Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Here is how Quantitative Easing is described and justified by the popular media and mainstream economists — and by Fed Chairman Bernanke.

What exactly is quantitative easing?

Tim Mullaney, USA TODAY, September 18, 2013[Quantitative Easing (QE) is] the technical term for the Federal Reserve’s policy of buying bonds and other assets in order to pump money into the economy.

The most recent strategy, called QE3, had the Fed buying $85 billion of bonds every month.

Does bond buying really pump money into the economy? Imagine your neighbor owns a Treasury bond. You buy it from him. Have you pumped money into the economy?

When your neighbor bought that T-bond, two of his accounts changed: His bank checking account was debited and his T-bond account, at the Federal Reserve Bank (FRB), was credited. A T-bond account is very much like a bank savings account.

In essence, when your neighbor bought that T-bond, all he did was transfer dollars from his checking account to his savings account. Did the amount of money in the economy change? Clearly, not.

Then, when you bought his T-bond, four accounts changed:

1. His checking account was credited

2. Your checking account was debited

3. His T-bond account was debited

4. Your T-bond account was credited.

All four accounts changed by the same amount. Did the amount of money in the economy change? Again, clearly not.

Now visualize that instead of you buying your neighbor’s bond, the Fed buys your neighbor’s bond.

Your neighbor’s checking account is credited and his T-bond (i.e. savings) account is debited — for the same amount. Did the amount of money in the economy change? Again, it did not.

Summary: Contrary to popular myth, promulgated by Bernanke, the media, the politicians and the mainstream economists, QE absolutely, positively does not “pump money into the economy.”

. . . and nurture the recovery.

The irony is that pumping money into the economy is widely known to “nurture the recovery.” Yet, the President, Congress, the popular media and the mainstream economists agree that federal deficit spending, which does pump money into the economy, should be reduced. Huh?

Anyway, because QE does not pump money into the economy, it does not “nurture the recovery.”

But wait. Many of the T-bonds are being bought from banks. Presumably, this provides the banks with more reserves, allowing them to lend more money, which would “nurture the recovery.”

Wrong, for three reasons:

1. As we have seen, the seller of T-bonds merely transfers dollars from one of his accounts to another. No new dollars are created. The (bank) seller does not obtain dollars it didn’t already have.

2. T-bonds themselves function as bank reserves, so the bank gains zero reserves

3. Despite the misleading term “fractional reserve” lending, bank lending is not constrained by reserves, which are available in unlimited amounts from the public, other banks and from the Fed itself. Instead, bank lending is constrained only by bank capital.

Summary: QE does not stimulate bank lending to “nurture the recovery.”

But wait, again. What about interest rates?

The Fed hoped to . . . drive down long-term interest rates so more people would buy and build homes and invest in businesses.

With short-term interest rates already near zero, the central bank’s traditional tool of lowering rates couldn’t be pushed any farther.

Fed bond buying increases the overall demand for T-bonds. Because the price of any commodity is based on supply and demand, Fed bond buying increases the price of T-bonds.

Bond prices and interest rates move inversely. When prices rise, rates fall. QE does indeed reduce long-term interest rates.

But is the reduction in interest rates economically stimulative? Does it cause more people to “buy and build homes and invest in businesses”?

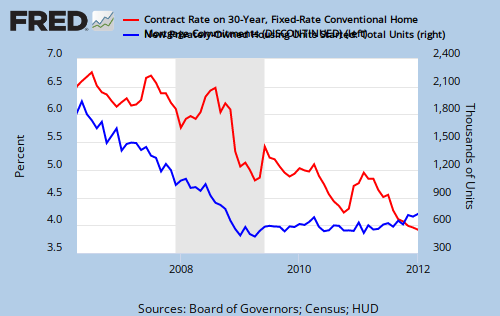

Fifty years ago, when I bought my first house, I paid 5% for a 30-year mortgage. Houses were selling like the proverbial hotcakes. Subsequently, mortgage rates rose — as did house sales:

Later, interest rates were raised in the late 1970’s, to cure inflation. Housing starts did decline, because of the recession. Then, for the next 10 years, while interest rates fell, housing starts rose, then fell.

Overall, and especially from 1991, there has been zero relationship between interest rates and housing starts.

Beginning in 1991, housing starts rose dramatically, while interest rates fell, but not reaching 5% until late in the Great Recession.

For 40 years, 30-year mortgage rates were above 5%, and housing starts were dramatically higher than today. More recently, the Fed has used QE1, QE2 and QE3 to reduce long term mortgage rates, which now stand at about 4% — and currently are rising, while housing starts have leveled off.

Meanwhile, the Fed talks about ending its latest QE, as though it were a powerful weapon against recession, that no longer will be needed.

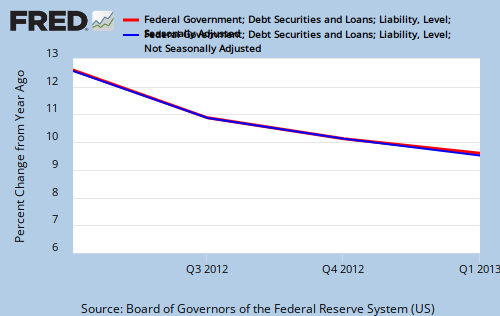

And there is one more problem with QE: It reduces the amount of interest (on T-securities) the federal government pays into the economy.

Rather than adding dollars to the economy, QE reduces the supply of dollars.

The facts: QE is a fraud. It is not a powerful weapon against recession. It is not a weapon at all. If anything, QE has a negative influence on the economy.

Today, economic growth is so slow as to be borderline recession. If QE could stimulate the economy, it would have worked by now and the Fed would use it well into the future, if not, forever.

The Fed’s mere threat to discontinue QE, has caused what seems to be an ironic panic in the stock markets.

Why does the stock market like a process that is anti-stimulative? Why does the Fed engage in this fraud?

(The Fed long has claimed that reduced interest rates are stimulative. If you want to know why that is false, read “Low interest rates — a sneak tax on you.”)

You’ll see that low rates widen the gap, between the rich and the rest. Business profits and the stock market love the cheap, desperate labor gap-widening provides.

Further, low rates do not increase the federal deficit or the federal debt, and they give the appearance the Fed is doing “something” about the economy, by adding a phony $85 billion a month.

1. The people are led to believe the Fed is struggling heroically to stimulate the economy.

2. The wrongly maligned deficit is not affected.

3. And of course, the gap between the rich and the rest is widened.

For the President, the Congress, the media and the mainstream economists, all bought-and-paid-for by the upper 1% income group, it’s the perfect ploy.

QE is, indeed, for dummies.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Good analysis. You did not include the MBS flow in QE3. In that case it could be argued that the public is transferring a risky asset (mortgages) to the Fed and receiving a risk-free asset (Fed credit) in return. There is no net change in money (unless the MBS are marked to market) but there is certainly a change in risk.

John Lounsbury

LikeLike

Under QE, the FRB mostly buys T-bonds. They are the safest security in the world (from the standpoint of capital), In return, the public receives dollars to invest in less-safe, though possibly higher-paying, securities.

LikeLike

RMM,

piedmonthudson is (at least partly) correct: “The Fed has been purchasing $40 billion per month of mortgage bonds and $45 billion per month of Treasury notes…” (http://online.wsj.com/article/SB10001424127887323980604579027232912527394.html)

Also, in response to ‘QE pumping money into the economy’ …

I think the most accurate way to describe it is Debt Monetization (for bonds and securities bought by the Fed from non-banks). The private sector non-banks get checking deposits, and lose their savings deposits. Checking deposits can be used to to purchase cars, groceries, equities, etc. So in a way QE (with non-banks) does pump money into the economy; or more accurately: it exchanges non-spendable money for spendable money.

Now, this doesn’t mean that money will get spend to boost aggregate demand in any meaningful way. It makes more sense to assume it won’t. The reasoning is simple: a non-bank bought a Treasury, or MBS, in the first place as a savings-vehicle that earns a rate of return. The purchaser intended to save that money, not spend that money! Just because the Fed moved that savings from a higher interest earning asset (treasury/MBS) into a lower interest earning asset (checking account), this in no way indicates that the money will be spent to boost aggregate demand. In reality, it probably won’t be precisely for the reason just mentioned: the intent in the first place was to save that money.

What that money might do though is chase after other savings vehicles that earn a higher rate of return than checking accounts, e.g. equities, commodities, etc.

Basically the Fed through QE (with non-banks) is squeezing the supply of one type of financial asset (treasuries) and therefore ‘forcing’ investors into other types of financial assets (commodities, equities, etc.). Musical Chairs. Except things like the price of commodities hit us consumers with higher prices at the grocery store… and so on.

Cheers.

LikeLike

“but not reaching 5% until late in the Great Depression.”

Recession.

LikeLike

Thanks, Steve.

LikeLike

Thanks for putting QE on a basis that everyone can understand. I would add that low rates hurt retirees that live on fixed incomes that cannot afford to invest in the stock market.

LikeLike

JK,

As the owner of a T-security or a mortgage bond, you have the right to sell it or not. The Fed isn’t ripping the security out of your hand. The Fed isn’t making you do anything you wouldn’t do otherwise.

If you want to sell your T-security, you can sell it to the Fed, or to your neighbor or to me. No matter to whom you sell it, your checking account will be credited and your T-security account will be debited.

All the Fed does is take the place of some other buyer. There is no change in the economy.

The sole change is: Because the Fed is an additional buyer, the price of T-securities goes up, which means the interest rate goes down.

LikeLike

RMM,

Yes, each owner has the right to sell the T-Security or Mortgage Bond, and then after sold, draw on that checking account for day to day purchases. But, when a private sector actor is purchasing your T-Security or Mortgage Bond, they lose their checking deposit (spendable money) and then have a savings deposit (i.e. non-spendable money). For every buyer there must be a seller. The big difference with the Fed doing the buying is more of the private sector is ending up with checking deposits – what I call here ‘spendable money’ – than could otherwise be the case if the Fed wasn’t doing QE (with non-banks). I think it’s important to recognize tthis. Yes, through a monetization of debt instruments (treasuries and MBS’s), there is indeed more ‘spendable money’ in the economy at any given moment. This can kind of be seen as ‘pumping money into the economy’. But it’s misleading for the reasons I mentioned in my first comment, specifically, that ~just because you move my savings from a financial asset that earns more interest (treasury/MBS) into a financial asset that earns less interest (checking account), that doesn’t make me more wealthy and therefore doesn’t make me more likely to go out and spend.

Said another way: people’s propensity to consume is mostly based on their income and net wealth, not their portfolio balance of what their net wealth happens to be.

Also, as you noted, QE actually makes those savers less wealthy since interest being paid by the Monetary Sovereign has decreased. I.E. income has decreased -> and propensity to consume is largely determined by income.

LikeLike

I’m actually reading this after my post. The first piece of this post says the Fed does not add to the money supply, the second piece says it does.

The Fed is a buyer that creates credit out of thin air and creates artificial demand. As I said below, with the amount of purchasing power that the regular Joe has lost – is keeping prices artificially high the solution?

There are always consequences to one’s actions.

LikeLike

Bapoy,

Yes, the Fed does create credit out of thin air. But so do banks when the y issue new loans. And check this out… if I get you to mow my lawn and issue you a written or verbal IOU, essentially I’ve created credit out of thin air too! Without paying you any cash, didn’t I just increase aggregate demand by issuing credit in the form of my own IOU to you?

Ok Ok Ok, technically it’s not aggregate demand because you mowing my lawn doesn’t count toward GDP.

But if you peel the onion back a layer and not worry about that for a moment… it becomes pretty clear that what drives Demand – “production” – is credit of some form or another.

LikeLike

The bond that the FRB purchased now goes back into the “thin air” that the newly created reserve credits came from… so to RMM point, no net difference.

LikeLike

ermayer,

Yes, RMM is correct that no new net difference in financial assets has occurred. I was making the point that through QE with non-banks, althought there is not a net difference in financial assets in the economy, there is indeed more “spendable money” at any given moment. But again, that doesn’t mean QE should increase aggregate demand.

LikeLike

JK,

You are confusing apples and oranges. The IOU you gave me for mowing your lawn not only does not count towards GDP, that agreement will not be lent times over. I mow your lawn today, you give me a document stating you owe me 20 bucks. In a week you pay me 20 bucks. This is a 100% reserve transaction, 20 dollars worth of labor for 20 dollars of tomorrow’s dollars.

What the banks and the Fed create is not only used by the immediate borrower, it is re-lent, and re-lent and re-lent times over. That’s why is a fractional reserve system. Essentially, they take 20 bucks and lend it times over. That process adds currency to the money supply thereby stealing purchasing power from the population by cheapening existing currency.

Mish put out some awesome charts today which show the net impact of this process. Real incomes are actually flat since 1968 and negative starting in 2000. I’ve argued this before, the measure of nominal GDP is useless to the regular Joe. In nominal terms, yes the GDP is growing, but in real terms it is not going anywhere. Real incomes are what matter.

So Mr Mitchell – keeping in mind that you yourself said that the Fed creates additional demand for treasuries to lower rates and increase its prices, if nominal GDP does not help the regular Joe – how does that change your view in terms of solutions – given that more currency/money will increase prices?

FYI – MMTers will ignore this because their argument falls flat on its face with this fact. Indeed, more money does not improve the economy, more real output does.

LikeLike

You can’t get more real output without somebody spending some money. There’s no reason to make anything if there are no customers with money in their pocket.

It’s not more money that MMT is suggesting. It is more money *in circulation*.

Oil in the sump is of no use to the engine. Even if there is plenty there the engine can seize-up. You need a pump that makes sure there is always the correct amount of oil circulating at the correct pressure.

I’d work on your understanding of how banks work. Fractional reserve is a myth. Banks create money with a debit and a credit. The credit then wanders around the economy until somebody saves it, or it returns to the owner of the debt and extinguishes it.

That borrowing expands the economy – in precisely the same way as the government expands the economy when it spends. And by the same process.

The problem is that the system allows saving in excess of investment demand. It is not automatically eliminated by any market process. And that spare money ends up back at the central bank. The government then has to kick it back around the circuit – just like the oil pump.

LikeLike

Bapoy,

I suggest you expand your understanding of the world to outsie the Austrian perspective.

1) I never said my abilisty to create credit is as powerful as a banks. What I said is getting stuff done is driven by some form of credit or another. As Minsky said; “everyone can create money; the problem is to get it accepted” … No doubt about it -> the State-backed banking system has much more power to get their credit accepted than I do.

2) Fractional Reserve Banking is a myth. Banks are not Reserve-constrained. They do not ‘multiply’ their deposits. Loans create Deposits, and in the aggregate… there is no limit. Hence, Lender of Last Resort. The Fed only slightly affects the money supply by setting the Fed Fund Rate as a cost of borrowing for banks. But the money supply is determined endogenously by the non-bank private sector’s demand for credit and the private banking sector’s willinging willingness to extend it.

3) “Real incomes are flat since 1968′ … that’s a distributional issue. If real income are flat it’s because a small percentage of the population – the so-called 1% – have realized all the productivity gains at the expense of the majority of people. Real standards of living are absoutely NOT flat since 1968 though. I invite you to give up access to the internet if you disagree.

4) More currency/money does affect output/production. Neoclassical and Austrians live in a fantasty-land on this point. It’s amazing really, an astounding ability to disconnect from reality and live in their imaginary theoretical construct. Now, an ever increasing money supply does have an inflationary bias, but that’s ok so long as it’s low and steady. It’s stimulative! Yes, more output does improve the economy, which can be stimulated by more money. Go ask any business owner what they want more than anything. Cha-ching! They want to hear the proverbial cash register sing. Demand drives a monetary economy. Say’s Law is more appropriate for a barter economy.

LikeLike

The no-taper decision is sending stocks to all-time highs.

LikeLike

I think this depends on whether you see the roll of credit. If you think that printing hard cash is the real “printing”, I suggest you are missing the boat on what has been happening.

First, credit is not necessarily removed by the Fed – in fact – in 2008, the system itself was purging trillions worth of credit without anyone’s help. Although the supply of actual cash has more than doubled to about 2.5 trillion, the collapse in the credit markets dwarfed that 2.5 trillion. This is the reason why prices appear to have remained “stable”. When you consider the amount of purchasing power the middle class has lost, prices should have dropped – not remained stable.

With that said and as I see the roll of credit, the Federal Reserve is indeed printing. It’s NOT printing cash, it’s issuing debt/credit in return for a piece of paper called T-Bond. So there is no debiting of your neighbor’s Treasury account and there is no debiting of the government’s Treasury account either. There is:

– A debit to the Fed’s account (this comes out of no-where)

– A credit to the Treasury

– The piece of paper called bond (title or stock) moves from the Treasury to the Fed (this is electronic now days).

– That’s the end of the transaction until the Treasury pays the Fed years down the line.

The same process happens for mortgage and other securities, including stocks. In my opinion, the purpose of this exercise is not to “pump” money into the economy, it’s to maintain a bid on these selected assets. That’s all.

By maintaining a bid on these assets, the Fed is attempting to drive down rates and attempting to maintain “demand”, thereby keeping the prices of those assets at inflated levels. I am not sure if you view high prices as not pumping money into the economy, but that’s precisely what the Fed is doing, and to me, this is printing. It is mind boggling to know that the whole exercise is built on such stupid reasoning, but, someone thought this is the best solution and there it is. A few idiotic people would prefer to see their houses worth 1 million (even if they will never cash it in) as opposed to it’s real market value. The real economy grows because people make it grow, not because a government bureaucrat wants it to grow. If you prefer the GDP measure of “growth”, perhaps we should ask the Fed to debit it’s account for 100 trillion for one government bond. That will for sure grow our economy out of this (NOT).

I hope you can see the issue with this as the regular Joe has lost a large piece of his purchasing power. What regular Joe needs is lower prices, not a “free” check.

LikeLike

Roger, I just made a similar point on Scott Sumner’s blog. As you doubtless know, Scott thinks QE is the the most amazingly potent way of bringing stimulus since the World began. Perhaps you could help disabuse him. See:

http://www.themoneyillusion.com/?p=23761

LikeLike

Rodger,

Shouldn’t Keynesians support high interest rates in response to a recession, because they increase the federal budget deficit? The economy boomed so much in 1983 and 1984 that Reagan won reelection by a landslide.

LikeLike

Right.

MMT subscribes to the popular belief that low rates make borrowing less expensive for business, thereby decreasing business profits.

MMT does not seem to take into account the fact that high interest rates cause the federal government to pay more interest into the economy.

Also, high rates do not really cut into business profits. A couple points difference in borrowing rates constitute a minuscule portion of business expenses, which businesses overcome by a minuscule raising of prices.

History shows that, if anything, higher rates are stimulative.

LikeLike

RMM,

I don’t think it’s accurate to say “MMT does not seem to take into account the fact that high interest rates cause the federal government to pay more interest into the economy.”

I’ve often heard the primary MMTers make this point, especially Mosler.

This doesn’t mean they prescribe high interest rates (MMTers are mostly Fiscalists after all), but they are definitely aware of the lost income from lower rates.

LikeLike

That’s just flat wrong.

MMT people, particularly Warren, are always going on about how QE takes interest income out of the economy and therefore is deflationary.

The difference is one of approach – in that the policy prescriptions suggest that there are better channels to inject government money than interest. Reducing taxes for one.

Primarily because people are going to save anyway – so they need no reward. Particularly foreign investors in your country’s government assets.

LikeLike

Yes, there are better channels to inject government money than interest. Unfortunately, the House of Representatives is controlled by the Republican Party.

The only fiscal stimulus bill that could make it through the House is a tax cut. Unfortunately, President Obama does not appear to want to cut taxes again.

LikeLike

NeilW,

Do you disagree with anything I said in these comments?

LikeLike

JK and NeilW

I suggest you look through Warren Mosler’s The Natural Rate of Interest is Zero.

Not only does Warren say that zero is the “natural” rate, but he says it is the “preferred” rate. Currently we are at both the natural and preferred rate.

Not good.

For me, the “preferred” fed funds rate would be in the neighborhood of 3%-4%.

LikeLike

RMM,

You need to differentiate between what MMTers take into account and what they prescribe. Just because 0 is the natural rate (wouldn’t be higher if the Fed didn’t pull Reserves out of the banking system), and just because 0 is a preferred policy… does not mean ““MMT does not seem to take into account the fact that high interest rates cause the federal government to pay more interest into the economy.”

LikeLike

Rodger-

I love your insight and posts very much, however, MMTers are more aware of the interest income channel than any other school of economics. As neil pointed out above, the regularly say the opposite of what you wrote in the original comment.

Now, if you want to talk about the pros and cons of various interest rates, thats very different than saying MMTers believe in a false popular myth. And Warren and Matt are right, without T-bond issuance, the natural rate of interest is zero, as reserves would increase forever. Thats a direct response to the neoliberal myth that deficit spending by the Govt drives up interest rates over the long term due to the loanable funds model.

But advocacy and explanation are two different things in this case. Warren simply advocate for a permanent ZIRP policy as a means of signalling to the public that the neoliberal myth is wrong, and that its a subsidy that its unnecessary. That deficit spending is better offgoing to other places through other channels, let the market determine its own prime rate. At least thats my interpretation.

LikeLike

I appreciate that RMM, but that’s because you believe you can encouraging people to essentially tax themselves sufficiently via increased savings to avoid a demand-pull inflation blow out.

The rest of us are less sure of that mechanism – both in terms of whether you can control it tightly enough during a boom and whether it encourages too much concentration of power, in the form of money stock, in just a few hands.

And as I pointed out, it makes little sense to pay foreigners to hold your government scrips. They will do that anyway because they are desperate to export to you.

So the difference is in the mechanism by which the injection into the economy takes place and the most appropriate people to receive it initially.

And that largely boils down to a normative argument – because we just haven’t tried to do it yet.

LikeLike

JK,

“Preferred.” “Natural.” “Takes into account.” “Prescribes.” “Supports.” “Subscribes to.”

Too much subtle semantics for me.

You’re saying MMT wants . . . what?

LikeLike

” . . . a permanent ZIRP policy as a means of signalling to the public . . . ”

Re. “signalling,” there’s an old joke that goes something like this:

Jesus complained to Moses: “My people are unruly, misbehaved and not seeming to understand my parables.”

Moses: “So stop talking in parables.”

So far the signal of a recession that won’t quite, doesn’t seem to be understood.

LikeLike

thats pretty much a non-sequitur response. Its not like we’re going to stop reading your work if you simply admit that the comment could have been written more accurately

LikeLike

O.K., my “sequitur” response is: The zero interest rate reduces economic growth. I won’t argue about whether MMT agrees.

If ever you’re arguing the question, you might ask what would be the economic result of negative interest rates, where no lenders could be found and one had to pay interest to own T-securities.

Perhaps that would clarify things.

LikeLike