Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

This will be quick.

God is in his heaven and all is well with the world:

Larry Summers Withdraws Name From Fed Consideration

Julie Pace & Martin Crutsinger, September 15, 2013Summers’ withdrawal followed growing resistance from critics, including some members of the Senate committee that would need to back his nomination.

Even the politicians and Barack Obama couldn’t handle the heat from sheer truth: Larry would have been the worst choice imaginable (along with his pals, Moe and Curly.)

Summers’s “withdrawal” is a Godsend that probably went something like this:

(Obama: “Larry, appointing you would be too stupid even for me, so you’ll have to, ahem, ‘withdraw.'”)

(Summers: “Gee, do I have to? If you make me quit, I won’t contribute to your Obama Presidential Library.”)

(Obama: “I don’t care, now that I have Penny Pritzker.”)

(Summers: “Well, O.K., but please don’t appoint a women. As you know, women aren’t capable.”)

This leaves us with the question of whom to appoint. I’ve seen a couple mentions of Warren Mosler’s name as a candidate for Fed Chairman — not exactly a groundswell, but at least a handful of people are thinking correctly.

Warren would be terrific, and the country would benefit greatly. I suggest that you contact your politicians and everyone you know, and tell them to contact their politicians and everyone they know — TODAY — and suggest, no, DEMAND, that Warren Mosler be our next Fed Chairman.

At long last, install sanity in the Federal Reserve and Congress and the White House.

If you want to know more about Warren Mosler’s thinking, check out: http://moslereconomics.com/

Hey, is http://www.MoslerforFedChairman.com available?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

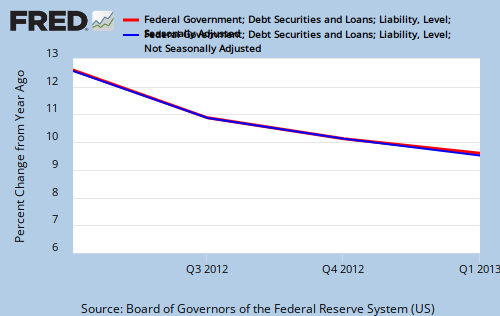

THE RECESSION CLOCK

As the lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Rodger,

I don’t know. Did you buy it?

Joe

LikeLike

No. He should.

LikeLike

Rodg,

Could do worse – certainly Summers was, and lI believe Yellin also.

But what would you expect from Warren at Fed beyond his four proposals for Fed reform from his site (may need to drop the (/) to make the link work).

All of his Fed reforms seem to favor the banker class and do zero for the public.

Insuring Treasuries, Lending unsecured to Member banks, Empowering banks further in monetary policy operations – what do you think The Restofus are gonna gain from a Mosler Fed?

Sure, permanent ZIRP is an easy call, but both the Bernank and the Ms. Yellin are hunkered right alongside that policy.

Making things better for the banks right now is the antithesis of our needed reforms, looking like another plain vanilla trickle-down prosperity policy.

Rodg, myself and Dr. Joseph Huber of sovereignmoney.eu are in Chicago later this week for the American Monetary Institute annual conference. Let me know if you’d like to have coffee.

Thanks.

LikeLike

Thanks. Corrected the link.

I’d expect Warren to do one thing: Explain to the world the practical differences between Monetary Sovereignty and monetary non-sovereignty.

That would be a giant step for worldwide economic progress.

Sure, I’d still argue with him about the “need” for JG, ZIRP, federal taxes, etc, but once the public understands MS, the rest can be argued intelligently.

Thanks for the invitation, but can’t make it.

LikeLike

Joe,

I’m pretty sure when u take a close look at ALL of Mosler’s proposals, such as this short version:

Warren Mosler’s proposals for the 99% | Mecpoc –

http://www.mecpoc.org/2011/11/warren-moslers-proposals-for-the-99/

you’ll find that Mosler is FAR more egalitarian than his proposals may appear at first glance, as they wrapped inside the context and paradigm of banker/finance-speak.

I mostly understand (weakly) the reasons for proposals such as “Lending unsecured to Member banks, Empowering banks further in monetary policy operations” when combined with FIRM restrictions on banks to do “Narrow Banking” i.e. engage in providing commercial and consumer credit, not gambling, not even “regulated gambling” with their capital base and customer deposits.

For example, it’s not necessary and doesn’t benefit the govt — nor the general non-bank private sector — for banks to do “secured” borrowing from the Fed, since the Fed is the ultimate backstop anyhow, and MUST step in to make sure ordinary commercial banking and lending clears.

But it DOES benefit the non-bank private sector to FORBID bank CEOs from being allowed to run ridiculous reckless Ponzi finance schemes, and then the Govt be in a position where a massive bailout is necessary, after the CEOs have walked with all the short-term Ponzi profits (as Bill Black has explained over and over), which is a lot like if the Govt stepped in to save a major urban hospital whose finances were mismanaged, instead of letting the hospital close and all the doctors and staff to go unemployed, and patients die.

Or in Warren’s quixotic commentary, the “liability side of banking — deposits, customer assets — is not the place to impose market discipline” i.e. by not bailing out collapsed banks after the fact. That is, the proper place to impose discipline on banks is the ASSET side — which is lending and taking on ridiculous levels of RISK, and in which loans which are guaranteed to go bad in the long-term amounts to infinite Risk.

More could be added, but “capiche?”

LikeLike

Gary, thanks.

I actually believe that Warren is stuck between his heart – his natural egalitarian self, and his head – a learned desire to not rock the boat of his cronies in fixed-income finance – which explains the ‘finance-speak’ wrapping.

But that’s another story.

The ‘Narrow, or Limited-purpose, banking’ proposal is a welcome notion, but here it lacks the systemic changes needed to make it work, as advanced by the likes of Kotlikoff and others – for full-reserve banking. If you want to reduce the risk of the bankers taking down the economy – for the simple reason that it is where we all live and work, then FORBID them from creating that asset side of their balance sheets, and rather force them to on-lend real money that depositors have lent to the bankers, rather than by continuing to allow the banks to create the asset side out of the ‘paper-issuance’ privilege now in play.

At that point, the bank CEO’s become financial intermediaries rather than empire builders, and the need to prevent Ponzi-finance is institutionalized, as is the enduring benefit to the non-bank private sector. The need for public deposit guarantees can quickly evaporate under such a regime. Banks that take excessive risk will FAIL. Even Minsky finally embraced this notion late in his career. Here: http://www.levyinstitute.org/pubs/wp127.pdf

“Financial Instability and the Decline(?) of Banking : Public Policy Implications” October 1994

I’d like to believe that Warren’s penchant for intellectual banter will bring him around to a position where his head allows him to pursue his heart-felt matters, and allow the inventors’ chips fall where they may. In reversing Warren’s comment to me I explained, we need HIM on our side.

Thanks.

LikeLike

Yes, bring on Mosler or even Yellen. Yellen is also known for being a dove. Both her and Mosler will bring the destruction of the dollar a step closer.

As I said a while back Mr Mitchell, keep an eye on the land of the rising sun for a sneak peak.

LikeLike

If Japan is the land of the rising sun, how would you characterize the euro nations, the world’s prime proponents of austerity?

The lands of the setting sun?

On balance, I’ll take Japan.

LikeLike

You mean Japan where the unemployment rate is usually 5.5% or less – right now around 4%? It is a pretty nice little place to live by any measure if you ask me. Good food too.

Warren would be excellent as Fed chair, because he could educate the clowns in congress on how our current fiat system works. Something past fed chairs have not done.

LikeLike

How about Frank Newman? He gets MS/MMT/MR or at least his own version of it. He has experience at the Treasury.

Warren is too far out of the beltway establishment.

LikeLike

Wikipedia: In 1993, President of the United States Bill Clinton nominated Newman to be Under Secretary of the Treasury for Domestic Finance.[1] The next year, he became United States Deputy Secretary of the Treasury, holding that office until 1995.

Clinton ran a surplus that caused the recession at the start of the Bush Presidency. Hmmm . . .

LikeLike

You’re assuming Newman had control of all the fiscal policy for the entire economy. As Deputy Secretary of the Treasury he certainly could not define tax policy or make spending decisions. That was Slick Willy and Congress.

Have you read his book “6 Myths that Hold America Back”? It’s pretty much the same as someone else’s book we know who happens to have “7 Deadly Innocent Frauds.”

LikeLike

Sorry, in reality he is a career banker chief executive who advanced many of the notions and practices that caused the crash.

He did two years on the other side of the door at Treasury.

Doing what?

His advocacy for increasing the public debt is clearly driven to produce additional ‘financial assets’ to be held by the investors.

Government guaranteed interest payments.

In perpetuity, I understand.

I thought the government was the monopoly issuer of the currency here.

LikeLike

Rodger, I’d nominate you for Fed. Chair! So, how would you begin your 3-yr term’s 1st year? And, what fiscal/monetary policies would you seek to seed/change in yr. 2? Then, what evident differences might we begin to see by yr. 3? Of course, should you be Greenspan-esque or better – I’d wager – you’d have 4 more years ‘at the mast’. …………….

LikeLike

Dan, as President, I’d adopt the “Nine Steps to Prosperity” shown at the bottom of each post.

But, since you want me to be “only” the Fed chair, I’d limit myself to three tasks:

1. I repeatedly would tell the world the realities of Monetary Sovereignty.

2. I would control inflation to about 2% annually, using interest rate control.

3. I’d try to sell Congress and the President on eliminating private banking, and replacing it with federally-owned banks. (https://mythfighter.com/2012/07/16/the-end-of-private-banking-part-ii/)

I would NOT try to stimulate the economy, as that is the job of Congress and the President.

LikeLike

Rodg,

If in your No. 1 you explained that monetary sovereignty empowers the government to directly create and issue all of the nation’s money without debt, then your number two would not be necessary because a monetarily sovereign and autonomous government can control the quantity of money via issuance and therefore has no need to control the cost of money through interest rates.

And therefore, being sovereign in money means that the government has nationalized the money system and has no need whatsoever for nationalizing the private banking system that lends its own capital.

That’s what monetary sovereignty is all about.

The money power.

Thanks.

LikeLike

Not ALL of the nation’s money. Actually, it’s about 20% of the nation’s money. Banks create the vast majority of dollars, by lending.

As for why banks should be federally owned, check out the link.

Also, create money “without debt” can be misleading, since all money is a form of debt. But, you probably mean, without issuing T-securities. That is true. T-securities are not necessary.

LikeLike

Rodger, thanks.

Reconstructing ………

Are you saying that the monetarily sovereign government only has the power to create twenty-percent of the money?

Because, if not, then why would the monetarily sovereign government allow a private banker with no public allegiance, the privilege of creating the eighty-percent of the government’s money supply as a debt, payable with interest, forever.

You see, Rodg? It just doesn’t make sense.

It is the money power that directs all economic outcomes and we decry these results as if the money power were either unimportant, or a necessarily private construction.

If you want to change the outcomes of the private debt-based money system, then you need a new money system – one that works from the strength it receives by being monetarily sovereign, through public money issuance.

All of it. Right out front. In the government budget.

If you’re not with the 20 Percent Sovereign school of money, and if you have learned and teach that all money ‘must be debt’, then please explain the debt-free Greenback issuance, which debt-free issuance is made many orders easier under our modern digital money scheme.

T-securities become part of our archaic monetary past once we restore monetary sovereignty and autonomy to the national system of money. Monetary sovereignty, Rodg, in its essence, means that it is OUR money system.

If we want new outcomes, then we need to take it back.

Thanks.

LikeLike

Sense or not, the government creates about 20% of the total money stock, and lending (mostly by banks) creates the rest.

Money is measured in many ways: M0, M1, M2, M3, L.

M0 is cash. Cash is a debt of the U.S government, which owes the holder full faith and credit. Dollar bills are federal reserve notes. “Bill” and “note” are words signifying debt.

M1 is M0+, checking accounts and travelers checks. All are debts.

M2 is M1 + other bank deposits and money market accounts. They too are debts.

M3 is M2 + large time deposits, institutional money market funds and U.S. dollar deposits in foreign banks. They too are forms of debt.

Check this graph: http://research.stlouisfed.org/fredgraph.png?g=muM

The blue line is M3 (which isn’t even the largest measure of the money supply). The red line is federal debt. As of 2006, federal debt was about 45% of M3..

All money, even greenbacks, is a form of debt. The collateral for all money is the full faith and credit of an issuer. See: https://mythfighter.com/2010/02/23/understanding-federal-debt/

The federal government owes the holder of a dollar, full faith and credit. That is what gives the dollar its value.

The greenback is a note. See: http://upload.wikimedia.org/wikipedia/commons/thumb/4/47/Greenback_1_dollar.jpg/800px-Greenback_1_dollar.jpg.

A note is a word signifying a debt.

LikeLike

If anyone still believes Barack Obama has not been bribed by the rich to screw the rest, read this: The People Win as Lawrence Summers Trades Power For Wealth

LikeLike