Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Austerity = poverty and leads to civil disorder.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

Marshall Auerback is a hedge fund manager who seems to understand the fundamentals of Monetary Sovereignty and economics in general. So I was a taken aback by his article referenced in the Naked Capitalism blog site:

Top 5 Reasons Why Raising the Minimum Wage Is Good for You and Me

In recent months, a number of states have again taken the lead on measures to raise the minimum wage. Massachusetts is moving toward a minimum of $10 per hour. Other measures are on the table in New York, Illinois, New Jersey, Connecticut and Missouri. Meanwhile Sen. Tom Harkin, D-Iowa, is pressing for the federal minimum wage to rise to $9.80 per hour by 2014.

Here are five reasons why we should cheer for working America getting a raise.

1. Good for Families: According to economist James Galbraith, raising the minimum wage would raise the incomes of 28 million Americans. Women would particularly benefit because they tend to work for lower wages than men. As Galbraith sees it, raising the minimum wage is family friendly policy:

With more family income, some people would choose to retire, go back to school, or have children, making it easier for others who need jobs to find them. Working families would have more time for community life, including politics; Americans would start to reclaim the middle-class political organization that they once had. Because payroll- and income-tax revenues would rise, the federal deficit would come down. Social Security worries would fade.

Wait a second, “Raising the minimum wage would raise the incomes of 28 million Americans,” and raising people’s pay encourages them to retire? Am I the only one who sees a disconnect, here?

With higher pay, working families will have more time for politics? Huh? And reducing the federal deficit is a good thing? Marshall, have you forgotten all you know about Monetary Sovereignty?

2. Good for Economic Recovery: To get the economy back on track, spending power has to be in the hands of those who actually spend in the real economy. That means regular people, not the super-wealthy who tend to hoard wealth or invest in financial products.

Every “investment in financial products” transfers dollars from one person to another. The dollars keep moving, from one bank account to the next, and during this process, some are spent.

Minimum wage makes automation more attractive, which leads to unemployment.

3. Helps People Get Out of Debt: As our economy has become increasingly directed toward Wall Street and the so-called FIRE (finance, insurance, real estate) sectors, more wealth has migrated to the top 1 percent. On top of that, real wages have increasingly lagged behind the growth in productivity. It is also clear that hours worked and persons employed in the “productive” sector have been in decline over the last few decades.

This all may be true, but is irrelevant to the question of minimum wage, which generally is paid to people with the lowest productivity (their productivity is not enhanced by computers). Giving them raises won’t increase their productivity, nor will it have a meaningful effect on the income gap.

An increase of a couple of dollars per hour or more in the minimum wage could make huge improvements in the difficult existence of the working poor, perhaps allowing them to exit the debt treadmill and stand a better chance of eventually rising into a revitalized middle-class.

Or, they could be fired as too expensive — to be replaced by machines.

Admittedly, corporate profits might suffer a little and some businesses at the lowest end might disappear. That said, corporate profits as a percentage of national economic output are already at an all-time record levels. And it’s questionable whether such levels of profitability can be sustained. Firms have lots of unused capacity lying around because people can’t afford to buy products and services. Sluggish sales growth is directly connected to lagging wage rates.

Raising the minimum wage will do little to correct “lagging wage rates,” most of which are far above the minimum rate. Firms have unused capacity, which mitigates against inflation. Reduce that capacity, and prices will rise, hurting all workers.

At the same time, dependence on food stamps has surged by over 14 million over the same period. And “financial engineering” has helped to create a significant escalation in debt being borne by the private sector, particularly consumers.

Food stamp usage has surged because we still are in a recession. Raising the minimum wage merely reduced business profits, but does nothing to cure the recession. Increased federal deficit spending is needed for that.

4. Protects Workers From Abuse: A higher minimum wage would also help to mitigate the abusive, exploitative working practices of a number of employers, who take advantage of the currently low minimum wage to seek cut-rate help. Such employers often use undocumented labor, which further undermines America’s working poor.

By definition, the current minimum wage always is “low,” so employers paying the minimum wage always can be accused of “taking advantage. Undocumented labor will not be helped by increases in the legal minimum wage.

5. Justice for Working Americans: The past 30 years have witnessed a dramatic redistribution of national and personal income in favor of profits for the rich. At the same time, this period has been associated with a dramatic decline in the performance of the US economy. To raise the minimum wage would be literally the minimum we could do for those who have suffered from the economic crisis: the working population. It would be an act of justice.

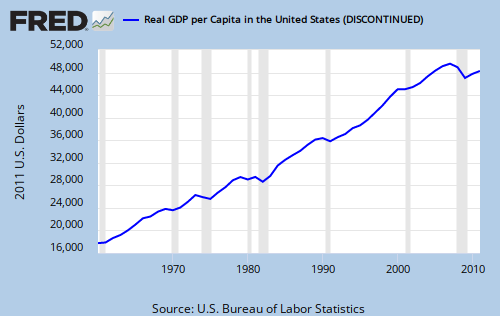

He says the past 30 years have “been associated with a dramatic decline in the performance of the US economy”? Really? His definition of “performance” must be different from mine. Here is the Real (inflation adjusted) Per Capita Gross Domestic Product for the past 50 years:

That looks like pretty good performance growth, but for the current recession period.

Bottom line, minimum wage laws do have some benefit. They prevent employers from being too exploitative and paying desperate workers starvation wages. But there is a downside — a major downside: Businesses measure production value of each asset, including employees.

As employee costs goes up, businesses look for alternatives, like mechanization and shipping jobs overseas. So minimum wage runs head-on into unemployment. Further, it does nothing at all, for the vast majority of people who already receive more than minimum wage, but still are part of the 99% lower income group.

Finally, minimum wage does not add dollars to the economy, so is not stimulative. It may, in fact, subtract dollars from the economy, as overseas payrolls increase.

All 5 of Mr. Auerback’s goals can be accomplished with the following nine steps, none of which involve minimum wage:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America

In short, the solutions lie with added government deficit spending, not with added burdens to business.

Rodger Malcolm Mitchell

Monetary Sovereignty

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

I was also surprised by Marshall’s latest post. Why increase the minimum wage? Why not just lower taxes on those workers? It seems that the latter 1) put let’s stress on businesses and 2) increases aggregate demand (gives more dollars to those who need them the most without taking dollars away from others).

Though, I do think I disagree with you about progressive taxation. I think there is value in less income equality. But I definitely agree with you that it’s better we do things to bring up the bottom than tear down the top. I’d support a bit of both… so long as the “net effect” is an increase of dollars in the economy.

LikeLike

Number 7 is a non starter with me, even though I understand where it is coming from. This would effectively give everyone the impression that the whole economic system is rigged (it is in any case). Number 7 would effectively give the 1% even more political power than they have even now because they own the vast majority of the corporations public and private.

Replace number 7 with the minimum wage and make it a serious increase as this would drive out exploitation. (we do not want it here anyway).

Combined with 5 and 6 and your ideas about retirement and automation from the other day a lot of progress could be made with the people that would lose jobs as a result of a higher minimum wage.

LikeLike

Keeping the corporate tax, while adding a higher minimum wage to the corporate burden, is not the way to build the economy.

Corporate profits are what pay salaries. The last thing you want to do is make our corporations less profitable. Corporations are the geese that lay the golden eggs. Feed the geese; don’t punish them.

LikeLike

“As employee costs goes up, businesses look for alternatives, like mechanization and shipping jobs overseas. So minimum wage runs head-on into unemployment.”

Static employee costs would run into those same problems.

LikeLike

You are correct. And that is exactly what has happened. Raising the minimum wage hastens the process.

LikeLike

Roger,

I agree with your criticisms of Auerback. Re your nine “steps”, obviously they solve plenty of problems, but I don’t think they have much to do with the SPECIFIC PROBLEM that minimum wages give rise to.

This is that the marginal product of labour declines with increased numbers employed. I.e. labour suffers from diminishing returns like everything else. So if the min wage is $X/hr, employers will employ people up to the point where the output or “product” of the least productive employee is $X/hr. And that’s it: they won’t employ any more.

The solution to that, seems to me, is to allocate JG people to existing employers (public and private). The availability of small number of employees which cost the employer less than $X/hr, or which cost the employer nothing at all, would solve the above “marginal product” problem.

LikeLike

Ralph, I agree with your first two paragraphs.

JG would merely doom more and more people to non-productive jobs.

One long term direction might be described in: https://rodgermmitchell.wordpress.com/2012/08/02/new-paradigm-ii-what-are-your-plans-for-the-age-of-disemployment/

LikeLike

Rodger,

Will your plan ensure that no American lives in poverty? I ask because, ideally, that should be the goal of the minimum wage.

Thanks,

Tyler

LikeLike

It’s bloody damn easy to eliminate poverty. A BIG & a JG. Problem solved. OK, won’t eliminate poverty amidst monks who’ve taken vows of poverty, but then we can have JGers force-feed them Thanksgiving Turkey everyday, make ’em live in McMansions & play videogames all day at gunpoint.

One enormous aspect of poverty is homelessness. The country I grew up in, called the USA, had no homelessness. Now there are droves. And this is an economy which has done well over the past few decades? Ha! Sadly, that USA no longer exists, and people work hard to make others forget it ever did. The main thing, above all is to eliminate the new American can’t do attitude. Can-Do, which the USA was once famous for, moved to China I guess.

LikeLike

Tyler, no plan can make that guarantee.

1. Even the proposed minimum wage is far below poverty level in expensive locations (Manhattan, for instance).

2. The minimum wage applies only to people who want a job and who have a job. It doesn’t apply to people who do not wish to work as someone’s employee (an entrepreneur, a student, an intentional vagrant), or to someone who wants a job, but can’t find one.

My proposal, if enacted, would reduce poverty, which a minimum wage would not (for the reasons I’ve given in the post).

Rodger Malcolm Mitchell

LikeLike

Rodger, you are arguing basically neoclassically, microeconomically, except for the good points about foreign leakage. Raising the minimum wage might not be the best policy, but it may be an attainable policy. The question is whether a higher minimum wage right now would do some good, and Marshall’s answer, IMHO correct, is yes.

Or, they could be fired as too expensive — to be replaced by machines.At times like these, this will almost certainly not be the dominant effect. Of course unemployment would result if we raised the wage to $100/hour.

A point (see Marshall’s #2) is that reasonably raising the minimum wage should increase employment now, not decrease it. The increase in demand from the quickly spent extra money in the workers’ pockets should more than support the additional hiring and the salary increases, and will not punish the employers; sales & profits should increase too. It’s a magic win-win for everyone. It will help just about everyone, including the ones you say it won’t help. Major corporations are sitting on a ton of cash. In more ordinary times, which a minimum wage raise should help bring us back to, they would invest & expand hiring & production. They don’t want to have it in Treasuries. But, they have no reason to do so now. Yes, sure deficit spend more. But raising the minimum wage at present will enable a given amount of deficit spending to have a greater economic effect.

In other words, Finally, minimum wage does not add dollars to the economy, so is not stimulative. is wrong. It won’t add NFA dollars, but it should add bank dollars. Should act somewhat like a “balanced-budget multiplier”.

minimum wage, which generally is paid to people with the lowest productivity No, minimum wage workers are far more productive than the people with the lowest productivity, stuck in their dead-end, mindless, make-work, but often fabulously remunerative jobs: Corporate CEOS, economic policy makers, the military, mainstream economics academics, bank & financial sector management. All of these have enormous negative productivity, and the economy would do a lot better if they were all instantly replaced by today’s minimum wage workers, or probably even homeless bums. (Couldn’t resist)

LikeLike

Australia’s unemployment rate is 5% and their minimum wage is more than double that of the United States.

LikeLike

The minimum wage is just one of dozens — no thousands — of factors affecting unemployment. Each nation has different circumstances.

All other things being equal, the higher the wage, the greater the incentive to reduce wages by cutting employees.

LikeLike

The single most important motive for mechanization is wages. Employers tend to mechanize to reduce wages, and the motive becomes stronger as wages rise.

Employers weigh the cost of machines vs the cost of employees, and when the cost becomes lower for machines, they buy machines and fire employees. Having owned several companies, I’ve been through that analysis many times.

LikeLike

Australia’s minimum wage has not prevented them from having a significantly lower unemployment rate than the United States.

A study on the minimum wage: http://emlab.berkeley.edu/~card/papers/njmin-aer.pdf

LikeLike

So you believe a rise in wages does not affect automation?

I suspect the studies that “prove” otherwise do not take time into consideration. That is, when wages rise, companies are motivated to look for automation. This takes time, often years.

The auto unions’ drive for ever higher wages and benefits motivated (and still motivates) the auto companies to automate. So today, we have robotic car construction. The purpose: To reduce employment.

So far, the Industrial Revolution has not had an adverse effect on employment, because the introduction of “dumb” machines created jobs in addition to eliminating them.

However, the future is with “smart” machines. McDonalds will not need to hire people to ask “Fries with that?” A robot will do it — a robot that understands English — something like Watson, the robot that won Jeopardy.

Rather than forcing employers to pay more, why not have the government pay more by providing more benefits — health care, retirement, food, shelter?

The government can afford it; business cannot. Minimum wage is the just government’s way of passing its obligations on to the private sector.

LikeLike

I don’t disagree that a rise in wages affects automation. Perhaps the federal government should send an annual check for $30,000 to every employed American with a salary below $30,000.

LikeLike

Do you think that employers, rather than paying salaries between $30,000 – $60,000, simply would pay $29,000 and let the government do the rest?

Actually, that might not be a bad idea. It would benefit businesses and employees, at no cost to anyone.

LikeLike

i totally disagree. government should increase the minimum wage and lower taxes to those businesses who have minimum wage employees.

rodger, you say the government should allow business to pay people to work all day way below a living wage and then the goverment can just pay people money directly to make up the difference.

i say that business should pay a living wage for full-time work or they should not exist. so, if business is having a hard time doing that then perhaps government can assist them with tax cuts and/or grants.

i believe that the proper role of business in society is twofold: to provide the currency issuing authority (in our case, the federal government) with goods and services and as a device to provide enough currency to the public to extinguish their tax obligations and to fulfill their net savings desires.

a business should NOT be solely a private (ad)venture. i think when you allow it to be just that, then a class of people comes into existence totally disconnected psychologically from the non-business-owning sector. they come to think that workers exist just to “used” and it doesn’t matter how much they’re struggling to survive as long as the work gets done and they make a sizeable profit.

you’ve said on other threads that you believe that banking should be “socialized.” i say that business should also be socialized, for essentially the same reasons you posit for banking.

at any rate, i understand that for business owners the private (ad)venture, not to mention the profits potentially flowing from that, is the “lure.” but if you allow business to be solely a private (ad)venture, then you get all the problems we have today, with the corporate and banking classes (successfully) lobbying congress to maintain government spending at dangerously low levels and even clamoring for even more draconian cuts.

i think with adequate government support to business, they would be able to make a profit and meet their obligation to society by paying the non-business-owning public a living wage.

in order for currency issuance to work towards public purpose, all currency issuing entities, and by that i mean banks and businesses, must act as agents of the currency issuing authority, the federal government. the problem we have now is that it’s working the other way around–the government is working for the (big) banks and (big) business.

LikeLike

Rodger,

Would you support a federal law making it illegal to have an income exceeding $20 million? Such a law might reduce the income gap.

Here’s an interesting article: http://www.huffingtonpost.com/2013/06/07/walmart-shareholder-meeting_n_3402520.html

LikeLike

No, I seldom support laws that punish or restrict the rich. I don’t support high taxes on the rich, and I don’t support restrictions on income.

But I do support laws that lift the “unrich” — increased Social Security benefits, free Medicare for everyone, aids to education, housing, food.

In short, to close the gap, lift the bottom rather than restricting the top.

LikeLike

Wouldn’t a maximum income law force the rich to lift the unrich by paying them more?

LikeLike

Not that I can see. There was a time when the top income tax rate was 93%, which is similar to your proposal. It did nothing for the poor.

The rich found ways to avoid the restriction, as the rich always do, and even if by some miracle, the government closed all loopholes, companies would rather lower prices than increase the salaries of the lower-income people.

Look at Walmart, for example. The company is profitable, yet the people are at minimum wage. Reduced salaries for the top, would simply pay for even lower prices.

LikeLike