An alternative to popular faith

Ask a debt hawk why he hates federal deficits and he will give you four main reasons:

1. Federal debt must be paid back by taxpayers. (But, because the federal government has the unlimited power to create the money to pay its bills, taxpayers do not fund federal spending.)

2. Federal debt adds to the government’s interest-paying burden. (Again, interest is no burden to a entity having the unlimited ability to create money.)

3. Federal debt uses up lending funds that otherwise would go to private needs. (But, federal spending adds money to the economy, making more, not less, funds available for private lending.)

4. By increasing the money supply, federal deficits reduce the value of money, thereby causing inflation. Readers of this blog have seen the graph (below) which shows no relationship between federal deficits — even large federal deficits — and inflation.

Note how the peaks and valleys of deficit growth do not match the peaks and valleys of inflation growth:

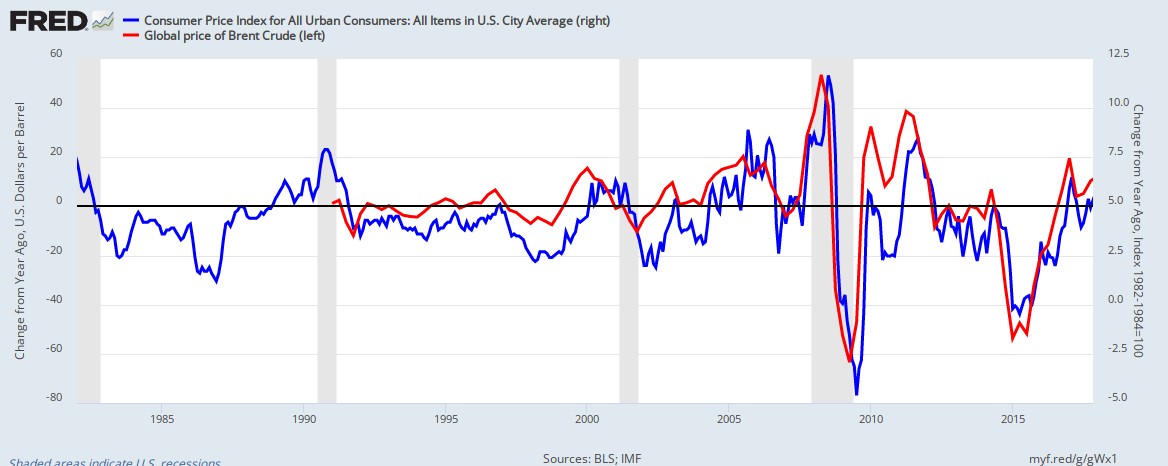

If deficits don’t cause inflation, what does? In a previous post “Is inflation too much money chasing too few goods”, we answered that question (“No.”), and we presented a graph indicating the real cause of inflation may be energy prices, more specifically, oil prices. See below:

The extreme movements of energy prices corresponding with the more modest movement of overall inflation, seem to indicate that energy costs “pull” inflation in either direction.

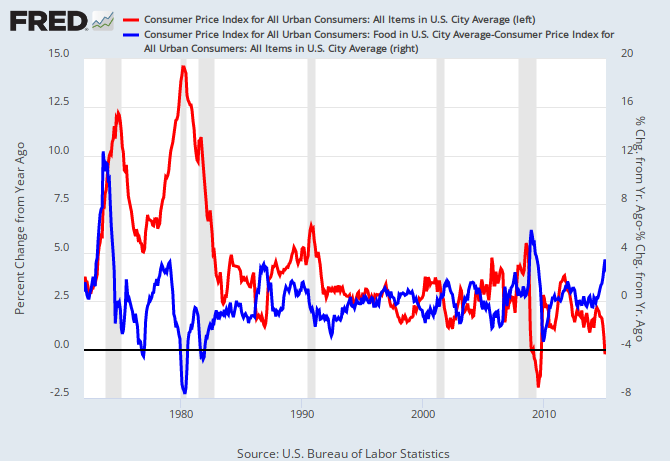

We can see this parallelism better by magnifing the CPI movement with a different vertical axis:

Now here is another graph that may substantiate the hypothesis that energy prices pull CPI:

It compares inflation movements (red line) with the movement of energy prices less the movement of inflation (blue line). Notice how closely the two lines correspond.

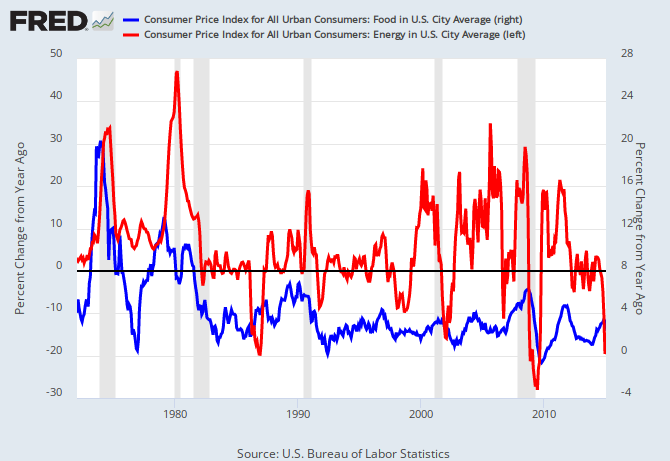

Compare that graph with the graph below. This graph is the same as the one above, except rather than comparing energy price changes with inflation, it compares food price changes. See how there is much less correlation.

Food price changes do not seem to be the key inflation-causing factor. In fact, energy price changes seem to cause food price changes:

Inflations are not caused by too much money. Inflations are caused by shortages.

Energy, and more specifically oil is, aside from food and water, the one universal need. It is the only commodity, the shortage of which, affects the prices of all other goods and services.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”

Rodger–

I came across a blog post of The Market Ticker Guy. You can read it here: http://market-ticker.denninger.net/archives/2130-On-Deficits-And-Debt-Financed-Government.html

He points out the similar idea that money creation hasn’t created inflation. He has similar data showing this. He does mistake that we’ll hit a brick wall someday when we can’t cover the interest payment. So, don’t throw-out what he says about money creation and inflation on account of this flaw.

But, what he does bring up is why we pay interest in the first place? Why does any of this money 1) have to have interest accrue? and 2) have to be a debt to begin with (or rather, why does it ever have to be paid back)?

LikeLike

The “I believe” post — https://rodgermmitchell.wordpress.com/2009/09/07/introduction/ — says the same thing. There is no reason for the U.S. government to borrow the dollars it already has created and can continue to create. That is a relic of the gold standard, when the government did not have the unlimited ability to create dollars.

Rodger Malcolm Mitchell

LikeLike

Rodger,

I recently read some of Warren Mosler’s writings which you of course have mentioned on your blog. Although the two of you come to similar conclusions on many topics, one major difference that I spotted are your ideas on both the cause of inflation and how to manage it.

Although you both point to OPEC as a big factor in inflation, Warren believes that taxes serve to clamp down on private sector demand which in turns slows demand for good and services, cools off the economy and voila, inflation is subdued.

Your cure for inflation is totally different. As I understand it, you believe that higher interest rates will increase the demand/attractiveness for money itself which will in turn subdue inflation.

Your two theories will obviously require very different policies should inflation begin to rise. Do you have any proof you can point to either show that Warren is mistaken or that you are correct?

LikeLike

Jason, you are correct. That is where Warren and I differ. He and I argue about it all the time.

Actually, his solution might work, sometimes. Increasing taxes might cure inflation by removing money from the economy. It also would “cure” economic growth. Because tax increases reduce the federal deficit, less money is pumped into the economy, which invariably leads to recession.

If you go to Warren’s site, you will see (at the top of the page) “MOSLER’S LAW: There is no financial crisis so deep that a sufficiently large tax cut or spending increase cannot deal with it.

I would call excessive inflation a “financial crisis,” so I believe Warren is arguing against his own law.

The demand for money is determined by risk and reward. The reward for owning money is interest. So increasing interest rates increases the demand for money (i.e. decreases inflation).

The only significant inflation we have had in the past 40 years (i.e., since the end of the gold standard) came in 1979. It was cured with high interest rates. Meanwhile, President Reagan ran huge deficits without inflation, which argues against the tax-increase “cure.”

Ask Warren the same question you asked me. I’ll be interested in how he answers you. His answers to me essentially are that there is no proof of his theory, because it hasn’t been tried.

Rodger Malcolm Mitchell

LikeLike

Rodger –

Another fellow on the board talked about “easy money” being invested in Oil, which would cause the price of Oil to go up and thereby the price of goods in general to rise. This would seem like more of a distribution problem to me, as it was when too much “easy money” was available for mortgages, causing a bubble in the Real Estate market.

So, it seems lobbing a bunch of fresh money at the private sector might cause problems if the distribution is lopsided. Whatcha think?

LikeLike

John, you make a good point. I tend to suggest less specific spending like eliminating FICA and giving money to the states on a per-capita basis.

Government directed spending can create lopsided markets.

Rodger Malcolm Mitchell

LikeLike

I sure don’t like the sound of this. If sovereign states could just easily print money to buy their way out of trouble, woudln’t this be just such as beautiful world? Isn’t printing money that does not have any embedded value what landed uncle Bob (Robert Mugabe) in trouble? You’ve all surely read what happened to the Zim economy – massive inflation going into the billions of percents? The way I understand it, money is supposed to represent a store of value (the economy, stupid!), and is only as good as there is value in the underlying assets. If you just printing dollars to buy your way of of trouble, something tells me you’re digging yourself into a hole. Call it inflation if you will, but your currency will wind out without any value whatsoever. Your response will be to print more of the notes, which will exacerbate the situation you find yourself in.

LikeLike

RK –

“Printing Money” or the electronic equivalent of it isn’t something you would do under all circumstances. It’s appropriate at times to add money to the “Private Sector” and not at others. Now is an appropriate time.

WRT to Zim and others that that experienced hyperinflation, too much money in the sector is a problem, but you also need to add some other factors in to really send it to hell in short order. Like having debt in foreign money, civil war, diversion of real goods to the black market (which only accepts foreign currency), having your leader destroy the country’s output. That sort of thing.

LikeLike

Right John,

Hyperinflation is not caused by money “printing,” at least not initially. In fact, the reverse is true. Hyperinflation causes money printing.

I continue to be amazed at people’s fear of hyperinflation, which we are nowhere near, and which easily is prevented and cured.

But those same people show no concern about reduced Social Security benefits, lack of health care, crumbling infrastructure, states going broke, poverty, homelessness, deficient education, etc., all of which exist today and could be addressed with federal spending.

It’s like letting a fear of meteors prevent you from going outside.

Rodger Malcolm Mitchell

LikeLike

Rhulani, you could use your intuition or you could use data. I prefer data, as shown in the above post. Which do you prefer?

Here are some more data for you. Go to Federal Debt Held By Private Investors, and you will see that the debt increased by an astounding 3,500% in only 40 years, and made an even greater increase in the past 2 years. So where is the inflation? Today, we fight deflation.

If you are going to disagree with my data, perhaps you should present some counter data.

Rodger Malcolm Mitchell

LikeLike

first let me say i find your blogs interesting and thought-stimulating. and the thought of the federal government not needed my tax dollars makes me grin ear-to-ear with delight.

your graphs show a correlation between energy (oil) prices and inflation, but couldn’t that be interpreted the other way around: that inflation is causing the change in energy prices? and isn’t inflation quantified by the change in prices of various goods (such as energy), and so whatever price index you use to calculate inflation could be based on energy prices.

LikeLike

Excellent question, Joseph,

I would grin too, if I could get the politicians, the press and even some of the economists to understand Monetary Sovereignty.

I suspect it is energy prices that are causing inflation, and not the other way around, because energy prices are moving so much more than any other factor — more than food prices, more than overall prices. Further, if inflation were causing energy prices to rise, one would expect the inflation slightly to precede the rise in energy prices. The opposite seems true. By a few months, energy prices precede inflation.

Here is a link that shows the timing of energy prices vs. CPI less energy. You’ll see that energy spikes slightly before overall CPI: CPI vs (CPI-energy) .

LikeLike

if the fed gov’t printed and gave $1 million dollars to each US citizen, do you think this would devalue our currency (i.e. cause inflation)? as i am interpreting your posts, i would expect you to say no; but certainly prices would go up. everyone would have extra money and go shopping, so we’d have more dollars chasing the same number of goods. what’s your opinion of this?

LikeLike

Joseph, if the government gave $1 million to each U.S. citizen, we surely would have inflation. Similarly, if the government taxed every citizen $1 million dollars, we would have a depression.

Now, what do these extreme examples prove?

See: Summary, item 12.

Rodger Malcolm Mitchell

LikeLike

it proves deficit spending causes inflation. the fed gov’t is a monetary sovereignty and [i]can[/i] spend as much as it wants. but it [i]shouldn’t[/i] because it would de-value the currency.

and if a gov’t decides to deficit spend [every year], then it should also be promoting some activity that would offset that deflation. perhaps we’ve gotten away with it so far because because of the increases in GDP. do increases in GDP offset inflation?

LikeLike

Joseph, you thought processes are contaminated with the dregs of the hard money era. That era ended on August 15, 1971. That was 40 (forty) years ago. Ever since that time, the currencies (of the US and most other countries) have fluctuated (“floated”) against each other.

The outstanding theoretical feature of that era was that there was a fixed supply of “backing” (gold or some other thing) for every unit of currency. That kind of thinking usually relies of some comparison of “deficits” and inflation.. More deficits, the process goes, the more inflation.

In the last several years, the deficits of the US have gone up by huge margins, yet the inflation rate has remained at very low levels. So a rethinking of that process is definitely in order.

How the currency’s of the world are priced and the underlying considerations that go into those considerations is an esoteric subject.

This gets into a very deep area about what gives any currency its value, but the bottom line is that the value of any currency is exactly, precisely what someone will give you for it./.

LikeLike

Joseph,

The deficit spending itself contributes to aggregate demand, which stimulates more production, and the additional supply prevents the additional demand from being inflationary, as long as increased production is possible (i.e., there is excess capacity, as there is today). Prices might make a one-time adjustment to a higher level, in order to reach equilibrium at the higher level of production. (Think of the Econ 101 X-shaped supply and demand graph.)

Secondary effects also tend toward stability: Increased production and employment leads to higher taxes and reduced safety net expenditures, which reduce the deficit and tend to dampen the increase in demand. Also, savings are likely to increase along with higher incomes, and act like taxes as “leakages” from the economy.

If we were to arrive at full utilization, and the deficit were to increase from that point, then (in a closed system) no increase of production would be possible, and prices would have to rise in order to clear the market.

The US, however, is not a closed system. Even if unemployment in the US were low, increased deficits would undoubtedly lead to increased imports, and the effect on domestic prices would be dampened because of that. As long as there was excess productive capacity worldwide, and free trade, only a large natural disaster or a very determined program to sabotage the economy would be able to create a runaway inflation. Something like creating an extra $1M per person ($10,000 per person probably wouldn’t do it 🙂

LikeLike

No Joseph, it proves your extreme example of giving $1 million to each citizen would cause inflation. By your logic, taxing causes depressions.

If you look at Item 8., you will see there has been zero relationship between federal deficit spending and inflation. Those are the facts, which I assume differ significantly from your intuition.

In answer to your question, decreases in GDP growth often precede reduced inflation. Today, we worry about deflation. Economics is a science. It should be treated as such. In science, intuition often is misleading. Better to believe facts than intuition

Rodger Malcolm Mitchell

LikeLike

I followed the link from one of your more recent blogs to this one.

You deem excessive inflation to be a financial crisis and at this point I find it difficult to argue. However, you believe Mosler is in effect arguing against his own law.

“There is no financial crisis so deep that a sufficiently large tax cut or spending increase cannot deal with it.”

I’ve been thinking about this and whilst I have not seen any of your discussion with Mosler (I’d like to) I think you are incorrect. MMT allows for targeted spending and what is inflation by the standard definition (I know you disagree) but too much money chasing too few goods which of course means the productive capacity in the economy is slow. How do we increase that productivity – by providing incentives/stimulus to the unemployed and/or tax cuts to businesses that take them on.

In your blog about inflation related to oil price that’s all the countries chasing the rising oil price so they can fuel their vehicles before the price does get too high, so it still remains too much money chasing too few goods. Most oil producing countries can use their oil as a buffer stock as well and consequently a price control mechanism, in the same vein the fictional NAIRU works. In the same way the JG/ELR schemes work. In the same way the diamond supply is controlled by [insert company name I forget here].

LikeLike

Click the link where I address the issue of “Too much money, chasing too few goods,” which is not a definition but rather a hypothesis as to the cause of inflation — a hypothesis I believe the facts have disproved.

Rodger Malcolm Mitchell

LikeLike

Thanks. I hadn’t read the comments. My idea had all ready been had 😦

I was quite interested in the hypothesis until this point. 😦 😦

LikeLike

And now I realise I misunderstood your reply.

LikeLike

“The demand for money is determined by risk and reward. The reward for owning money is interest. So increasing interest rates increases the demand for money (i.e. decreases inflation).”

And increasing rates decreases investment because fewer project will yield enough return to cover the cost of capital. So that will lower growth. I’ll side with Warren on this one.

LikeLike

Dismayed,

If you are correct, you should see a relationship between low interest rates and high GDP growth — and vice versa. But, if you go to Item 10 , you will not see that relationship. Actually, there may be a very slight reverse correlation, where high rates stimulate high growth.

Why this counter-intuitive result? While interest is but a minuscule part of most company’s costs, higher rates force the federal government to pump more money into the economy.

Rodger Malcolm Mitchell

LikeLike

As of today I learned about monetary sovereignty, and it seems insightful, though counterintuitive indeed. I see where it makes sense though. On the other hand, with respect to the knowledge and understanding of economics, there’s something to be said about the government not wanting taxpayers to understand this, because if they did they would demand the elimination of taxes. Yet taxes help the government control the population, among other tools such as our police force (different topic). My question is if this is true, why doesn’t anyone want to believe it and take advantage of this concept? Occasional recessions may be inevitable, but ones like this recent one could have been mitigated to an even greater degree from the sounds of it.

LikeLike

Many people believe it. Those subscribing to MMT (Modern Monetary Theory), i.e. the Chartalists believe it. Look up Warren Mosler.

Because it is counterintuitive, no politicians have the honesty or courage to endorse it. One day they will, at which time everyone will proclaim it’s obvious and they knew it all along.

Yes, the recession probably could have been prevented altogether.

Rodger Malcolm Mitchell

LikeLike

Do you think this spike in oil will cause inflation that will derail the recovery?

Do you think the FED starts to hike ahead of schedule, which Calculated Risk blog believes 1/3 of the way into 2012 at the earliest

LikeLike

Peter,

Historically, a spike in oil prices has been associated with inflation. If the Fed senses inflation, it will increase interest rates. This is a politically sensitive act, as there is belief (wrong, in my opinion) that raising rates slows economic growth.

Nevertheless, the Fed’s #1 job is not to stimulate the economy, but to prevent inflation.

Rodger Malcolm Mitchell

LikeLike

Yes, the stimulus almost bankrupted us – but it was too small! Wow.

“Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.””

LikeLike

A Monetarily Sovereign nation cannot be “bankrupted.” It can pay any bill of any size, any time. That is what Monetarily Sovereign means.

Rodger Malcolm Mitchell

LikeLike

What authorities have granted the United States the right to be a “montarily sovereign” nation and possess this ability to “create unlimited amounts of debt”…..with only the promise to repay in dollars? If a country has oil and

the United States only dollars (or unlimited debt)……why would the oil country desire dollars (with virtually has no value) in exchange for it’s oil?

How many nations have the same status?

Therefore, I should believe the following:

Deficit spending can be “unlimited”….and not create inflation. Oil, which is assumed to be “limited” or finite, but priced in dollars (that has no value but the promise to repay with more dollars)…… has historically been proven to create inflation…. based upon oil’s availability and consumption.

Hope that you may reply. Thank you, Don Stacy

LikeLike

Don,

Prior to August 15, 1971, the U.S. was on a gold standard. The U.S. creation of dollars waslimited to its gold supply. It required itself to have a certain quantity of gold for each dollar created.

This requirement incorrectly was believed to increase the stability of the dollar. (Meanwhile, the Great Depression and many inflations occurred while the U.S. was on a gold standard. So much for “stability.”)

This limitation prevented the U.S. from controling its sovereign currency supply. We were monetarily non-sovereign. The euro nations too, cannot control their sovereign currency supply, simply because they do not have a sovereign currency. They too are monetarily non-sovereign.

President Nixon, in 1971, announced that after August 15, the U.S. would allow its currency to “float.” It would not be limited by gold or by any other physical substance.

The dollar is non-physical; it has no physical limits. The government creates dollars by sending instructions (not dollars) to creditors’ banks, telling these banks to mark up the checking accounts of its creditors. Dollars themselves cannot be sent anywhere, as they do not physically exist.

You never have seen a dollar, touched a dollar or smelled a dollar. They simply are numbers in accounts. Dollar bills are notes showing the holder owns a dollar, but they themselves are not dollars.

The U.S. dollar is backed by the “full faith and credit” of the U.S. government. There is a longer description of this at: https://rodgermmitchell.wordpress.com/2011/06/20/why-a-dollar-bill-is-not-a-dollar-and-other-economic-craziness/ , but briefly, full faith and credit means:

– The government will accept only U.S. dollars in payment of taxes

– It will pay it’s debts (T-bills et al) and its bills with U.S. currency

– It will force all your domestic creditors to accept U.S. currency, if you offer it, to satisfy your debt.

– It will not require domestic creditors to accept any other money

– It will maintain a market for U.S. currency

– It will continue to use U.S. currency and will not change to another currency.

– All forms of U.S. currency will be reciprocal, that is five $1 bills always will equal one $5 bill and vice versa.

A Monetarily Sovereign nation does not support its sovereign currency with any physical substance. The Saudis are Monetarily Sovereign, and their currency too, is supported with their full faith and credit — not with oil.

If the U.S. owes you money, you have no claim on the Grand Canyon, Washington Monument, Congress or any other federal assets. Similarly, if the Saudis owe you money, you have no claim on their oil. You must rely on their full faith and credit. Period.

Many other nations are Monetarily Sovereign — the UK, Canada, China, Japan, India, Australia, to name just a few. (Note that the UK, though part of the EU, was smart enough to keep the pound, which means it never can go bankrupt. Greece wasn’t that smart, so can and has failed to pay its debts)

Japan, for instance, has a debt exceeding 200% of its GDP. Further, it has gone through one of the greatest disasters in its history. But because it is Monetarily Sovereign, it is in no danger of bankruptcy. The euro nations, by contrast, never could survive such a tragedy.

There are two fundamental questions regarding the U.S.’s Monetary Sovereignty:

1. How many dollars CAN the U.S. create?

2. How many dollars SHOULD the U.S. create?

The answer to #1, is: Unlimited.

The answer to #2 is: Enough to stimulate the economy, but not enough to cause inflation. Since, to date, inflation has not been caused by “too many” dollars, we have a long way to go. (Please re-read the original post, and you will see that, in today’s world economy, inflation has NOT been caused by too many dollars chasing too few goods.)

If we were to encounter an inflation we couldn’t fight any other way, we simply would increase taxes or cut spending. That should be a last resort. The Tea/Republicans want to do it now, which is hurting our recovery.

Unfortunately, Congress and the President do not understand all of the above. If you now do, you know more economics than they do.

Rodger Malcolm Mitchell

Sorry for the length of this answer, but the explanation cannot be given in sound bites.

LikeLike

Where inflation is caused by “supply shock” aka cost-push, and the supply is imported, then Net Financial Assets (Gov’t crated USD) flow out of the domestic Fed accounts into foreign fed accounts. As only a portion of that returns to circulate in our domestic economy, it is to some degree “out of play” i.e. it’s not circulating in the domestic economy and acts like a drain of domestic demand (tax) in this respect.

LikeLike

I’m still learning, but my understanding is that if USD represented a fixed value, then you’d be right about the drain (tax), but given that the Fed can simply spend more USD domestically, it doesn’t have to drain domestic demand unless they let it. In fact, more USD in foreign accounts (or any accounts) is a sign of dependence upon the USD and Fed.

LikeLike

Good day mr Mitchell! It seems you share the same views as I, but I have never seen you mention that the “federal reserve” is a private bank. Apparently courts always rule that it is a private corporation and it is owned and controlled by 12 regional central banks. Would you say this is true, or do you actually believe the Fed is controlled by congress? Kind regards.

LikeLiked by 1 person

If the U.S were to become energy self-sufficient (via the extraction and production of domestic shale oil, etc.) and independent for the need for importing oil, would this effectively extinguish inflation? Could this actually cause deflation in the U.S.?

LikeLiked by 1 person

If energy self sufficiency reduced oil prices, there could be a deflation. However, self-sufficiency wouldn’t necessarily cause oil prices to decline.

There already is a surplus of oil in the world, and the oil companies are withholding it to support prices. Presumably, they would continue this practice.

LikeLike