Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Cynthia Tucker, winner of the 2007 Pulitzer Prize for commentary and a visiting professor at the University of Georgia, wrote a blog post from which we’ll quote a few passages:

Last month, the GOP-dominated House passed an agriculture bill that omitted funding for the food stamp program — partly because the Republican caucus disagreed over whether cuts to the program should be merely harsh or extremely severe.

Not so long ago, hardliners sought to cloak this sort of cruelty in the language of the greater good: the need to reduce government spending. But last month’s bill didn’t even attempt that pretense: It included billions in agricultural subsidies for wealthy farming interests, including some Republican members of Congress.

Of course, the “need” to reduce government spending is in itself a lie that is cloaked. There is absolutely no such need.

In fact, reductions in government spending lead to recessions and depressions, while increases in government spending lead to recoveries. The reason is straightforward: Mathematically: Gross Domestic Product = Federal Spending + Non-federal Spending + Net Exports.

Basic algebra shows that reduced federal spending growth must result in reduced GDP growth. No economic mechanism exists whereby spending decreases can increase economic growth.

Spending decreases increase the gap between the rich and the rest — which is why those politicians most bribed by the rich are most in favor of reductions in federal deficit spending.

Further, no one pays for federal deficit spending — neither taxpayers, nor taxpayers’ children nor grandchildren. Not now. Not in the future. No one pays anything. That’s the way it works in a Monetarily Sovereign government.

So why does the middle class resent cost-free federal spending for food stamps, unemployment compensation and other forms of welfare?

About 20 percent of [Atlanta Food Bank] beneficiaries report that this is the first time they’ve ever asked for assistance from government or charitable programs. Among them are people who once belonged to the secure middle class; some were formerly donors or volunteers at the food bank.

Bill Bolling, founder and executive director of the Atlanta Community Food Bank, said, “They’re keeping their part of the social contract. They are getting up every day and going to a job, maybe two jobs. If a man gets up and goes to work every day, I don’t care what his job is, he ought to be able to feed his family.”

And a government, having the unlimited ability to create money, ought to help its citizens feed their families. But, of course, that is not want the rich want. Destitution and desperation help build a large servant class for the rich.

Conservative critics speak contemptuously of those struggling to make ends meet, to describe a lazy “47 percent” who want nothing but handouts, to dismiss those who can’t make ends meet as responsible for their own hard luck.

Some of that hostility toward struggling Americans can be explained by a racial antagonism that presumes that most of them are black or brown.

That’s the “food stamp mama” image implanted in the public’s mind, by the rich-owned media — a false image as it turns out.

Programs like food stamps are understood by whites to largely benefit shiftless black people.

[But] the Great Recession laid waste to the finances of many white families, too. They (whites) account for about 35.5 percent of food stamp recipients. Black Americans are disproportionately represented, but account for only about 23 percent. Latinos account for about 10 percent of recipients

The motivation of the rich to bully the middle and lower classes is clear: To widen the income/wealth/power gap. But why is the middle class so ready to join in the bullying?

And that is the key word: “Bullying.” Children do it. When a weak child is bullied by a strong child, many others will join in. Why?

Not being a professional psychologist, I can only guess that the motive is self-protection. A child may feel the need to distance himself from the weak and to align himself with the strong. If he can join in kicking the weak, he himself will not be kicked, and he even may gain approval from the strong.

So we have the spectacle of middle- and even lower-income people sneering at those receiving food stamps, unemployment payments or other poverty-associated benefits, when they themselves soon may need such benefits. It’s illogical, but instinctive, and instinct beats logic every time.

Instinct allows the so-called “religious” right to turn people against themselves. The populace actively wants to believe those right-wing lies that the poor are worthless, good-for-nothings, who would rather wallow in poverty and feed from the government trough, than work to earn an income.

This belief supplies the weak with a justification for bullying the weaker.

I know such people. A couple are even in my own family. I’ve found that no facts, no statistics, no logical proofs will sway them. They simply know in their hearts that the poor must be treated with a firm, ruthless hand to “teach them a lesson” and to keep them from “beating the system.”

Thus as the rich watch laughing, the middle-class does their dirty work, an effort that always turns back against the middle.

The middle class is finding that what goes around, comes around. Will the lesson never be learned?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

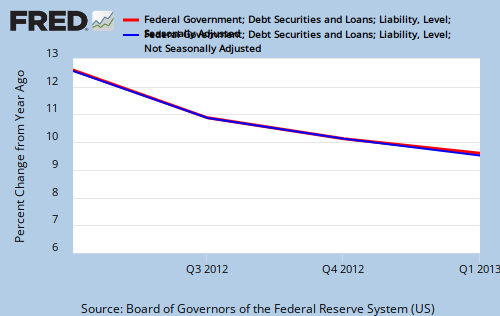

THE RECESSION CLOCK

As the lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Here is the response to the most recent NBC News/Wall Street Journal Survey. “Do you think Congress should or should not raise the debt ceiling?” Question 16, page 19.

Click to access 13340_sept_poll_economy.pdf

LikeLike

Thanks. Sad, isn’t it.

Of course the phrasing of the questions skewed the results somewhat:

The federal debt ceiling does NOT act as a check and limit on the country’s overall liabilities. It acts as a check on the country’s willingness to pay for already committed liabilities.

It’s like saying that refusing to pay your credit card bill acts as a check and limit on your liabilities. Not quite.

LikeLike

Are there other countries that are monetary sovereign that have NO debt ceiling? And are being managed properly?

LikeLike

Many nations are Monetarily Sovereign: China, Canada, Australia, the UK, Japan, just to name a few. I know of no other nations that have a formal debt ceiling, though they all worry (unnecessarily) about the size of their debt.

LikeLike

Debt Ceiling Polls: WTF?

http://econintersect.com/b2evolution/blog1.php/2013/09/13/debt-ceiling-polls-wtf

LikeLike

Hey Rodger, good piece as always. Personally, beside from the ignorance of monetary sovereignty among the public, I find the one sided discussion of American “debt” to be one of the most dishonest I can imagine. Surely, its not too complicated for economic or finance journalists or professionals to understand that T-bonds are held as private wealth. And if only one can admit the reality of this simple two-way transaction (like every other financial transaction in the world), then one should be able to understand that the debt ceiling is also equivalently the default risk free private financial wealth ceiling. By definition, if you are saying the Govt shouldn’t issue any more T-bonds, then you are also saying that the Private sector shouldn’t have any more of one of the world’s safest means of saving money. Its so goddamn frustrating to listen to people (some of whom must be intelligent) totally deny something so obvious and simple.

LikeLike

I think the $16 Trillion debt and inflation is driving part of this rational.

Almost every article or blog about spending includes national debt and inflation

in the comments. Many seem to be middle class making the comments.

How do we get around those elephants in the room?

LikeLike

Good question. One innocently might think that simply disclosing the facts would suffice. However, humans often resist facts, as witness the ongoing religion vs. evolution battle.

People follow leaders, and in this case, I believe a political leader would be required. To date, no political leader has displayed the courage or the knowledge to disclose to the public that federal “debt” is nothing more than the total of T-security accounts at the Federal Reserve Bank, and that the Fed controls inflation, year after year, within its target range.

In discussions with Stephanie Kelton at UMKC, I offered a marketing plan, that if implemented, might help make headway. If they don’t pick up on it, I’ll just publish it on this blog. Perhaps someone else might find it worthwhile.

LikeLike

Assuming politicians and economist see the light.

How will the way we handle the national debt affect

our trading partners and the dollar as the world currency?

LikeLike