Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

The Chicago Tribune, my favorite owned-by-the-rich, to-hell-with-the-rest newspaper, published today an editorial ironically titled, “More of the same — unfortunately.”

For the Tribune, it really was more of the same — unfortunately.

The editorial decried the slow pace of job creation.

The weak recovery is failing to gain momentum. Many Americans are being left behind — sidelined, underemployed or otherwise underutilized — while their skills atrophy.

The (unemployment) rate dropped 0.1 percent in August almost entirely because 312,000 Americans exited the workforce. So even though 115,000 fewer people held jobs in August, the rate went down because many Americans no longer are trying to find work.

The trend reflects an aging population that is retiring, as expected. But the numbers also were up for “discouraged workers,” those who have given up looking for jobs because they don’t think they’ll ever find one.

The Affordable Care Act gives some employers and workers an additional incentive to go part time, so as Obamacare kicks in over the next year, don’t be surprised to see part-timing spike.

It’s a right-wing hint, hint: Getting rid of Obamacare somehow will grow the job market — perhaps by dooming millions more people to the abject poverty associated with ill health.

Never mind that employers hire the number of workers needed to accomplish tasks, and never mind that employers pay what the market forces them to pay. When employers try to employ part timers, they need to hire more part timers to do the same work.

And this doesn’t even consider reduced efficiency, job skills, commitment and loyalty. Having owned several businesses, I can assure you, part timers are no bargain.

Job creation is proceeding at far too slow a pace to make up for what was lost.

Washington, regrettably, has more talking points than good answers. The most aggressive response has come from the U.S. Federal Reserve, which is pumping $85 billion into a bond-buying program designed to stimulate growth.

The so-called “bond buying” program adds nothing to the money supply. It’s sole effects are to reduce long-term interest rates and to reduce the money supply!

Why, reduce? Because with low interest rates and with fewer T-securities outstanding, the federal government pays less interest into the economy. That is not stimulative; it is recessive.

The Fed’s latest program, nicknamed QE3, simply isn’t delivering enough economic growth — enough jobs. It’s past time for the Fed to give it up.

Right. QE3 delivers zero jobs, so yes, give it up. And stop pretending it is stimulative.

And now, here are the Tribune’s big ideas, their “more of the same — unfortunately” grand plan:

To give business confidence and truly get the economy moving again, Washington needs to make progress on three big issues:

First, reform entitlement programs so employers won’t fear future tax hikes to rescue them.

In Tribune, right-wing-speak, “reform” is a euphemism for “slash.” What they really mean, but don’t have the honesty to say is, “Slash the programs that benefit the poor and middle-income groups.

“Slash Social Security. Slash Medicare. Slash Medicaid. Slash food stamps. Slash job creating initiatives like road and bridge building, education, crime prevention and pharmaceutical research. Slash food regulation, drug regulation, stock and commodity market regulation and above all, slash bank regulation.

“Finally, increase FICA, the most regressive tax in U.S. history.”

Second, revamp (and simplify) a federal tax code that, because it chooses winners and losers, discourages muscular hiring and investment.

All taxes “choose winners and losers,” but the real point is: “Revamp (and simplify)” are euphemisms for tax the lower income groups more, and reduce taxes on the rich (the self-proclaimed “job creators.”)

Every tax “simplification” plan ever proposed by the right-wing, increases the tax burden on the middle class.

Third, stop amassing an unaffordable national debt — almost $17 trillion and rising. Repaying that obligation threatens to devour too much of future workers’ incomes.

The usual, right-wing bullsh*t. The national debt is nothing more than the total of privately owned T-security accounts at the Federal Reserve Bank. T-security accounts essentially are bank savings accounts.

The so-called “debt” could be eliminated tomorrow, at a cost of $0 to current or to future workers, simply by transferring the balances in holders’ T-security accounts to their checking accounts.

It would be the same as transferring dollars from your savings account to your checking account. No cost to anyone.

The Tribune has learned that “more of the same — unfortunately” continues to fool the populace and to benefit the Tribune’s rich owners. So why not continue the charade?

If the people keep buying snake oil, keep selling it. If it works, keep doing it. So they do.

When I played “fetch” with my dog, I sometimes would fake a throw. He would run to find the non-existent stick. After I did this a few times, he learned I was faking, and quit being fooled.

The American populace, having not yet learned the media and politicians are faking when claiming the debt is “unaffordable,” still continue to be fooled. In that sense, they are not as smart as my dog.

Unfortunately.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

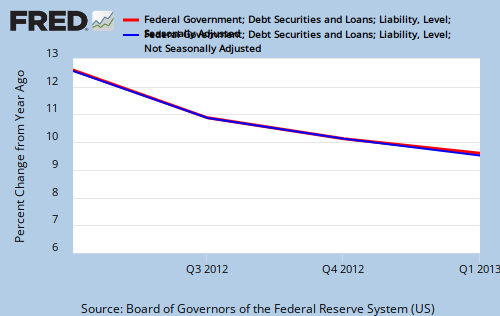

THE RECESSION CLOCK

As the lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

“When employers try to employ part timers, they need to hire more part timers to do the same work.”

That’s true, at least in theory. Sometimes they can reduce hours instead of having layoffs, but that’s not the point. They may even have to pay for more hours of work, employing part timers instead of full timers, but for lower-wage employees (say up to $30K a year), it’s still cheaper than adding $12,000 of health insurance costs per employee. Part-time work was already spiking in anticipation of the (now delayed) employer mandate.

(I had to laugh at “commitment and loyalty”. Those are a 2-way street. The US corporate world hasn’t had commitment and loyalty for many years now, and so they don’t expect it from employees anymore either. The few remaining companies who have mutual commitment and loyalty with their employees are not the ones that offer no health benefits now, and are reducing full-time workers to part-time.)

If right-wing tax reform has always meant taxing the poor more, how is it that the Reagan and Bush reforms have resulted in 47% of the people not paying any income tax at all? And cut the rates for all taxpayers, not just the top bracket?

LikeLike

Warren Buffett admits to paying a lower income tax rate than his secretary.

Also, income tax is the least of the problems. ConsiderFICA and sales taxes, which for the middle and lower income groups, add up to much more than income taxes.

Today, the right-wing mantra is: “Broaden the tax base,” and “tax simplification,” which is code for “Make the lower income groups pay more.”

LikeLike

You talk as if Warren Buffet’s secretary were a minimum wage worker. She makes 6 figures – part of the “1%”.

FICA – the idea of that evil Republican FDR.

Sales tax – among the states with the highest sales tax rates are those Republican strongholds California, New York, Washington, and Illinois.

LikeLike

O.K., you’re right. Clearly the Republicans are more on the side of the middle- and lower classes than the Democrats.

You do believe that, don’t you?

LikeLike

Does it matter what I believe, or does it matter what they do?

LikeLike

1. I believe golfer is forgetting about Mitchell’s Law #4…it’s called pass the buck (shift the burden) and Republicans now specialize and capitalize upon it. While red states typically receive more federal $ per capita than blue, the numbers relative to population are diminishing yearly.. Most states’ incomes via taxation have incrementally increased (post-recession), but continue to be offset by decreases in federal funding, primarily thanks to a Republican majority in the House of Representatives.

2. 12 of the top 15 states in median income are blue. It might make sense that the overall tax rates for those states would be slightly higher due to cost of living, etc. However, the top three states for overall highest state taxes are Tennessee, Arkansas and Louisiana-all red states.

LikeLike

You mean

“To survive long term, a monetarily non-sovereign government must have a positive balance of payments.”

I have not forgotten, but I think it is misworded in that it applies to the economy and not the government per se. US State and local economies survive on net exports with mostly balanced State and local budgets, or small deficits constrained by their borrowing ability, certainly not sustained positive balances.

Higher income should mean lower tax rates for the same level of services, not higher. If their tax rates are higher, I think it must be because government there is doing more, as their blue constituents have directed them to do. My point (and Rodger’s) was about how the taxes are collected. If those red states have higher overall taxes, but not higher sales taxes, they must be relying more on progressive income taxes and less on regressive sales taxes. You would think that would be a blue state strategy, not red, if the Democrats were more concerned about the poor and middle classes.

LikeLike

I have two points to make. First, back in 2001, President Bush sent checks of $600 to every married couple as part of the Economic Growth and Tax Reconciliation Act. At the time, I spoke to several families and all of them were grateful and most used the funds to catch up on some bills. There was no inflation and while the funds were added to the National Debt number it is 12 years later and these funds have not and will never need to be clawed back. I use this as an example to support many of the points Roger makes in his blog.

Second, I am against US action in Syria, and ironically it seems that the many Americans are against this action because they mistakenly think the US is broke and can’t afford another war. I may get the desired result for the wrong reason.

LikeLike

Agreed re. Syria. I cannot imagine any good that can come from attacking Syria, and I can think of lots of bad.

LikeLike

I think Americans are, as the media seems to think, “war weary”. In addition, they see no vital US interest threatened, and they think it is not clear which side we should be on, if we were to take a side in their civil war. They are more concerned about the lives that could be lost than the money spent. My view is that if we want to do something about the use of chemical weapons, the UN and/or the World Court is the proper venue. And if we want to bypass them, set ourselves up as judge and jury, then we should be thinking about the proper penalty for mass murder.

LikeLike

How do we measure ‘inflation’?

I’m 100% sure there was, but who was tracking it? The government numbers tend to understate both inflation and deflation.

I think that looking at prices is not accurate measure of inflation because prices fluctuate for various reasons. Instead of prices, we should measure the growth in the money supply, that is the ultimate read on inflation.

LikeLike

Bapoy, but why on earth should anyone care about the “money supply”? The relation between any of the definitions of “the money supply” and price inflation is very loose and tenuous.

Price inflation is what reasonable people care about. With rare exceptions, in the grip of illogical and innumerate economic mythologies, modern governments spend too little money, and usually in the obviously wrong places and at the wrong times. This causes unemployment, slow growth and in the long run, inflation.

LikeLike

The money supply is the worst possible measure of inflation because it completely ignores to critical pieces of data that go into calculating inflation. The savings rate or velocity of money and the total number of goods and services for sale. Inflation is a ratio, it isn’t a single nominal number.

Two examples:

On savings, if I give you $1 million in fresh digital money created just for you by the Govt and you don’t spend any of it, how much did that new money impact inflation? The answer is of course, zero. New money can only impact inflation as its spent or chasing goods and services. So thats the first basic point the Austrian theory of inflation totally overlooks.

On the quantity of goods and services for sale, lets say that in our economy there are $10 and only 10 apples for sale. If every apple that is produced is consumed, that breaks down to $1 per apple. If in year 2, our population and productive capacity grow to the point that we are able to produce 20 apples. If banks or the Govt didn’t grow the money supply a corresponding amount, we have deflation. This is another most obvious fact that your concept of inflation ignores.

LikeLike

I have to say, VERY weak arguments from Calgarus and Auburn. Your arguments sound like this.

Calgarus: You should not look at the money supply because “reasonable” people care about prices only. And the government spends “too little”.

Bapoy: Of course everyone cares about prices. But my argument is not whether we cared about something, the argument is what causes it. I would have an extremely hard time explaining what “reasonable” and “too little” means?

Auburn: Money supply misses some critical components, savings rate, velocity of money and goods/services for sale. Oh, and crediting your account for 1 million doesn’t mean you will spend it.

Bapoy: Savings are part of the money supply the last time I checked. The velocity of money also has nothing to do with either the money supply or inflation, a falling velocity merely represents an increased demand to hold money, a rising one means the opposite. I can assure you that I will spend a huge chunk of that million and so will everyone else.

On deflation, I will ask again – can anyone tell me when was the last time you complained about lower prices for goods and services. The natural course of events is deflation. It is how the market distributes wealth and increased productivity. This benefits savers, people on fixed incomes (retirees), laborers – the people who create the wealth. However, we don’t seem to grasp that simple concept and the majority are happy with the current dysfunctional system. I would much rather have deflation anytime. And deflation does not mean there won’t be demand, that’s a lie, unless you would starve yourself to death because prices will drop by 5 cents if you just wait till tomorrow. Or perhaps you go around naked also. Or walk 50 miles to work. Or maybe you could live under a bridge for a few years. The demand and supply will always be there whether it’s inflation or deflation. Do you not see how non-nonsensical these arguments are?

I will go back to my original question. Why look at a “basket of goods” when we could just be looking at the money supply as a measure of inflation? I suspect it is to someone’s benefit that the regular Joe is not focused on the money supply. I know MMTers will try to destroy my argument because the theories sole premise is that it’s more currency that creates more wealth. You are welcome to prove me wrong.

LikeLike

“Why look at a “basket of goods” when we could just be looking at the money supply as a measure of inflation?”

Simple, because its all wrong and it doesn’t tell us anything. As I clearly and accurately described above, inflation is not a nominal number. Its an equation or ratio. Why is this so hard for you to understand. Not all of the money supply chases goods and services (savings).

And you happily overlook the other impact of deflation, wages decreasing. When is the last time people didn’t complain about getting their wages cut? And since mortgages dont get discounted for deflation, you owe a fixed rate of interest and principle repayment costs every year, but if we are in a deflationary environment, those fixed costs will continue to increase as a share of your shrinking income. This is all really basic stuff actually. And the fact that you cant understand it is sad.

LikeLike

“Not all of the money supply chases goods and services (savings).”

The only money that doesn’t chase goods and services are DDA accounts, because these are available on demand. You lend your savings to the banks and the banks lend the savings – it’s how they make a profit! So yes they are chasing goods and services! How do you know wages will get cut during deflation? Did real wages go up with the the high rates of inflation from 1970 to date? They did NOT.

Even if wages dropped, prices would drop further. People have needs and companies want profits. Either they sell at lower prices (which you could afford) or they lose business to a better managed business, it’s what management gets paid to do.

With regards to the mortgage item, an individual made a decision and unfortunately has to face the consequences. That is the defect with the fractional reserve system, it’s built in to it. If inflation was so positive for mortgages and loans in versus wages, than why did we have a collapse in 2008? I agree, it is basic stuff, how quickly do we forget.

I am not opposed to price increases as there are various reasons for it (bad crop, people’s attitude,etc). I am opposed to money supply growth, especially via the issuance of debt/credit because it steals productivity gains from the population. Here is a new concept, the economy can grow without new money. Yes it can…

Go ask any company whether they prefer plain old paper gains or REAL gains (Mr. Mitchell knows I bet). I bet every single one would say REAL gains. This means that even if companies are being paid less for their goods/services, they will remain profitable so long as the funds they are receiving buys them more than the cost of goods sold. So deflation is not “bad” as the politicians would make you believe.

LikeLike

Bapoy,

Inflation is the loss in value of money compared to the value of goods and services. Inflation can happen when the money supply goes up or goes down.

You are correct that prices fluctuate for various reasons. Inflation also fluctuates for various reasons.

There also are many measures of the money supply, and these measures fluctuate differently and for many reasons.

In the past 40 years, inflation has been associated with oil prices and not with money supply. See: https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/

LikeLike

That’s a bit confusing. Oil prices skyrocketed from 2000 to 2008 reaching 150. I don’t recall seeing drastic price increases during that period. Also, oil prices dropped from 150 to 40 bucks by the end of 2008. I also don’t recall seeing any price drops during that time either. Also, was oil the cause of home prices going through the roof (homes makes up one of the largest chunks of the economy)?

Oil is important, but there are many other variables and I just don’t see how we can pin price increases in oil or any other commodity for that matter. There are other input costs aside from energy, like raw materials, shipping costs, etc…

One thing is 100% guaranteed though, prices should be dropping as productivity increases. However, we have not seen that, we have seen prices increases at 2% or higher clips. So the productivity improvements have not been passed on to the consumers via lower prices.

In my opinion, these gains have not made it to the consumer because of fractional reserve lending (FRL), however, FRL is what’s needed to finance government spending. I know you support government spending; however, in my opinion you cannot have a thriving economy and government spending at the same time. The boom years of the internet revolution are long gone and if we don’t get another one in it’s place, any amount of government spending will not resolve the issue. Most likely we will get more government spending and we will see it fail time after time.

LikeLike

Examine Rodger’s graphs carefully. By using the derivatives of oil and CPI, not their actual levels, and using different scales and different zero points, he makes the lines look highly correlated. There are long periods when oil was going down, and yet CPI or any other general price measure still went up.

But it is true that oil, labor, and land are the most pervasive inputs, and their prices tend to drive the inflation rate. Land and labor are continuously increasing, at least in nominal price level, for different reasons having nothing to do with money supply or banking. And we were far more dependent on imported oil in the 1970’s than we are today.

Shipping costs are highly dependent on oil prices. That is one of the major ways that oil feeds inflation, even more so today in a more globalized economy.

Productivity increases are not passed on to consumers in the form of lower CPI in a healthy economy, although they are reflected in lower relative prices for certain things, particularly electronics. Productivity increases usually accrue to workers or to profits or both, in varying amounts depending on the relative bargaining power of labor and management.

LikeLike

Look at https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/

LikeLike

golfer1john,

Rodgers’ charts track oil prices to CPI and does not answer what the cause of the price increases is. It merely proves that prices are increasing across the board at the same time.

It’s like saying gold is up as well as jewelry. It does not at all prove that oil is the cause of the increase, it just proves oil went up and so did the prices of other items. Can we say that it was the other items that caused oil prices to go up? Why not? Did oil supplies collapse by 90%or did demand increase 10 fold? The answer is NO, than how did oil go from under 20 bucks to 150 and from 150 to 40?

To clarify where I’m coming from. The CPI missed the increase in housing prices on the way up and on the way down. That was the question on my original post and the reason of why in my opinion the CPI is a useless measure. I bet if you chart money supply vs these items you get a much better picture and the true root cause of the issue.

LikeLike

Golfer,

Read the link I’ve supplied. It answers your questions about the cause of price increases.

Housing is only one factor in inflation.

LikeLike

Ah, so you don’t believe that the Saudis control oil prices by restricting supply (not to mention the 1973 embargo).

LikeLike

Another out of paradigm myth by you. Banks dont’ lend out reserves. And private credit growth has nothing to do with financing Govt spending. How are we supposed to debate with someone when you get all these absolute basics wrong?

LikeLike

First off, you give the banks the right to lend your savings – it’s why they pay you. You know they will lend it before you lend it to them. There is nothing there, only a promise to pay you that amount plus the interest as per the agreement. And savings account do not have a reserve requirement.

As of demand deposit accounts, the majority of the money has also been lent via something called sweeps. The funds are swept nightly from DDA accounts. To put it in simple terms, the money is not in your accounts and nobody knows where it is. There are only promises to pay in those accounts, the funds have been lent and re-lent times over.

And that’s not even the worst part of issue. The issue is that there are tons of “money” that was borrowed into existence, especially via government spending. Now picture this, trillions in promises and debt built on a couple of trillion of actual money. You go figure out how this is “sustainable” as Mr Mitchell puts it. Something tells me this will blow up sky high.

LikeLike

“So the productivity improvements have not been passed on to the consumers via lower prices.”…Bapoy

We currently spend much less on food relative to the average wage than we did 40 years ago. Clothing? People used to patch and sew clothes. Now they throw them out when they rip. I was recently at a Dollar store in NJ. You can get reading glasses, frozen meals, even steak for $1. A 24 pack of water used to be $6 five years ago. Now it is between $4-$5.

LikeLike

Good point and I agree. Those things you mention are there thanks to productivity improvements.

One example of what I mean is homes. The majority of families OWNED their homes 40-50 years ago. Today, they owe them.

They used to buy a car cash, today they have to finance it. They use to buy essentials cash. Today they have 10 credit cards maxed out.

Again, it is what a fractional reserve is, it’s based on debt, not real incomes. If you think today is bad, it will get much worst.

LikeLike

golfer said, “By using the derivatives of oil and CPI, not their actual levels, and using different scales and different zero points, he makes the lines look highly correlated. There are long periods when oil was going down, and yet CPI or any other general price measure still went up.”

The inference is that somehow, by fiddling with numbers, I was able to show something that doesn’t really exist.

There are six graphs at https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/ All seem to show the same thing in different ways.

But., if you disagree,why not post a graph showing that oil prices do not drive inflation.

LikeLike

I will put a graph together Mr Mitchell!

LikeLike

Right after you show that falling oil prices cause rising consumer prices.

LikeLike

Rising oil prices cause rising consumer prices.

LikeLike

And when oil prices fell, what caused the continued rise in consumer prices?

I’ll answer that: something else.

LikeLike

” I was able to show something that doesn’t really exist.”

Not exactly. You gave the impression that oil prices and consumer prices were both moving in the same direction, when in fact they were moving in opposite directions.

LikeLike

“[W]ith low interest rates and with fewer T-securities outstanding, the federal government pays less interest into the economy. That is not stimulative; it is recessive.”

This is why I don’t think Volcker’s rate hikes caused the recession of the early 1980s. I think that recession was caused by a small federal budget deficit and high oil prices.

LikeLike

Probably reduced debt growth was the most important factor

We don’t seem to have recessions when federal debt growth is above 10%.

LikeLike

please consider the real estate infation i e house price inflation pre-1960s onwards

what was it like in USA.. And what effect state-owned or federal-owned banks [if any]? that is Gov getting benefit of the “free money” [my term slightly different to yours] the creation of the free money by the COMMERCIAL BANKS pushed inflation up compared to (in Australia) tending to hold it down until the 1980s when they were privatised, no doubt pushed by UK?

LikeLike

Real estate prices rose from post WWII levels into 2008. That increase created the optimism that led to the “Great Recession” of 2008.

The federal government does not benefit from “free money.” It creates all the money it wishes, at no cost, simply by pressing computer keys.

Contrary to popular myth, money creation does not cause a general increase in prices, (aka “inflation”).

Inflation always is caused by shortages, usually shortages of food and/or energy. (See: https://mythfighter.com/2020/08/18/what-causes-inflation-no-its-not-money-printing/)

In fact, inflation can be CURED by money creation, if the central government buys the scarce products and distributes them to the private sector.

LikeLike

Hi Bill

Thank you for your kind replies. You say

‘The federal government [currently] does not benefit from “free money.” It creates all the money it wishes, at no cost, simply by pressing computer keys.’ Is that by bond-issuance or what mechanism – pls forgive me not au-fait enough..

surely that cannot be yet so, unless you mean would create?

I take it you mean Gov WOULD create all the money it wishes? under your proposed system?

Therein could lie the Gov’s problem, Of Inaction. It might be seen as a step too far, especially for those used to having the the purse-strings [or indeed not understanding how the money works in real.] The benefit of real physical work started early for growing and making in the hills above Perth, on $0.15c an hour in the mid-1960s as a 12-year-old, then in Newspapers pre-digital, but photo-setting coming in, then a stint in Gov, civil design engineer by 1978 in UK. what is your background? – you seem to be quite informed, is that at a practical level (hand-skill also, construction, ‘Developer’, rentals, gov, academia, etc) or theoretical] . Whereas with a CHARGE (i am suggesting at first using local banks issuing Bank of England/US National/State-owned Bank Money, a step to Demonstrate the Efficacy of Your Solution . As i see it the Private Money-Issuing got way out of control – especially in the USA (or some areas of it hence the divide – just as described in ‘Grapes of Wrath – the seeds of discontent are sown deep). Just As You Say (or like it) GreenER Deal could be created money, but after an Immediate GreenER Deal Action Plan (as distinct from the high-interest and “Repayment” of what does not need to be repaid, so similar to yours but maybe more practical and incremental therefore more attractive to those with the purse-strings). Fresh money – could be there to householders to get off oil/gas. This was never allowed in the UK’s Green Deal but the concept of balancing cost of interest with savings on bills was there. Eco-Fitters could be just entering into a ’20-year-money Eco_Fit contract’ if Thorough enough at 0.5% base rate – IMPORTANTLY Base Rate Returned – plus 1% markup just as real hard-earned money used to be (building society savings re-lent, etc). GreenER Deal would allow cancellation at 20 years for such special purposes, so at lower costs than interest-free – ie the marginal, more beneficial investments need not be “repaid”. THEN by introducing base rate diversion to the public purse – across the board on all commercially-created credit Money, Regulators could start the rest of created-money interest Slice to the public purse, a year or two later. Other Special money ring-fenced for public purposes, etc, just as you are saying, incrementally for the reasons above – getting the system going.

Best regards

Ian G. +44 (0)121 449 0278. 9am-9pm GMT

PS regulation could also be there for Health Insurance for low earners? Would that go against the thrust of your comments? e.g. Hospital Benefit Fund?

PPS What is the basic existing mechanism in USA of money-creation? in UK it used to be a third currency notes post WW2, so 2/3 commercially-created credit money. Notes shrank to 3% by 2006. Hence our Problem. And of course the unfairness for the rest of the world of US-UK commercial-money system creating most of the money. Do you have a figure for US-UK’s proportion globally of all created money? I propose all countries should be creating their own development money – like GreenER deal and secondly getting a slice from a yet to be implemented return alongside VAT or taken at point of sale from Imports resold. That way – if for Barrages, renewable energy such as Tidal and Fresh Water bays (tidal, security agasinst the rising sea for New York, etc. with wind and pumped-storage) become affordable, along with reductions of consumption in Western “Economies”. [And the poorer countries can then also Afford their own health care and decent hospitals]

LikeLike

Who is Bill?

To pay a creditor, the government sends instructions (in the form of a wire or a check), not dollars, to the creditor’s bank, instructing the bank to add dollars to the creditor’s checking account.

When the bank does as instructed, new dollars are added to the economy.

The bank then clears these instructions through the central bank, which always clears federal government instructions.

That is how the federal government creates dollars — by creating instructions from thin air, and sending these instructions to banks.

LikeLike

sorry to go back over this

Bill is Bill Mitchell in Australia.

BUT

in view of Styephanie Keltons recent (TaxResearch.org.uk referenced) point about monetary addiction.. Are what you are saying above different to UK-banks’ commercial free-for-all suddenly NOT under scrutiny?

Hope things are tolerably well for you over there?

I think to get things clear we have to get a clear distinction between GovMoney from central bank and ConmercialBank “free” money, do we not? Still important work to do

seems like what you said

This is a party, led by a psychopathic, short-sighted philosophy. It has become embedded with the notion that anything the [others] wish to do must be fought, lest the [anyone else] receive credit, Now more clearly applies to Britain?

LikeLike

Bill Mitchell from Australia is not related to Rodger Mitchell from the U.S.

You are correct that there is a difference between federally created dollars and private sector-created dollars.

Federally created dollars come into existence via federal spending. They stay in the economy until they are destroyed via federal tax payment.

Private sector-created dollars come into existence via lending. Every money loan creates dollars because the borrower now has dollars, but the lender still has dollars in the form of a loan document. These dollars are destroyed as the loan is paid down.

Yes, the Republican Party would vote against chocolate ice cream if the Democrats favored it. The GOP has but two goals: Enrich the rich and win elections.

LikeLike