Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

There is one reason for our repeated financial crises. No, it is not the real estate bubble burst, though that contributed, once.

No, it is not our disfunctional Congress. In fact, Congress is functioning exactly as demanded and paid for.

No, it is not the debt limit law, which is a symptom, not a cause.

The single, underlying reason for the debt crisis is summarized in the following article:

The Financial Crisis That Could Bankrupt America & the Millennial Generation

By The Daily TickerIn the year 2050, experts predict more than 80 million Americans will be over the age of 65, or double current levels. In the same timeframe, the number of “working age” Americans – those between 18 and 64 – will rise just 17%.

In other words, the problem we have today of too few workers trying to support too many retirees is going to get much worse.

The demographic realities of America’s aging population threatens to bankrupt the nation, which is already spending 22% of the federal budget on Social Security.

It’s downright calamitous for the youth of America, which is facing the prospect of sharply higher taxes to pay for entitlement programs.

Stan Druckenmiller, a legendary investor and founder of Duquesne Capital Management, (said): “I am not against seniors. What I am against is current seniors stealing from future seniors.”

And there you have it, all the falsities, misunderstandings, lies and myths, with which the populace has been brainwashed, compressed into in one concise article.

The truth is, federal finances are not like your personal finances:

1. The United States, being Monetarily Sovereign, cannot be forced into bankruptcy.

Our government, having created the laws that created the dollar, has the unlimited ability to create more dollars. The only way the U.S. could go bankrupt is for a corrupt Congress and President to pass laws restricting this money creation.

2. Given the government’s unlimited ability to create dollars, federal taxes do not pay for federal spending. Workers do not support retirees. If there was but one worker in all of America (or even zero workers), the federal government could continue to create the dollars to pay every bill, not only for retirees, but for everything the government wishes to support.

3. Spending 22% of the federal budget (or any other percentage) neither is bad nor good. With unlimited spending ability, there should be no concern about the size of any one budget item.

4. There is no need for the youth of America to pay higher taxes. Literally, there is no need for the youth of America to pay any federal taxes at all (though local taxes remain necessary). Federal taxes do not support federal spending.

In fact, federal tax payments are destroyed upon receipt. As soon as your tax dollars are removed from your checking account, they no longer are part of the U.S. money supply. They have disappeared. Government spending created dollars ad hoc.

5. Druckenmiller is clueless about Monetary Sovereignty. When today’s seniors receive Social Security, they do not steal from future seniors. If if FICA were eliminated (as it should be), this would not affect the government’s ability to pay for Social Security, Medicare or anything else.

In short, the very premise of today’s financial crises — the notion that federal finances are like personal finances — is dead wrong, clearly wrong, diametrically wrong.

Austerity, aka deficit reduction, aka “balanced budget,” impacts the middle and the poor far more than it impacts the rich. Austerity widens the gap between the rich and the rest.

So why do the politicians, the media and even the mainstream economists subscribe to such a damaging idea. Why do they insist on crippling America, especially the middle- and lower-income groups, for no good reason?

They have a “good” reason: They have been bribed by the rich, to widen the gap between the rich and the rest.

Being rich requires that there be a gap. If there were no gap, and everyone had the same amount of money as everyone else, no one would be “rich.” The wider the gap, the richer are the rich.

So the rich pay to have the gap widened:

They bribe the President and Congress via campaign contributions and promises of lucrative employment later.

They bribe the media via their ownership of the largest media outlets. Media writers do not bite the hand that feeds them.

They bribe the mainstream economists via contributions to major universities. Gaining and maintaining tenure requires going along with the university leaders, and with being printed in the media that — you guessed it — are owned by the rich.

So with lies being blared in a continuing fire hose of misinformation, the public has been brainwashed into believing the federal deficit should be cut — brainwashed into believing that what hurts them is a good thing.

Visualize this: When the federal government creates and spends money, where does that money go? Into the economy. Federal deficits are surpluses for the economy.

The federal government is Monetarily Sovereign, and has the unlimited ability to create dollars. But, the economy is monetarily non-sovereign, and can run short of dollars.

Why then, do media writers fret about federal deficits, when they really should worry about the economy’s deficits?

Their readers have been brainwashed, and the richest .1% have paid for the soap. Americans believe federal finances are like personal finances, so they wrongly fear the federal deficit and federal debt.

And that is why the U.S. repeatedly has financial crises.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

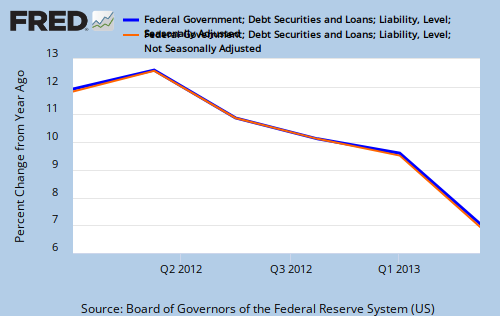

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

How Druckenmiller became a billionaire is beyond me. If we have too few young workers, why can’t they get jobs?

LikeLike

“too few workers trying to support too many retirees”

This is not a problem of money, it is a problem of real production. No matter how much money the retirees have, if there are not the real resources to support them, they cannot buy enough. You have recognized this fact in previous posts.

Fortunately, the analysis is flawed. It is not only retirees that must be supported by workers, it is children as well. And the ratio of (children + retirees) to workers is not monotonically increasing, and will not reach even the levels of the 1960’s, even if MMT is not implemented. Randall Wray has written a paper on this subject.

LikeLike

Mr. Hudson’s “The Bubble and Beyond” should be required reading.

“it is a problem of real production” is explained by Mr. Hudson completely. You are correct!

LikeLike

All well and good. However the fact that banks are permitted to “create money” through the issuance of debt instruments is as responsible as any misunderstanding of monetary sovereignty. The reasons for which have been explained and expounded upon by economists who fully understand M.S. concepts.

LikeLike

More on inequality

LikeLike

There is no need for the youth of America to pay higher taxes. Literally, there is no need for the youth of America to pay any federal taxes at all (though local taxes remain necessary). Federal taxes do not support federal spending.

In fact, federal tax payments are destroyed upon receipt. As soon as your tax dollars are removed from your checking account, they no longer are part of the U.S. money supply. They have disappeared. Government spending created dollars ad hoc.

Curious why the IRS tax receipts are held in various banks until “needed” by the US Treasury? Is this just one big Gov slush fund??? And why does the Fed Gov try to beat small biz down to 4% or less margins on products and or 8% or less gross margins on services?

Seems like a giant demented federal game to keep middle class and the poor struggling compare to the Forbes 400…

LikeLike

not MMT or MS, but you all might enjoy this well-meaning nutcase

Artist Taxi Driver

LikeLike

This is not a recession – its a ROBBERY! Guy seems sane to me!!!!

LikeLike