Mitchell’s laws: The more budgets are cut and taxes inceased, the weaker an economy becomes. To survive long term, a monetarily non-sovereign government must have a positive balance of payments. Austerity = poverty and leads to civil disorder. Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

In the 9/14/11 post titled, “How about socialized banking,” and elsewhere, I have suggested that all banks be federally owned – i.e. the elimination of private banking.

I gave the following reasons:

No bank ever would become insolvent. There would be no “runs” on banks by depositors. Savings would be 100% protected. The lack of a profit motive would eliminate “credit default swaps” and other risky investment derivative beasts that helped lead to the Great Recession. The lack of a profit motive also would eliminate the temptation to lend to credit-poor borrowers.

The absence of outrageous, multi-million dollar salaries would translate into less costly banking services, plus services would be offered in what are now “bank deserts,” where the poor are required to use expensive, neighborhood check-cashing storefronts. There would be no need for “reserves” or for the massive bureaucracy needed to track reserves, nor for the massive compliance bureaucracies, nor for FDIC insurance. No need for Fannie Mae or Freddie Mac.

I was reminded of this when I read in the naked capitalism blog:

JP Morgan Loss Bomb Confirms That It’s Time to Kill VaR

Posted: 11 May 2012One of the amusing bits of the hastily arranged JP Morgan conference call on its $2 billion and growing “hedge” losses and related first quarter earning release was the way the heretofore loud and proud bank was revealed to have feet of clay on the risk management front. Jamie Dimon said that the bank had determined that its Value at Risk model was “inadequate” and it would be using an older model.

While firms look at VaR over a range of time frames, daily VaR (what is the most I can expect to lose in the next 24 hours) to a 99% threshold is widely used. The fact that VaR is a lousy metric should not come as a surprise.

When people are paid bonuses annually, with no clawbacks for losses, and banks show profits a fair bit of the time, who is going to question bad metrics when the insiders come out big winners regardless?

But VaR is a particularly troubling example, more so because it is sufficiently, dangerously simple minded enough that regulators and managers a step or two removed from markets have become overly attached to its deceptive simplicity.

As mathematician Benoit Mandelbrot discovered in the 1960s, and Nassim Nicholas Taleb popularized in his book Black Swan, risks in financial markets do not have normal (Gaussian) distributions. Taleb, in his article The Fourth Quadrant, pointed out there are many situations where statistics are at best questionable and at worst unreliable: where you have non-Gaussian risk distributions (as you have in financial markets) and complex payoffs.

Now VaR isn’t the only risk model JP Morgan is using, but it has served to allow the inmates to run the asylum.

Basel Committee on Banking Supervision has considered alternative risk metrics, in particular expected shortfall (ES). ES measures the riskiness of a position by considering both the size and the likelihood of losses above a certain confidence level. In other words, it is the expected value of those losses beyond a given confidence level. The Committee recognises that moving to ES could entail certain operational challenges; nonetheless it believes that these are outweighed by the benefits of replacing VaR with a measure that better captures tail risk.

See the problem, here? The regulators believe that to prevent bank failures and malfeasance, banks need a better model to evaluate risk. That’s like saying, “To prevent losing in Las Vegas, people need to improve their gambling systems.” How about, just not gambling? Wouldn’t that work better?

Banks are run by humans. As long as humans are rewarded for risky behavior, they will engage in risky behavior. Period. No models, no regulations, no punishments can prevent it.

Rather than trying to develop the impossible — a system that not only will evaluate risk, but prevent motivated humans from engaging in risk — how about if we eliminate the risk and the motivation, altogether.

If all banks were owned by the federal government, there would be no profit motive — no reason why banks would trade for their accounts — and no personal motivations for bonus rewards based on trading success.

JPMorgan, “a-too-big-to-fail” bank, is not the first — not by a long shot — to engage in excessively risky behavior. And it absolutely, positively will not be the last. So long as there is a profit motive and a bonus motive, these events will happen, again and again and again.

The Basel Committee on Banking Supervision is whistling past the graveyard if it believes there is any solution for the problem, so long as banks are profit-making enterprises. There is not one good reason why banks should be privately owned, and a multitude of reasons why they should be owned by the federal government.

In the past decade, how many U.S. banks have failed? Go to: The FDIC’s “Failed Bank List”. I was too lazy to count; you can see for yourself. At least 450 U.S. banks have failed in the past 10 years!

That’s an astounding number. A ridiculous number. And those are just the banks taken over by the FDIC. This huge list doesn’t include all those banks that were rescued without FDIC intervention. The cause was always the same: The profit motive led to greed overriding sense.

And this was not an unique occurrence. In the 1980’s hundreds of Savings and Loans went bankrupt, costing the public hundreds of millions of dollars. Why. Again, the profit motive overrode sense.

Finally, there is one more reason the federal government should own the banks and indeed, all lending institutions. Today, there are about $38 trillion dollars in the U.S. domestic economy. Of these, only about $10 trillion (26%) were created by the federal government. The rest were created by banks.

History shows that when the federal government begins to lose control over its money creation, we have recessions. It seems that when times are good, banks become more and more reckless with their lending and investment, until they cause a recession, at which time the federal government has to step in with stimulus spending.

Wouldn’t we be better off if there were no recessions and no reasons for the federal government to save the risk-takers and the public?

I call on Congress and the President to have the courage to protect the public and to do what is necessary: End private banking, and have the federal government assume ownership of all lending institutions.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

I fully agree with nationalizing the banking industry. Since it’s primary source of profit is the free use of a public privilege (creating money) it should be a public industry.

LikeLike

I agree. What is up with this? How can they (banks) charge interest for the creation of something which cost nothing to make, is given value by the force of the people (US military) and is supposed to be for the good of the people?? It’s truly amazing.

LikeLike

You have got to be kidding! This is just what the country needs is government employees running banks.

How is the Postal Service doing? Have you ever seen any government run program that worked.

Where were Federal Regulators in the last banking crisis? If they had done their job, many of the banking issues could have been avoided.

Look at countries where the government ran everything. Total failures!

I am glad no one listens to your socialistic ideas.

LikeLike

So you think the privately-run banking industry (the industry the caused the Great Recession) is doing a good job? And, you blame the regulators, not the criminals??

As for the post office, try FedExing or UPSing a letter anywhere in the country for only 45 cents.

Who said anything about the government running everything?

Since you don’t like “socialist ideas,” I assume you will have no use for Social Security, Medicare, the U.S. highway system or protection by the military, the FBI, the CIA, the police and fire departments, and will not visit the national parks — all “socialist” ideas. And by the way, aren’t you glad your bank has that “socialist” idea, FDIC government-owned insurance?

LikeLike

How is the Postal Service doing?Been doing fine. Very cheap. Very efficient. That’s why it has to be under attack by politicians all the time, and restricted absurdly. There is a cult religious dogma in the USA that government can’t work. So any sphere where the government works for ordinary people must be under constant political attack, except where it is a sacrosanct welfare program for the wealth cult leaders.

Have you ever seen any government run program that worked. Plenty. The government does many things much better than the private sector. Health care, electric power. A monetary economy is a government program that works. Works best when people realize the essential role fo the government, which is very different from the private sector.

LikeLike

a typical bullshit response from a right wing bullshitter

LikeLike

http://www.esquire.com/blogs/politics/the-post-office-lives-8757430?hootPostID=43df3e9dcbc0f695e7ecf5d03b479e78 good article about what the useless republicans done to the postal service

LikeLike

Interesting paper.

LikeLike

Surely all we need is more Govt debt

This proposal is a bit like a guaranteed job to me. Not necessary (and could do more harm than good) to solve the main problem we have now. That is too much non Govt debt and too little Govt debt

What I would do is have both privately owned banks and Govt owned banks. And then let the people decide.

NZ have done this for example with Kiwibank. And many have opened an account with this bank. But the other banks are still there to compete.

LikeLike

“What I would do is have both privately owned banks and Govt owned banks. And then let the people decide.”

Thanks. Kiwi bank is an excellent example. I wish we had it here.

Where would you put your money?

LikeLike

When I lived in NZ many years back I had one account at the Post Office and one at the BNZ. Both were Govt owned back then

The service was first rate in both.

Now it would depend. I like competition and choose but also quality service. Right now if I returned possibly one account at both

LikeLike

Ops and choice

LikeLike

if that was the plan, remove the federal government protection for the too big to fails, i could go for it then

LikeLike

“Steve Keen

May 13, 2012 at 10:36 pm | #

RJ, MMT contains a logical error when applied to a mixed fiat-credit money economy. It is therefore not an explanation of the actual workings of the system we work in. I have been holding off on making this statement until I had completed the paper, but I get tired of you forever stating as fact something that I know contains an error–not a fatal one, but one that reduces the effectiveness of its remedies.”

I post quite a bit on Steve web site. Mostly to correct basic errors including by Steve. But some shockers by other poster

This is hurdle web sites like this has to overcome. It will be a long battle. But if Steve ever publishes this paper (it was first mentioned years back) it will at least give a paper to work from.

LikeLike

I’d love to know exactly what he thinks this logical error is. Why doesn’t he just up and post it already?

I actually found MMT & blogs like this through Keen’s blog posting a guest post by Bill Mitchell. I think it gives a much more complete description of how the economy works than Keen himself. He seems to be focussed just on the private credit side of money, which obviously as this blog entry points out, is incredibly important, but not the full story. Then again, I wonder if MMTists pay enough attention to private credits role.

LikeLike

“I wonder if MMTists pay enough attention to private credits role.”

I’m guessing they don’t, which is why Cullen Roche spun off and created MMR.

LikeLike

Not a new idea, but I’m impressed that you are pushing it, considering that you strike me as being a political moderate.

I don’t know much about banking, but gather banking is, in practice, a public-private partnership ? That the banks could not stay in business very long without government support ? That they would fail during crashes if not for government insurance, government bailouts, and government as a lender of last resort ?

That being the case, it seems that society has a moral right to closely regulate the banks. That operating banks as privately owned public utilities, similar to electric utilities, should be on the table. And yes, nationalization should be on the table.

I’m not qualified to say which option is best, but I’ve come to the conclusion that deregulated for-profit banking is unacceptable.

LikeLike

Why not cure the disease instead of killing the patient?

End Fractional Reserve Banking,enforce 100% reserve.(This may also be the solution to “bubbles and inflation” ??)

End FDIC,enforce self insurance (Fed may use this opportunity to gain revenue instead of taxes by leanding the banks $2 trillion @ 2% for 36 years

to fund their insurance pool Giving taxpayers an tncome of $110 billion per annum.)What a great way to fund “the general welfare..

All part of the “Great News !! Zero Income Taxes…” program.

JPM had a 2% loss on its position, should make you wonder,

“What are the other positions?”

But then again ask,”Who made the $2 billion profit ?”

Banks should be allowed to invest for themselves as a function of private banking BUT they must also pay their own losses since they also keep their gains.

LikeLike

Fractional Reserve Banking is a myth. Bank lending is not reserve constrained, since banks can always get more cash from the Fed’s discount window. Requiring 100% reserves would drive up the cost of loans to consumer, but would not restrain banks.

LikeLike

Rodger

I fear that your appeal to the highest political instances has no meaning. Consider

Click to access Fullbrook59.pdf

After reading what to say? Time to sharpen the pen?

LikeLike

To “JS”, THANX,

What a fantastic piece !” The political economy of bubbles

Edward Fullbrook” (paecon)

“We cannot solve our problems with the same thinking we used when we created them”.Albert Einstein

Quote Justaluckyfool,” Perhaps the answer lies in how you redistribute the wealth of a nation; not in how you acquire it.”

We the people must take back the control of the currency of our Monetary Sovereignty, with that the control of the redistribution.

The process is easier than one would believe.We the people have the power

and need only exercise that power. Amend the Fed, Don’t end the Fed.

TAKE AWAY THE POWER OF THE FINANCIAL INSTITUTIONS AND GIVE IT BACK TO THE PEOPLE !

LikeLike

I don’t necessarily disagree with the idea to nationalize banks, but I’m wondering if it would really be the best solution. The profit motive that invariably leads to bad decisions should be done away with, but there are other situations where the competition is good, like with the types of services and support they offer to the customers.

I’m wondering if some sort of hybrid system could be implemented, where the bank could still be owned by the government, while retaining some autonomy in how they interact with and provide service to the customer.

LikeLike

A reader named RJ has suggested following the New Zealand example. They have a government owned bank called “KIWIBANK” that competes with privately owned banks. Because of increased safety and honesty, it is picking up customers rapidly.

I like the idea.

LikeLike

Modern banking is already a hybrid system, a public-private partnership as Mosler says. There’s a range of possibilities from public to private. The truly imporant thing is for ordinary people to understand what banking is & does. You can win a Nobel Memorial Ec prize without understanding. Otherwise, it’s a license for bankers to steal.

LikeLike

Sure, I get that it’s already a partnership. It’s just that the way it’s currently arranged doesn’t seem to be very beneficial to the majority.

Anyway, while I was trying to look up information on Kiwibank, I came across an article suggesting that the Post Office offer some basic banking services, as they did many years ago.

http://truth-out.org/index.php?option=com_k2&view=item&id=5903:saving-the-post-office-the-models-of-kiwibank-and-japan-post

LikeLike

1.) Why do you even want competition in your banking system? Competition is not always good. I would not want to live in a society which had competing police departments or competing roads to my door or competing water lines to my house. It’s called a natural monopoly.

2.) If you think that government-owned banking would end up being wasteful or cronyist, you have a much more powerful weapon than your dollar; you have the vote. If you’re worried that a state or national bank would grow fat and lazy with government ownership, the ballot box will definitely cause them to wake up.

That said, a hybrid system might be for the best. You can have a national banking plan for people wanting to play it safe and private banking for people who want more aggressive risks and returns. It works very well for healthcare in nations that have single-payer, but I suppose that’s socialism, too.

LikeLike

Perhaps you would endorse:

THE SOLUTION:(by justaluckyfool, “Great News!! Zero Income Taxes…”

ONE.

AMEND THE FEDERAL RESERVE CHARTER; TURN THE FED RESERVE INTO THE FEDERAL RESERVE BANK OF AMERICA (FRBA),RESTORE MONETARY POWER BACK TO THE PEOPLE ,OPERATE THE FRBA WITH ABSOLUTE TRANSPARENCY, (“GLINDA,the Good Witch, owns a Great Book of Records that allows her to track everything that goes on in the world from the instant it happens.”_The Road to Oz)

ESTABLISH THE FRBA AS THE ONLY MEANS FOR MONETARY SUPPLY,ALL OTHER INSTITUTIONS MUST MAINTAIN 100% MARGIN ON ALL INVESTMENTS.

TWO.

ESTABLISH A ZERO FEDERAL PERSONAL INCOME TAX.

INTEREST INCOME (REVENUE) WILL REPLACE PERSONAL INCOME TAXES.

The Federal RESERVE Bank of America,make it the melting pot for Federal Reserve.,FDIC,FHFA,and the GSE’s,Fannie,Freddie,Ginnie and Sally, as well as the IRS.These organizations will be needed to service the federal loans.

All loans by any financial institution must be backed with 100% reserves.No more Fractional Reserve Banking.No more production by private banks of this Monetary Sovereignty’s currency.All loans may be used as assets for borrowing from The FRBA so that they comply with the 100% reserve. Any loan that is not in compliance must be sold to the FRBA or the financial institution would be placed into receivership.

Private banks will have to be self-insured. Risk 100% their own investors money for 100% reward or loss.

LikeLike

I’m late to the party, but hear, hear.

Now, what about private investing? Hmmm.

LikeLike

[1] Roger writes: “In the 9/14/11 post titled, “How about socialized banking,” and elsewhere, I have suggested that all banks be federally owned – i.e. the elimination of private banking.”

Yes, I have been saying this for years. Why not make banking and currency like a public utility? This would get us past the debt trap, and revolutionize mankind. Private control of central banking is an elephant in the room that few economists never dare mention. It causes 95% of all our financial woes, plus most of our political woes, since politicians are on the payroll of private bankers.

Private control of currency and central banking is tyranny. It is the greatest power on earth, and the greatest scourge. Whoever has this power can buy armies, police forces, media outlets, governments – everything. That is why it is so viciously guarded. It’s why it is never mentioned in the lame-stream media. Politicians dare not mention it, since they are on the private bankers’ payroll. The only exception was Rep. Dennis Kucinich, who consistently introduced bills to make the Fed a public institution. All bills were ignored.

In Ireland, no politician dares mention the public banking option, not even Sinn Fein, or the “socialists,” or the United Left Alliance, all of which claim to oppose the new household tax and the “European Stability Treaty,” which puts all European governments under the direct control of Brussels and the ECB in Frankfurt. All whine about austerity, but none dare mention the solution to everything, which is public banking.

In Greece, Alexis Tsipras, head of the “Radical Left Coalition,” whines about austerity, but he is adamant about keeping the euro, and would NEVER consider public banking. He just wants to get on the payroll of the ECB bankers, like every other European politician.

The “Occupy Wall Street” crowd just wants to punish the rich by taxing them. This is not only useless (since it will never happen), it is unnecessary. Instead of trying to bring the rich down, why not bring everyone up via public banking?

Private control of banking is the disease. Unless we admit this, all discussion is blind chatter about the symptoms.

PUBLIC banking is tied directly to monetary sovereignty. People who don’t want to talk about pubic banking and monetary sovereignty are either idiots, or else they are shills directly or indirectly on the payroll of private bankers.

Consider Paul Krugman, to take an example. He too whines about austerity, but Krugman thinks the problem is not debt (controlled by private bankers). No, he thinks the government simply needs to borrow more from those same private bankers, with the debt dumped on the masses. Thus Krugman seems to be a “populist,” when in fact he is a shill for the bankers. That’s why he gets so much exposure in the media.

[2] Roger writes: “There is not one good reason why banks should be privately owned, and a multitude of reasons why they should be owned by the federal government.”

Banker shills say that if the bankers’ godlike powers were given back to the public, then governments would print too much money, causing inflation. This is another lie. In reality, inflation only happens when there is an imbalance between money supply and money demand. The money supply can be regulated, such that balance is maintained. If there is not enough money in circulation, then we can print more. If there is too much money, and inflation looms, then we reduce the money supply via temporary taxes. By contrast, today’s federal taxes all go to pay the interest on the debt on the national currency we borrow from private bankers. This is insane.

Among the masses, many idiots say that public banking would be worse than private banking. This is like saying, “The ship is sinking, and we are all doomed to die, but let’s not do anything about it, since the alternative might be worse.” Bankers love these clowns. One of the fools (above) says the failure of regulators is proof that government is worthless. Excuse me, but those regulators, like politicians, are on the payroll of unaccountable private bankers!

As for the cretins that rail against “socialism” in any form, Roger has already disposed of them above. As I said, bankers love these retards.

[3] We can keep private banks, but make public the central (federal or national) bank. The only state in the USA that is not is fiscal trouble is North Dakota, since that is the only state that has a public central bank. The Bank of North Dakota partners with private banks and oversees them, such that the private banks do a healthy business, but may not engage in fraud and theft, as we see in the Too-Big-To-Fail banks.

[4] Some people think the solution is not public banking, but a “gold standard.” These idiots fail to understand two things. First, gold prices can be (and are) easily manipulated for the benefit of elitists. Second, ALL currency INCLUDING GOLD is fiat currency. Gold, like paper money, only has value because people agree that it does. It is not like land or food, which have absolute value.

Regardless of the currency we use (gold, paper, sea shells, tally sticks, or whatever), fiat systems go awry when they are privately controlled.

[5] Public banking brings up the issue of bailouts. Nobody “bails out” the big banks. The big banks bail themselves out, via shell games. How could governments bail out the big banks, when governments get all their money from those same banks? Therefore, whining about “government bailouts” is another means to avoid looking at the reality of private control.

[6] Suppose you lived on an island with 10 other people, with each of you living in his own hut. And suppose you and the others used a currency – let’s say sea shells. Now suppose that only one hut had total control of the sea shells. The one person in that one hut has sole power to determine what shells are “currency,” and to determine how many shells are in circulation. That one hut would rule the other nine. That is the situation we have today.

THINK ABOUT IT, PEOPLE. We are poor because we have no bits of paper called “money.” Who controls those bits of paper? Target them, and you target almost all of your problems.

[7] As long as our currency and central bank remain under private control, “nationalization” will simply mean that private bankers’ debts and losses are dumped on the public. When we “nationalize” a financial institution, we leave it under private control, while socializing the debt. This is false nationalization. True nationalization means public control, which all begins with public control of the currency and central bank.

LikeLike

Heck yes!

We can’t have people mutually and consensually storing their money voluntarily with other people! That sounds too much like “freedom”!

LikeLike

People storing their money with other people is not the problem.

The problem is that the banks’ privilege to create money comes from the community but is denied to everyone except the banks. It is also the only source of money in our economy. Thus, the banks hold everyone else in servitude by only creating and giving out money if people agree to pay back more than they borrowed. Since the bank only created enough money for the principle, there is not enough money in the economy to pay both the principle and the interest on all the debts. This whole system forces the community as a whole to go into debt, and thus slavery, to the banks. Even if a few individuals avoid debt, the total debt plus interest in the economy has to exceed the amount of money in the economy. There is no way this system can possibly work without having serious problems – like inflation and deflation, booms and busts – a the while, those at the top skim the interest off the top to enrich themselves while everyone else has to pay for it. Even the few debt-free individuals have to pay higher prices to their indebted suppliers of goods and services.

LikeLike

Why are people paying interest to banks in the first place? It’s not as though the banks are creating anything of value, they are simply profiting off a monopoly granted by the government (we the people). It’s like a scam. Supposedly central bank interest is remitted to the treasury, but private bank interest certainly is not.

LikeLike

Would you lend someone money without receiving interest?

LikeLike

Zarepheth,

The other source of dollars is federal deficit spending, which does not require interest payments.

I’ve not thought about this before, but I’ll speculate that so long as total federal deficits are higher than total interest, there always will be sufficient dollars to pay interest. Have to give this further thought, though, because I may have overlooked something obvious.

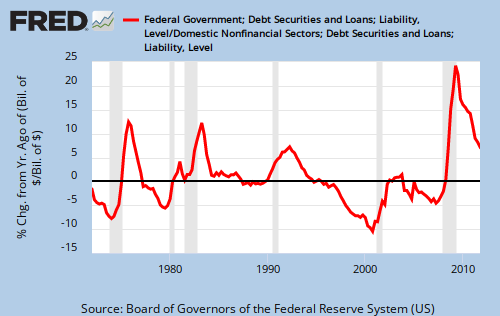

The following graph is a bit confusing, as it uses two different scales, but the red line is the federal deficit, scaled on the left. The blue line is Total Assets Interest-Earning, All Loans And Leases, Gross, Consumer Loans, Credit Cards, All Commercial Banks, multiplied by 2%, scaled on the right. As you can see by comparing the scales, the red line today is 100 times as high as the blue line, today.

This year there are about $600 billion in assets earning interest, which assuming an arbitrary interest rate of say, 2% (probably high), would equal $12 billion in interest. The federal deficit is about $1.3 trillion — about 100 times higher — plenty of dollars to pay interest.

If I have more time to think about it, I may publish a post on this.

LikeLike

It’s too bad that the federal government does not realize that it could create the dollars for it’s spending instead of “borrowing” them from the federal reserve – or whomever chooses to buy treasury bonds. If those government bonds were counted as part of the debt, I’m pretty sure the total debt would exceed the money supply. By the way, does the blue line also include corporate bonds and similar debt instruments?

LikeLike

The money supply = Total Debt Outstanding Domestic Non-financial Sectors. Every form of money is a form of debt.

The blue line = Total Assets Interest-Earning, All Loans And Leases, Gross, Consumer Loans, Credit Cards, All Commercial Banks

Rodger Malcolm Mitchell

LikeLike

Your response, Money supply=Total Debt Outstanding Domestic NON-FINANCIAL SECTORS !

Does that include the verified $300 trillion in derivitives held by the FINANCIAL SECTOR. Also does that include the trillions owed by borrowers that have trillions of future interest payments on financial assets (loans) held by private financial institutions?

In your quest for what you may are overlooked ,please read,”How the Banks Broke the Social Compact, Promoting their Own Special Interests ”

by Michael Hudson …”Governments can create new credit electronically on their own computer keyboards as easily as commercial banks can. And unlike banks, their spending is expected to serve a broad social purpose, to be determined democratically. When commercial banks gain policy control over governments and central banks, they tend to support their own remunerative policy of creating asset-inflationary credit – leaving the clean-up costs to be solved by a post-bubble austerity. This makes the debt overhead even harder to pay – indeed, impossible.

…

It is too early to forecast whether banks or governments will emerge victorious from today’s crisis. As economies polarize between debtors and creditors, planning is shifting out of public hands into those of bankers. The easiest way for them to keep this power is to block a true central bank or strong public sector from interfering with their monopoly of credit creation. The counter is for central banks and governments to act as they were intended to, by providing a public option for credit creation.Read more..by Prof. Michael Hudson ; http://www.globalresearch.ca/index.php?context=va&aid=28938

LikeLike