Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Cutting the deficit is the government’s method for taking dollars from the middle class and giving them to the rich.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

==========================================================================================================================================

President Obama is breaking is own arm, patting himself on the back for applying leeches to an anemic patient (i.e. draining billions of dollars from our sick economy).

He has given the upper .1% income group the increase in FICA (the worst tax in America) they wanted. No, not wanted for themselves. They don’t pay FICA. They wanted it for the 99.9%, to increase the income gap.

Just in this way alone, Obama has damaged America far more than Osama ever did.

Fortunately for the economy, raising the top rate on people making above $400 thousand per year, will collect so little money as to be essentially meaningless. (Those people know how to stay out of the top rate. Ask Warren Buffett.)

So while the tax increase on the rich does no good for anyone, it scarcely does any harm, either. It took Congress and the President all these months to create a nothing. And the Champagne glasses are lifted on high.

(And who cares about that FICA tax increase on the middle class anyway? After all, isn’t the federal government running short of dollars? And the middle and lower classes have plenty of dollars to spare, don’t they?)

The first myth of economics is: Federal deficits are too high. It is a myth promulgated by politicians, who are paid by the upper .1% income group to widen the gap between them and the rest.

The second myth of economics is: Social Security will run out of money. Also promulgated by that same nefarious group, who are paid by that other nefarious group. It’s all about the income gap.

My estimate: About 99% of the nation believes these myths, putting lie to the notion that you can’t fool all the people all the time. (Hey, even I have dear friends who tell me they are proud to pay taxes to support America. And these are advanced-degree-smart people.)

This blog has provided repeated proof of the myths’ fallacies, so we needn’t deal with them further, here. Instead, let’s deal with another myth: Federal deficits are harmful while private borrowing is helpful.

The Fed, Congress, the President, and most of the sages commenting in the media are convinced that all things private are superior to all things public. I often read how “the government doesn’t create anything,” which I suppose almost, but not quite, is true if one eliminates from consideration all federally funded projects that are executed by the private sector.

That is, the government does not build roads, bridges and dams. Private contractors do. The government doesn’t do much research, doesn’t grow much food, doesn’t create many medicines, doesn’t cure diseases, doesn’t do much educating, doesn’t build many ships and planes — the government doesn’t do much except fund these activities — activities that wouldn’t happen without federal funding.

So perhaps, for a new year’s resolution, the wags can vow not to say during all of 2013, “The government doesn’t create anything.”

Sadly, the Fed, an agency of the government (yes, it is), seems to believe the myth, for it repeatedly lowers interest rates (that’s what QE is all about) in a silly effort to get the private sector borrowing, at the same time, advocating less deficit spending by the federal government.

In their upside-down world, deficit spending by an entity with the unlimited ability to create dollars, is unsustainable and should be reduced, while deficit spending by entities that repeatedly run short of dollars and go bankrupt, should be encouraged!

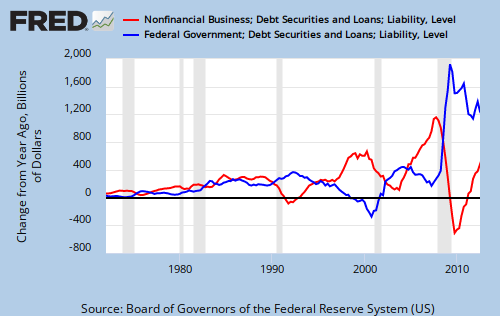

The graph below shows annual changes in Federal debt (blue line) and annual changes in business debt (red line). Does it strike you how these two lines relate to recessions?

Business debt rises in advance of recessions and predictably, falls during recessions. Federal debt falls in advance of recessions and rises during recessions. Again and again and again. (I stress “again and again” to give the “correspondence doesn’t prove cause” deniers something to chew on.)

How do you explain this phenomenon? My explanation is that as businesses borrow more, they becomes overextended. Meanwhile, as the federal government, which never can be overextended, deficit spends less (probably because of Congress and the President), the economy suffers from a lack of funds (the anemic patient being bled by leeches).

These two processes meet at a recession, at which time business borrowing virtually stops and federal deficit spending must be increased to end the recession. Funny, how the much-loathed deficits are necessary to rescue a dying economy.

The following graph shows essentially the same thing, except rather than showing absolute debt numbers it compares the ratio of federal debt to total debt vs. the ratio of business debt to total debt.

Again we see that as personal debt rises, here as a share of total debt, and federal deficits fall, also as a share of total debt — that’s when we have recessions. Further, recessions are cured when federal deficits are a rising share of total debt, and business debt is a smaller share.

Interestingly, we only seem to have recessions when the year-to-year change in the federal debt / total debt ratio is less than 0.00.

So what is happening today?

Today, Federal debt is falling as a share of total debt and business debt is rising — a recession scenario, with only one positive note: The year-to-year change still is above 0.00. So, that could mean another recession is not yet upon us. But, it’s coming soon enough.

Today’s scenario is what one would expect from a President and Congress that have been bribed by campaign contributions to reduce federal deficits and to increase private borrowing (via low interest rates).

As this is written, President Obama is strutting about his great “victory,” but barring unforeseen changes, history will judge him as mediocre at best — probably closer to the bottom than to the top.

And we had such great hopes.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY

This is what is being sold to the public as a victory:

LikeLike

Some of us Americans are so ignorant.

We prefer “tax cuts” while we still get to pay higher taxes anyway and more (devaluation of earnings by the government). Can the people start doing their civic duty and start getting involved in the economy and politics, you are being DUPED.

The 99% are not better off with more deficit spending.. We are WORST off.. MUCH MUCH MUCH more worst off. More debt devalues existing money and the new debt is FUNNELED into “projects” selected by the rich and for the rich. If deficit spending worked, we’d be in the biggest boom in the history of the US (we just spent 8 trillion in 4 years).

Deficit spending:

– YOUR earnings are being stripped and “invested”, sorry… handed over to friends of politicians.

– YOUR savings are being devalued and being handed over to friends of politicians.

– The rich will tell you how GOOD this is for you.. The government deficit spends for the good of the people… blah..blah…blah..

Deficit reduction:

– YOUR earnings will gain more value.

– YOUR savings will gain more value.

– The rich scream like hyaenas…

There was a tax cut passed by congress yesterday not a tax hike, yet we are hearing screams from the liberals as if they’ve changed anything.

Nobody has the guts to tell the American people the truth…We are IDIOT, brain-dead, fools if we listen to this BS….

LikeLike

1.) Rodger writes: “About 99% of the nation believes these myths, putting lie to the notion that you can’t fool all the people all the time.”

Yes, the public believes falsehoods in numerous topics. For example, in any war, the victors write the history books, and they fill the books with lies. The USA is no exception.

Of all lies, however, none are as strongly and widely believed as lies regarding the finances of Monetarily Sovereign governments.

In this topic and all others, the people who cling most strongly to lies are people who fancy themselves educated and intelligent. Their opinions form their world view, plus their sense of personal identity. Hence they regard any questioning of their opinions as a personal attack, and they respond with anger, smugness, or hysterical gibberish.

As a result, the 1% and their puppet politicians rule with impunity.

I favor foreigners, plus very young people, and people who never read or watch the corporate news media. People who admit they know nothing about U.S. government finances, and have never formed an opinion on the matter. Give me a teenager who watches only “American Idol.” That’s a person I can help.

By contrast, the people beyond help are those with totally wrong opinions, but who think they understand banking or national finances. This includes many people (not all) who claim to understand MMT. Half the comments on MMT blogs are so garbled, or so absurd, that they do not merit reading.

One clown (who sometimes comments here) claims to agree with MMT, but does not care that the FICA increase will remove (and destroy) another $125 bilion a year from the U.S. economy. This idiot insists that federal tax revenue does incdeed pay for the federal government.

Other clowns comment here as well. I used to respond to them, hoping to clear up their confusion so we might both learn something, but now I ignore them like Rodger does. One of them left a comment in this very same thread.

++++++++++++++++++++++++++++++++++++++++++++++

2.) Regarding the widely held belief that federal deficits are harmful, while private borrowing is helpful (i.e. all things private are superior to all things public), I say that this reveals a high level of average selfishness among the U.S. population. The concept of government, in its abstract sense, is people helping people, while the concept of private enterprise means people enriching themselves, often at the expense of others.

The best arrangement is a mix of public and private. As Rodger says, some industries are best left in private hands, while other industries are best left under government control (e.g. banking and prisons) . The question is where we want the profit motive to be the mainspring.

++++++++++++++++++++++++++++++++++++++++++++++

3. Regarding people who say the government “doesn’t do anything,” their comment is trvial. Yes, people do all the work. So what? Government is people organizing themselves into an orderly social structure.

People who advocate the total privatization of everything are “spoiled stupid.” They enjoy the benefits of public (i.e. government) administered programs ranging from Social Security to trash pickup in their own neighborhoods. Do they really want a society in which the police and fire departments only cater to the rich?

++++++++++++++++++++++++++++++++++++++++++++++

4. Rodger says that, “As businesses borrow more, they become overextended. Meanwhile, as the federal government, which never can be overextended, deficit spends less (probably because of Congress and the President), the economy suffers from a lack of funds (the anemic patient being bled by leeches).”

Yes the business cycle is really a credit cycle. In good times, businesses increase their borrowing to the point where they eventually cannot service their debt. The result is a recession, which would not be a problem if federal politicians increased government spending. Unfortunately politicians work for the 1%, who want a wider gap between themselves and the 99%.

During a recession, the banks do not lend, and businesses do not hire. And since the USA has a trade deficit, the ONLY CURE is increased government spending. However, during a recession, corporate media outlets increase their lies about US government finances (e.g. the lie that deficit spending is “unsustainable”). The poorer the public becomes, the more the media insists that the public needs more poverty (i.e. austerity).

++++++++++++++++++++++++++++++++++++++++++++++

5. Both Democrats and Republicans work for the 1%. Republicans do it by reducing federal spending. Democrats do it by increasing federal taxes.

Where were the Democrats when the 2% FICA tax “holiday” was set to expire?

LikeLike

As I understand the process, fed deficit is paid out of t-bond sales which then get tacked on to the fed debt. Taxes aren’t spent by government.

The debt is the resultant of the deficit. And if there’s not enough takers for t-bonds the Fed will absorb the difference with electronic “out of thin air” keystrokes. The CBS correspondent Scott Pelly was told this by Chairman Beranke in an interview, and Chairman Greenspan said on Meet The Press “we can not default; we can afford to meet any financial obligation” or words to that effect.(Sept, 2011 NBC on Youtube)

Deficit = proficit ; Debt = t-bond savings account with payment from treasury to t-bond holder, not owed by the public to IRS. We the people did not sign off on the deficit, congress did it without our ok., ie, taxation without representation. So the “debt” will never be called in on every citizen the tune of $100Gs each. That would be undoable and subject to a helluva revolt. We owe what sign off on privately. Actually, as Mitchell states, we don’t even need federal taxation, only state and local are needed.

LikeLike

“The debt is the resultant of the deficit.”

Yes and no. We could have debt without deficits and we could have deficits without debt. They are two separate operations, linked only by a law that links them.

Federal “debt” is the total of deposits in T-security accounts at the Federal Reserve Bank. Deficits are the difference between spending and tax collections.

If the government stopped accepting deposits into T-security accounts, there would be no debt. If the government never ran a deficit, it could continue to accept deposits in T-security accounts, in which case there would be “debt” without deficits.

The word “debt” has done more damage to the American economy that any other word in the English language. It is misleading. The word should be changed to “deposits.”

LikeLike