The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

==========================================================================================================================================

It commonly is believed large federal deficits cause inflation. Examples often are given of Germany, China, Brazil, Italy and other nations that experienced hyperinflation.

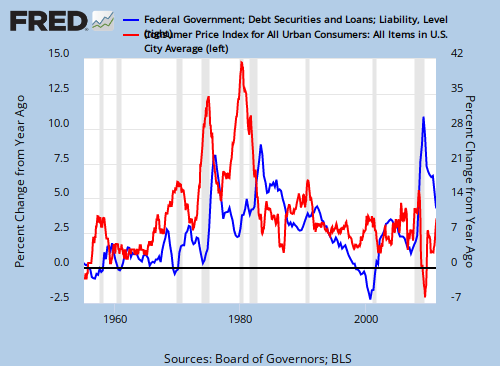

So it might be useful to see what the experience in America has been. Here’s a graph created by the St. Louis Federal Reserve. The blue line is deficit growth. The red line is inflation.

In the past 50 years at least, deficit growth has not been associated with inflation.

Inflation is more closely related to special factors than to deficits; such things as oil shortages, wars and weather are the main culprits.

I do not suggest the government should create an unlimited amount of money, though it has the power to do so. In 1979, gross federal debt was $800 billion. In 2009 it reached $12 trillion, a 1400% increase in 30 years.

During that period, GPD rose 440% (annual rate of 5.5%) with acceptable inflation throughout. The same 1400% increase would put the debt at $180 trillion in 2039, a mean deficit of $5+ trillion.

This calculates to a 9.5% annual debt increase for the past 30 years. Repeating that growth rate would put the 2010 deficit at about $1.14 trillion, and the 2011 deficit at about $1.25 trillion.

The deficit for year 2039 would be about $15.8 trillion. I know of no reason why the results would not be the same as they have been in the past 30 years.

However, increasing the debt growth rate above 9.5% might show even better results. In the 10 year period, 1980 – 1989, federal debt grew 210%, from $900 billion to $2.8 trillion (a 12% annual debt increase), while GDP grew .96% from $2.8 trillion to $5.5 trillion (a 7% annual increase).

During that same period, inflation fell from 14.5% in 1980 to 5.2% in 1989.

In summary, large deficits have led to GDP growth, while not causing unacceptable levels of inflation. Those are the bare bones.

For more information, see http://www.rodgermitchell.com

The fact that there is _any_ average inflation over a long period of GDP growth proves that something is very wrong.

LikeLike

Aaron,

The inflation is intentional and is based on the economic philosophy that a little inflation is stimulative. It encourages consumers to buy today rather than waiting to buy tomorrow. There are other reasons, too.

Rodger Malcolm Mitchell

LikeLike

I question the fundamental assumption that stimulating consumption today (monday) is a good philosophy.

The implication is that this stimulated say 1% is over and above (whatever may be deemed as sustainable)

So what do you do on Tuesday?

You need to borrow 1% from weds plus 0.1 from thursday to maintain the numeric 1% so called ‘growth’

Your chart above needs to extrapolate a compound curve into the present/future.

NB ‘Stimulate’ is by definition describing something ‘over and above’ – above what? – sustainable? ie consumption=production=consumption – ie zero inflation/deflation in the price measure unit of account

LikeLike

I understand the “compound interest” inference, but what is your preferred alternative to growth? Further, if you don’t like 1%, would .9% suit you better?

Here is a graph of GDP growth. Please indicate the compound curve you fear:

LikeLike

Hi Rodger – Appreciate your reply and rhyme with a lot of what you have to say.

But in this comment/context.

Of course i like growth – providing it is sustainable growth in efficiency/productivity.

This is NOT the same as (ever) increasing consumption

You cannot meaningfully/ simplistically lump the two together.

Yes they are (inter) related.

Consumption can stimulate production/efficiency – (by raising prices) and the opposite is true (by lowering prices) but consumption without correlated production/efficiency is obviously unsustainable.

In a word free from central and fractional reserve banking CB FRB the above would ‘self regulate’ and ‘natural growth’ would spontaneously occur (sustainable) – and interest rates would also self regulate

BUT ‘stimulated’ consumption via FRB etc, borrowing from the future – is a whole different ball game.

Define the word ‘stimulate’ and the answer should be self evident

Cocaine anyone? parabolic need for ‘stimulus’?

PS

Your graph doesn’t necessarily prove any productive growth whatsoever.

Am not saying there has been none, but.

It could show nothing more than the units of account used to measure.

So unless you have a graph that shows the increase in production – minus the increase in measuring units – then we cant ‘see’ what real ‘growth’ there is.

Just because you go from measuring in kilos to mm doesnt imply 1000% ‘growth’ lol

LikeLike

Here’s “Real (i.e. inflation adjusted) Gross Domestic Product Per Capita.” Does that help?

By the way, I use the word “stimulate” to mean enhance, as in: “Feeding a baby nutritiously will stimulate his growth.

LikeLike

lol – no compound – But anyway – do you honestly believe it?

As you quite rightly – and frequently point out, hegemonic USA can, has and does produce enormous ever compounding quantities of currency units (of account) – as many as it thinks it can get away with

To the extent that the supply of units against products/services has devalued the unit by what 96%? since 1914?

So flip the first chart upside down and draw a curve down to 4%

http://www.pricedingold.com doesnt tell the whole storey – but is insightfull

Thing is, that size and cost of government has exploded – and now represent a huge % (exponentially large/increasing%) of so called GDP – inevitable – for as long as the saudi protection racket maintains oil in sovereign USD

But we are getting away from the initial point

My questioning your use of ‘stimulus’ in a positive context – i disagree.

I believe that long term use of stimulus is bad for ones health

The whole chart(s)/ game is one exponential stimulus – which defies gravity, or the laws of eco-nomics

LikeLike

Not sure what gold has to do with anything, but if you feel uneasy about all that so-called fiat money, you should buy gold. Good luck.

I’m guessing, you don’t like federal deficit spending because you believe it causes inflation. Right? News flash: It doesn’t.

Inflation is an intentional creation of the government, based on Supply and Demand.

This applies not only to goods and services but to money. So, adding dollars to an economy causes inflation only when the Supply of money exceeds the Demand for money, AND the Demand for Goods and Services exceeds the Supply.

The second graph I showed you was inflation adjusted. What would turning it upside down prove?

By the way, before you tell me about the Weimar and Zimbabwe hyperinflations, I should tell you that neither was caused by deficits. Both (and virtually all hyperinflations) were caused by shortages of goods and services.

LikeLike

I mentioned gold – as a period prior to fiat

A period when wealth was earned/created – not brought into existence by creating money/debt

But please, I don’t wish to create an argument – I value your insights and your perspective of sovereign money is bang on.

This power has consequences (of course) – question is what are they.

For a hegemonic currency, inflation is (dollars are) absorbed globally – Zim is at the bottom of the money tree, it can only import inflation

Zim deficits devalued the currency (hyper inflation) – and capital controls/ price fixing caused the shortages – creating demand – or more accurately necessity’ for larger denominations.

Trillion denominated notes cannot be printed by any other than the central bank – the word cause’ is an interesting one

My definition of inflation, is the creation of currency units.(monetary policy as you say)

Manifest price inflation – manifests exactly as you say

Which brings us full circle

Question (with your (price inflation definition) para in mind

If GDP and currency units both experience ‘growth’ of say 9% – do we actually have any growth?

Begs the question – what is ‘growth’

Please – I am asking a serious question – I would appreciate your considered / reflected opinion

PS when I said flip the chart – I did mean the first one (non inflation adjusted) – and then plot the usd 96% devaluation against the ‘growth’ curve

LikeLike

“I mentioned gold – as a period prior to fiat – A period when wealth was earned/created.”

All money is “fiat,” i.e. created by government fiat. Whether or not it is tied to gold is immaterial. Gold is not wealth. It is just a “good” as part of Goods and Services.

Zimbabwe’s hyperinflation was caused by Robert Mugabe, who stole land from farmers and gave it to people who didn’t know how to farm. The resultant food shortages led to the hyperinflation.

Inflation is not the creation of currency units. That would make Inflation = Supply.

But Inflation = Supply/Demand. Inflation is a general increase in prices, not an increase in money supply.

“If GDP and currency units both experience ‘growth’ of say 9% – do we actually have any growth?” No. But if real GDP increases (i.e. GDP increases faster than inflation) we have growth.

LikeLike

Real (inflation-adjusted) GDP vs. Real Personal Consumption Expenditures

LikeLike

Thats a bit clearer – i shall digest – thank you for your efforts.

So please – your definition of ‘growth’ in the context of last message

LikeLike

Gold is not wealth, I agree and neither is money – Both are means of exchanging wealth (goods/services ie resources)

Obviously you don’t create wealth by printing more exchange units – true? (Sovereign or otherwise – even gold)

When Spain plundered the southern Americas – Stole and brought home too much gold/silver – the distorted economy/money supply/unit of account caused the Empire to ultimately collapse

Wealth is earned/created. (or stolen)

Economics is eco-nomics, ie rooted in the latin Ekois (resources) and Nomic (management)

It is NOT the management/manipulation of exchange units – other than to manage the eco above. Ie the root meaning of the word

The power of a sovereign state and the potential to manipulate sovereign currency units – has potential consequences, ie the power to distort pevert the LAW of eco-nomics.

For it is a LAW in the true meaning of the word/sense and like gravity, cannot be stimulated without simultaneously creating the force that compels a “reversion to the mean” (ie sustainable growth)

This LAW is as true for US as it was for Zim.

The British ‘caused’ Mugabe to take back African soil (cause is never a single event)

The subsequent lack of farm produce for export ‘caused’ the currency to collapse. Mugabe/ C’bank then printed larger denominations (no one else) to compensate for the (means of) exchange rate (in currency units)

Whatever food was produced – had huge relative value if exported as opposed to being sold domestically for zim paper (which was numerically price capped)

In addition to this – Mugabe fiscal policy (using said inflated and subsequently printed units) further manifested prices on the street (supply of money exceeding goods)

All else being equal, you will agree that “price” inflation CANNOT happen without simultaneous corresponding inflation in the units by which the products/services are being measured – simple law of mathematics.

100 products/ 100 exchange units = price £1

100 products/ 500 exchange units = price £0.2

500 products/ 100 exchange units = price £20.00

Price is the result of the ratio between the supply of goods OR supply of units – Pointless arguing chicken OR egg

The LAW of eco-nomics will always revert to the mean (one day) unless you discover some $=Mc3 or some super ‘sovereign’ power or whatever.

Price is not the measure of eco – without the exchange rate formula – and even then, eco is the defacto measure of eco

LikeLike

Your theory is expressed by this simplistic formula: Inflation = Money Supply. Unfortunately, that formula doesn’t square with the facts:

Actually, Inflation = (Money Supply / Money Demand) / (Goods & Services Supply / Goods & Services Demand)

As you can see, your simplistic formula completely neglects Money Demand and both the Supply and Demand for Goods & Services

See: https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/

Since you clearly have paid no attention whatsoever to the facts presented in the original post, and you continue to ignore facts, I feel further discussion will be useless.

LikeLike

I have read many of your articles and I love the effort made and wish to understand – I see that and share it

Apart from a few minor issues, I don’t disagree at all – I acknowledge your (rare) insight

But I believe there is another piece in the jigsaw that’s missing – and I believe? That there MUST be.

There must be because of the fundamentals I mentioned – that “all else being equal” it is just impossible for a price to rise without an increase in money supply or decrease in goods

Having accepted that basic premise – yes?

Then we can start to looks at the hows and whys and the myriad of influencing factors – for example, population, increased population/ production – ie if 10% more money coincides with 10% production then zero ‘price’ inflation – So of course more M3 doesn’t always correlate with 10% CPI.

In fact the whole idea of manipulating fed rates/M3 is to smooth and tighten your charts by anticipating the next peak/trough – that’s their job

The fed will manage your exact same charts – measuring products monetised

So the points you make ref your two links, I don’t dispute – and they don’t contradict my fundamental premise.

If I accept your points and you accept my premise – well then there is obviously something else going on

Note that neither did not say fiscal/ deficit or monetary policy necessarily causes ‘price’ inflation – I didn’t get as far as cause

I wanted to first agree on the basic premise – that “all else being equal” it is just impossible for a price to rise without an increase in money supply or decrease in goods

The problem is that the CPI is measured in dollars (the very thing you are trying to cross reference) and not in CP ie consumer products (ie qty)

You are also looking at % change year on year – If you plotted over 25 50 years you would see a different story.

http://pricedingold.com/networth/ plus http://pricedingold.com/investment-real-estate/ and more

I am not here selling gold – am just saying that measuring in dollars that fluctuate cannot present a clear picture.

Eco- nomics is that managements of resources – not management of exchange tokens

LikeLike