Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Where are the liberals? Where are the economists?

America has two political parties: The right-wing Democrats and the extreme right-wing Tea/Republicans. Who speaks for the left wing?

The National Memo

Block A Grand Bargain With Bold Progressive Solutions To Social Security And Medicare

October 22nd, 2013, Richard KirschIn his post shutdown press conference, President Obama repeated his call for changes in Social Security and Medicare. His 2014 budget included cuts to benefits for both. That aligns him with House Speaker John Boehner, who called for savings in Social Security and Medicare during the shutdown battle.

Senators from both parties have shown their willingness to support benefit cuts as part of a big budget deal.

The purpose of a government is to improve the lives of its people. How does unnecessarily cutting benefits improve the lives of Americans?

Progressives must rely on more than saying “hands off Social Security and Medicare,” although that should remain central to our message. We need a strong offense, to go with that potent defense.

Here are two simple, popular, powerful proposals. On Social Security, make the richest 5 percent of people pay into Social Security on all their earnings, just like 95 percent of workers now do. Use the new revenue to both boost Social Security benefits – which are too low – and extend the solvency of the Social Security Trust fund.

On Medicare, slash the cost of prescription drug prices just like the Veterans Administration and all our global competitors do, saving hundreds of billions of dollars in the next decade.

The U.S. federal government is not like you and me. Being Monetarily Sovereign, the federal government never can run short of dollars.

Even if federal taxes were reduced to $0, the government easily would be able to pay all its bills. That is the fundamental difference between Monetary Sovereignty and monetary non-sovereignty.

This means:

1. Additional tax revenues are not needed to support Social Security

2. Cutting prescription drug prices does not benefit the government, and in fact, reduces the economically stimulative effect of federal payments for drugs.

The Social Security proposal has been introduced in both houses of Congress, which would boost benefits in two ways: changing the way benefits are calculated (designed to particularly help low- and moderate-income seniors) and changing the inflation adjuster Social Security uses to the CPI-E, which more accurately captures what seniors pay.

This is exactly the opposite of the chained CPI proposed by President Obama, which under-counts what seniors typically purchase.

President Obama has been bribed by the rich (via campaign contributions and promises of lucrative employment later – plus that Obama Presidential Library) to widen the gap between the rich and the rest. He rewarded Penny Pritzker, and she will reward him. (Call it “the Bill Clinton, get rich after leaving office syndrome.”)

The legislation raises the money to pay for the benefits and extends the Trust Fund by gradually removing the cap on earnings taxed by Social Security, which is $113,700 in 2013. Doing so would extend the period during which the Trust Fund has enough money to pay all benefits from 2033 to 2049.

By using the phrase, “Raises the money to pay for,” the author demonstrates ignorance about the difference between Monetary Sovereignty and monetary non-sovereignty. A Monetarily Sovereign government does not need to “raise money to pay for” anything. It creates money ad hoc.

Progressives have long talked about Medicare using its enormous purchasing power to get the same kind of low drug prices paid by the Veterans Administration or every other country on the globe.

There are two bills in Congress that aim to do this. While neither is designed to get the maximum savings – a combination of the approaches taken in each is needed – either would work to make the point that we can strengthen Medicare by stopping the drug companies from ripping off the country.

Again, a demonstration of ignorance about the difference between Monetary Sovereignty and monetary non-sovereignty. Paying drug companies stimulates the U.S. and world economies.

Instead of making painful cuts to Social Security and Medicare, we can boost benefits for seniors and make sure that the programs are there for the long term by having millionaires pay into Social Security like everyone else and stopping drug companies from ripping off Americans.

Or far better yet, have the federal government pay for Social Security and for Medicare, while collecting no FICA at all.

The politicians and most economists have been bribed to remain ignorant (call it “the Sgt. Schultz syndrome”). But and all it takes is for liberals to understand, and a few brave economists to state, the differences between Monetary Sovereignty and monetary non-sovereignty.

Is that so hard?

[Richard Kirsch is a Senior Fellow at the Roosevelt Institute, a Senior Adviser to USAction, and the author of Fighting for Our Health. He was National Campaign Manager of Health Care for America Now during the legislative battle to pass reform. The Roosevelt Institute is a non-profit organization devoted to carrying forward the legacy and values of Franklin and Eleanor Roosevelt.]

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

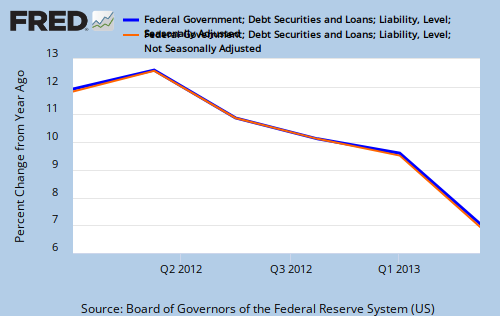

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Hold on a minute,

If Obama works for the ubber rich, and the rich want to increase the gap, and sovereigns are not like people and can issue new currency at will, and this new currency is stimulative to the economy – Than why would the rich want to stop that? Wouldn’t the rich benefit more than the poor from a growing economy?

Wouldn’t a growing economy creates additional wealth (capital, assets, etc), things that makes the rich richer.

LikeLike

Good question.

The vast majority of federal spending benefits the not-rich more than the rich. Think of everything the government spends money for — Social Security, Medicare, road building, the military salaries, military supplies, food stamps, and on and on and on.

For the rich, the gap is what counts. If there were no gap, no one would be rich. The gap is what makes them rich, and the wider the gap the richer they are.

Give this question some thought: If you wanted to widen the gap, how would you do it?

LikeLike

Good question.

I see your point.. What confuses me though is, why do people seem poorer today than they were 10 years ago, and poorer 10 years ago than 20 years ago, and poorer 20 years ago than 30 years ago, and poorer 30 years ago than 40 years ago. And 40 years ago there were little if any of these programs in existence. Perhaps I just don’t comprehend.

But what if these programs are not designed to help the poor. What if these programs are nothing more than a way to extract purchasing power from the same poor and middle income people they are supposed to help and funnel it to the wealthy?

In terms of wealthy you have 2 classes. One uses their power to steal from others, the other builds new wealth/assets to increase the gap between themselves and the rest.

Bill Gates lived with an average middle income family some 50 years ago. Today, he has billions and billions of dollars in the bank and he did it, by doing what I’ve outlined above. He built Microsoft from the ground up (creating tons of wealth), he competed against other wealthy folks, against other technology companies, he hired 100s of thousands of people (if not millions) over the years, made many of them wealthy or well off. At the same time, his company revolutionized the world, computers are where they are today.

On the other side of the spectrum you have industries like medicine and the military, which has persuaded the ones in power to implement laws to essentially create a monopoly of the industry giving them control of prices. This industry has potential to provide much value to society, instead it has focused on sucking it’s blood.

I personally have seen very little in the way of legislation which has led to an improvement in the quality of lives of the population. How could it be that we were better off 40 years ago when there were little or no public programs?

LikeLike

Not sure how you measure “better off.”

Longevity is greater today. Medicine is better. Our cars, electronics, housing all are better today.

On the other hand, the income gap is greater today than it has been for at least 70 years. See: http://research.stlouisfed.org/fredgraph.png?g=nGE

I suspect the lower 99% are in fact, better off, but the upper 1% are way, way better off. The reason: Ongoing concern about the size of the federal deficit, which has kept the deficit far below where it should have been for economic growth.

LikeLike

Roger,

You are back to square 1. Why would the wealthy want to stop economic growth when they are the same ones benefiting from it as per your own words.

“I suspect the lower 99% are in fact, better off, but the upper 1% are way, way better off. The reason: Ongoing concern about the size of the federal deficit, which has kept the deficit far below where it should have been for economic growth.”

The theory that the issuance of new money may be inaccurate and perhaps it does not result in economic growth, however, perhaps it does benefit the wealthy who have first access to both money and credit.

I suspect that this is the reason the wealthy you speak of are not against issuance of money. In fact, the government is printing new money daily and they seem to for it, i.e., the media was clearly against the shutdown which would have in fact forced a reduction in spending. So if the wealthy were for cutting spending, why wouldn’t they just pay the media to say how good cutting spending is and fool the masses into austerity?

LikeLike

One more thing Roger…

The chart posted above shows that the Gini ration started turning higher exactly in 1971. Is that interesting or what….

LikeLike

And 40 years ago there were little if any of these programs in existence. Perhaps I just don’t comprehend.

. How could it be that we were better off 40 years ago when there were little or no public programs?

It is true that in many ways the average person is worse off than 40 years ago. But you don’t comprehend why. You get things exactly backwards, because the history you outline is fiction. ALL of those programs existed 40 years ago. What happened is that the decision was made to cut, not increase such programs. To revive ancient, irrational economic ideas, exactly when they were deprived of any artificially produced relevance whatsoever.

LikeLike

Calgacus,

I suggest doing a little homework before calling me a liar. This data is available publicly by various US entities. I googled it and found it in a few seconds. Entitlement programs made up 5% of GDP in 1970, today, it makes up around 15%. Can you tell me why the population is poorer now than 40 years ago even though our government is spending 3 times (300%) more. The numbers don’t lie.

http://fivethirtyeight.blogs.nytimes.com/2013/01/16/what-is-driving-growth-in-government-spending/?_r=0

LikeLike

The ratio of entitlement programs to GDP may not be the best measure of poverty, since the benefits awarded in these programs change every year.

Perhaps a better measure can be found at: http://www.census.gov/hhes/www/poverty/data/historical/people.html

Look in table 6.

LikeLike

Fair enough, there has been population growth of 52% from 203 million to 308 (2010 data). But to be more fair, we should also factor the growth in the workforce. The workforce also increased from 65 million to about 110 million which is about double in size (~90% growth). Fed data below:

http://alfred.stlouisfed.org/graph/?chart_type=bar&s_1=1&s%5B1%5D%5Bid%5D=LNS12500000&s%5B1%5D%5Bvintage_date%5D=2013-09-06&s%5B1%5D%5Bline_color%5D=%230000FF&s_2=1&s%5B2%5D%5Bid%5D=LNS12500000&s%5B2%5D%5Bvintage_date%5D=2013-10-22&s%5B2%5D%5Bline_color%5D=%23FF0000&s%5B1%5D%5Brange%5D=Max&s%5B2%5D%5Brange%5D=Max

If you look at the link I previously posted, it is clear that the government is spending much more in entitlement programs (almost 300% more). http://fivethirtyeight.blogs.nytimes.com/2013/01/16/what-is-driving-growth-in-government-spending/?_r=1

I also looked at the gross spending in 1970 and compared to today’s spending per capita. The government is spending 4 times more today than the entire spending in 1970 iust in pensions, health care, education, and welfare. In 1970 the gross spending per capita as 3 thousand and spending in pensions, health care, education and welfare is 14 thousand per capita today. Total spending was $1,600 per capita in 1970 vs $20,000 today. This is mind boggling in my opinion, the population is not 25 times larger.

To sum it all up, there are more jobs today when you factor in population growth, we are spending much more on entitlements, and on a per capita basis we are spending ALOT more.

In my opinion it is perfectly logical that this is the case, and the data will support it no matter how you look at it. The quality of lives of the population doesn’t increase with government spending, that actually decreases it. The quality of lives of the population increases when there are more of the things they consume relative to the population.

LikeLike

Meant to say “10 times larger…” in the above post. Forgot to add, the rate of inflation between 1970 and today is about 500% (that is a large number), but that is still smaller than the 10 times (1000%) growth in overall spending.

The inflation rate may be a shock to many who are used to seeing the Fed figures at 4%. That is the misleading part of rate of interests, when you look at the growth over a long period, the interest compounds. In other words, 4% this year is less than the same 4% next year.

In any case, net spending is still way up by factoring in inflation.

LikeLike

Rodger,

What’s your opinion on Mauldin Economics?

LikeLike

So far as I can tell, he parrots the usual “cut-the-debt” nonsense, and seemingly has no concept of the differences between Monetary Sovereignty and monetary non-sovereignty.

Also, he is a relentless self-promoter, who spends lots of time talking about his book and his family.

Aside from that, he’s fine.

LikeLike

Of course MMTers understand what you are saying, but redistributing money via elimination of the FICA tax cap and expanded benefits would be helpful for the economy in the aggregate as the differing propensities to consume and thus the multiplier effects of said dollar transfers take effect. And it wouldn’t necessarily be bad to cut prescription drug spending if that money was spent on expanded unemployment insurance for example.

Now you and I know that none of this is necessary, but everyone else still thinks its good policy to shrink the deficit, so no matter what their proposals they will hurt the economy (just some proposals less than others because of the aforementioned fiscal multipliers).

A real “compromise” would be Dems trade R’s an elimination of the entire federal corporate tax code for R’s agreeing to suspend FICA completely (until, if ever, its necessary to contain inflation). But of course, thats a Grand Bargain that would be to smart and helpful to the country to actually pass this Congress.

LikeLike

Joseph Huber, Joseph Huber, sovereign money, sovereign money. Though our constitution allows for the creation of all money by the federal government, presently it creates only a small percentage of it. Bank money rules the roost. If the central bank where made an actual part of the federal government, a fourth branch, then a nation is monetarily sovereign. Under present conditions it is not. Everything you say a monetarily sovereign nation can and should provide without the removal of money from the economy is not up for argument. The de facto conditions certainly are.

LikeLike

The scholarly hack speaks, he has the simpleton’s understanding of MMT (or related), he’s just an arrogant pusher of the usual debt free money scheme. Lot’s of scary stuff on his ‘sovereign money’ website, which I’ve heard, read and seen many times before.

Debt based private banking isn’t going AWAY., any time soon…

Huber’s own words from Sept, 2013:

‘…and the notion of sound finances, as is MMT today. Mosler’s original MMT manifesto was titled Soft Currency Economics. Presumably this was not by mistake. As if in a sovereign-money system principles of sound finance could be suspended. I would not want to put myself out for monetary reform, just to see unsound money-printing by the…’

Just more of the usual nonsense from some clown pushing for a pie in the sky, impossible agenda.

Can anyone out there even begin to supply a real, honest scholarly anti-MMT take down, not riddled with inaccuracies? Not so far.

LikeLike