The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

==================================================================================================================================

I know this is a strange time to talk about fighting inflation. Recently we struggled up from a minus inflation (aka “deflation”) and now are at a puny 1% level. But too often, when I say that federal deficit spending should increase, a debt-hysteric concern expressed to me, is not just inflation, but the typical debt-hawk exaggeration: hyperinflation!

The debt-hawks seem to be the kind of folks who, upon seeing a starving child, would not feed that child for fear the food would cause obesity. Today, our economy is starved for money, but the debt hawks fear monetary obesity (aka “inflation”) and they warn us of wheelbarrows full of money. They give silly speeches about what they term “fiscal prudence” and what I term, “starving the baby.”

So as long as we must face debt hysteria, and the hysteria has to do with a non-existent though dreaded inflation, we might as well talk about preventing and curing inflation. Inflation is the loss in value of money compared to the value of goods and services.

So, there are two fundamental methods for curing inflation: Reduce the supply of money or increase the demand for money. Both methods increase the value of money vs the value of goods and services. (In theory, increasing the supply of goods and services or decreasing the demand for goods and services also would work, but there is no known method for accomplishing this without changing the money supply.)

Ideally, any anti-inflationary activity should be effective, quick to activate, quick to take effect, incremental, easy to rescind and not damaging to the economy. But while tax increases remove money from the economy, and so can be effective, they fail all the other tests. They are highly political; They are slow to pass through Congress. They take effect slowly, because taxes are collected slowly. They cannot be passed and implemented incrementally. They are difficult to undo. And they damage the economy. The require answers to difficult questions: Exactly which taxes should be increased? By how much? Should we have a tax increase during a stagflation? How do we calibrate an incremental tax increase?

Compare this approach with another approach: Interest rate increases. Interestingly, interest rate increases have both pro-inflation and anti-inflation effects. Pro inflation: Increase in business costs and increase in the money supply due to increased federal interest payments. Anti-inflation: Increase in the demand for money vs the demand for non-money.

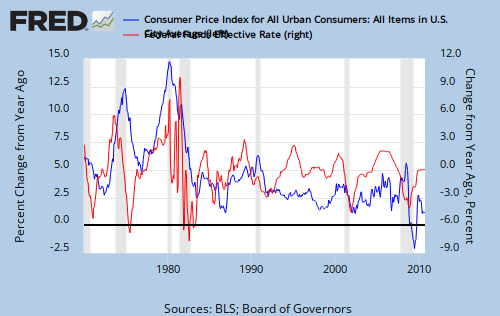

On balance, the anti-inflation effects are stronger. One hint is this graph:  that seems to indicate interest rate increases are followed about one year later by inflation decreases.

that seems to indicate interest rate increases are followed about one year later by inflation decreases.

The other hint is the Fed’s ongoing success in controlling inflation despite massive increases in the money supply. Interest rate increases actually work.

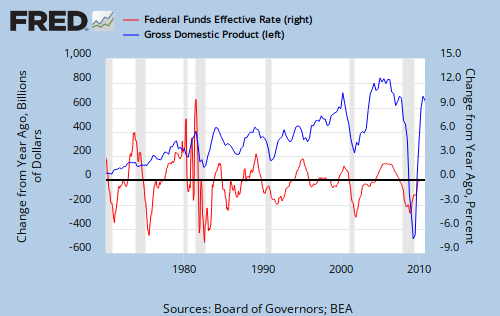

Interest rate increases can be done quickly and in small or large increments — just what is needed for inflation control. And contrary to popular faith, high interest rates do not negatively affect GDP growth. See:

In summary:

–We are nowhere near inflation

–We can control inflation by raising interest rates

–High interest rates do not negatively affect GDP growth

We can and should feed the starving economy without letting unfounded worries about our ability to prevent or cure the economy’s obesity, prevent us from saving the child.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”

Rodger, as you have pointed out previously, modern inflations are generally supply side (cost-push) owing to petro price rises, rather than demand side (demand-pull), owing to too easy credit. Increasing interest rates tends to increase the price of credit money, so it decreases demand. However, the present problem is with declining petro supplies.

Peak oil happened in 2006. The next wave of price increase will be due to energy prices as EROEI falls and demand increases due to demographics. Estimates are at the present level of technology it will take 50 years to transition to alternatives. For several decades beginning in the not too distant future, petroleum will be still be dominant and in very short supply, leading to extremely high prices. This will lead to social and therefore political problems.

Eurasia and the adjacent ME is were the energy is centered, and the battle is now joined. See, for example, The “Great Game” and the Conquest of Eurasia: Towards a World War III Scenario?-Mackinder’s Geo-Strategic Nightmare by Mahdi Darius Nazemroaya (also parts 2 and 3 separately). This is much more than an economic problem. It is a geopolitical one with economic roots.

LikeLike

You’re right, Tom.

There are a couple of questions, the answers to which, no one knows:

1. How much pumped oil actually exists? (Many nations have hoarded supplies as insurance.)

2. How much untapped oil exists in undersea, shale, unexplored areas, etc? America barely has touched its continental shelf. Imagine how much oil must exist in the 70% of earth’s land that lies under deeper waters. We can’t judge tomorrow by today’s technology.

Then there is the question of how fast prices will rise. The monetarily sovereign nations can exist with inflation well beyond the 2%-3% Fed goal. For instance, cut business and personal taxes, while providing more socialized benefits, and the public would not feel the pain of inflation.

You are correct that wars may change things. America has the world’s most experienced troops and officers, and the most equipment. Among the major powers, we’re the only ones experience in fighting.

Rodger Malcolm Mitchell

LikeLike

1 and 2. How much there is already in storage and how much in the ground is a secret. There are estimates but those in a position to know the details aren’t saying. But what we do know is the figures on oil supplied, and that peaked in 2006. Moreover, we know the figures on EROEI and that is dismal. A lot of available petroleum costs almost as much in energy expended as energy gained. That, of course adds to nominal price.

We don’t know how fast prices will rise since the GFC has skewed global demand. However, we do know that once the crisis ends, the price of energy will be the chief constraint on growth, other than the increasingly obvious effects of climate change that will require a smaller carbon footprint, or dire consequences. The latest Royal Society report is dismal.

So we are boxed in on two counts, availability of real resources to meet demand and the inability to use available supply owing to externality.

This is going to be a lot bigger problem than inflation, but it is going to result in cost-push inflation once the crisis abates and the global economy picks up steam. China is already being hit with higher energy costs, as well as severe externality that is also a cost although difficult to estimate nominally.

LikeLike

Cost push short term. There’s a lot of work going on in producing petro-chemicals from coal and oil shales.

Certainly there’ll be a shift from oil to coal and that has a cost.

LikeLike

Why does raising interest rates have an ameliorative impact on cost-push inflation?

LikeLike

Andrew, it doesn’t. There is some confusion about “demand.” Because interest is the reward for owning money, raising interest rates increases the demand for money, which increases the value of money.

MMTers argue that high rates increase the cost of goods and services, which would be a cost-push inflationary effect.

In Post 1, above, Tom Hickey also mentioned that high rates decrease the demand for credit, which may be true, but high rates also increase the willingness of lenders to lend. So there may offsetting effects.

Look at this graph and tell me what you see:

Rodger Malcolm Mitchell

LikeLike

That is one weird graph.

LikeLike

Rodger,

I guess you answered by question with your first sentence, but I’m not sure the point that you are trying to get across with the rest and how it relates to the question I asked – I’m probably just being dense.

I don’t see much in the graph. The two variables seem to be loosely correlated?

LikeLike

Andrew,

It commonly is believed that low interest rates stimulate borrowing. I long have argued that for every borrower there is a lender, so that what may stimulate borrowing, discourages lending.

The graph seems to show that high interest rates do not decrease the amount of borrowing. If anything, high rates may actually increase the amount of borrowing, but as you properly noted, the correlation is minimal.

In short, the Fed’s efforts to stimulate borrowing by lowering rates, is futile and perhaps counter-productive.

Rodger Malcolm Mitchell

LikeLike

Isn’t Interest rate adjustment like the rat that starts pressing a button in their cage in an attempt to get food – even though the food is delivered at random intervals.

It’s a marvellous experiment that shows how the pattern optimising mammalian brain gets easily misled.

The more I look into this field, the more amazed I am at the complete lack of concrete evidence for decisions that affect millions. It’s like the middle ages!

LikeLike

Right, the Fed reduced interest rates 20 times to stimulate the economy — all in vain. Given the opportunity, they would reduce rates another 20 times. Their ancestors used leaches to cure anemia.

High interest rates:

1. Do not inhibit GDP growth

2. Do not inhibit lending

3. Do inhibit inflation

Rodger Malcolm Mitchell

LikeLike

On the other hand, doesn’t raising rates in a demand-push inflation situation lower the spread and make speculation less appealing? Do we ever have demand-push inflation?

If high rates don’t inhibit inflation, is there any good reason for the Fed to ever set rates above 0 or issue bonds?

Are you suggesting that when Volcker raised rates in the 70’s, that isn’t what stopped inflation, instead, the oil supply shock subsided?

Too many questions…

LikeLike

Andrew,

Speculation always is appealing.

Never heard of “demand-push.” It’s cost-push, which can be caused by increases in demand for (especially) oil.

You misread. I said high rates do inhibit inflation.

LikeLike

I agree with you that all taxes are unfair. But isn’t it MMT’s major premise that they are necessary to validate the currency in the first place. If you eliminate taxes, then the only reason to use the money is convenience, is it not? This would remove the unethical element of compulsion from the system (and might even get the libertarians and conservatives on your side 🙂 )

LikeLike

Federal taxes are not needed to create demand for money, because there are sufficient state and local taxes for that purpose.

Rodger Malcolm Mitchell

LikeLike

Federal taxes are not needed to create demand for money, because there are sufficient state and local taxes for that purpose.

Makes you wonder why you need state governments at all. Let the Fed fund what’s needed through smaller local governments who really understand what’s needed and keep pork to the minimum.

States obviously don’t know what the hell they’re doing–they are all going broke; of course, so are the big cities. Size matters.

LikeLike

Good thought.

LikeLike

The MMT’ers propose that the federal government, which has no financial constraints, largely assume the financial burden of the states, which are revenue constrained. Distributionally, this is can accomplished on a per capita basis nationally.

It is important that the federal government handle chiefly the funding, however, and let state and local governments handle the management to keep decision-making as decentralized as possible in order to prevent ascendence of a an authoritarian centralized institutional power structure.

LikeLike

But Rodger, in that case you make MMT’s point. Taxes are the engine that validates the system; pushing the principle back to the states doesn’t change the principle. Fiat money means just that: legally binding.

LikeLike

Henry, I’ve merely said federal taxes are unnecessary, since there are ample state and local taxes. MMTers tend to agree. However I disagree that any taxes are necessary.

Rodger Malcolm Mitchell

LikeLike

My understanding is that taxes are the very lynchpin of MMT or the “chartalist” position, as that is what determines the legality of the fiat currency. If you oppose all taxation, then how does the currency receive its validation and how do states or local entities fund their operations?

Or have I misunderstood your position?

LikeLike

You may need to have taxation to get a currency started, otherwise there is no impetus to accept it initially. It’s effectively the starter motor for the pump engine.

However once you have got the pump engine going then the currency takes on a value of its own, and like any engine you won’t need the starter motor again until it stalls.

It’s very arguable that you don’t need taxation to validate the currency at that point. We won’t know for sure until we try.

LikeLike

Visualize a brand new country, with no taxes and no money. What is the very first step?

LikeLike

Please answer this. Also kindly say what “full faith and credit” means in the context of a fiat currency.

Also, if money is defined as debt, and if this means more than an accounting convention, then in what exactly does this debt consist. As you point out somewhere, a dollar is a “bill” or a “note”; but what exactly does the government or the Fed. Res. “owe” since it is not convertible to specie?

LikeLike

The government owes full faith and credit, which is described at: Full faith and credit

LikeLike

I do not agree with MMTers that taxes are necessary to give value to money, but in any event, federal taxes are not necessary, as there are ample state and local taxes.

Rodger Malcolm Mitchell

LikeLike

From THORNTON PARKER:

I am making some progress in trying to understand your points about monetary sovereignty. I do understand that a government with monetary sovereignty can spend without being limited by taxation — at least as long as others are willing to accept its payments at face value. But I haven’t found a discussion by you of how the US Government’s budget relates to the banking system that has its own processes for creating credit, and hence money. The present credit and real estate problems are due to excess private sector credit creation. The government and the Fed have been trying to mitigate some of the problems by taking over some of the debt instruments. It seems to me that while your points about monetary sovereignty make sense, you appear to be claiming too much for the government role in setting the total money supply. Have you discussed the relationships between the government deficit or money creation, and the much larger block of private sector debt?

I have come to visualize a modern economy as having two sides, one for production and one for consumption. When things are working well, the production side creates the profits and employee earnings needed to support the consumption side. For the past three decades, however, investors, public companies, and Wall Street have been depleting the production side to capture short term gains and profits. This was hidden by creating ever larger amounts of credit to sustain the consumption side and make the economy appear to be healthy on Main Street. The private sector seemed to have some of the benefits of monetary sovereignty until it all came unglued. If this is an accurate, if brief, description of what happened, then I think that far more will be needed to rebuild the production side of the economy than just fiddle with the money supply and the federal budget.

Finally for now, you wrote that, “Bill Gates and Warren Buffet do not have unlimited power to create their currencies.” I differ with you on this, particularly in the case of Bill Gates which I have studied. Before Microsoft went public, he retained 45% of what would be the total shares outstanding after the IPO. While his contribution to the company obviously had value, his cash contribution to the company was almost zero. As soon as the IPO set a price for his shares, he became a multimillionaire on paper, and then a multibillionaire. He has been selling shares through a liquidation program for years. In addition, the company was authorized to issue many more shares. It used some of these shares, which were also valued at the market price to buy services, products, and even other companies. The shares of acquiring company stocks are the currency that drives the M&A market. This is as near to unbounded legal counterfeiting as one can get, and it was on the equity side of the financial markets, not the credit side.

Best, Thornton Parker:

LikeLike

You have it about right. The fly in the ointment is economic rent, which is parasitical on the economy, and infests the host as it grows in proportion to production. Economic rent includes land rent (by far the largest portion historically), monopoly rent (extraction to price setters), and financial rent (rent on money and financial products). Since economic rent is parasitical in that it is non-productive it needs to be limited. The way to limit it is through targeted taxation and regulation. This disincentivizes rent-seeking and incentives productive investment. See the work of Michael Hudson on this.

LikeLike

Let’s take land rent. It goes to land owners. What do the land owners do with the money? They spend or save it. If they spend it, the money goes to someone else, who will spend or save it.

If the land owners save it, the money also will go to someone else (unless the saving is done by buying T-securities from the government).

In short, land rent is as productive as any other use of money, other than T-security purchases.

That goes for other rents, as well. Money doesn’t stop with its first use.

Rodger Malcolm Mitchell

LikeLike

Michael Hudson, Higher Taxes on Top 1% Equals Higher Productivity (video)

LikeLike

Professor Hudson’s thesis can be summarized: Removing money from the economy, via federal taxes, stimulates the economy. A dubious proposition at best.

Rodger Malcolm Mitchell

LikeLike

Re: Professor Hudson’s thesis can be summarized: Removing money from the economy, via federal taxes, stimulates the economy. A dubious proposition at best.

———–

Possibly. This is MMT 101, however. Frankly I find your ripostes are often childish and churlish as soon as the heat get to be too much for you. Hudson is not some unqualified amateur. If you are going to make such a sweeping statement in relation to a respectable person’s thesis, back it up responsibly.

LikeLike

Mr. Parker,

You said, ” The present credit and real estate problems are due to excess private sector credit creation. Actually, our economic problems are due to the disappearance of money. Mortgages are debt, which is money. When the mortgages disappeared, money disappeared, which is what caused the recession (as it always does).

The solution to the problem was to replace the lost money with money created by the government, i.e. by federal deficit spending.

Yes, the total money supply consists of privately created money — lending creates money — plus federally created money. When the privately created money disappears, the federal government must step in and replace it with federally created money.

By the way, even Bill Gates does not have the unlimited ability to create money. Force him to pay a bill for a “measly” (in federal terms) $1 trillion, and he will go bankrupt. The federal government would have no difficulty paying a bill of $1 trillion or even $100 trillion, and it would not need to collect $1 in taxes to do so.

Rodger Malcolm Mitchell

LikeLike

Charles, sorry if I misunderstood Professor Hudson. How would you summarize his thesis?

Rodger Malcolm Mitchell

LikeLike

Rodger, his thesis is that taxes targeted at economic rent are needed in order to prevent parasitism from undermining productive activity. He recommends targeting taxation at economic rent instead of at income, which affects demand, or at reasonable return on productive investment.

The idea is to disincentivize parasitism and encourage productive activity, i.e., the production > distribution > consumption cycle that depends on income for effective demand and productive investment for increases in productivity.

MMT agrees that taxation is necessary, first, to give value to a fiat currency, and secondly, to withdraw nongovernment NFA as appropriate iaw functional finance. MMT also recommends targeted taxation.

Hudson is a Minskian, So are all MMT’ers. Hudson is a professor at University of Missouri at Kansas City, along with Randy Wray and Bill Black. This is referred to as the Kansas City School (as opposed to the Chicago School). The notion of taxing economic rent is a Minskian one in that it addresses financial instability arising from excessive debt and abuse of leverage, components of financial rent.

LikeLike

Tom and Charles,

Not being MMT, I feel free to disagree with it. For instance, I argue with Warren and Randy all the time about how to prevent/cure inflation.

First, federal taxes remove money from the economy and removing money is anti-stimulus.

Second, the “rent undermines productivity” thesis falls under the “first use” myth — the idea that money stops with its first use.

Whether or not rent itself is parasitical (a notion with which I disagree), what does the landowner do with the rent he receives? He spends it or saves it. In short, he transfers it to another person, who spends it or saves it — then to another, then another and on and on.

Money does not stop with its first use. The only time money stops working for the economy is when the federal government takes it. The federal government is the ultimate parasite (unless it deficit spends).

Rodger Malcolm Mitchell

LikeLike

Rodger, how would you target taxation and why?

LikeLike

Rodger,

My impression is that Charles was not referring to your summary but to your remark that the thesis was dubious. I suppose he was asking why you thought so.

I live in Latin America, where there is a powerful rentier class at the top of the pyramid. I suppose they do save their money or spend it, but it doesn’t “trickle down” much–I suspect a lot of it is spent in the US and Europe and also socked away in foreign accounts. The gap between rich and poor is great. To tax rentier money does seem to make sense if you want a more equitable society and avoid a kind of “toll booth” economy–which is what is starting to happen in the US. The PRI candidate in Mexico, Pena Nieto, lives in incredible Versailles-like mansions that make even Dubai billionaires look like pikers. The workers who built those barely eke out a living.

LikeLike

The problem is not that the rich are too rich. The problem is that the poor are too poor. A Monetarily Sovereign government should spend money on things that lift the poor. Trying to reduce the gap by punishing the rich always hurts the poor more than the rich. See: https://rodgermmitchell.wordpress.com/2010/07/04/some-thoughts-on-closing-the-financial-gap/

As you said, the rich know how to hide their money, and whatever they can’t hide from the government is deducted from the economy.

Rodger Malcolm Mitchell

LikeLike

Yes, I agree, the problem is not that people are rich. However, it is a problem when the rich get rich on the basis of corruption–which in L. American is rampant; or on the basis of exploitation, such as neoliberal measures that rob to the working class and favor rentier accumulations of capital. This is happening in the US, after all.

LikeLike

Two separate issues: Corruption and rich getting rich. Corruption is bad, whether or not people get rich. Getting rich is good.

So, be against corruption — all corruption, and don’t be against getting rich.

Rodger Malcolm Mitchell

LikeLike

Exactly! This cuts the envy at the heart of leftism at the very root. A simple but crucial point.

I have a doubt, however. I certainly agree with you about taxation. At the same time I find Hudson’s point compelling. How do you address the danger of the financial sector becoming parasitical and too powerful (as in the way Wall St. is taking over with its revolving door to the US gov’t) without taxing rent income in accordance with the classical economists?

LikeLike

Tom, as I said in FREE MONEY, I would reduce taxation to increase the money supply, and I would begin by eliminating FICA.

Then I would begin to raise the standard deduction until eventually all federal taxes disappeared. I would do the later incrementally, so as not to shock the system and cause inflation.

Rodger Malcolm Mitchell

LikeLike

Interesting, Rodger, but that still shifts the problem of taxation to the states and localities without addressing targeting. States and localities tend to favor consumption taxes, which 1) are regressive, and 2) inhibit productive activity. They also use property taxes. They exempt businesses from property taxes to compete with other states, shifting the asset tax burden onto residential RE. So this doesn’t seem like much of a solution to me.

LikeLike

Tom, whether states “tend to” enact taxes you feel are regressive, is not the point. I did not suggest shifting the tax burden to the states. I suggested reducing the tax burden.

The less the federal government takes in taxes and the more financial support it gives the states, the healthier the states will be.

Rodger Malcolm Mitchell

LikeLike

Rodger, you are avoid the question. You admit that some taxation is needed to give value to the currency. How would you target taxation?

LikeLike

Tom,

The notion that taxation is necessary to provide demand for money is an MMT concept to which I do not subscribe. However, there is no proof, one way or another, so to avoid the “You think. I think” useless debate, I merely say, O.K., fine. But federal taxing is unnecessary, because there are ample state, county and city taxes available.

In my opinion, if there were zero taxes, there still would be demand for money, but I long since have learned not to argue the point with MMTers, because I have no facts, nor do they.

Rodger Malcolm Mitchell

LikeLike

Tom, by the way, the phrase “target taxation” is a bit alien to me. Do you mean what taxes would I eliminate first? If so, the answer is:

1. FICA

2. Incrementally raise the standard deduction.

Simultaneously, I would finance the states so they would need less taxes, which they could reduce at their discretion.

Rodger Malcolm Mitchell

LikeLike

I am still no clear on your position, Rodger. Are you advocating no federal, state or local taxes? Are you proposing to control any ensuing inflation with interest rates alone? I really don’t understand your fiscal and monetary policy here.

It seem to me that without some taxation somewhere at the federal state or local level, interest rates would have to set very high to prevent inflation unless government could control the endogenous money supply, which it now does not due to bank lending being reserve-independent.

If some taxation is necessary, how would you target it and why?

LikeLike

Yes, I advocate eliminating federal, state and local taxes — not all at once, but over time.

Why do you think interest rates would have to be “very high”? Today, interest rates are essentially zero, we are spending massively, yet where is the inflation? Same thing happened with the Reagan deficits. In the past 40 years, inflation has been caused by oil prices, not by deficits.

So what is your evidence?

Have I answered your question?

Rodger Malcolm Mitchell

By the way, bank lending is not reserve dependent. It is capital dependent.

LikeLike

Rodger, I agree that taxes would be unnecessary as long as 1) people accept state money without liabilities to the state payable only in state currency, 2) optimal output, full employment and price stability can be maintained.

This would involve precisely adjusting the amount and velocity of money with respect to output and maintaining it an open national economy confronted with globalization.

How is this accomplished in your view? While it sounds attractive, I hope you will excuse me for being skeptical without hearing the details.

LikeLike

BTW, when I say “targeted taxation,” I am speaking about what taxes to impose when taxation is called for, along with the rationale for doing so, rather than which existing taxes to eliminate.

Supposing some taxation is needed for whatever reason, how do you propose targeting it and why?

For example, we presently have a progressive income tax. if only because the rich have the money, but also for “redistribution,” and “sin” taxes to discourage behavior for social and economic reasons.

LikeLike

I’m not sure what a good “whatever reason” might be. Anyway, your question is, which poison do I consider least poisonous. Right?

The sin taxes. Legalize pot and tax it. Legalize all currently illegal drugs and tax them. Maybe tax casinos a bit more — but maybe not. Haven’t thought about it enough.

Beyond that it gets quite difficult, because whatever you tax is anti stimulus and anti the thing you tax.

And this is the reason taxes are so poisonous. Federally, they are unnecessary and harmful. Locally, they merely are harmful, and would be unnecessary if the federal government would support the states.

Rodger Malcolm Mitchell

LikeLike

Tom,

People will accept the dollar so long as they believe the country will manage inflation and the dollar is backed by full faith and credit.

I don’t know what “optimal output” is in a practical sense, or how any system could control it.

In my opinion, the MMT method for obtaining full employment (federal government is employer of last resort) is an impractical pipe dream. Who would hire? Supervise? Fire? What jobs? Where? How long? What salaries? What benefits? Pensions? In essence the MMT profs want to create the world’s largest company, with an uncertain task and an uncertain goal, paying what fees and taxes to whom? And all this run by political hacks for an uncertain length of time. This would make the WPA look like child’s play.

Having owned companies for 55 years, I have my doubts. Maybe Warren, who is a businessman, knows how to do it. I don’t.

I also don’t see the need for adjusting money velocity for two reasons: I don’t know how and I don’t know why.

MMTers seem to want lots of government control (i.e. incompetent control). My plan is much simpler: Incrementally add money to the economy until you get hints of inflation, at which time you raise interest rates incrementally to bring inflation down. Let the economy, not politicians or economists, figure out how to spend the money.

Rodger Malcolm Mitchell

LikeLike

You just outsource it to the voluntary sector and the private sector, with the public sector topping up if the other parts don’t deliver in a particular area.

There is a minimum level of resources that everybody needs to live a life free from poverty. The state should guarantee that in return for the individual’s contribution of a full week’s effort.

To that extent you need to separate ‘jobs’ from ‘income’.

Only at that point is the bargaining in the labour market a bargain amongst equals rather than a master dictating to a servant.

LikeLike

Say more about “outsource.” How are the sources selected? Does this mean the government functions as a giant “temp” agency?

Rodger Malcolm Mitchell

LikeLike

No. That would be chaos! They can’t handle outsourcing rubbish collection.

I much prefer loosely coupled systems.

My feeling is that the state funds the individual directly to a level that provides their basic needs in return for a signed off timesheet from some third party who is using the individual’s time to do ‘useful work’ (anything from charity worker to running the country).

In return you scrap the minimum wage and all the other silly restrictions on free bargaining of labour.

Now if I’m right that means that workers are then effectively ‘free’ to all organisations in the economy unless they have to pay extra because of a shortage of the particular type of worker they want.

The market will then define the supplement each individual can command.

Poverty eliminated and the labour market becomes a genuine bargain amongst equals.

LikeLike

Rodger, since you have continually ignored my question about how you would target taxation, I assume that you consider taxation unnecessary.

LikeLike

Tom,

I guess I don’t know what you mean by “target.” I told you what taxes I would eliminate first and what taxes I would eliminate second. At your insistence, I also told you what taxes I could accept (barely).

Anyway, yes, I consider taxation unnecessary — worse, harmful.

Rodger Malcolm Mitchell

LikeLike

No problem, Rodger, I was just trying to find out where you stand. I am fine with no taxes if it can work. I am just skeptical it can with out inflation.

I don’t regard “sin” taxes as contributing much to tax policy, since they are relatively trivial. So I would consider some sin taxes as being consistent with a no tax policy.

LikeLike

Eliminate all taxes today and you would have inflation. It’s a long, slow process. Had we begun it 40 years ago, when we became Monetarily Sovereign, we could be living in a tax-free, government debt free society, today.

Rodger Malcolm Mitchell

LikeLike

Jorge, you asked, “How do you address the danger of the financial sector becoming parasitical and too powerful (as in the way Wall St. is taking over with its revolving door to the US gov’t) without taxing rent income in accordance with the classical economists?

There are many questions within that one. The “revolving door” has nothing to do with taxes. Enact a law against it, I suppose.

I don’t know what “parasitical” means in the real world of business. Is Bill Gates a parasite, because he spends most of his time not working at Microsoft? Is a landlord a parasite, though he may spend all his time managing his properties?

The concept is straight out of Marx, who was the master of class warfare. I reject the notion, else we all are parasites for owning shares of stock.

Interesting how the have-nots always worry about someone “taking over.” Once it was the Irish and the Italians. Then the unions. For a while, the Catholics. Always the Jews. In some locales, the blacks. Now the financial sector?

Hey, someone has to lead us.

Rodger Malcolm Mitchell

LikeLike

I find your reply rather insufficient, if you don’t mind my saying so. Hudson makes a strong case that the economy is being “financialized”. I think you are quite aware of what he means by this and the problems it poses. Are we not suffering a major economic problem in the US owing to this? What I wrote was not crypto-marxism, and I never said that revolving doors had something to do with taxes. Your gratuitous defensiveness is a bit astonishing. You are also rather provincial in your view. I can assure you in all non-marxist objectivity that class interests exist, and that they are not always benefic or have the public weal in view.

LikeLike

Jorge,

Hudson sees something inherently wrong with a “financialized” economy? I happen to disagree.

We have had six depressions in the past and recessions too numerous to count. Was the economy too “financialized” all those times, too?

You used “revolving door” and taxation in very the same sentence, which made me think they were connected. Unreasonable?

Unlike most blog operators, I actually try to respond to many of my readers’ comments. Occasionally I may misunderstand their points, as each person tends to use different language styles and different words to mean the same thing.

My readers almost invariably are intelligent, and some are not accustomed to seeing their hypotheses taken apart. So a few go where they will find people with exactly the same thoughts, thereby learning nothing.

Those who stick around are treated to ideas that may not have occurred to them. I learn from them; they learn from me.

I happen to disagree with the foundations of Hudson’s theses. I’m sorry if you take offense at this, but idea exchange is the purpose of this discussion blog, and if I think an idea is wrong I’ll tell you and I’ll tell you why. If you have a belief, defend your ideas, rather than calling me provincial. Or run and hide. Whatever.

Rodger Malcolm Mitchell

LikeLike

MInksy distinguishes between contractions resulting from the business cycle and the financial cycle in his principles of financial instability. Richard Koo describes the latter as a “balance sheet” recession resulting from excessive debt. Irving Fisher explained the Great Depression in terms of debt-deflation. What Jorge is referring to is well-understood in heterodox circles. The mainstream missed it. Many now think that recovery is underway because the business cycle is turning up. But the financial problem are still working themselves out and will be for some time.

LikeLike

Neil,

That might work, but I suspect it would devolve to unemployment compensation. Think of the realities of trusting thousands of people to sign time sheets. I’d feel more comfortable with giving the states $1,000 per person, and allowing them to spend the money on the things states spend money on: Roads and bridges, education, law enforcement and justice, and graft, all of which gets money into the hands of the people, without federal interference.

The primary purpose of federal financing is defense and creating money. I’d prefer to allow lower governments do the planning and execution, where realistic.

Rodger Malcolm Mitchell

LikeLike

Well, Rodger, I think the problem is that you did not say why you disagreed, you simply said you did, and that Hudson’s thesis was “dubious.” Perhaps you are unaware that you typically do this–read through the exchange with Tom, to mention just one. I would have to agree with Jorge that your reply was insufficient. It would actually have made for an interesting exchange.

LikeLike

Totally wrong, Henry. My exact words were, “Professor Hudson’s thesis can be summarized: Removing money from the economy, via federal taxes, stimulates the economy. A dubious proposition at best.”

Then I received comments about Professor Hudson’s credentials (a telling sign) and his school of thought, but nothing to refute my summary of the link.

Do you disagree with the summarization or do you disagree with the idea of that summarization being a dubious proposition? Why?

Rodger Malcolm Mitchell

LikeLike

Tom, I have great difficulty with the word “cycle.” It implies inevitability and predictability, neither of which are accurate.

I do not believe the economy goes up because previously it went down, as “cycle” implies. I believe the economy moves because of specific reasons, unique to each specific time. We did not have a recession because we had growth earlier. We had a recession because of specific government actions, based on a misunderstanding of economics.

Had the government acted differently, there would have been no recession and thus, no “cycle.”

The Great Depression, like all depressions before it, and almost all recessions, was caused by insufficient federal debt, not by cycles. See: https://rodgermmitchell.wordpress.com/2009/09/07/introduction/

Rodger Malcolm Mitchell

LikeLike

Re: Do you disagree with the summarization or do you disagree with the idea of that summarization being a dubious proposition? Why?

Actually, I think you were being asked why it was a dubious proposition. You never explained that. It has always been clear–except to you–that people weren’t disagreeing with your summary, but simply wanted you to support your evaluation.

LikeLike

Henry,

I summarized his position, which I interpret to be: “Removing money from the economy stimulates the economy”. I disagree with that position.

To see support for the notion that removing money from the economy does not stimulate the economy, please go to: Summary

Rodger Malcolm Mitchell

LikeLike

Rodger, for Pete’s sake! Why have a blog? Just cancel everything and refer people to your posts and “everything” will be made luminously clear!

LikeLike

Or, I could cut and past exactly the same thing I said earlier. What’s your objection to reading the original post?

LikeLike

Charles R. Norris was a 17-year-old when he entered the Civil War in mid-1861. Writing to his family in Leesburg, Virginia, he declared, “You need not send for me or want me to come home for I would not leave for a thousand dollars.”

I think one thousand dollars then must have been nearly equivalent to one million dollars today.

LikeLike