Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

==========================================================================================================================================

Here are your handy recession predictors. Save the link to this page. The graphs automatically will update.

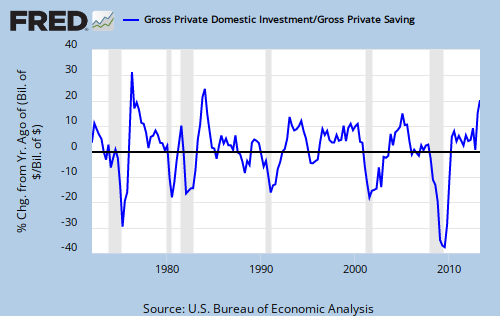

We tend to have recessions when the year-to-year percentage change of Gross Private Domestic Investment goes down, especially when it falls below zero:

We tend not to have recessions when the percentage change is rising.

We tend to have recessions when the total of Private Investment and Saving is on the downswing:

We tend to have recessions when the percentage change in the annual ratio between Gross Private Domestic Investment and Gross Private Savings is falling, especially when it falls below zero.

And, as we’ve seen in past articles, recessions tend to follow years of decreasing Federal Debt:

Finally, Federal Deficits – Net Imports = Net Private Savings

and

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

Given that the federal government is determined to reduce the federal deficit, which will involve reducing Federal Spending and increasing federal taxing, what do you think will happen to Gross Private Investment, the total of Investment and Saving, the ratio between Investment and Saving, and Federal Debt? What effect will there be on GDP?

You can pose that question to your favorite Congressperson and newspaper.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY

ECRI says we are already in recession, since July.

http://www.cnbc.com/id/50015102/Ignore_039Fiscal_Cliff039_US_Is_in_Recession_ECRI039s_Achuthan

LikeLike

It feels like 1937 again, when deficit hawks convinced FDR to pull back on spending, just as the country was beginning to turn the corner on the depression, and plunging us back into an even deeper depression that took WWII to pull us out of. I wonder if the Republican strategists (not the ones you see on TV) know this, and this is their latest plan to win back the White House? I usually prefer incompetence over conspiracy when asked to explain policy choices, but you have to wonder if the PTB are really so historically ignorant. Then again, maybe they are…

I continue to believe actual new money, in the form of Greenbacks, would eliminate both the debt bomb and the austerity fuse (austerity leads to debt be decreasing output necessary to pay the debt; ask Greece or Ireland etc.).

We don’t need debt, we need money. And money need not be debt. Ask Lincoln/Zarlenga/Henry George/Ben Franklin, or me, about that.

LikeLike

A debt is a claim on value, or on worth, or on wealth. If you have a dollar in your hand, then you have a claim of one dollar’s worth of the “full faith and credit of the USA.” Meanwhile the USA is in debt to you for one dollar.

Since all money is a claim of value, all money is debt. No exceptions. Anywhere. Any time. No conceivable system of money is debt-free. (The type of currency is irrelevant.)

However, not all debt carries an interest rate.

For example, the U.S. government expects to spend $3.8 trillion in FY 2013. That $3.8 trillion will not carry an interest charge. It will function exactly the same as Civil War-era greenbacks.

Also in FY 2013, the Treasury will sell $901 billion worth of T-securities, since the Treasury expects to have a $901 billion deficit. However that is a separate matter.

Regarding the “debt bomb,” the U.S. government faces no debt bomb, and never will. If you mean consumer debt, then in some respects the bomb has already exploded (e.g. the housing bubble collapse) while in other respects the bomb is still ticking (e.g. the $1 trillion in student loan debt).

For the USA the only way out of the current depression is for private banks to start a new bubble (which will entail a consumer debt bomb) or for the federal government to dramatically increase spending (which politicians refuse to do, since they work for the 1%).

LikeLike

We currently pay some 20% of our tax dollars on the debt, so the debt is real, and it enriches the idle rent-seeking class, who are mostly already wealthy. Sure, there are some pension funds in there, but they could be invested in things like State Banks, earning a consistent return, while benefiting the State.

Taxes do not have to exist either, *IF* a truly sovereign government can create its own money. Since we do NOT have such a government, whether by ignorance or by choice, we do have taxes to “claw-back” money, making it appear as if only debt-money can exist. (We do need taxes to prevent resource monopolies and too much wealth imbalance, and to control inflation, but that is another matter).

Greenbacks are and were a whole different form of money, treated as not applicable to the public debt, by law (probably unconstitutional, but hey…), and not accretive to the debt when issued. The closest thing to them is coins, but these are awkward and in too small amounts to matter much.

The debt bomb is what people make it out to be. If they practice governance as if America is sovereign, it will be; if they don’t, it won’t be. Government violates the constitution all the time, and the “coin Money” clause is no different in that respect.

Have the Federal Reserve issue money without receiving Treasuries first, and than I’ll believe we can have sovereign money from them. Otherwise, have Congress authorize debt-free money instead, our longest-lasting and best currency.

LikeLike

[1] “We currently pay some 20% of our tax dollars on the debt…”

Federal tax revenue does not pay for federal government operations, nor does tax revenue pay for interest on T-securities.

[2] “Sure, there are some pension funds in there, but they could be invested in things like state banks, earning a consistent return, while benefiting the state.”

If you are referring to state-owned banks like the Bank of North Dakota, then I agree. I strongly advocate state-owned banks. Actually I think all banks should be owned by the federal government or by state governments so that banks do not run strictly on the private profit motive. Banking is one industry in which the private profit motive should be eradicated. Prisons are another.

[3] “Taxes do not have to exist either, if a truly sovereign government can create its own money.”

I agree that taxes are not necessary at the federal level, but some MMT people are stuck on the idea that federal taxes are needed to control inflation, and to maintain the authority of the fiat dollar. My view is that even if the MMT people are correct in this (which is questionable), then taxes (at the federal level) should be the last resort to control inflation and maintain dollar legitimacy. I want lower federal taxes, and more federal spending.

[4] “Since we do NOT have such a government, whether by ignorance or by choice, we do have taxes to “claw-back” money, making it appear as if only debt-money can exist.”

If you mean that the U.S. government has Monetary Sovereignty, but politicians pretend that the government doesn’t, then I agree. Politicians work for the 1%. The 1% want less federal spending, plus higher federal taxes, because this puts the public further under the heel of the 1%. What is federal spending but people helping people? When government spending is reduced, then people are forced to beg from bankers, from Wall Street, and from the 1%. Currently we have over $1 trillion in student loan debt, with no way for students to pay off the debt, since we are in a depression. And since student loans cannot be erased via bankruptcy, the students will be indentured servants for life, which is exactly how the 1% want it. Politicians could easily erase that $1 trillion debt, but politicians work for the 1%. Besides, the average American prefers to suffer. He whines and moans, but when you suggest a real solution, he smugly rejects it. His failing is not of intelligence of education, but of moral character. He is not “misguided.” He is a selfish idiot who prefers to be deceived. And the 1% give him what he wants.

[5] “We do need taxes to prevent resource monopolies and too much wealth imbalance, and to control inflation, but that is another matter.”

Perhaps, but we could do the same thing with laws. Of course, for that, we would need a world in which politicians were not so corrupt, and the public were no so stupid.

[6] “Greenbacks are and were a whole different form of money, treated as not applicable to the public debt, by law (probably unconstitutional, but hey…), and not accretive to the debt when issued. The closest thing to them is coins, but these are awkward and in too small amounts to matter much.”

If “greenback” means Civil War-era money, then yes, greenbacks had no connection with the federal debt, since the Federal Reserve did not exist. Other than that, however, greenbacks were identical to today’s federally issued dollars. The rub, today, is that the Treasury must sell enough T-securities to match the federal deficit each year. This is a stupid law, but the bankers and the 1% want the law to continue, since they want the public to (falsely) think that the U.S. government cannot spend any more money, since the government (falsely) has a “debt crisis.” And I repeat that all money is debt, in any type of monetary system. That includes greenbacks. However, not all debt carries interest, and not all money comes from bank loans.

LikeLike

We agree on most things, Mark, including what you’ve added in your own comments. Yes, I was referring to Civil War Greenbacks, which actually were our longest-lasting currency – 1862-1972 (1996 when Treasury burned their last stock of them), but only $351 million most of that time, so way too little to make much of a dent in the money supply. Still, it’s proof of concept, like coins.

True Greenbacks (aka United States Notes) are not debt if you take taxes away. Than, they would be come just “money.” since taxes, we agree, are not necessary to fund government, you can see where I’m coming from on this. I had this discussion with Byron Dale at the PBI conference last Spring, and, after some back-and-forth, in which he said the Note I was holding up was debt, he also agreed with me that if you untaxed the Greenback (and stopped calling it a “Note”) it would be debt-free money.

This is a concept few people are willing or able to get. So ingrained in people is the idea that you can’t get something for nothing, thanks to their own personal budgeting almost every day of their lives. It’s hard for people to accept, or even WANT to accept, that fiat money can simply be created.

Of course, inflation IS a tax of sorts, but producing real goods (Byron Dale suggests transportation infrastructure, but why limit it to that?), you would offset inflation with real goods and services. As goods and services expand to meet the new supply of dollars, it would be counter-inflationary.

My argument about preventing monopolies on resources and location is actually a Georgist argument, and well-proven. Aside from Sin taxes, Georgist taxes are the only truly “fair” taxes (not to be confused with the Fair Tax, which is Unfair).

Relying on people to be less “stupid” will only lead to tears, I’m afraid. Much better to change the incentive structure and let the market and human behavior adapt in human-friendly ways.

LikeLike

Scott, it’s a technical point, and we shouldn’t get bogged down in it but . . . by definition, every form of money is, and has been, debt. That is what gives money its value.

By necessity, all money in the history of the world, has been debt. Even gold was debt when it was used as official money rather than as a simple trading/barter commodity.

A dollar is debt because the government owes the bearer full faith and credit. Without that debt, the dollar would have no value.

“Full faith and credit” means:

–The government will accept U.S. currency in payment of debts to the government

– It unfailingly will pay all it’s dollar debts with U.S. dollars and will not default

– It will force all your domestic creditors to accept U.S. dollars, if you offer it, to satisfy your debt.

– It will not require domestic creditors to accept any other money

– It will maintain a market for U.S. currency

– It will continue to use U.S. currency and will not change to another currency.

– All forms of U.S. currency will be reciprocal, that is five $1 bills always will equal one $5 bill and vice versa.

That is the collateral for the dollar, and that collateral is what gives the dollar its value.

There never can be debt-free money. The issuer always owes the holder something.

LikeLike

Rodger – see my response to Mark.

Also, there is a difference between government debt and private debt. The dollar can be used to settle the latter without the government engaging in the former, in the case of direct-Treasury issuance of dollars, something that cannot be said, as a matter of seigniorage and accounting fact, in the case of Federal Reserve dollars. The seigniorage savings alone would amount to hundreds of billions/year.

LikeLike

We are still not on the same wavelength regarding money and debt.

Let me clarify it again.

In nations that have Monetary Sovereignty and a fiat money system, there are three ways that money gets into their economies:

1.Government spending

2.Bank lending. (Bank loans are money, since loans create deposits)

3. A trade surplus. (This does not apply to the USA, which has a trade deficit)

Banks and the government create money from nothing. They do it by changing numbers in digital spread sheets. But whereas bank-created money carries an interest charge, government-created money does not.

Nonetheless, government-created money remains debt-based. This includes greenbacks, plus all federal reserve notes (which themselves are green on the back.)

Debt-based does not always mean bank-originated. In the case of federal spending, “debt based” is a neutral term (unlike bank debt, which is often odious).

In any fiat system, a coin or a paper bill is a note (whether the word “note” is printed on it or not). It is currency, but it is not “money.” The money exists in the digital ledgers of banks. In the days before computers, money existed on the manually written ledgers of banks.

When you have a dollar in your hand, you have a claim to one dollar’s worth of that ledger money. That claim, that one dollar, is a DEBT that you own and control. You are the creditor. If you deposit that dollar in a bank, then you lend it to the bank. You are a creditor to the bank. (However you are a debtor to the bank if you take a loan from the bank.)

This is the way that all fiat money systems operate. (Ultimately all money systems in any form are fiat money systems, even when the currency is gold.) A dollar is a unit of account. It says you own a claim — a debt — of one dollar. Who owns that debt? Who is it owed to? >>YOU<<

Thus there can be no such thing as “debt free money.” But in the case of government-issued greenbacks, the debt is neutral (unlike bank-issued loans). If the dollar is in your hand, then you own the debt. If you spend the dollar, then the person who receives the dollar now owns the debt.

Because people do not understand the term “debt,” they falsely think all money is created as bank loans, including the $3.8 trillion that the government plans to create spend this fiscal year. Thus, they falsely think that all money comes from the Fed. Thus, they falsely think the U.S. government does not really have Monetary Sovereignty.

The bottom line is that when you call for the U.S. government to issue greenbacks, you are calling for the U.S. government to do what the government is doing already, only more so. And preferably without the sale of T-securities.

In short, you are simply calling for more government spending and / or lower taxes, which is exactly what Rodger and I want.

Furthermore, if I understand you correctly, you also want genuinely public (i.e. government-operated) banks. Again, Rodger and I agree with you.

The confusion arises because the dollar bill in your hand is a “greenback,” whether the money originated as a bank loan, or as government spending.

LikeLike

It’s really not the same whether the government issues money or the Federal Reserve does, for a few reasons:

1. Not only does the government not owe interest on the debt, it doesn’t owe principal either. That is, this new Money may be spent any number of ways, having nothing to do with the government paying a debt. If I pay you for a gallon of milk (assuming you are a grocer), you accept the Note because it has universal validity due to the government’s monopoly and Legal Tender status (“This Note is Legal Tender, payable for all debts…” etc.). But that’s really it (we’ve already agreed taxes are unnecessary in a truly sovereign Greenback system). There is no “background” debt where the government owes the Central Bank money because they originally issued Treasuries for dollars. THAT is the government debt under a Federal Reserve Debt-Money system, not what the consumer does with the dollar later. The debt is at the origination point, not when the bill circulates. (I’ll change my mind on this point when the Federal Reserve starts issuing money without being pain in Treasuries for it first – this is not a mere “accounting trick either,” it’s how the Central Bank makes billions, at least when rates aren’t nearly zero as they are now. I know the MMT people, and maybe the MS people too say rates should stay at zero, but history shows they won’t).

2. We don’t have to have taxes to pay the debt when money is issued directly from Treasury. MMT is fond of saying we can just issue whatever we need, but in practice, we can’t because of this restriction. MMT is simply wrong as well, when they say the Central Bank is part of government, by law (including a number of SCOTUS cases, by practice (the Fed resists even being publicly audited; what other gov’t agency even has a say about that?), and by the payouts it makes to the member banks – 6%/year; what other agency directly pays a private third party for non-contracted work?

3. This isn’t really proof that Federal Reserve Money is different than United States Money, but it is telling about the kind of control the banks have over the former: there are, by law, broker-dealers with whom the Federal Reserve must go through when buying up Treasuries. That is, they can’t just buy direct from the Treasury, but have to pay a fee to these middlemen to do so, and NO ONE says these broker-dealers – required by law – are not private.

4. The Federal Reserve is forbidden, again, by law, from buying government debt like Municipal or State Bonds, even though the municipal/state bonds are a tiny fraction of the debt the Federal Reserve has already spent on the banks. It’s not the money, it the law that gets in the way (well, perhaps the Federal Reserve philosophy too, but we don’t know that for sure).

I’m advising a plaintiff who is suing the Treasury for this very confusion, deliberately put forth by Treasury, as a result of institutional capture, among other things, both stipulated and not. You can read more about the case here: tompainetoo.com, under v. Treasury. My petition to re-issue Greenbacks: http://www.change.org/petitions/end-the-debt-crisis-with-debt-free-united-states-notes is exhibit 2, and I am in regular correspondence with the plaintiff, who just today advised me of the current appeal status:

United States Court of Appeals for the Ninth Circuit

Notice of Docket Activity

The following transaction was entered on 12/18/2012 at 3:48:53 PM PST and filed on 12/18/2012

Case Name: Clifford Johnson v. United States Department of th, et al

Case Number: 12-16775

Document(s): Document(s)

Docket Text:

Filed clerk order (Deputy Clerk: cb): Granting Motion (ECF Filing) motion to extend time to file brief filed by Appellant Mr. Clifford Johnson Appellant Clifford Johnson opening brief due 02/19/2013. Appellee Timothy F. Geithner answering brief due 03/21/2013, and Appellee United States Department of the Treasury answering brief due 12/21/2012. The optional reply brief is due 14 days after service of the answering brief. [8444919] (CB)

LikeLike

The argument about whether the Fed is or is not part of the Federal government could go on forever. The Fed (by law, which Congress can change) has a certain measure of independence, but its leaders are appointed by the government and answer to the government and can be fired by the government, and the Fed could be disbanded by the government, tomorrow.

Consider Bernanke the “general of the Fed army.” He consults with the President, but ultimately he fights the daily battles as he sees them, using the tactics he favors. But if the President doesn’t like the way the war is fought, Bernanke will be fired. Meanwhile, he is called before Congress, and asked for explanations, more often even than a general.

Some say the government isn’t really Monetarily Sovereign, because we don’t always act as though we were. But there are a fundamental differences between federal debt and local debt, and those differences are Monetary Sovereignty.

Whether or not you wish to acknowledge that the government owes the holder of a dollar full faith and credit (thereby making the dollar a debt), is of little consequence. It’s more of a semantic argument than a functional argument.

Rather than continue to argue about how many angels can dance on the head of a pin, we should agree there are perhaps dozens of ways in which the so-called “debt crisis” could end tomorrow, and none of them involve austerity.

Some involve minor changes in the law (for instance, eliminate the “Debt Limit,”) ; others require no changes at all (for instance, the Platinum Coin Solution).

But the real battle is against austerity. That should be our focus, and it begins with motive. That is, why do the government leaders, knowing exactly what we all know, continue to opt for austerity?

Will your lawsuit move us closer to that answer?

LikeLike

Yes, the lawsuit will move us closer in a couple of ways:

1. It will prove conclusively that the Treasury and the Federal Reserve are in collusion around a fundamental lie that involves hundreds of billions in lost seigniorage every year.

2. It will prove conclusively that we can have debt-free money. I find your argument that all money is based on debt less persuasive than the argument that the Federal Reserve is mostly independent of the government, though overseen by it. Next year will be the 100th anniversary of the FRB, and there is no institutional memory of how things were before that. That needs to be reawakened and the lawsuit would do that.

3. It will dovetail into the Positive Money movement, the American Monetary Association’s efforts (e.g. HR2990), and even some parts of MMT/MS, though not for diehards who insist on keeping things the way they are but just “re-understanding them.” Some Occupy people, not enough, are starting to get this too.

Today, the president endorsed his own plan for austerity that independent scorers rate as worse than falling off the fiscal cliff. The Republican counter-plan to keep the tax cuts in place for all but the people making a million and up is so absurd, they must think they actually won the election.

Of course, as you know, this is not even the argument we need to have. Adjusting the marginal tax rate, while gutting the middle class and elderly on SS and Medicare, more, or less, is really dancing on the head of a pin.

We need to have a different conversation, and it isn’t the one MMT is tagged with – that debts don’t matter because it’s money we owe ourselves, or if foreign creditors, than money we can just create. People have an instinctive revulsion towards debt, even if they are in it themselves, and a second revulsion towards money-creation (a problem for Greenbackers too, but one I think can be overcome by patriotic appeals to sovereignty, which aligning with the Central Bank, as MMT/MS does, cannot do).

Austerity does not work, but traditional Keynesians like Krugman and Reich, who just say “worry about the debt later” won’t cut it either. We have to offer a true way to eliminate the debt by not creating it in the first place, by creating truly sovereign money, U.S. Notes and coins.

Also, there is the issue of paying people yields on Treasuries for doing nothing, and of paying middlemen millions for “processing” fees. Neither of these is likely to appeal to the masses, as they can barely pay their rent and other necessities. MMT/MS endorses the status quo and is suspect because of that. Greenbacking does not.

LikeLike

Scott,

Federal “debt” is nothing more than the total of the T-security deposits in the Federal reserve bank. “Debt” can be eliminated by eliminating those deposits.

That requires changing the obsolete law that requires them, then stop issuing T-securities.

Contrary to popular myth, federal “debt” is not the necessary total of deficits. We can have deficits without debt and debt without deficits. The two are separate, connected only by an obsolete law.

All so-called federal “debt” could be eliminated tomorrow, merely by debiting all T-security accounts and crediting the checking accounts of their owners. This would require creating no additional dollars, so has no inflationary implications.

It’s identical with a bank debiting its savings accounts and crediting the holders’ checking accounts. Costs the banks nothing.

By the way, if you play Monopoly, your Monopoly dollars are debt, based on the rules of the game. You are owed the ability to buy Monopoly properties and to pay Monopoly debts — even to get out of jail. This debt is what gives Monopoly money value, in comparison with pieces of paper that are not Monopoly money.

You can make pieces of paper Monopoly money, by declaring that they adhere to the rules, with the agreement of the players. However, if you just put pieces of paper into the game without agreement of the players, those pieces of paper are not debt, and do not have value.

It is functionally and definitionally impossible to issue money that is not debt. The money issuer always must owe the holder collateral, often full faith and credit.

Gold is an example. When it is just a barter instrument, it is not money. If you use a $10 gold piece as a barter instrument, it is not debt, and may be worth more than $1,000 in trade.

However, if you use gold as money, that $10 gold piece is worth exactly $10, and is a debt of the U.S. government, the collateral for which is the full faith and credit of the government — not the metal value. It is full faith an credit that gives all coins their value. Same for all money.

If you start printing Scott-bucks, and try to pay me with your new money, I will ask, “How do I know this money is worth anything?” You will tell me it is collateralized by your house, by your car, or simply by your full faith and credit. Before I accept your Scott-bucks, I will evaluate your collateral.

Similarly, before I accept dollars, I have evaluated their collateral, the full faith and credit of the U.S. When nations experience hyper-inflation, citizens reject the value of the collateral.

But if you tell me there is no Scott-bucks collateral, not even your full faith and credit, I will assume those Scott-bucks are worthless.

If you don’t believe me, I would like to buy your car with Mitchell-bucks. I offer no collateral, but they will be in any denomination you choose.

Deal?

LikeLike

Rodger – If my Scott-bucks were as acceptable as, say, Berkshire bucks, it could be an alternate for of tender for payment of debt, but the only faith and credit than is that the issuer won’t flood the market with them, causing inflation, and that they will continue to be accepted in the future. It is not the issuing bank debt that gets absolved by my using the Berkshire bucks but mine. The bank actually collects on the seigniorage – the difference between production costs (which are minimal, or near zero, if done electronically, and the face value. It is only a liability to the issuer if, under double-entry accounting rules, the money has to be counted as a debt.

The AMI proposal, embodied in HR2990, seeks to change the accounting rules too, which I agree with, so that money is issued simply as…money.

I’ve spoken to an accountant, and he assures me there is nothing sacred or of natural law etc. about double-entry accounting rules. We can abandon that and make a new rule.

Of course, this is not how the banks operate today, but should we hold social justice hostage for a convention of accounting? I think not.

Of course we could eliminate the debt tomorrow. And the day after tomorrow, all those debt-holders would declare bankruptcy, not because their debts were unpaid, but because the interest was unpaid, and that was built into their future revenue stream calculations. I am NOT arguing for saving the rentier class!

However, we need to incrementally wean off the debt-based monetary system, by replacing debt-money with just money, created to fulfill a growing population and a base of goods and services. Money should exist in sufficient quantity to meet the productive capacity of the nation – we’ve already agreed on that. It must not go to the banks exclusively – I think we agreed on that too, but I don’t see how MMT/MS prevents that since it endorses the current creation of debt by a private (yes, it is) Central Bank. BTW, the leading stockholders of the FRB are all the TBTF banks, and who got the bailouts from the FRB – the TBTF banks. Hmmm….

LikeLike

Rodger writes, “It is functionally and definitionally impossible to issue money that is not debt. The money issuer always must owes the holder collateral, often full faith and credit.”

Yes, all fiat money systems involve debt, but not all debts carry an interest rate. Fiat money is not “based on debt.” Fiat money IS debt. Debt is a claim of ownership. In the case of a bank loan, the claim (the debt) carries an interest charge. In the case of simple money, the claim (the debt) does not.

But, as Rodger says, these are semantic issues. The battle is against austerity, which is to say, the battle is against public stupidity.

+++++++++++++++++++++++++++++

Rodger writes, “Before I accept dollars, I have evaluated their collateral, the full faith and credit of the U.S. When nations experience hyper-inflation, citizens reject the value of the collateral.”

Yes, hyperinflation means that citizens reject the value of the collateral. Citizens think their government and money system have no power, authority, or legitimacy. Hence the money has no worth. As the system collapses, the government can print more money, but this will not help.

Therefore, people who use inflation issues to reject the facts of Monetary Sovereignty do not understand inflation. They understand nothing. And they are proud of their ignorance.

Regular inflation refers to price increases, but it is problematic to base the inflation rate on changes in the general price index (e.g. the CPI). Rodger says (and I agree) that the main driver of inflation is energy prices. The prices of all goods and services tend to rise and fall with the price of energy.

In many ways, official inflation figures are political tools, like official unemployment figures. The U.S. government and corporate media always under-value the unemployment figures, and over-value the inflation figures of foreign governments that Washington opposes.

LikeLike

Inflation isn’t caused by energy prices, it is caused by speculation on energy. In the summer of 2008, a barrel of oil went for $147/barrel. 7 months later it went for just $35/barrel. Demand, meanwhile, went down maybe 10% (probably 5%, worldwide). What happened? Traders were forced to cover their margin bets; their credit was no good anymore. The oil market, like all commodity and land markets, is heavily manipulated.

This is another big reason to take money out of the banks and FIRE sector generally.

You can’t do that as long as it is a Central Bank issuing money.

You CAN do that if it is Treasury issuing money and putting it directly into public works (Oh, OK, there will have to be “holding” accounts, but these should be simple and not used for speculation until vendors are paid – a “lock box”). This is really a different way of doing things, of putting money directly into the productive class and away from the rentier class.

LikeLike

If inflation is caused by speculation on energy, and speculation affects energy prices, then inflation is caused by energy prices. Right?

The Treasury already puts money directly into public works: It’s called Medicare, Medicaid, Social Security, roads, bridges, dams, the military, food and drug inspection, all sort of research and development and the thousands of other federally funded benefits to the public.

That’s where the vast majority of federal spending goes. Which would you like to see eliminated?

Actually the Fed and the Treasury are mere functionaries of Congress, which makes the money decisions about the above-mentioned efforts. The Fed did not invent the fiscal cliff; Congress did.

LikeLike

Well, since you asked, I would like to see less spending on the military, which has about doubled its budget since 9/11 – we have better places to put that money, as well as allocating the labor it pays for in society, plus these external wars and military actions are making enemies of everyone (when the rest of the world catches up to our drone technology, there will be Hell to pay here).

But most of all, I would like to eliminate the 20% of our tax dollars that goes to pay the interest on the debt, completely unnecessarily, as we agree.

Congress, acting on behalf of the banks, knowingly or not, wishes to impoverish the rest of the country, so that the banks and other holders of our debt can continue to be relatively richer. This is a major reason why Congress must take back the power to “coin Money” on its own, and not have Treasury issue Treasuries to borrow what we could simply make.

I would also like to see a financial transactions tax. See here: http://www.huffingtonpost.com/ellen-brown/fiscal-cliff-desperate-ti_b_2319236.html to prevent speculation-driven commodity pricing that causes hardship here and actual starvation and death in third world countries. Goldman Sachs and other players in this deadly game have more deaths on their hands than Stalin and Hitler combined. Figures from the Bank of International Settlements show a multi-quadrillion amount of trading in the shadow banking system, all untaxed. Even a tiny tax of, say, 1/20th of 1 percent would be enough to replace income taxes….not that we need to tax incomes in the first place!

Sometimes I am amazed at what’s possible, while the ignorant and corrupted politicians only want to do the impossible – squeeze budgets to produce revenues. Ellen Brown, head of the Public Banking Institute, and author of the article linked above, also suggests zeroing out the debt with trillion dollars coins – a legal, albeit gimmicky, way of doing what Greenbacking would do over time too.

The fiscal cliff is obviously a Congressional creation, and the action upon it is both too little to matter, and completely unnecessary and counter-productive. On that we agree.

LikeLike

Scott, you said, “If my Scott-bucks were as acceptable as, say, Berkshire bucks, it could be an alternate for of tender for payment of debt . . .”

Why would Berkshire-bucks be more acceptable than Scott-bucks?

You also said, . . . “replacing debt-money with just money. . . “

If there were no debt, no collateral, associated with your “just money,” why would people accept it?

LikeLike

There doesn’t have to be collateral, there has to be acceptance and some belief that the Scott-bucks, or whatever, won’t be over-produced. I doubt Scott-Bucks would convince anyone, but a bank-issued Berkshire Bucks might (in fact, before the first legal tender law, banks, even taverns, produced regional money all over the country, not always neatly interchangable and trusted, but sometimes…).

Money, as Aristotle said, is a “legal creation.” When the first three issuances of Greenbacks were issued, people thought a strapped Northern States Congress would over print them and they were devalued relative to gold. But by the 1870s, they had appreciated back to their original value relative to gold, then passed it. By the 1880s, there was a Greenback party to promote them!

And they were backed by nothing but the belief that they could be used to pay taxes and all other debts (hey, if they can be used to PAY debts, how can they BE debts?!?)

LikeLike