Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

==========================================================================================================================================

Today, our politicians are struggling to find a way to reduce the federal deficit. They want to increase taxes (without increasing taxes) and reduce federal spending (without reducing spending). Reducing the deficit is known as “austerity” and austerity has had consistent results, down through the years. It causes new recessions and deepens existing recessions.

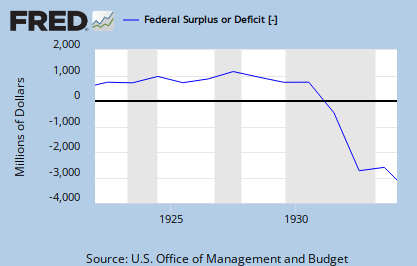

Here is a graph of federal deficits from 1901 through 2012. If you squint and count carefully, you’ll see we have had 22 recessions, an average on one recession every five years. (When the blue deficit line rises, deficits are being cut. When the blue deficit line goes above 0, we are in a surplus.)

1901 through 2012

22 recessions: On average, one recession every 5 years.

Although our economy is complex, and each recession has unique causes, Monetary Sovereignty posits that deficit reductions and federal surpluses have negative effects on the economy, by reducing money growth. Further, the politicians and media, being in the employ of the top 1% income group, tell you deficits should be reduced.

You might find it interesting to see facts, rather than to rely on intuition and the BIG LIE. You might like to see past deficits and surpluses graphed against recessions.

I’ve broken the years into segments, so you can see the individual recessions and what precedes them.

1901 through 1915

4 recessions; preceded by 2 surpluses; 1 reduced deficit

1915 through 1922

2 recessions; 0 surplus; 1 reduced deficit

1922 through 1933

3 recessions: 3 surpluses

1933 through 1949

3 recessions; 1 surplus; 1 reduced deficit

1949 through 1970

4 recessions; 2 surpluses; 1 reduced deficit

1970 through 1983

3 recessions; 2 reduced deficits

1983 through 1992

1 recessions; 1 reduced deficit

1992 through 2012

2 recessions; 1 surplus; 1 reduced deficit

Of the 22 recessions, 9 were introduced by federal surpluses and 8 others were introduced by deficit cuts. Only 5 came when deficits were increasing.

This post began, “Today, our politicians are struggling to find a way to reduce the federal deficit, also known as “austerity.” The growth rate of the U.S. economy this year has averaged a bit over 2%.

The euro nations’ politicians keep applying austerity. The result: Their economic growth rate this year is less than zero: a -.1% (minus growth rate).

Our politicians are working very hard to turn the U.S. into the eurozone and to lead us into another, probably worse, recession. President Obama’s “grand bargain” will accomplish that.

And he knows exactly what he is doing.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY

“Only 5 came when deficits were increasing.”

Hi Rodger-Can you give your readers some reasons or explanations as to why, even with increasing deficits, there were still recessions?

LikeLike

Steve:

There are many reasons for recessions, but fundamentally:

GDP = Federal Spending + Non-federal Spending – Net Imports

Deficits are the difference between federal spending and taxes. When deficits rise, federal spending still could fall (if taxes fall more), or Non-federal spending could fall (if personal debt increases), or Net Imports could rise (if inflation increases overseas).

Also, the money supply, which involves private bank lending, could fall, even when deficits rise.

As you can see from the graphs, it is comparatively rare for recessions to follow increases in deficits. For instance, the most recent recession, which was associated with the real estate bubble, probably would have happened no matter what deficits were doing, though increased deficits would have made it less severe and cured it faster.

LikeLike

Question: What causes recessions?

My answer: Mainly the credit cycle, combined with Washington politics.

When we ask what causes recessions, we ask what causes the business cycle — that is, what causes the GDP to grow or shrink. As Rodger says, there are several causes, but according to the Austrian school, the main cause of the business cycle is the credit cycle. (This is one area where I agree with them.)

There are two ways that money gets into the U.S. economy. One is by government spending. The other (and unfortunately much larger) is by bank lending. Bank loans (credit) are a form of money.

Bank lending goes through a credit cycle, i.e. an expansion and contraction of access to loans (or credit). The cycle itself has cycles within it, such as the real estate bubble, or the dot-com bubble.

The cycle works like this: In prosperous times, when corporate cash flow rises beyond what is needed to pay off debt, a speculative euphoria develops. People with money try to increase their fortune via gambling. They use leverage (i.e. bank loans) to buy things. As a result, asset prices (e.g. housing prices, or stock process) are subjected to competitive, leveraged bidding. This causes asset prices to rise. As speculation continues, fueled by easy credit, a speculative price bubble appears, along with a rising debt load. Since bank credit is easy to get, there is an increase in the part of the money supply that exists as bank loans (i.e. an increase in credit, along with debt). The result is a temporary increase in employment and economic growth. This puts us at the top of the credit cycle and the business cycle. (But it also puts us in killer debt.)

Eventually the debt burden becomes so high that the income and the speculation of borrowers cannot keep up with their debt obligations. Sooner or later, some key player in the game collapses (e.g. Lehman Brothers, which was the fourth largest investment bank in the USA). This collapse causes a chain reaction. The bubble pops. The economy falls into a recession. (Speculative bubbles are extreme examples of the credit cycle, but they highlight the basic process.)

That’s where we are now, and Washington politicians want to worsen the depression via austerity.

At the bottom of the business / credit cycle, if the U.S. government will not increase the money supply via increased spending and / or decreased taxes, then the recession becomes severe, which is where we are now. At that point there are only three possible solutions to the depression. That is, three ways to start an upswing in the credit and business cycle.

1. The USA becomes a net exporter. (This won’t happen.)

2. Wall Street develops a new credit bubble. (This cannot happen, since there must be a minimal amount of overall prosperity in the real economy for a bubble to get going.)

3. The U.S. government increases the money supply via increased spending and / or decreased taxes. (Unless the U.S. government declares a world war, this probably won’t happen, since politicians are owned by the 1%. Obama wants nearly $1.6 trillion in additional taxes over the next decade, plus $600 billion in cuts to social programs, including $350 billion from Medicare and other health programs.)

Regarding bank credit, I regard it as analogous to a mixture of methamphetamine (for high energy), MDMA (for speculative euphoria) and LSD (for hallucinogenic denial of reality). The drug cocktail of bank credit produces a “high,” plus a brief frenzy of activity, but the toxins (i.e. the debt) take a terrible toll on the body. When the drug wears off, the body is exhausted.

At that point, the body needs healthy nourishment free of toxic debt (i.e. needs increased government spending and / or decreased taxes). But politicians and the 1% say the cure is starvation (austerity).

And the masses believe this. Thus, the national body dies, just as a person with anorexia nervosa starves himself or herself to death.

LikeLike

Mark or Rodger, could you elaborate a bit more on bank loans? What exactly do you mean by calling them “a form of money”? Aren’t they created out of government money held by the bank prior to lending? I hear “loans create deposits” a lot. I also hear banks’ lending may sometimes cause their reserve balances at the fed to go negative; I take it, an overdraft situation that they are expected to remedy? Thanks in advance.

LikeLike

When a bank lends you money, it merely credits your checking account, which creates dollars.

When the reserves get too low, the bank borrows from the federal government, to bring its reserves back up. Because there is no limit on this, reserves really are not a limit to bank lending. The only real limit is the bank’s own capital.

LikeLike

Okay, my checking account is credited, hence dollars are created for me to spend. Isn’t some asset account of the bank’s debited simultaneously? Or is that exactly what you mean by pointing to the bank’s capital as the limit?

As for reserves question, a loan transaction trickles towards the bank’s reserves at the fed, but that’s not a hard limit as the fed lends to the bank in turn. Is that the right interpretation?

I am not sure if I understand (maybe I am not equipped to). Is a bank loan money out of the blue as fiat money is?

LikeLike

@ NIHAT

Banks and the U.S. government both create money out of nothing by changing the digital accounts in computerized spread sheets. When a bank lends, or when the U.S. government spends, they simply credit accounts – that is, they change the numbers in digital ledgers. In both cases, money is created. In both cases, debt is involved, but it is not the same kind of debt.

For a bank loan, debt is the interest charge. For government spending, debt arises in the process of selling T-securities. Bank debt is killing us. Government debt is trivial.

Interest on the national debt is the third largest destination of government spending (after Social Security and the military), yet this is trivial because the government can always create more money. And the interest paid is a way to get money into the economy. Moreover the government could stop selling T-securities altogether of it wanted to. (Rodger and I wish it would.)

If the banks and the government both create money from nothing, and if the government can always create more money, then can banks always create more money as loans? Yes, but banks have their own debt obligations. If I get a million dollar loan from Chase, then I am in debt to Chase for a million, plus interest. If I deposit that million in a savings account at B of A, then B of A is in debt to me for a million, plus interest.

Thus, banks create loans money from nothing, but banks are also in debt to depositors, and to other banks.

Unlike the U.S. government, a bank cannot simply erase its debt. If a bank’s books get out of balance, the bank becomes insolvent. By contrast the U.S. government is almost always out of balance (i.e. runs a budget deficit), but this doesn’t matter, since the U.S. government is not constrained in spending.

On a different note, let’s repeat Rodger’s comment above. “When the reserves get too low, the bank borrows from the federal government to bring its reserves back up. Because there is no limit on this, reserves really are not a limit to bank lending. The only real limit is the bank’s own capital.”

Translation: contrary to popular opinion, banks no longer engage in fractional reserve lending. People cling to this myth as blindly as gold bugs cling to their imaginary gold standard. I wish Rodger would write a post that further clarifies why fractional reserve banking is a myth.

Nihat asks, “Okay, my checking account is credited, hence dollars are created for me to spend. Isn’t some asset account of the bank’s debited simultaneously? Or is that exactly what you mean by pointing to the bank’s capital as the limit?”

The bank logs your deposit as both an asset and a liability (that is, a debt) since you have merely lent your deposit to the bank, and you may get back your deposit any time you wish. Thus, when a bank boasts that it has a zillion in assets, the bank is also a zillion in debt.

Likewise the U.S. government has a debt of $16.2 trillion, but also has $16.2 trillion in assets. The debt hawks don’t want you to realize that. They want you to think that standard double-entry bookkeeping is okay for banks, but does not exist for the government. They want you to think the U.S. government is in debt by $16.2 trillion. Period. And YOU are personally on the hook for over $51,400. So pay up NOW by submitting to higher taxes and lower government spending! Submit to poverty and the depression. It’s your moral duty to give Social Security to Wall Street criminals!

Nihat asks, “As for reserves question, a loan transaction trickles towards the bank’s reserves at the fed, but that’s not a hard limit as the Fed lends to the bank in turn. Is that the right interpretation? I am not sure if I understand (maybe I am not equipped to). Is a bank loan money out of the blue as fiat money is?”

Yes. Bank loans and government spending are two different sources of money, but both use fiat dollars.

As I see it, the problem with American society is that too much of the money supply comes from bank loans (e.g. the massive student loan debt) and not enough comes from government spending.

Of course, if we call for more government spending, then most people react (in knee-jerk fashion) that we are calling for no banks at all, which is absurd, since ALL money requires banks in some form. Government spending only become money when it is logged on the computerized ledger of some bank. Banks are keepers of the spread sheets. Unfortunately we have given private banks far too much power to issue money in their own. Hence consumers are loaded down with crippling debt. Today, every American ultimately works for bankers and Wall Street.

It’s insane.

LikeLike

Mark, thanks a bunch… I really appreciate Rodger and you, your passion and knowledge. I think I got thorough answers to my questions.

LikeLike

“It is dangerous to be right when the government is wrong.”

The debt limit is an effective way to control “Spending&Deficits”

(which some individuals like the 99 per centers who is led to believe

Plain truth is that the debt limit does not affect the “deficits or surpluses.

The critical revenue and spending decisions are made during the congressional

budget process.

The debt ceiling is a cap on the amount of securities the Treasury can issue,

something it does to raise money to pay for government expenses. These

expenses, and the deficit they wrought, are a result of past actions by

Congress to create entitlement programs, make appropriations and cut

taxes. In that sense, raising the debt limit is about paying for past expenses,

not controlling future ones. For Congress to refuse to let the Treasury raise

the cash to the pay the bills that Congress itself has run up simply makes no sense.

Republicans are doing the squawking now because there is a Democrat in the

White House, But back when there was a Republican president, Democrats did the

squawking. Back in March or April of 2006-(not sure the month)-there was one

Democratic senator in particular denounced George Bush request to raise

the debt limit. The fact that we are here today to debate raising the debt limit

is a sign of leadership failure—repeat again “leadership failure, the senator

thundered. “Increasing the debt limit, weakens us domestically and internationally—

Washington is shifting the burden of bad choices today onto the backs of our

children and grandchildren.

That senator was “our President—Barack Obama –failure of leadership.

LikeLike

The debt ceiling is crazier even than what you said. It is an attempt to prevent the U.S. paying for debts already committed. It’s like you spending money, then refusing to pay your bills.

Anyway, “The debt ceiling is a cap on the amount of securities the Treasury can issue, something it does to raise money to pay for government expenses,” is not quite correct. The federal government does not “raise money to pay for government expenses.

The federal government creates dollars ad hoc, by paying its bills. If issuing of T-securities fell to $0, the government still could pay all it’s bills. This became true in 1971, when the government became Monetarily Sovereign. Today, T-securities serve no useful function.

LikeLike

LW, the debt ceiling is simply a political tool; a way for the minority party in Congress to gain leverage for what it wants. When Republicans are the minority, and they want to slash spending on social programs, they refuse to vote yes on raising the debt ceiling until Democrats agree to cutting social programs. When Democrats are in the minority, and they want less money for wars, and more for social programs, they refuse to vote yes on raising the debt ceiling until Republicans grant them concessions.

It is usually Republicans who use the debt ceiling tool, since this is the only way that Republicans can possibly get cuts in social programs. Average Americans say they want a balanced budget and a smaller debt and deficit. However, average Americans don’t want their Social Security or Medicare cut, and they don’t want to pay higher federal taxes. In the face of opposition from the public and from Democrats, the only way that Republicans can get away with slashing social programs is by holding out on the debt ceiling vote, which comes after the budget vote. This is how the Republicans created their ridiculous fiscal cliff, which Republicans are now whining about.

Democrats controlled both houses of Congress from 1979-1995, during which time they effectively abolished the debt ceiling. Republicans brought it back when they retook Congress in 1995. Their disastrous “Contract With America” was about deregulating banks and Wall Street, while cutting federal spending so drastically that America became dependent on bankers and Wall Street.

LikeLike

Nihat,

Dollars, which have no physical substance (they merely are accounting notations) always are “created out of the blue” — in two ways, and destroyed in two ways:

1. Lending creates dollars; paying back loans destroys dollars

2. Federal spending creates dollars; federal taxing destroys dollars.

Since a dollar has no physical substance, and is nothing more than a statement of debt, all financial debts are dollars (or some other currency). If I lend you $1,000 and you give me your note, you have my $1,000 and I have your note.

Both the $1,000 and the note are part of the money supply (“Debt Outstanding Domestic Nonfinancial Sectors,” the broadest money measure.)

LikeLike

Thanks Rodger. I don’t want to be obstinate, but I have no hangups about “money things.” Rather the gist of my question is this.

Say, I am very rich, and have set aside $10M to lend out to people with good ideas. Venture capitalist, right? But I am lending out from funds that already exist (not in physical form necessarily but as a spreadsheet entry, as a positive liquid asset balance I am holding). The loan dollars I give out are therefore not out of the blue! And I am not going to call them “destroyed” when they are paid back to me. Are you saying that a bank loan is fundamentally different from this?

I kinda suspect it is not fundamentally different, but there is a language issue here. Something is occurring to me as I am writing all this. From the points of view of the bank customer borrowing from the bank, and of the private sector receiving federal spending, the monies that become available to them thus are subsequently returned to their origination point. To these users of money, they are as good as any, and they are no longer available to them once paid back. Hence, the creation/destruction terminology you use is meant to be from the point of view of the user of those dollars. Am I right?

LikeLike

Let’s say you give someone $10M. That person gives you nothing. You now have less money and they have more money.

Now contrast that with lending someone $10M. They have 10M dollars and you have their note for 10M dollars.

Look at a dollar bill. It says, “Federal Reserve Note.” All you two have done is exchange notes. You lent him 10,000 federal reserve $1 notes and he lent you his personal note.

At the end of some time, he will return your federal reserve notes, and you will return his personal note.

So before the loan there were 10,000 dollars, and during the period of the loan, there were 20,000 dollars, and when the loan is repaid, there again are 10,000 dollars.

That is why “Debt Outstanding Domestic Nonfinancial Sectors is the broadest definition of money.

LikeLike

Alright, Rodger, now I got your meaning.

Not to keep on arguing, but I see a fundamental difference between money creation by way of federal spending and by bank lending as you explain above. The federal government, rather the monetarily sovereign authority adds money to the system when it spends, and this is literally an “addition” operation as in getting a positive result by adding a positive number to zero. The bank lending described above adds money to the system by way of leveraging existing funds, i.e., by a “multiplication” operation, and you can’t get a positive result by multiplying zero with any finite number. I guess, prior to your explanation, I kept viewing money creation as a strictly additive operation.

Thanks for bearing with me.

LikeLike

One minor clarification on the above.

Supply and demand says that more supply will be match by an equal decrease in value. Less supply will be matched by an equal increase in value.

So an increase in the amount of money, lika all else, is matched by a decrease in the value. A decrease is also matched by an increase in value.

Adding more currency doesnt do anything, it does not add purchasing power. It actually steal from the savers as well as those on fixed incomes and those at the bottom of the food chain. The same folks deficits are suposed to ‘help’.

Roger please note that your readers think the government adds purchasing power when it increases deficits, not true at all.

LikeLike

You forgot about demand. Currency is added to the economy by increased federal spending and/or decreased taxes, either of which adds to GDP (aka “purchasing power).

LikeLike

The way I see it, dollars are subject to supply and demand, but not in the same way as commodities.

For finite physical commodities, supply-and-demand has a straightforward meaning. Less commodities and / or more demand for the commodities leads to higher prices.

For infinite, non-physical fiat currency, supply-and-demand have a double meaning. One meaning involves scarcity (just like commodities). The other involves faith in the government, plus faith in the banks and the monetary system. (With a commodity like food or petroleum, we don’t need to have faith that it will serve us.)

A rise in prices can mean a loss in “value” of dollars, since more dollars are needed in an environment of rising prices. This involves scarcity.

However, dollars can lose “value” even when prices are not rising, and there is no scarcity of dollars. If the public loses faith in the government, and loses faith in the banks and the money system, then the currency becomes worthless. If the government tries to compensate by printing money, we have hyperinflation.

For MMT people, federal taxes are necessary to create scarcity of dollars, thereby increasing demand for dollars, thereby controlling inflation. This is an article of blind faith for MMT people, and they will not budge. Even when they agree that an alternate view is totally correct, they say the alternate view is wrong. This same blind stubbornness also applies to their opinion that federal taxes are necessary to maintain the authority of the fiat dollar. Even when they agree that an alternate view is totally correct (that state, county, and municipal taxes can do the same thing), they say the alternate view is wrong.

For Rodger and me, demand is best maintained, and inflation is best avoided, via the proper use of interest rates. Federal taxes should be the LAST RESORT to control inflation. I’d like to see all federal taxes abolished completely. The only way I would agree with the MMT people is if the USA did away with banks and with the selling of T-securities, and the U.S. government simply wrote checks. In that case then, yes — we might consider federal taxes as a way to regulate inflation by regulating the money supply.

Put another way, MMT people favor maintaining demand via taxes and artificial scarcity, whereas Rodger and I favor maintaining demand by boosting the perceived value of dollars, via higher interest rates. We can regulate the prices of a commodity by controlling its supply, or by controlling its “richness” or perceived value, regardless of supply.

Maybe I’m a bit extremist on this, but federal taxes of any kind drive me up the wall. They are a convenient way for the 1% to further enrich themselves by imposing needless austerity on the economy.

Of course, for MMT people, the 1% and their puppet politicians are simply “misinformed.”

LikeLike