise of inequality, as predicted.

Let’s take a moment to catch our breath. First the “close agreement between model and reality” might be explained by “reverse engineering” of the model. When a model contains many variables, each of which has a different weight and change rate, finding “close agreement” with reality could mean fiddling with each variable until an overall mathematical match is found.

This is called “predicting the past.”

Commodity price chartists, run into this problem all the time. They look for a formula that has predicted the past, only to discover it doesn’t predict the future.

Further, when Turchin talks about, “increasing state bankruptcy, as spending by the elite who control the government coffers, spirals,” and “rising government debt (a) current crisis in Washington,” he is demonstrating an ignorance of Monetary Sovereignty.

Rising government debt is not a crisis, but a growth necessity, and the U.S. neither is closer to, nor further from, bankruptcy, than we have been for 40 years. Yet, the gap has grown massively.

But when Turchin says productivity (economic output per person) is one of the variables leading to economic disorder, this seems to agree both with logic and data — if we assume unemployment is a predictive signal for economic disorder.

The red line is annual, real Gross Domestic Product, per capita growth. The blue line is unemployment (shown in the negative).

When fewer people can produce more, fewer people are needed — at all levels of income — unless demand grows even faster.

But government spending is an important part of demand and demand growth is inhibited by deficit growth reduction.

Bottom line, we find ourselves in an endless downward helix:

1. Productivity and population both increase..

2. When fewer of an increasing population are needed to produce goods and services, unemployment will increase unless more and more goods and services are demanded.

3. The federal government’s purchases are an important part of overall demand, so reductions in federal deficit growth reduce demand growth, leading to unemployment growth.

4. Meanwhile, the populace is brainwashed by the rich-owned politicians, the rich-owned media and the rich-owned, university-employed, mainstream economists into believing federal deficit spending should be reduced.

5. Not only does deficit growth reduction reduce demand (see #3), but it reduces the direct income of the not-rich, as the vast majority of deficit spending benefits the not-rich more than it benefits the rich. (Social Security, Medicare, Medicaid, poverty aid, employment by federal suppliers, etc.)

6. Greater unemployment together with reduced social benefits spending, increases poverty.

7. Such tax “reform” proposals as “broadening the tax base,” increases in FICA and all sales-related taxes, have a greater impact on the not-rich than the rich.

8. As unemployment increases, relative tax collections decrease, stimulating the government to apply even greater cuts to federal spending, which then reduces the services most needed by the not-rich.

What does a cholera outbreak in Mexico have to do with the US government shutdown? Plenty. The Centers for Disease Control and Prevention (CDC) in Atlanta, Georgia, would normally monitor the situation to help prevent the disease spreading across the border. But the shutdown has put the agency out of action. Cholera could therefore spread in the US for some time undetected, warns an epidemiology consultancy that is tracking the Mexican outbreak.

9. Because of what Turchin terms “elite overproduction,” the very rich work even harder to widen the gap between them and the not-quite-as-rich, who in turn, work to widen the gap between the middle — and down the line to the destitute.

(Turchin) believes our current experience also reflects something new: technology has brought about the emergence of a complex, networked society, one that, he argues, existing democratic institutions are too simplistic to govern.

In summary, what is the cause of our misery, and how can it be resolved? Turchin seems to feel the cause is population and productivity growth, and it can be resolved if (quote) “citizens evolve decentralised, networked institutions more suited to managing complexity.

I believe the cause is the insatiable desire to widen the income/wealth gap, and can resolve when a powerful and trusted leader, who has compassion for the underclasses (a F.D. Roosevelt? J. Kennedy? L. Johnson?), and understands Monetary Sovereignty, educates the populace and reverses the drive for austerity.

Or, as more people are driven to destitution, there will be a revolution.

Food Stamp Cuts Coming For Everyone — Including Nearly A Million Veterans

October 28th, 2013, Jason SattlerNearly 48 million families will see a cut in their Supplemental Nutritional Assistance Program (SNAP) benefits this Friday, resulting in a reduction of 16 meals a month for a family of three. These cuts to food stamps, as SNAP is more commonly known, are the result of expiring stimulus programs and are likely to be compounded by further cuts in the upcoming federal budget agreement and restrictions being implemented by the states.

This cut will affect all SNAP beneficiaries — children, seniors, people with disabilities — including an estimated 900,000 veterans. More than 80 percent of these Americans are living in poverty.

Are 48 million, angry, hungry families enough to begin the revolution?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

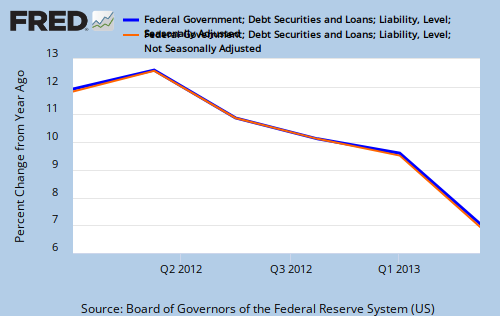

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Right on, thats why when one analyzes the macroeconomy, one must start with the very basics. Ceterus Paribus, productivity increases and population growth are inherently deflationary. Which is essentially the same thing as when Rodger says, a growing economy needs a growing money supply. Unfortunately very few people, and certainly never a mainstreamer, understand this basic fact. Because this is the case, new money must come from somewhere in order to avoid deflation events=depressions. The question should be, which is the better way to grow the money supply, through private sector mechanisms (private debt creation through banks) or by the Govt through deficit spending. This is a real area that needs to be studied, but alas, people just wish away the reality of fiat money creation. People can barely be bothered to even admit that the money supply grows let alone talk about it in a reality based way. Probably because people are uncomfortable talking about creating money when normal people slave away at jobs they generally hate for their entire lives just to gather some accounting entries. Then again. nobody ever said humans were capable of complicated thought and cognition in the aggregate, (RE: 80% of Americans are still religious).

LikeLike

‘The question should be, which is the better way to grow the money supply, through private sector mechanisms (private debt creation through banks) or by the Govt through deficit spending.’

LikeLike

Private money creation is in the form of loans, which must be paid back. Federal money creation never needs to be paid back.

The payback stage of private money creation works against new money creation.

LikeLike

Rodger, pg.18 of the slideshare basically infers the same thing, based on Irving Fisher’s 1936 paper,’100% Money and the Public Debt.’

LikeLike

i don’t see a revolution happening, regardless of how many starving people are out there. and i say that knowing full well that the numbers are increasing.

what i do see happening, unfortunately, is a dramatic increase in random violence, for which the authorities will be unable to come up with a motive.

in fact, it’s already happening now and it’ll just get worse, unless a miracle happens and congress gets a heart and dramatically increases government spending, targeted to the 99%.

LikeLike

you see what i’m saying? just totally out of the blue, without warning… terrifying… all the more terrifying that so many people in this country have guns…

http://gma.yahoo.com/tsa-agent-killed-lax-shooting-suspect-custody-181655831–abc-news-topstories.html?vp=1

LikeLike

Before the shooting, who knows? He may be one of the “good guys,” the NRA wants to guard our schools.

LikeLike

totally out of the blue, again…

http://www.metro.us/newyork/news/local/2013/11/05/gunman-kills-himself-after-opening-fire-in-new-jersey-mall/

LikeLike

Best possible outcome: One less gun nut. The world is a saver place.

LikeLike

Rodger, what do you have in mind when you say ‘revolution’? What form might a revolution take, and where, aimed at what, and involving how many? Curious about your conception. Thanks………

LikeLike

The best case would be for a charismatic leader — a Roosevelt or a Gandhi — to gain power, and use that power to teach the nation Monetary Sovereignty.

The worst case would be for all the armed people in America to begin shooting each other.

I’ll let you decide to which case we are closer.

LikeLike

I’ll take a stab……all the armed people in America begin shooting each other. Gee that was easy since I can read a newspaper.

We aren’t organized or powerful enough to storm the Bastille, so we’ll move toward what Yuu Kim calls “random violence. I feel (s)he is right… that IS what’s happening. We use to call it going postal.

Given our illustrious past, a Ghandi or any other do-gooder will only get either shot in the head or stymied by knucklehead Tea Party types.

The rich wanting to keep the gap wide is not an economic problem; it’s a psychological problem. One of these days the rich will have to ask a Cray supercomputer, objectively programmed with all the relevant variables, “which way is the best way to get richer–give everyone what they need or hold back and widen the gap even more?

Now I’ll let you decide what the Cray super computer will tell them to do and what the clever/cunning rich will decide when the diarrhea is just about to hit the hurricane and some of their own kids/relatives start showing up in the ER or the morgue.

It’s ok until it’s your ox that’s getting gored.

LikeLike