Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

BACKGROUND

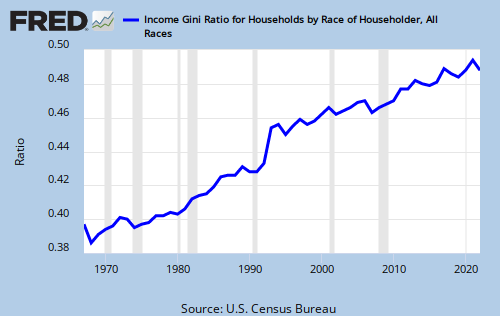

As you’ve seen in previous articles (for instance, No, it’s not your imagination. The upper 1% really are screwing you more. Saturday, Jul 7 20120) the GINI ratio is a calculation of the gap between the richest and the rest. The higher the number, the greater the gap. Every year the number is higher; every year the gap is greater:

The above-referenced article listed “Ten suggestions (for the upper 1%) about how to screw the lower 99% even more, and increase the income gap.” Here is a quick outline of the “10 Suggestions.” Read the article itself for more details:

1. Maintain or increase the FICA tax.

2. To “save” Social Security, claim it’s insolvent, reduce benefits and increase the starting age and tax benefits.

3. To “save” Medicare, claim it’s insolvent, and reduce payments to doctors, hospitals and other health care providers.

4. Cut government employment and payments to government suppliers.

5. “Broaden” the income tax base. Include more people in the Alternative Minimum Tax (AMT).

6. To reduce “big government” cut food stamps, unemployment compensation, Medicaid, aid to education, job training and all other federal aid programs.

7. Cut financial assistance to the states.

8. Spread the myth that the U.S. government is insolvent, like Greece, and that federal taxes and borrowing pay for federal spending.

9. Allow banks to trade for their own accounts, bail them out when their investments go sour and never accuse a banker of criminal activity.

10. Nominate arch conservatives to the Supreme Court to maximize the political power of the rich.

TWO MORE METHODS

With 10 simple ways to screw the average American, you would think the super-rich would be satisfied. But no, here are 11th and a 12th methods, countenanced by the bribed politicians:

I. Replace full-time, experienced workers with part time, inexperienced workers at much lower salaries.

naked capitalism

Barbara Garson: How to Become a Part-Time Worker Without Really TryingBig companies squeeze down even more on workers by turning what were once full-time jobs into part-time positions to avoid providing benefits and to push pay even lower. 21% of the jobs lost during the Great Recession were low wage, meaning they paid $13.83 an hour or less. But 58% of the jobs regained fall into that category.

Employers have used the downturn to dump entire departments and to reorganize themselves so that the same work, the same jobs, requiring the same skills, would henceforth, in good times and bad, be done by contingent workers. During the course of the Great Recession corporate profits went up by 25%-30%, while wages as a share of national income fell to their lowest point since that number began to be recorded after World War II.

Not only are salaries lower for part time workers, but these poor souls receive no benefits. They cannot afford health care or health care insurance. But even the middle class is under huge financial pressure from increasing health care and health insurance costs.

II. Make sure college, the source of hope for financial growth, is unaffordable:

Bloomberg

College Costs Reaching a Breaking Point?

By Karen WeiseStandard & Poor describes a spiraling problem for colleges: As they raise tuition, more families need aid to afford school. Students take out more debt. Colleges are increasingly directing their aid to wealthier families—who need it least.

And uniquely among all debts in America, student debt is not dischargeable via bankruptcy. If you owe money to the federal government (the one lender in America that creates its own money, so should not ask for repayment), you essentially are locked into a debtor’s prison of unaffordable, unending debt draining away your ability to grow financially.

WELCOME TO SLAVERY

Experienced, full-time workers are being replaced with inexperienced, part-time workers, at lower salaries and no benefits. Meanwhile, working class Americans are denied college — their one path to financial security — by a combination of unaffordable tuitions and unaffordable college loans.

The rich have created a brilliant, 12-part plan. It will force you, your children and your children’s children to spend your lives working harder and harder for less and less, completely at the mercy of the rich.

If you accept the twin myths that the federal government “can’t afford” paying benefits, and that federal spending causes inflation, then welcome to slavery in America. Lincoln never imagined this.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

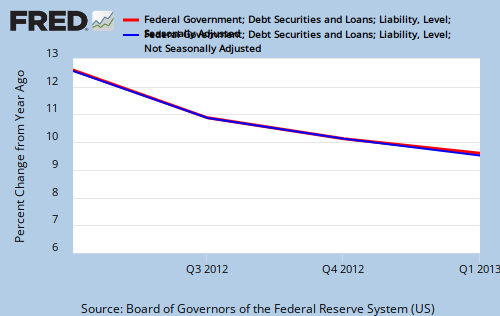

THE RECESSION CLOCK

As the lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

In the UK the use of zero hour employment is on the rise. This form of slavery equates to you have a job with a company, however, you are guaranteed no specific number of hours, no benefits, no nothing. You wait for a call each day to see if you are to work that day and when. The US/UK Gangster States are just a wonderful places to reside. Third world here we come.

LikeLike

In short, the Walton family tells you, slavery / hunger are better than joblessness/ starvation. Which do you want?

LikeLike

This is awesome.

I don’t know about you Mr. Mitchell, but I would rather have a low paying job than no job. Perhaps you don’t assimilate to folks in the same situation.

The issue is not companies paying low wages, it’s the Fed by force of the government keeping prices high.

I am also surprised you show that chart, it clearly shows what un-pegging the dollar from gold has done. What used to be a system where debts were immediately settled, wages represented business conditions, turned into a mess where wages stagnate as folks get themselves into more debt.

It’s sad and comical at the same time, the same complainers are also asking the government to force more inflation onto the system. As if the poor folks working in Walmart could keep up with it.

LikeLike

http://research.stlouisfed.org/fredgraph.png?g=1vY

DannyBoy:

LESS than a 3% total increase in inflation in the past 4 years (from slightly less than 0%.in 2009 to 2.6% in 2013). From 1960 until 1995 the inflation rate was continually HIGHER than anytime in the past 4 years. Your inflation interpretation is completely unfounded and borders on delusional paranoia. Like Rodger, I too have told you that commodity based economies are destined to pretty much guaranteed failure and are best left to the slag heap of history. See details on AdamSmith.Org, on the destructiveness of the gold standard (and this is from a bleeping AE site)! Continually you apply vague, out of paradigm theoretical micro-economic examples with zero basis in reality when commenting here on MS. The primary topic you dwell upon-PRICE STABILITY-seems to be beyond your grasp. You continually spout nonsense when FACTS are available like those I’ve submitted above.. You appear to be exactly like other disillusioned, confused and out of touch anarcho libertarians (e.g. Robert Murphy). Poor Murphy, laughably, even Neoliberal poster boy David Friedmann crushed Professor Murphy into submission in their recent debate. Say nothing of MMT’s Warren Mosler and his low-key shredding of Murphy just this past June. Please Danny, leave the dark side.

LikeLike

Do you know that the government has changed the way inflation is measured?

Yes, the rate of inflation has been lower since 2008, but do you know why? I bet nobody on these boards can tell you the right answer, because nobody on these boards understands how our monetary system works.

You and Mr Mitchell are confusing things. In our current system, it’s debt that’s created, not currency. This is why you don’t have run away prices because the debt is either repaid or defaulted on.

Do you know how many home owners and companies filed for bankruptcy the last few years? Tons, in the trillions. All those trillions are no longer part of the money supply and force prices down. And there is nothing wrong with lower prices, I bet nobody you know would complain about lower prices? But they sure complain every day about higher prices.

The dark side is the one asking for inflation, not me. I want the market to dictate who wins and who loses, not a few bureaucrats who will always have an excuse to defend the rich.

With respect to gold, it’s not a matter of what I want. Gold has been a currency for the biggest part of the world’s history and will again be. Not because I say so, but because people will chose it. I don’t have an ounce of gold, but go out and see what currency, outside of the bigger ones, are receiving bids and I bet that gold is #1 and will be for a long long time.

What you and Mr Roger miss is, that it’s the market that ultimately decides what it wants. After the fiat currencies cancel each other out, everyone will have no choice but return to a gold back currency.

I will close with this, as Warren Buffet once said, be fearful when others are greedy (confident) and be greedy when others are fearful. You, Mr Mitchell and just about everyone in the US (except real Libertarians – probably 1% of the population) are very greedy and confident. I side with the real Libertarians and history will prove us right.

LikeLike

Are those the only choices? Low paying job or no job?

What about having a good job, along with benefits?

Do you feel comfortable with millions of people struggling to survive in minimum-wage, part time jobs, and having no benefits, while wealthy few make millions and have all the benefits?

Inflation has been hovering around 2%, which is near the bottom of what most economists feel is safe. Unfortunately, those bottom-feeding jobs you seem to like, haven’t even kept up with that minimum inflation.

And as for gold, the worst economic period in U.S. history came while we were on a gold standard: The Great Depression.

As usual, you’re wrong about jobs, wrong about inflation and wrong about gold. I must admire your consistency.

LikeLike

No, the great depression was a product of the Federal Reserve who took the helm in 1913 and was the cause of the run in credit in the 1920s (gold did not cause the stock market bubble in the 1920s). The cause of the first great depression will be the cause for the second. Hard headed “geniuses” that can’t see that it’s lower prices that the economy needs, not more bubble blowing.

I’m sure you are aware of what the government’s measure of inflation keeps track of. Does it keep track of home prices? No it doesn’t, and it doesn’t keep track of many other essential items.

With regards to the 2% targeting thingy, how on earth can you or any economist say that 2% is too low? Too low for what? Jesus Christ, the poor folks with no labor bargaining power cannot keep up with inflation at 2% (the rich can easily keep up and profit from it as they have FIRST access to credit), you think we need more?

There is nothing wrong with saying the truth.

LikeLike

The point is, gold did not prevent the Depression.

In fact, gold exacerbated the Depression, since being locked to gold dissuaded the government from applying enough stimulus. The belief then (as it is now) was that the government “couldn’t afford” stimulus.

Because of gold, that belief was near correct then, but not at all correct now.

The 1933 “recession-within-a-depression” was the result.

High inflation hurts an economy. But, low inflation is stimulative, because it motivates people to buy “today” in anticipation of higher prices, tomorrow.

Deflation is very recessive, because it causes people to delay buying.

So the Fed tries to avoid both high inflation and deflation, by opting for low inflation, with a target of 2%-3%.

LikeLike

Stimulus?

Mr Mitchell, government spending is not stimulus.. it’s theft. Unless you feel that getting ever less valuable currency for your labor is stimulus. Keep in mind that the poor don’t get a pay raise, but they sure get the same amount which buys less and less month after month.000000000

And no, any artificially created inflation is not good, it’s theft. Sir, in your posts you appear to defend the poor, yet you think it’s to the benefit of the poor to steal just a little bit from them. Again, the poor cannot hedge against price increases, the wealthy can and will just like they have the last 40 years. The gap sir, the gap will continue to increase with higher inflation rates.

You are also missing my point. Yes, artificially forcing inflation will make people buy things today, but at the expense of what? Demand will be pulled forward, but the growth will be on credit/debt which cannot and will not be repaid. There will be no real income growth – are you surprised there hasn’t been any since the 1970s? Are you also surprised to see the economy crash when the amount of debt reaches a tipping point?

Lower prices are NOT recessive, they are the natural state of the economy. The higher the profits, the higher the competition, the lower the prices. Inflation steals the gains from increased productivity and efficiency from the population. In other words, the free market tends to force equality – you want to stop it. Sir, you cannot have the cake and eat it too…

LikeLike

“. . . the free market tends to force equality . . .”

Bill Gates and Warren Buffett would be proud of that statement. Apparently, the free market has made you equal to them.

But even prouder would be the Walton family, owners of Walmart. Their free market has created massive equality — among underpaid employees.

LikeLike