Mitchell’s laws: The more budgets are cut and taxes inceased, the weaker an economy becomes. To survive long term, a monetarily non-sovereign government must have a positive balance of payments. Austerity = poverty and leads to civil disorder. Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

Kermit the frog famously said, “It isn’t easy being green.” It also isn’t easy convincing people that traditional economics not only is hypothetically wrong, not only is factually wrong, but is wrong to such a degree it is extremely harmful to our economy.

The more extreme debt-hawks believe the U.S. federal government should run a balanced budget or even have no debt at all. The more moderate debt hawks feel some debt may be necessary at times, but to them, federal debt is like bitter medicine you take only when absolutely necessary.

All debt hawks, whether extreme or moderate, are long on facts, but short on evidence.

Their “facts” inevitably include federal deficit and debt measures, projections to the future, debt/GDP ratios and spending for Medicare and Social Security.

But when they interpret the facts, they provide no evidence that their interpretations reflect reality.

By contrast, here are facts, and a few opinions, which you may choose to interpret for yourself.

1. Fact: Money is the way modern economies are measured. By definition, a large economy has a larger money supply than does a small economy. Therefore, a growing economy requires a growing supply of money. QED

The graph below shows the essentially parallel paths of GDP vs. perhaps the most comprehensive measure of the money supply, Domestic Non-Financial Debt:

One could argue that money begets production or that production begets money, and both would be correct. The point is that money supply (i.e. debt) and GDP go hand-in-hand. Reduced debt growth results in reduced economic growth.

2. Fact: All money is debt and all financial debt is money. In addition to being state-sponsored, legal tender, there are four criteria for modern money:

Monetarily Sovereign money must be defined in a standard unit of currency.

MS money has no, or limited, intrinsic value.

The demand for money is determined by its risk (danger of default or devaluation, i.e., inflation) and its reward (interest rates).

Money must be owned by an entity other than the entity that created it.

The above criteria describe many forms of money including currency, bank accounts, T-securities, corporate bonds, and money markets. There is no form of money that is not debt. A growing economy requires a growing supply of debt/money.

2.a. Fact: Federal “deficit” is a statement of the net amount of money the federal government has created in one year.

Opinion: The word “deficit” is pejorative. A more neutral description would be money “created” or “added,” as in, “The government has created $1 trillion,” or “The government has added $1 trillion to the economy.” Compare the psychological meaning of those statements with the current phrasing, “The government has run a $1 trillion deficit.”

3. Fact: U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

4. Fact: Recessions tend to come on the heels of reductions in federal debt/money growth (See graph, below), while debt/money growth has increased when recessions were resolving. Taxes reduce debt/money growth. No government can tax itself into prosperity, but many government’s tax themselves into recession.

Recessions repeatedly come on the heels of deficit growth reductions, and are cured with deficit growth increases.

5. Fact: The federal government gave itself the unlimited ability to create debt/money on August 15, 1971, when it went completely off the gold standard. This ability is called Monetary Sovereignty.

Because the federal government now has the unlimited ability to create dollars, it neither taxes or borrows in order to obtain dollars. It simply creates them. Tax dollars are destroyed upon receipt.

6. Fact: Federal “debt” is the total of outstanding Treasury Securities. Here is how the federal (not state or local) government supposedly “borrows.” If you “lend” to the federal government, first you must put dollars into your checking account.

Then you tell the government to debit your checking account and credit your Treasury security account by the same amount. The process is similar to transferring money from your checking account to your savings account.

Then, to “pay off” the “debt,” the government simply debits your T-security account and credits your checking account. Thus, the government could pay off all its debt tomorrow, simply by debiting all T-security accounts and crediting the “lenders'” checking accounts.

The entire process neither adds nor subtracts money from the economy (but for interest paid).

Our Monetarily Sovereign government does not borrow the money it already has created, but rather exchanges one form of U.S. money (T-securities) for another (dollars). The entire “borrowing” process actually is nothing more than an asset exchange.

Federal borrowing of the money it previously created, is a relic of the gold standard, when the federal government did not have the unlimited ability to create dollars.

But do T-securities have any benefit? Yes, federal interest payments add to the money supply, a stimulative event. Federal control over interest levels adds to the government’s ability to control the value of the dollar.

T-securities (debt) are not functionally related to the difference between taxes and spending (deficits). They are related only by laws requiring the Treasury to create T-securities in the amount of the deficit.

The Treasury has the ability to create T-securities (debt) without there being any deficit, and the government can run a deficit without creating T-securities. Federal debt is not functionally the total of federal deficits.

7. Fact: Federal taxes, as a money-raising tool, are unnecessary, harmful and futile — unnecessary because since 1971 (when the U.S. government became Monetarily Sovereign) the government has had the unlimited ability to create money without taxes, harmful because taxes reduce the money supply, which reduction leads to recessions and depressions, and futile because tax money sent to the government is destroyed as a balance sheet credit.

Our Monetarily Sovereign government does not store dollars for future use. It creates dollars, ad hoc, by paying bills.

The so called “debt” merely is an accounting of the total outstanding T-securities created out of thin air, by the federal government. The government is legally required to create T-securities in an amount equal to the deficit, but this requirement became obsolete when we went off the gold standard and became Monetarily Sovereign, in 1971.

Today, the federal government creates money by spending, i.e. it credits checking accounts to pay its bills. This crediting of checking accounts adds dollars to the economy.

The federal “deficit” is the net money created in one year and the federal “surplus” is the net money destroyed in one year. In short, deficit spending creates money and taxing destroys money. If taxes fell to $0 or rose to $100 trillion, this would not affect by even one dollar, the federal government’s ability to spend.

Further, (opinion)all tax (money-destroying) systems are unfair. See: http://rodgermitchell.com/FairTaxes.html. For a country with the unlimited power to create money, spending is not related in any way to taxing.

8. Fact: Contrary to popular myth, there is no post-gold standard relationship between federal debt and inflation. (See graph, below)

There also has been no relationship between inflation and the overall money supply, best indicated by “Total Debt Securities for All Issuers.”

Opinion: While dramatically increased the money supply can reduce money value (aka “inflation”), factors affecting demand seem to have been more important.

Inflation seems to have been more closely related to oil prices than to any other single element. (See the graph, below)

A brief discussion of oil prices and inflation is at https://rodgermmitchell.wordpress.com/2009/09/24/is-inflation-too-much-money-chasing-too-few-goods/

In this regard, hyperinflations are not caused by “money-printing,” but rather by shortages, most often shortages of food. So-called “money printing” (ala Zimabwe and Germany), were the governments’ response to hyperinflation, not the cause.

9. Fact: There is no post-gold standard relationship between federal debt and tax rates, which have remained level through massive deficits. (See graph, below) Fact: You and I, who are the children and grandchildren of the ’80’s, have not paid the massive Roosevelt and Reagan debts.

Taxes do not pay for federal spending. Federal spending creates dollars.

9.a. Fact: Federal deficit spending does not use “taxpayers’ money.” Federal spending creates money ad hoc.

When the government spends it credits bank accounts. No taxes involved. By definition, deficit spending means taxes do not equal this year’s spending let alone previous year’s spending. Only surpluses use taxpayers’ money, by causing recessions.

For the above reasons, our children and grandchildren will not pay for today’s money creation, but they will benefit from today’s deficit spending — better infrastructure, army, education, R&D, safety, security, health and retirement.

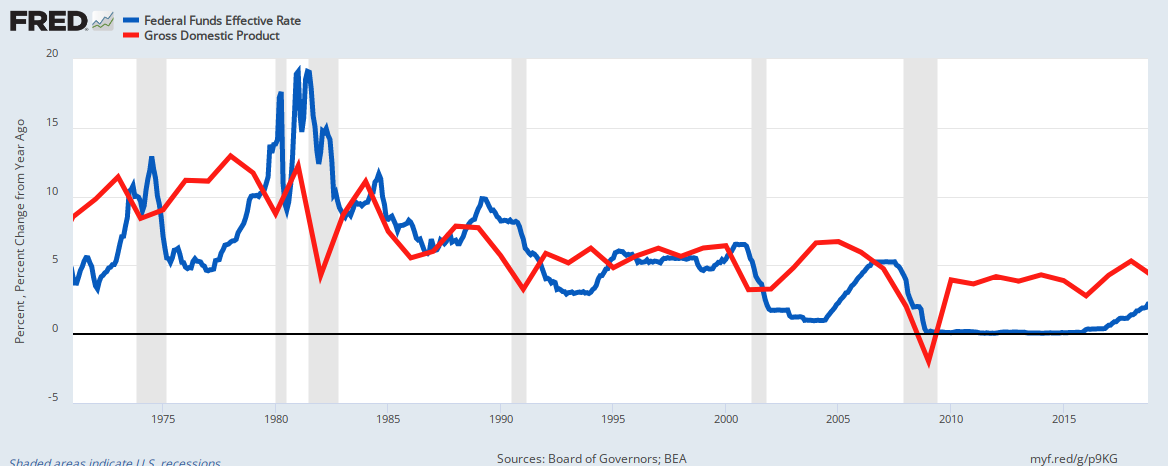

10. Fact: There is no post-gold standard relationship between low interest rates and high GDP growth.

Opinion: The opposite seems true:

Why do high interest rates seem to stimulate?

Opinion: High rates force the federal government to pay more interest, pumping more money into the economy.

11. Fact: The Federal debt/GDP ratio is a meaningless fraction, because it measures two, mathematically incompatible pieces of data. It’s an apples/oranges comparison. GDP is a one-year measure of output; federal debt is the net outstanding T-securities created since the nation’s birth.

The T-securities created years ago affect this year’s debt in the debt/GDP ratio, while even last year’s GDP does not affect this ratio. See: Debt/GDP

Because federal debt is the total of T-securities, and the federal government has the functional ability to stop creating T-securities at any time, the Debt/GDP ratio easily could fall to 0, depending on federal law.

11.a. Fact: The debt/GDP ratio does not measure the federal government’s ability to pay its bills. The government does not pay bills with GDP; it creates the money ad hoc to pay its bills.

Were GDP to be $0, the government still could pay bills of any size, simply by crediting the bank accounts of its creditors.

12. Facts: In 1979, gross federal debt was $800 billion. In 2009 it reached $12 trillion, a 1400% increase in 30 years. During that period, GPD rose 440% (annual rate of 5.5%>) with acceptable inflation. The same 1400% increase would put the debt at $180 trillion in 2039, a mean annual deficit of $5+ trillion.

This calculates to a 9.5% annual debt increase for the past 30 years. Repeating that growth rate would put the 2010 deficit at about $1.14 trillion, and the 2011 deficit at about $1.25 trillion. The deficit for year 2039 would be about $15.8 trillion.

Opinion: I know of no reason why the results would not be the same as they have been in the past 30 years. However, increasing the debt growth rate above 9.5% might show even better results:

In the 10 year period, 1980 – 1989, federal debt grew 210%, from $900 billion to $2.8 trillion (a 12% annual debt increase), while GDP grew .96% from $2.8 trillion to $5.5 trillion (a 7% annual increase). During that same period, inflation fell from 14.5% in 1980 to 5.2% in 1989. See graph, below.

Facts: In summary, large deficits have coincided with GDP growth, while not causing unacceptable levels of inflation.

Opinion: Federal money creation is constrained only by inflation, not by supply, debt, deficits, GDP, debt repayments or any other factor — only inflation. History indicates: a) We never have reached that point and b) Such inflation could be prevented and cured by raising interest rates (for minimal inflation) and/or by federal purchase and distribution of the scarce items causing the inflation.

(While raising interest rates does increase production costs and also adds to the money supply by forcing greater government interest payments, higher rates increase the demand for money, which is anti-inflationary. The graph below may indicate that CPI decreases follow interest rate increases by about a year.

13. Facts: Any health insurance proposal that covers more people will cost more money. Extracting that money from doctors, hospitals, pharmaceutical companies, by necessity, would reduce the availability of health care.

Increasing taxes on any individuals (even the wealthy) or on businesses, will depress the economy by removing money from the economy. Only the federal government can supply additional money while stimulating the economy.

14. Fact: Social Security is supported neither by FICA nor by a trust fund. Were FICA eliminated, and benefits doubled, Social Security still would not go bankrupt unless Congress decided to make this happen.

In June, 2001, Paul O’Neill, Secretary of the Treasury said, “I come to you as a managing trustee of Social Security. Today we have no assets in the trust fund. We have promises of the good faith and credit of the United States government that benefits will flow.“

Yet, SS continues to pay benefits. Your Social Security check comes from a mythical trust fund that contains no money and receives no money.

Social Security (and Medicare) benefits are paid ad hoc by the U.S. government, not from a trust fund, and are not dependent on FICA taxes. which (opinion:) can and should be eliminated. See: FICA

15. Fact: The finances of the federal government are different from yours and mine and businesses’ and state, county and city government finances.

Unlike the federal government, which is Monetarily Sovereign, we cannot create unlimited amounts of money to pay our bills. We first need to acquire money, either by borrowing or by saving, to spend.

The federal government does not acquire money. It creates money by spending. As an accounting principle, the tax money you send to the government is destroyed upon receipt. Then the federal government creates new money to pay its bills. The government has no fund from which it pays bills.

Fact: Were taxes to decrease to zero, this would not change by even one penny, the federal government’s ability to spend.

Opinion: The failure to recognize the difference between the Monetarily Sovereign federal government and all other entities, which are monetarily non-sovereign, is the primary reason for recessions and depressions.

16. Fact: The federal government has the unlimited ability to create the dollars to pay any bill of any size. It never can run short of dollars; it never can go broke.

Opinion: The federal government should distribute dollars to each monetarily non-sovereign state, on a per capita basis.

The states would determine how they distribute the dollars (to counties, cities and/or taxpayers). I suggest a distribution of $5,000 per person or a total of $1.5 trillion.

17. To understand economics you must understand Monetary Sovereignty.

Fact: In 1971, the U.S. went off the gold standard, thereby becoming a Monetarily Sovereign nation, and at that moment, all economics textbooks became obsolete. Sadly, mainstream economists, the politicians and the media have not yet caught up.

=======================================================================================

Summary: So there you have a list of facts, plus a few opinions, which I have noted. Read the facts and draw your own inferences.

You can find a great number of debt-hawk sites (i.e. Concord Coalition, Committee for a Responsible Federal Budget), which in essence are privately funded think tanks, paid to influence popular belief, with propaganda masquerading as data.

There, you will see data showing the size of the federal debt. These data are presented in a way designed to imply that the debt (money created) is too large.

But you will find no proof of these ideas. You will see no historical graphs equating debt with any negative economic outcome, simply because such graphs do not exist. Debt hawks believe federal deficits are so obviously bad, no proof is needed.

Yet, despite lacking proof, debt-hawks have foisted their opinions on the media, the politicians, weak-minded economists and the public, much to the detriment of our economy.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

Wow!!! Rodger, with all due respect, you are so out to lunch it’s not even funny.

Money does not HAVE to be put into circulation by government spending.

Let the people (i.e. actual market) spawn and retire the actual notes for their transactions. That will be the ultimate sovereignity.

All those notes have to say is:

-$1Unit.

-Rating agency X states that borrower has excelent credit.

-Printed by the US Treasury on request and behalf of borrower.

What you are hiding in this false-choice, usury-concealing website, is that the Fed-banking-system cartel are a government appointed monopoly on fresh issued credit.

I must say, convoluting all this and confusing people over currency issuance and government spending is a work of diabolical genius. I’d love to find about your shorting positions.

But excuse me if you really are not a concious agent of this.

LikeLike

Wow!! Rodger, I think Camilo here has figured you out. Promoting doom and gloom on your blog which is putting the markets into a panic and shorting it to take advantage of all your influence. How many millions has this strategy made you?

PS- Camilo, you’re a nut!

LikeLike

Jason, the markets don’t need me to put them in a panic. Congress and the President have done the job nicely, by reducing the deficit at just the moment an increase in deficit spending is needed.

If our imports equaled our exports: Federal Deficits = Net Private Saving

However since imports are greater than exports, deficits must even be larger:

Federal Deficits – Net imports = Net Private Saving.

If you don’t believe it, invest as though the economy will grow. Put your money where your beliefs are.

Rodger Malcolm Mitchell

LikeLike

Rodger,

I think you missed my sarcasm (see my PS).

LikeLike

Ah, yes. Got it. 🙂

Rodger Malcolm Mitchell

LikeLike

We might have a problem inherent in our government. Considering most Federal legislatures come up through civic office on the county and state levels, they’re used to balancing budgets. Once they get to Washington, they take this mentality with them.

And then you have people like Ron Paul who insist we should go back to the gold standard because gold is the “historic currency.” Of course gold is a commodity, just like oil or corn, or US dollars, so that doesn’t make any sense. It also takes us back to a banking system rife with corruption, and the inevitable bank runs, failures, etc.

What you’re pointing out here is that the only reason anything has value is because there is demand for it. People used to labor in order to obtain gold. Now they labor in order to obtain dollars.

Successful businesspersons understand this concept, which is why they seem to have their own printing press. They create demand for their product or service, or they offer a solution to fulfill a demand. Steve Jobs gets this.

I haven’t read but a couple of your articles so far so I don’t know what your opinion is of the recent credit downgrade, but in my opinion I think the resulting market clamoring away from stocks into t-securities is precisely because dollars will retain their demand in a depression. Your charts above and data show that the actions our government took on August 2nd can very easily lead to a depression.

LikeLike

I’m pretty sure letting the government print money rather than borrow and tax makes people who use its currency less wealthy. Government-caused Inflation is a de facto tax on all users of the currency.

Once the public sees that the government in question is printing all the money it wants, businesses and individuals will stop using that currency. Zimbabwe, for example, prints money regularly which results in hyper inflation. People simply cease using the local currency and instead barter or use other forms of currency.

This “Monetary Sovereignty” theory is omitting the effect of printing money on markets, businesses and individuals.

LikeLike

I’m pretty sure “mining gold” is the same thing as “printing money,” so now that we’ve got that out of the way, I don’t understand your point.

LikeLike

Rusty, shame on you for not reading the post and then for quoting the old “Zimbabwe” mantra. (You forgot to mention “Weimar Republic,” another debt-hawk favorite.)

Go up to Fact #8. Then read Cause of inflation

I hope you will allow facts to overcome your intuition.

Rodger Malcolm Mitchell

LikeLike

You have accepted the definition of money as debt, created through contracts in which one party, the State or its empowered banking mechanism, offers essentially nothing but bookkeeping services at interest as its consideration, as against the consideration offered by the other party to the contract in the form of tangible blood, sweat, tears, and creativity throughout his or her lifetime.

If one doesn’t accept that definition of money, basically representing indentured servitude, there is really not much room to talk with you.

Historically, the State didn’t create money, but as soon as money arose, it stepped in to attempt to monopolize is use. As I see it, you are legitimizing the State’s coercive role with a lot of graphs!

LikeLike

Historically, the state did create money. This is why we have coins with the faces of emperors. Rulers would coin money and then force people to use it by taxing them with their own coinage, which would require the people to obtain the rulers’ currency which created demand. Peasants in feudal state have very little use for gold, so its only value was in the demand it had by the rulers.

The only reason gold was used as money was because it was rare enough to prevent counterfeiting. We’ve gotten better at anti-counterfeiting measures since then, so we don’t have to rely on rare metals to protect our currency.

LikeLike

Another factor (i think Wray explained) was that since a King had to collect taxes in the currency that he spent to obtain the fruits of the ruled, the royal currency would hardly be valid for FOREIGN exchanges.

What kind of foreign exchange? Trade. Colonies. Hiring foreign mercenaries to wage war (often it was too expensive and difficult to send an army of local soldiers to conduct a coup on your cousin’s kingdom). Today we have global Foreign Exchange. With the Internet, instantaneous payments and currency exchange is possible … and done daily. No need to worry about shipping precious metals to distant lands (which is BARTER) nor “tally sticks”.

LikeLike

An important point, IMO, is that in pre-industrial times, royal spending and taxes allowed the King to seize the production of the workers and peasants (free food for protection racket, soldiers, etc.). Production was limited and goods were scarce.

Since the industrial age, industry was producing goods in abundance, TOO abundant. No longer an issue of Supply. Business needed Demand Enhancement for Capitalism to function.

LikeLike

Dennis, all money is debt.</b. The dollar is debt backed by the full faith and credit of the U.S. government. If you don't like dollars, I guess you'll have to settle for barter.

Rodger Malcolm Mitchell

LikeLike

A very informative argument, but it ignores the crucial fact that the United States IS NOT monetarily sovereign! Just as Germany has given up its sovereignty to the Central bank of Europe that issues Euros, the United States also gave up its sovereignty to the Federal Reserve!

LikeLike

Germany has given up their monetary sovereignty in exchange for the Euro. The United States of America has monetary sovereignty because we still have the US Dollar, printed by the US Treasury, a department of the Federal government. The Federal Reserve is not in control of the currency, and is itself under the authority of the United States Congress.

LikeLike

Thomas,

You are wrong . . . and right.

Contrary to popular wisdom, the Federal Reserve neither is independent nor has the unlimited ability to create money. The Chairman and the Board serve at the pleasure of the President of the United States. He could fire the whole lot of them, tomorrow.

The federal government creates money by paying its bills, i.e. by crediting the checking accounts of its creditors. The Federal Reserve does not run this process. Congress does. Congress (with the blessing of the President) can spend all the money it wishes, any time it wishes. So Congress and the President are Monetarily Sovereign.

However, in one sense you are correct that the government is not Monetarily Sovereign, or at least it restricts its own sovereignty. This is explained toward the end of: https://rodgermmitchell.wordpress.com/2011/06/09/the-loss-of-monetary-sovereignty%E2%80%93how-congress-puts-us-on-a-path-to-recession-or-depression/

Rodger Malcolm Mitchell

LikeLike

those who know the price of everything and the value of nothing

LikeLike

Hi Rodger,

I came across this website several months ago and I am fascinated by your insights. I’m not an expert on economics so I can’t be anlytical when critiquing your points of view and I mostly agree with them anyway.

I have a question I’d like you to try and answer for me. The fact that I’m asking it probably underlines my lack of knowledge in economics! I am British and every pound and pence in circulation, whether a note or a coin, has the Queen’s face on it. Now she’s 85 years old and when she dies in the near future all the coinage and notes will have to be taken out of circulation and replaced with those bearing the face of her successor, presumably Prince Charles. Now I’m not wishing the Queen dead (I think that’s still classed as treason and she seems a nice old lady), but there will obviously be a crossover when both the old and the new money are both legal tender so, If I am interpreting your theories right, the act of the Bank of England in replacing the old coins and notes with new ones will be automatically stimulative to the economy! Am I right, or completely wrong?

LikeLike

UKMike,

1. Only a tiny fraction of pounds and pence are represented by coins and notes. The vast majority are represented only by notations in bank accounts.

2. To the small degree destroying old coins and pressing new ones requires deficit spending, that would be a bit stimulative.

3. But the mere replacement of coins by other coins is no more stimulative than is the replacement of ragged, old pound notes with fresh new pound notes, which happens daily.

That said, if they put Kate Middleton’s image on the coins and notes, I would consider that highly stimulative.

Rodger Malcolm Mitchell

LikeLike

Hi Rodger,

Im from monetary non-sovereign Greece lol,

I personally agree with everything you say here, but i have one question.When the monetarily sovereign government issues bonds (or what u called T-securities) and ‘sells” them to its CB…doesnt it pay interest to the CB periodically?And if so whats the need for this?And where does the money for this interest comes from?

LikeLike

There is no need for a Monetarily Sovereign nation to borrow, i.e. to issue bonds. Borrowing is a relic of the monetarily non-sovereign days, which for the United States ended on August 15, 1971, when we went off the gold standard. We could (and should) stop issuing bonds, today.

The U.S. creates dollars by spending. If you are a U.S. bond holder, the U.S. will pay you interest by instructing your bank to mark up your checking account. The dollars don’t “come from” anywhere. They are created when your checking account is marked up.

Unlike you and me, and the states, counties and cities in the U.S. and Greece, Italy and the other euro nations, the U.S. does not need to “have” money in order to spend money. The U.S. creates money by spending money.

The finances of a Monetarily Sovereign nation are completely different from the finances of a monetarily non-sovereign nation, the later being more like your personal finances.

Rodger Malcolm Mitchell

LikeLike

If I am understanding you correctly every good citizen should pay as little income tax as possible to save the country from itself.

LikeLike

Yes, make that “legally possible.” But, of course, everyone already does that. Don’t you?

The problem is not the good citizens but the law, which should be changed.

LikeLike

Is it possible for a monetary sovereign to experience hyperinflation? If so, how is that avoided. If not, why not?

LikeLike

Yes, it is possible, though hyperinflation is a rare event. The most common definition is an inflation of 50% or more, per month. The U.S. never has experienced it.

Contrary to popular belief, hyperinflations are not caused by a government “printing too much money.” Truly extraordinary circumstances are required. The German hyperinflation, which lasted but three years, was followed by Germany’s creating and paying for the greatest army the world ever had known.

That hyperinflation was caused by the impossible requirements placed on it by the victorious allies of WWI.

The Zimbabwe hyperinflation was caused by Robert Mugabe, who stole land from white farmers, who knew how to farm and gave it to black farmers who didn’t. The resultant food shortage resulted in mass starvation and stratospheric food costs.

In short, hyperinflations cause money “printing” and not the other way around. The government struggles to pay its bills in the midst of massive shortages.

Today, with world trade making such massive shortages even less likely, hyperinflation also is even less likely.

No knowledgeable economist worries about an American hyperinflation, despite the occasional scare articles written by self-proclaimed “experts.”

LikeLike

Thank you!

LikeLike

The U.S. can never go broke in nominal terms, the abandonment of the gold standard ensured that. However, what you are describing is simply another form of crowding out of the private sector by government spending, only instead of higher interest rates, we have a larger proportion of new money being created by the federal government. If you subscribe to the theory that government is not the optimum mechanism for determining outcomes, then in real terms, this should cause an economy to be less productive, and less wealthy over the long run.

I’d theorize that outside of fiscal constraints, federal deficit spending is only constrained by a few things: The continued use of the dollar as a reserve currency for global trade and as a consequence having the largest most liquid bond market in the world.

Ironically, it looks like the unconstrained growth of the dollar and decreasing faith in the ability to repay these dollars based on the productive efforts from the real economy has started other nations to begin to start the process of settling trades in other currencies, and/or using bilateral trade agreements and other bond markets to begin to develop.

I do like however that economics has gone from the dismal science, where most economic functions are a consequence of scarcity, to where an abundance of something simply does not matter.

LikeLike

Dear Mr. Mitchell,

It was my impression that the amount of money supply is calculated by the Treasury (or the Fed?) based on the representative total value of products and services that the US makes or provides over a certain period. Is this wrong? Are there no constraints at all on how much money can be flooded into the economy by our sovereign government?

Sorry I have not read all of your blog posts yet and I came across this MMT thing only very recently.

LikeLike

Money comes into the economy via the Fed.

The treasury is responsible for funding the government but it cannot create money outside of coins.

The fed creates all money (credit). That money comes into the economy in 2 ways.

1) banks borrow the new credit from the fed at a low % and lend it to consumers for a higher %. Consumers spend the new money into the economy.

2) the government either borrows from the fed, banks, other governments and spend into the economy.

Note that the by creating new credit the fed, the banks and the government are basically counterfeiting. Since the new credit/debt can be spent in the economy, it is synonimous with counterfeiting or theft.

The rich, who have the access to more credit, become richer. And it’s not only the banking rich, it also includes the government rich. Those getting some of the new credit via the government, like unions or other free loaders, are at an unfair advantage. It’s theft no matter how you cut it.

The laborer who relies on the sweat of his forehead to feed his family is thrashed as his income rarely grows. His wealth is slowly stolen by issuing this newly created debt/credit.

LikeLike

The Fed is 100 years old. The U.S.is 236 years old. Who created dollars during our first 136 years? Think about it.

The answer: The same people (the Treasury at the direction of Congress) create dollars, today.

Clearly, you are not an economist, so you might wish to open your mind to learning, rather than calling me a liar. Just a suggestion.

LikeLike

There are several measures of the money supply: MB, M1, M2, M3, L, Debt Outstanding Domestic Nonfinancial Sectors. None of them hav anything to do with the “representative total value of products and services.”

There are no limits to federal deficit spending (aka “money creation”) aside from inflation. Contrary to popular wisdom, there has been no relationship between federal spending and inflation. See: https://rodgermmitchell.wordpress.com/2010/04/06/more-thoughts-on-inflation/

LikeLike

There hasn’t been any relationship between government spending and inflation…

This 100% a freaking lie and the author knows it. Do you know how much value a dollar has lost in the last 100 years?

Are you serious?

By definition, an increase in the amount of money devalues existing money allthings equal. No calculation is needed to prove this, why do you think counterfeiting is illegal?

The statement about more money needed in a growing economy is also a lie. Do you prefer being stolen from or not being stolen from? If the answer is you dont want to be stolen from, than money does not necesarily need to grow.

What drives the economy is simply interest. If an investor believes that by producing today he will reap more benefits than tomorrow, he produces today. If not, he waits until he gets a maximum return. This is essential for a healthy economy, as we all eat, we all live in homes, drive cars, need roads, need water. So you want to promote a healthy economy for the good of the majority.

Going back to your point about the deceiving case for government spending. The government can spend every penny in an economy. You know what would happen? Everyone would stop producing and your economy stalls like its doing today.

Government’s role should be that of a utility, build roads, implemement and enforce laws, provide security, etc…

The last thing you want a government to do is take over control of the money supply. Not that banks and the fed are much better, but at least they would not allow for an all out collapse because in a collapse they lose it all.

Politicians dont have a clue of money, and only care about their careers. Spending, especially to apeace the masses, would be their primary goal irrespective of collapse. The dollar would collapse in a heart beat.

A better solution is to remove the fed, remove government backing for any industry, including banks. You break the law, you go to jail, you go bankrupt, you go belly up. Enforce a gold standard, cut deficit spending and return to a government to where increase in spending is matched by a tax hike.

This leaves the wealth on the hands of those creating it. Those talking about defending laborers need to rethink about this because they are being con’ed. You are being lied to, and that includes the author of this piece.

And no, the finances of the government are not different than ours.. we, the people, either pay for the government to operate via taxes or by theft (devaluation). You are correct in that we are not allowed to steal. But stealing is stealing no matter how you cut it.

I will close with this.

Who benefits from bank counterfeiting? Bank execs

Who benefits from government counterfeiting? Gov execs

We, the people, dont need bailouts damn it. We need a government that enforces the law so that we, the laborers, keep what have rightfully earned.

LikeLike

Yes, there has been inflation. What data shows that government spending caused it?

See: https://rodgermmitchell.wordpress.com/2010/04/06/more-thoughts-on-inflation/

LikeLike

“No calculation is needed to prove this”

Is that right? We should just believe whatever you say without you having to prove anything? That’s faith-based economics.

LikeLike

Yes, his caveat was, “all things equal.” Of course, all things are not equal, because he focuses only on supply and forgets about demand. The Fed controls inflation by increasing the demand for money.

LikeLike

The fed attempts to control inflation. If it was successful, we would be at 2% year in and year out.

Yet, whe you look back inflation was running at over 3%. Now use the rule of 72 and let me know how long before prices double.

This setting of money, like supply and demand, should be a function of the free markets, not the fed, not the government.

The supply of money should also be a function of the free markets.

You know, we all want positive things in society, and let me tell you, my thinking has definately evolved over the years about this topic.

Do you want good for poor hungry people, for laborers?

Why are some against poverty, hunger, yet support devaluation of the same poor, hungry people’s money?

Why are we against corruption, yet support unions, when we know they extort money from tax payers?

Why are we against theft, but support government issuing new currency?

Why are we for a good economy, yet support policies that stifle motivation for innovation, production?

I will leave you one single word. Selfishness

LikeLike

Vane says, “money, like supply and demand, should be a function of the free markets, not the fed, not the government.”

That’s silly talk. It’s difficult to go very far in a conversation when the start of the argument comes from a place of complete and utter ignorance.

Money supply as a function of the free markets has been tried. Bank notes issued by the banks. It lead to bank runs, and complete economic collapse every decade for close to a hundred years.

But I guess that’s just “the market correcting itself.”

Let’s also look at the Fed, which is a reserve system operated by the banks. It is essentially a centralized bank operated by the free market.

And inflation is not caused by the fed or the government but by the free market. Markets had inflation long before central banks and a floating currency. Market prices fluctuate all the time based on the principles of supply and demand, regardless of who is issuing the currency.

Why are we against corruption and support capitalism, when we know capitalists extort money from the tax payer? (Rhetorical question there, phrased int he same way the anti-union argument was made.) Why do capitalists support the collectivization of capital but oppose the collectivization of labor? Why is it virtuous for capital to negotiate in its best interests but it’s sinful for labor to negotiate in its best interests?

Why do you support the ideas promoted by the Objectivist political opinions and then somehow think it’s those who want a stable society are the ones who are selfish?

LikeLike

Steven,

I see, we have a different view of inflation. Yes prices do fluctuate in a free market as you rightfully state, but inflation is no necesarily a rise in price. If your definition is that it is a rise in price, than why even call it inflation, why not just call it for what it is, a rise in price?

You and I know tha everyone sees inflation as a ‘phenomenon’ which tends to result in higher prices. Irrespective of what your definition of inflation is, we all know how supply and demand work, don’t we?

If productivity and efficiency have increased resulting in more food, housing, clothing, etc, relative to individuals than why have prices not dropped?

It is because there is more currency chasing those goods and you know. Is it the free market pumping billions into the banks? Is it the free market looking the other way when bank execs and government officials conspire to steal from the masses? Is it the free market bailing irresponsible behavior?

How you end up combing the fed and banks into free markets beats me. If it’s free than why is the fed buying government debt?

If its free why did it bail out banks, and unions via GM.

The collapses you refer to below were made by one group only and you and I know full well who the group is. Our own government.

Are you being honest here, is the fed not printing billions and handing it to the government?

It’s not the free markets, it’s us humans that want to believe our hands are greater than god’s. In the end, there is only so much water, so much food, so much energy, and the number of papers and digits wont change that.

Go and defend teachers reaping 80k a year when the regular Chcagoan makes 32k. Do you ever think of who’s on the other end, or does it not even matter. There is no objectivism here my friend, only truth.

In the end, the blood will be in your hands, not mine.

LikeLike

It’s idiotic to complain about LONG-term inflation. The money my gramps earned 100 years ago at a whopping $5 a day (ultra-high income those days) from Henry Ford, was mostly SPENT the same week. Whatever he saved, that money earned interest that would NOT be possible without the current system.

At least the Fed understands that mild inflation is good for business.

It’s especially beneficial for debtors. Not so much for creditors, who are (a) banks (b) ordinary investors.

Remember the McKinley campaign vs W. J. Bryan? Bryan was backed by Populists. Farmers and small biz who were DEBTORS favored inflating the money supply (with silver at that time) so they could pay their debts cheaply with more plentiful silver, and NOT be forced to obtain gold from the NYC monopolists … or else go bankrupt.

Gold Std was ULTRA-AUSTERITY … with periodic regular massive disruptions and bankruptcies during which debtors would not lose a few percent over time, they lost EVERYTHING they worked for.

Remember: “You shall not hang mankind from a Cross of Gold” speech?

This was widespread common sense.

The Wizard of Oz book was obviously about these Crashes caused by the Gold Standard, though the author denied it, all the common symbols of current politics were there.

One of the Karl Rove-ish (Mark Hanna) tactics was he became aware of a prospector who discovered a vein of gold in Alaska, and they named the site Mount McKinley DURING THE FREAKING PRESIDENTIAL CAMPAIGN. How’s that for Public Relations “spin”? It was a close and bitter political battle.

To get the Fed passed (same for shortcomings of Obamacare) — it was nominally about democratizing the “lender of last resort” which previously existed in the form of a single man: J.P. Morgan — of course the process was politicized in various ways to appease Wall Street, the wealthy and powerful who had the CLOUT.

The preliminary plans were not secret. These were BROADLY discussed for years, and approved by the nationwide banking and business community (not every small biz, for obvious reasons, but all the big players), with some bickering on the details of who would be Class A vs Class C (if I recall) shareholders with or without meaningful voting rights, appointing more non-bank businessmen (VIP corporates) vs. more bank executives and financial experts.

The plans were boiled down to two proposals, Glass & Vanderlip. Glass won. Same Glass who later wrote Glass-Stegal to put a firewall between Ponzi speculation vs. vanilla commercial banking … the wall that got torn down by “modernization” laws in the late 90s, thanks mostly to Phil Gramm with nearly 100% Republican support and a majority of Dems too after they bickered over some details, then of course Clinton signed this GOP pro-gambling pro-Ponzi legislation. We have the aftermath of the betrayal of Glass. People recognized that this “new” (which was actually old going back to antiquity) style of banking required LEGAL constraints and regulations, to avoid creating “Casino Capitalism”, for finance to remain functional.

So YES, the creation of the Fed was “politicized” in United States politics. Surprised? What isn’t?

VIP parties and factions needed to be “bought off” to some extent, like the Insurance and HMO industries needed to be “bought off” to get them to sign on to Obama’s AFA bill, and they were brought in to actually draft the legislation as more pro-Finance than pro-Health Care, more pro-Biz than pro-Consumer.

Nevertheless, there’s plenty of MYTHS about the Fed that are nothing but right wing garbage.

The purpose of money is or should be production and COMMERCE, today, so money is designed to be SPENT. If one believes in genuine old school market capitalism, the purpose and design of our monetary system should NOT emphasize benefit to hoarders and savers over commerce and production.

Wealthy Savers complaining about inflation were already GIVEN their crème pie — it’s the fact that the Govt agrees to pay interest to T-Bond holders including Banks for “borrowing”, even tho the Govt need not “borrow” at all. Govt doesn’t actually go into “debt” (except in accounting jargon) so much as provide SAFE NO-RISK ASSETS guaranteed by the US Constitution for Fat Cat rich savers (over $250K in savings) to “park” their wealth, without taking on high-risk investments or equity stocks or those AAA+ rated “safe” mortgage securities and similar “sure thing” derivatives. Yes, they can invest, but they can also “park” savings, thanks to Uncle Sam. UNGRATEFUL MUCH?

LikeLike

Very interesting times indeed. I guess this is what we’ve come to.

A few things that need correction on your post.

1) Gold is not money because I or a few gold bugs say it is, it is money because people don’t need to be coerced into using it, to purchase it. People buy gold because it’s a pretty rock that everyone will be willing to share their savings for. This is the truth and there is no way for you to refute that.

2) You talk of about the risks of finance as if these were inherent to free markets and/or capitalism. That is not the case. The free markets and capitalism would see it to make sure gamblers take their losses and finance would for sure remain functional. The issues we have today are completely correlated to the Fed policies (always lower rates) and bailouts that have been occurring since the 80s. Technically, Glass Staegal is useless, seriously. Hasn’t the government turned their blind eye on banking corruption the last few years (how many are in jail?) and didnt they even bail them out?

3) Ahhh wealthy savers… yeah it’s their fault.. Oh wow… Let’s see who the ungrateful bunch are. Are the producers the rich people or the poor people? Who benefits more from the inherent bubbles with money creation, poor people who have no money and credit or rich people who do? Who, as you say, can safely park their wealth somewhere in the world to avoid devaluation and who does not, the rich or the poor?

So here comes Goodman, the defender of the poor, pushing an agenda that will destroy the same people he professes to defend. Is that not clear Goodman?

LikeLike

Gold isn’t money because people want to buy it. If that’s the case then art is money. Cars are money.

“there is no way for you to refute that.” More of that faith-based economics where you don’t have to prove your claims. They’re true because you said they are. It’s not economics is tautology.

LikeLike

This is where Vane needs to reread what he typed:

“By definition, an increase in the amount of money devalues existing money allthings equal”

All things AREN’T equal. MV=PY. If only M increases then we get inflation. But that doesn’t happen in reality.

When M increases it creates jobs and more production, so “Y” also increases. So never ever are all things equal.

We could also get inflation from Y reducing while M stays equal. Which has essentially happened in the past 100 years with food and energy increasing production at a much slower pace than population has. So more people eating and using energy has been responsible for the inflation you see.

LikeLike

Oh wow, i definately expected a more sophisticated rebutal.

Just remove all things equal..

Are you telling me that if you produce at a faster pace than demand can consume that it belongs to the government?

Let’s be clear, the free market rebalances the equation in front of your eyes, 100% efficiently, yet you question it, deny it, and hope that the government continues to meddle delaying nature’s rightful process.

Do prices not drop when there is too much supply, which in turn, removes excess supply and bringing supply and demand to balance?

Do prices not rice when there is too little supply, which in turn, adds additional supply and bringing supply and demand to balance?

Your question about proving proof that government spending causes inflation… what more prroof do i need other than your own words and the article above. How does new money make it into the economy?

Is it not via banks and the government?

Per your own words prices can rise and/or drop for natural reasons, than inflation is not an increase in price and deflation is not a decrease. I whole heartedly agree with you, and this means that price indreases are a SYMPTOM of pumping NEW money and credit into the system.

You want proof, go google money supply and compare numbers for the past 20, 30, 40 years. Go google the value the dollar has lost since 1980.

If today, the government creates 1 trillion dollars, this is synonymous with going into every single USD account and removing money from it. It’s fraud, it’s theft. There is no other way to cut it it.

Going back to the supply of money…

I’ve proved to you that new money is what devalues existing money. Prove to me why more money is needed in a growing economy. Per your own words, the Fed attempts to mirror nature and attempts to control the rate of interest to control the supply and demand for money. Than it’s not about needing more of it, it’s about letting the free market setting the rate of interest of money.

This can, and i’m sure people will figure it out one day, work if we allow the free markets to take hold. Instead of enforcing responsibility in the markets, our government has created moral hazards.

We not only spend money to keep failed institutions alive, which the free market has been forcing failure upon, we created environment where the companies dont abide by any laws.

Would follow any rules if you knew the government would not take you down and if you got in trouble, bailed you out?

It’ not the money spent to bail them out that’s the issue, it’s the principle that you are getting rewarded for failure and that going forward it wont only be GM, the banks, etc that will break the laws and treat people like crap, it will be most of them.

The interesting thing about this is that the same people asking for new money to be created are against ‘evil’ companies. Look in the mirror folks.

LikeLike

“Are you telling me that if you produce at a faster pace than demand can consume that it belongs to the government?”

I am saying that if you produce more, it helps price stability. That is all.

LikeLike

Im sorry…

Price stability?

No, it helps me, you, everyone because consume those things. The more the better.

The point i was trying to make is that the government should represent the majority.

More cars, more food, more homes, more is better because it improves our standard of living.

You cannot promote more production by stealing from producers. You cannot promote more production by giving things away.

You promote by doing the opposite. Let producers keep, entise people from leave social programs, not entise them to join.

We are running the world backwards. Socialists are the ones that have it backwards.

Capitalism works, what we have is a socially sick capitalistic society. Remove the social piece and we are good to go.

LikeLike

“Let’s be clear, the free market rebalances the equation in front of your eyes, 100% efficiently, yet you question it, deny it, and hope that the government continues to meddle delaying nature’s rightful process.”

Then tell me, why aren’t we operating more efficiently in the last 30 years? Taxes have decreased, regulations decreased, and since then inequality and recessions have persisted. The free market essentially equates to higher profits at the expense of lowering wages and other compensation.

LikeLike

“Do prices not drop when there is too much supply, which in turn, removes excess supply and bringing supply and demand to balance?

Do prices not rice when there is too little supply, which in turn, adds additional supply and bringing supply and demand to balance?”

You base your beliefs on a priori assumptions. That the free market operates with perfect efficiency. Your statements are correct at the basic level, but in reality we aren’t experiencing the above situations.

LikeLike

“If today, the government creates 1 trillion dollars, this is synonymous with going into every single USD account and removing money from it. It’s fraud, it’s theft. There is no other way to cut it it.”

That’s simply not true. That’s like saying a farmer who plants a row of trees in his field is removing a row of trees from the neighboring farmer’s fields. There isn’t a fixed amount of apples. There isn’t a fixed amount of currency. Adding more doesn’t take away from anyone else.

Especially not when the population rises, production rises, and demand rises. The amount of available currency has to be balanced with all of these things, otherwise some people are cut off from the currency system altogether having no access to capital. This is why Benjamin Franklin argued for paper currency. http://www.federalreserveeducation.org/resources/detail.cfm?r_id=1047cf84-4f84-4a4f-afbc-f6b319bed907

Not only are you operating under an a priori tautology, you’re just bad at math.

“Prove to me why more money is needed in a growing economy.”

Pull out your Monopoly board and play it for a few hours with three friends. Now add two more people and another board but don’t add anymore money into the pot. How is that economy going to grow without adding more money into the supply? You can devalue the properties, but deflation is “theft” in the same way inflation is “theft” under your internal logic. (If someone’s money is worth less next year it’s theft. If someone’s productivity is worth less next year it’s theft.)

If you add money to the game, the new participants can now participate in the economy, and the existing properties are not devalued but new properties can now be purchased and developed.

In the same way, adding new people to the economy requires new access to currency so they can convert their goods and services into economic trade.

“the free market rebalances the equation in front of your eyes, 100% efficiently.” Since when?

LikeLike

Let’s use your monopoly example to put this to rest.

You have 10 bucks i have 10. We agree that our labor is 1 dollar.

Now, add to more to the pot, we have 4 people. If you believe in supply and demand, than our labor cost would likely drop to somewhere around .50 cents. The supply of work is the same, but demand for work has doubled.

Am i making sense?

If we were producing oranges, 4 people would produce double the orange. If all of us want oranges, prices would drop by half acomodating our drop in wages.

LikeLike

Please show me how lower wages are theft..

You think money has some magic value, it doesnt, its a piece of paper thats valuable because its supply is limited. Just like gold, food, housing, cars, etc…

Lower prices dont mean lower standard of living. Lower wages do not mean lower standard of living.

Would you rather make 1 million and live in a hut eating bread or make 10k and live in a mansion eating steak?

More money does not make more houses, cars, steaks…

Fancy theories and words dont change these facts.

LikeLike

Vane,

I didn’t say their wages. I said their productivity.

You’re saying a currency which represents productivity is theft if the value of the currency drops.

But you’re saying it’s not theft if the value of what I produce drops.

If I had a home worth $220,000 and today it’s worth $109,000, that’s not theft because it’s a real asset not a liquid asset. But if I had $200,000 that is now worth less, that is theft. You’re inconsistent.

LikeLike

Vern,

I assume by the ideology you’re expressing that you believe in what has been rebranded “sound money.” So you put magical value in gold and silver it doesn’t have. “It’s a piece of rock that’s valuable because it’s supply is limited.”

Yet we’re digging gold out of the ground every day.

How is creating money at a slower pace than extraction of gold more inflationary than pegging our dollar to a natural mineral?

Adding more money to the economy at the same rate as demand is added provides fluid markets, and access to capital, and does not create inflation. Greed creates inflation. Capitalism itself causes inflation.

LikeLike

It’s not true hey.

So why is counterfeiting illegal if the amount of currency does not matter?

Can you tell what supply and demand is steve?

LikeLike

Because the Constitution gives Congress the exclusive right to coin money. Because money represents a value for something: it used to be metals, and now is the full faith and credit of the United States. Because individuals do not possess the full faith and credit of the united states. Because counterfeiting is cheating. Because counterfeiting reduces the acceptability of real money. Because companies are not reimbursed by fake money.

Counterfeiting wasn’t made illegal because of inflation.

You don’t even know what inflation is. You think it’s something other than the increased price of goods. The way we measure inflation is by the price of goods. That’s what inflation is.

So when a copper mine shuts down and the cost of copper goes up, everything that uses copper rises in price, causing inflation. When an oil refinery in California experiences a power outage, like we saw last week, prices of gas jumps by $0.50gal, which causes the cost of travel and delivery to increase, which causes the cost of business in general to increase, which causes general price inflation.

Inflation is caused by many things, and printing more money isn’t the main factor involved.

LikeLike

You are too good.

‘Reduces the acceptability of money’.

Now go and ask anyone and i bet they will tell you this means it devaluesmney.

Come on steve.

LikeLike

You didn’t “prove” anything, you simply stated a bunch of nonsense as fact.

“If today, the government creates 1 trillion dollars, this is synonymous with going into every single USD account and removing money from it.”

What proof? The government has been dumping trillions of dollars into the economy with no growth in inflation, in fact inflation has been below historic levels so much that economists are worried about deflation.

LikeLike

“If today, the government creates 1 trillion dollars, this is synonymous with going into every single USD account and removing money from it. It’s fraud, it’s theft. There is no other way to cut it it.” –

I think this is only true, if the newly created 1 trillion is distributed into the hands of a few people via a banking system, where their increased buying power comes at a relative loss of buying power to everyone else and this is how it is done.

“That’s simply not true. That’s like saying a farmer who plants a row of trees in his field is removing a row of trees from the neighboring farmer’s fields. There isn’t a fixed amount of apples. There isn’t a fixed amount of currency. Adding more doesn’t take away from anyone else.” –

I think this is only true if the 1 trillion were placed equally into the hands of 320 million citizens, via a mechanism such as Social Security or access to medical care, or education or into 320 million savings accounts but this it not how it is done.

Vane’s argument is correct because of how the money distribution is executed in the real world, and Steven’s argument is correct in theory until the method of distribution is changed or you don’t account for who gets the money as long as “the economy” gets it.

Do I understand this correctly?

LikeLike

Inflation = the value of a dollar vs. the value of goods and services.

The Value of a dollar = Demand for dollars vs. Supply

Adding a trillion to Supply would cause inflation if Demand didn’t rise proportionately.

Demand for dollars is related to many factors including population, GDP, and interest rates. The Fed reduces inflation (i.e. increases Demand) by raising interest rates.

Bottom line. Increasing the Supply of dollars may or may not cause inflation, depending on Demand.

LikeLike

Jp,

The economy stinks because the fed continues to meddle with the value of money.

First off, the fed creates currency via banks and the government. Where do you think the money to buy government debt comes from?

Second, the rich, which have to the newly created credit have an unfair advantage, using money created out of thin air to purchase real assets, becoming more ane more rich as more and more money is created. Why do you think most people dont actually own a home now days. We quietly went from a nation of citizens that owned their homes and farms and businesses, to one that owes all of it.

You talk about taxes and regulations. What good are regulations when your government, knowing full well that people like Mozzilo, Corzine, and a million others, look the other way and do not enforce the law they swor to uphold in office?

Does it matter that we have regulations that require banks to hold a minimum reserve and when they get in trouble, not only do we change accounting rules set by the same governmnet, we bail the out and ignore their crimes.

Has the free market not told you and our government these companies are parasites destroying us time and time again?

Taxes…. i dont care how low or high they are. One thing i know, if a politicians says he will increase them, he gets the boot. If he does the same, but borrows instead, he gets applauded.

The government, the economy, the environment is a reflection of us. Right now we suck.

LikeLike

You know people like you have gone on and on about the threat of hyperinflation. Ron Paul and the Mises Institute have warned of 16% inflation or more due to Quantitative Easing. It hasn’t materialized.

The Fed dumped over $16 trillion into the economy and inflation has remained at or below 3%. Hell, in 2012 and 2012 inflation has been under 2%.

At what point do you realize your tautology is a lie?

LikeLike

Where do i mention hyperinflation…

You conviniently ignore many factors that come into play when you refer to inflation.

You say its under 2%… whats under 2%? is it rice? meat? the gas you mentioned above?

Again, inflation has jack to do with price and all to do with money and credit. Ron Paul is much nore in line with reality than many on this board.

If you viewed inflation as an increase of the money and credit, than it becomes more obvious why there is no hyperinflation.

The fed can create all the credit it wants, trillions of it. If that new credit never makes it into the economy (isnt everyone tapped out?), than it doesnt have the increase in price effect you speak of.

Combine that with a drop in home prices, and again you clearly see why there is no inflation.

You are playing a dangerous game and you know this full well. I can tell who is well versed in these things, and you are no rookie.

Not sure what ron or mises have said, but i have not. But if you think thhe government can simply print and give it way, you the US of today will be quickly extinct.

LikeLike

Vane, you better abolish Banking going back millenia to ancient Rome. Banks DO create money “out of thin air” by balance sheet expansion. Banks DO NOT pyramid money created by the Fed. That’s not how it works. Myth.

Banks create loan proceeds (deposits) on balance sheets. On the other side of the balance sheet is the new Asset, the signed agreement.

By this process, Banks create ZERO “NET” money, yet over 90% of money in circulation at a given time is outstanding bank credit that has not yet been extinguished.

So some conservatives say the answer is to abolish Banking as it currently exists, to OUTLAW banking. But that, ironically, would be “govt tyranny”. It’s saying that this kind of business cannot accept an IOU and issue a deposit for the IOU which is a counter-balancing IOU (liability of the bank). Capitalism cannot grow and flourish without CREDIT. Credit is the means that makes today’s ideas and efforts become tomorrow’s profits, many months or years in the future.

Ergo, without realizing it, Libertarian Ideologues would totally abolish Capitalism, achieve the dream of generations of Communist Ideologues long passed, by starving capitalism to death. Libertarian/Austrian purist ideology is economic Anti-Communism. Right? So being a mirror-image of extreme Marxism, Communism in Opposite-Land, it marches towards the same idiotic outcomes.

LikeLike

Hmmmm..

First off, I am not conservative. I would put myself in the real-libertarian bucket, not to associate with what you know as the tea party and such.

I agree with you on the banking process above. You conveniently miss the Fed’s policy though. What about lowering rates every time we hit a rough patch? What about bailing out institutions? What about providing “liquidity”?

The issue is that the credit (not money as you say) acts as money and devalues people’s savings. It pulls forward demand and your economy becomes a pyramid scheme as opposed to an economy growing on real demand. Is it any wonder to you that most people are up to their eyeballs in debt, barely making minimum payments monthly. Forget about the savings (which you somehow equate to being bad), people are running negative. And as I’m sure you are aware, this is very good for your health too. I guess it’s no wonder men no longer think about their freedom, how can they if all they think about is how they will make it through next month.

You also conveniently miss explaining why the US flourished when we had the gold standard? Why did so many people come to the shores of the US while we were in the gold standard? Did the crashes not begin after the Fed’s bubble blowing policies in 1913?

No Libertarian wants to abolish banking, stop spreading that lie. However, banking should be that – banking. To be honest with you, Libertarians want governments to let banks be and do whatever they want. Just implement sound money laws (no lending of people’s deposits). For those people willing to take the risk and put their money on a failing institution, too bad. For the banks going under because of stupid risk decisions, too bad too. Let them fail, we don’t need failing institutions. The Fed is essentially a useless institution – let me ask you – what does the Fed do? Can the market not set rates more efficiently than the Fed? Can the market not manage demand and supply of money more efficiently than the Fed?

The idiotic outcome is the one we have embarked on, right on 1913 as I mentioned above. We want to avoid all bad things in life (bad economy and crisis), yet we are the same ones making those much bigger and destructive. We are stupid morons that think we can control things around us. Would you have too big to fail banks if it were not for the Fed bailing them out time and time again? Would our economy be in shambles with high unemployment if the Fed wasn’t trying to pump up asset prices? We are a bunch of buffoons that can’t even figure this out.

LikeLike

Your rhetorical question about how the US flourished under the gold standard is way off base. The US wasn’t the only nation with the gold standard. Why was the gold standard responsible for economic growth in the US while other nations were drowning in inflation (imports from the new world), and poverty?

The crashes didn’t begin in 1913, the Fed was created in response to decades of crash and panic after crash and panic. Since 1913 there have been far fewer crashes and only a couple panics.

The Fed sets federal lending rates, the market still determines their own rates.

LikeLike

People, if you’re going to talk about socialists and socialism, at least know what you’re talking about. Federal spending is not socialist. Social Security is not socialist. Medicare is not socialist. Food stamps are not socialist. They all are part of our capitalism.

Socialism is group (usually government) ownership and control over production and management of economic assets. Your local police and fire departments and the U.S. military are socialist. Would you rather they be privately-held for-profit agencies?

All this quasi-religious jabber jabber about the evils of socialism and the wonders of the private sector are absolute rot, with no factual basis. For some things “socialism” is better; for other things capitalism is better. The best is a blend.

LikeLike

I tend to agree on the social item.

In terms of whether i would rather have private?

You speak of private companies as if being for profit is a bad thing?

Isnt everyone for profit?

Dont unions use their power to rip off tax payers?

What people need to understand is that ONLY the private sector creates profits, wealth, whatever you want to call it.

Governments take from the private industry and distribute as they wish.

Printing or spending does NOT create any wealth. Being sovereign means being a free nation with borders. Period.

I will say it again, issuing new currency to spend dilutes existing currency. This is basic math and is as simple as 1 + 1.

Take a gallon of water and spread in 10 cups. Than take the same gallon and spread it on 20. You still have the same gallon of water, but some of the water was removed from existing cups and moved into the new cups.

In the same way, US dollars represent the earned wealth of individuals, companies, etc.. when new currency (cups) is issued, the existing wealth is spread from existing dollars (cups) into the new cups. This is so simple, a first grader should be able to figure this out.

I’d also like to point out that if i ever went back and saw an issue with an opinion (these are facts, not opiniond), i would correct my statement.

Mr Mitchell, you wrote this article in 2009. I could have told you back then that spending would not work. This is no longer an opinion, our government has spent over 4 trillion and the economy still stinks, and getting worst day by day.

When will you retract your opinion?

Spending does not work because we’ve neglected to accept the laws of god, what cant be paid, wont. The way to fix the issue is not to keep digging a deeper hole, it’s to allow the bad debt to be written off, allowing prices to adjust to their rightful place.

Let’s face the music Mr Mitchell.

LikeLike

You are not quoting facts; they are your (uninformed) opinions.

There is a difference between a sovereign government and a Monetarily Sovereign government. The euro nations are sovereign, but they are not Monetarily Sovereign. Sadly, you don’t understand the difference between Monetary Sovereignty and monetary non-sovereignty.

Dollars do not represent “earned wealth.” Dollars merely are accounting figures. I can tell you exactly how many dollars there are in America. Can you tell me how much “earned wealth” there is?.

Without the deficit spending, we would be in a depression.

Your water illustration is childish. Value is based on supply AND demand. You have forgotten about demand.

And as for quoting your “laws of god,” before you assume the voice of god, better learn economics. I’ve allowed your silly, ridiculously long rants to find space on this blog, hoping you would come to your senses, but you have used up my patience.

LikeLike

vane=biggest idiot on this blog since “john galt.” I award vane the first annual MS blog “john galt” award for his sheer stupidity.

LikeLike

Yeah… I already addressed your fallacious idea that wealth is a fixed commodity. You’re making this evident by your “basic math” example of a single gallon of water.

In an economy, not every glass of water is full, and it is the movement of water between glasses that is the economy. Some glasses have more water and some have less, and every glass seeks to increase their level of water.

But you also have to keep adding glasses to the equation exponentially. And adding more gallons of water to provide water to these new glasses isn’t detrimental, it just expands the overall size of the economy because there is now more trade, and more access to water.

As I said before, planting more apple trees doesn’t steal apples from someone else, it just multiplies the amount of available apples.

LikeLike

Private sector creates real wealth in the form of goods and services.

Yet what is the value of UNSOLD goods? What is the value of the most expensive automobile sitting unsold on a dealer lot? Nothing. Negative worth. It’s a COST to keep it there.

What is the value of unused industrial capacity? What is the value of untapped human capacity?

Private sector production creates real “value” but ZERO financial value whatsoever. SALES creates value, and SALES is choked off when the money supply (relative to needs of commerce, imports, savings, and private debt overhang) is choked off or too low.

If Congress would listen to the MARKET, they could easily measure the quantity of Dollars that leave the American economy for imports (which Big Biz like the C of C wants), plus the quantity of Dollars that get socked away in buried treasure chests or hoarded in sock drawers or more to the point, stuffed into Savings Accounts which become stored at T-Securities (thanks to Uncle Sam).

That quantity of money “lost” out of the economy and therefore “unspent” is called “Demand Leakage”. Insufficient Demand = Recession, Depression, mass Unemployment, widespread Business Failure, widespread Bankruptcy, mass inefficiency.

But instead, you worry about losing a few percentage points of savings or value of those nominal Units of Account over a few decades. Forest or Trees?

LikeLike

Yes… I hit the jackpot. Only one person that realizes that it is the private sector that creates REAL wealth. Than poor Mr Goodman goes on to confuse things by asking about unsold goods.. And don’t get me wrong, it is a valid point. So, let’s talk about unsold goods. And before, we do let’s talk a little about money and about demand and supply.